Answered step by step

Verified Expert Solution

Question

1 Approved Answer

First image second image Third image Fourth image Fifth image Hello, I need help with this question. I couldn't take the whole picture at once,

First image

second image

Third image

Fourth image

Fifth image

Hello,

I need help with this question. I couldn't take the whole picture at once, I had to take five screenshots to fit the Chegg image dimension. The deadline is in an hour from now.

Thank you.

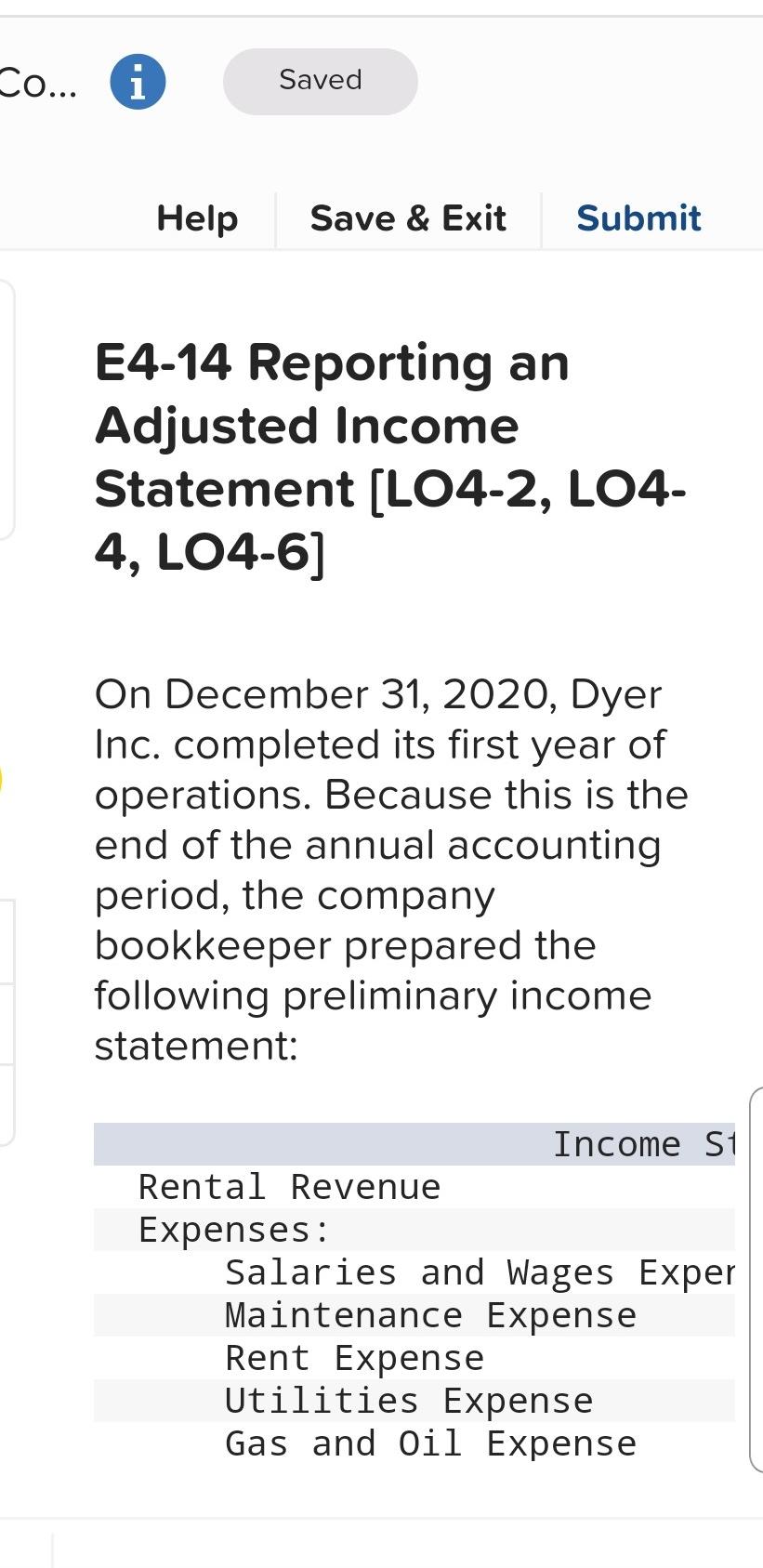

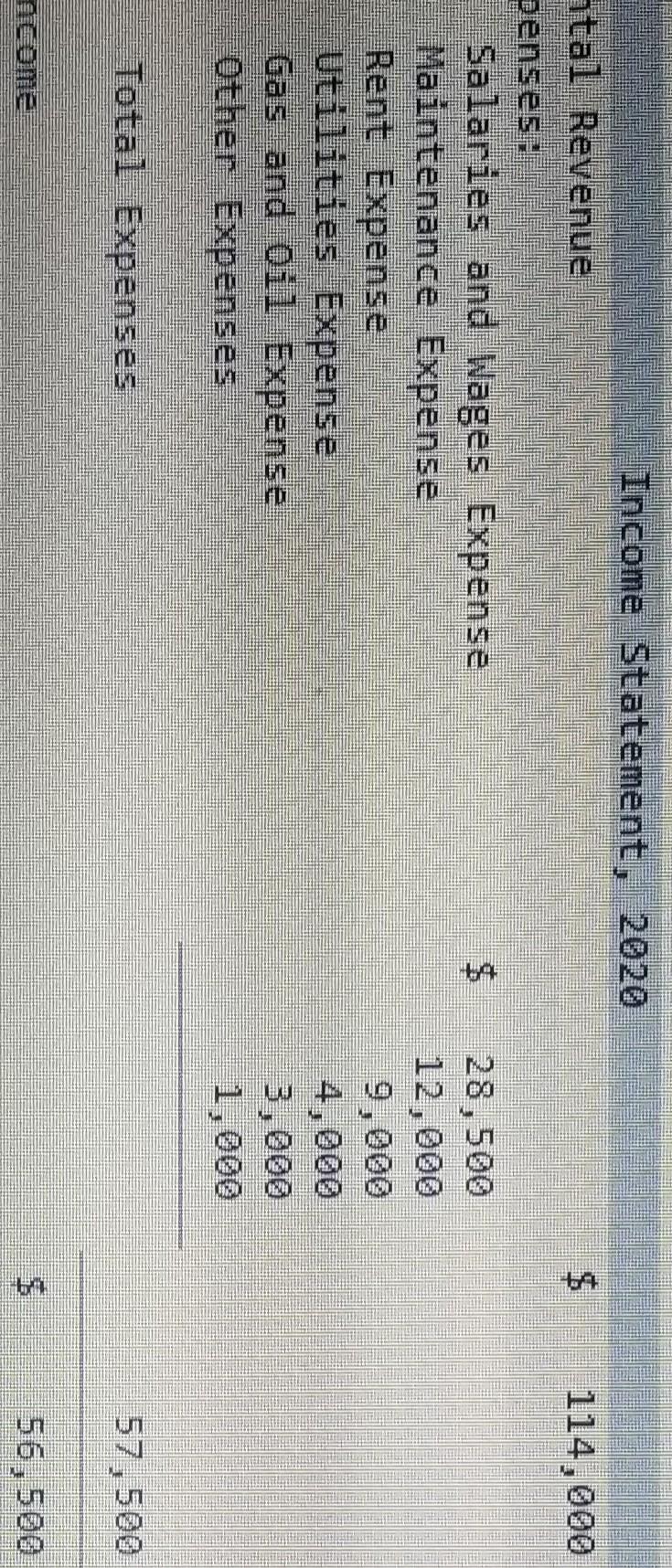

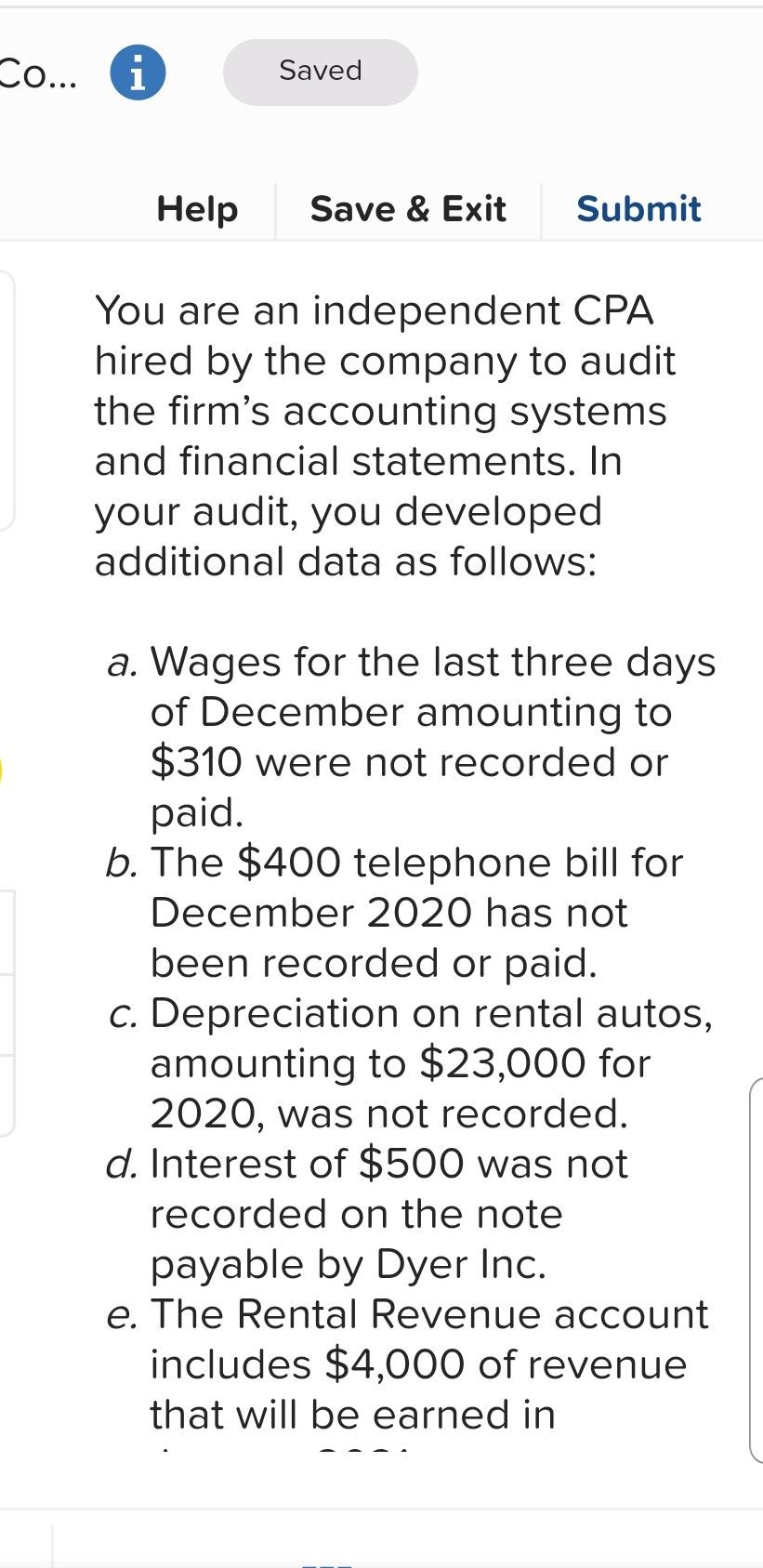

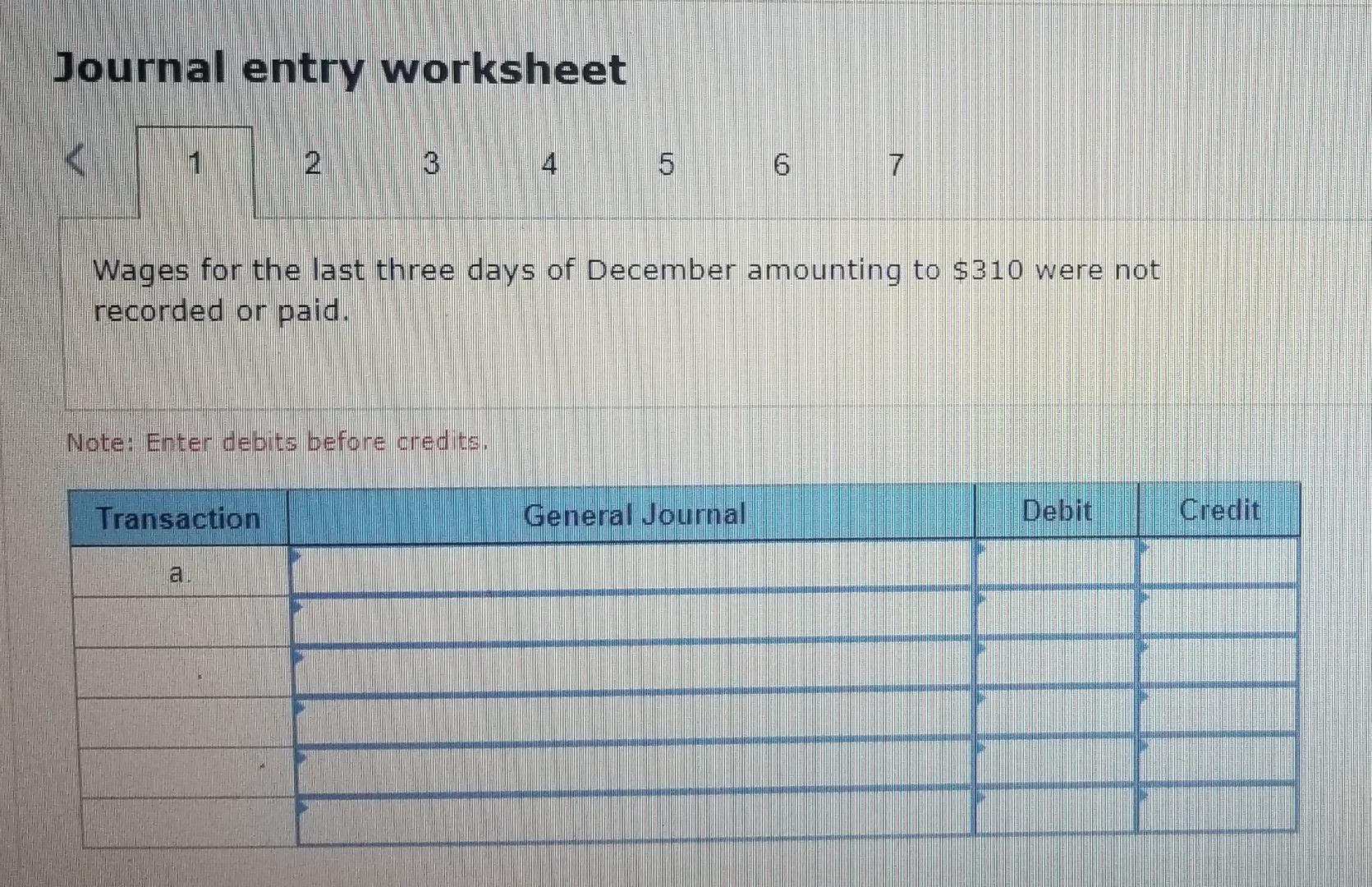

Co... 1 Saved Help Save & Exit Submit E4-14 Reporting an Adjusted Income Statement (LO4-2, LO4- 4, LO4-6] On December 31, 2020, Dyer Inc. completed its first year of operations. Because this is the end of the annual accounting period, the company bookkeeper prepared the following preliminary income statement: Income S1 Rental Revenue Expenses: Salaries and Wages Exper Maintenance Expense Rent Expense Utilities Expense Gas and Oil Expense ST $ 114,000 Income Statement, 2020 atal Revenue penses: Salaries and Wages Expense $ Maintenance Expense Rent Expense Utilities Expense Gas and Oil Expense Other Expenses 28,500 12,000 9,000 4,000 3,000 1,000 Total Expenses 57,500 $ 56,500 Co... i Saved Help Save & Exit Submit You are an independent CPA hired by the company to audit the firm's accounting systems and financial statements. In your audit, you developed additional data as follows: a. Wages for the last three days of December amounting to $310 were not recorded or paid. b. The $400 telephone bill for December 2020 has not been recorded or paid. c. Depreciation on rental autos, amounting to $23,000 for 2020, was not recorded. d. Interest of $500 was not recorded on the note payable by Dyer Inc. e. The Rental Revenue account includes $4,000 of revenue that will be earned in Co... i Saved Help Save & Exit Submit payavie Ny vyei ini. e. The Rental Revenue account includes $4,000 of revenue that will be earned in January 2021. f. Maintenance supplies costing $600 were used during 2020, but this has not yet been recorded. g. The income tax expense for 2020 is $7,000, but it won't actually be paid until 2021. Required: 1. Prepare adjusting journal entry for each item (a) through (g) should be recorded at December 31, 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 2 3 4 5 6 6 7 Wages for the last three days of December amounting to $310 were not recorded or paid. Note: Enter debits before credus, Transaction General Journal Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started