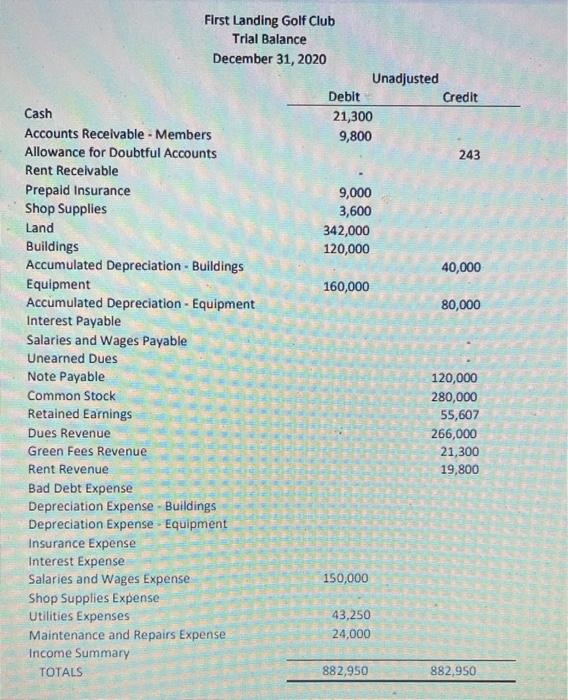

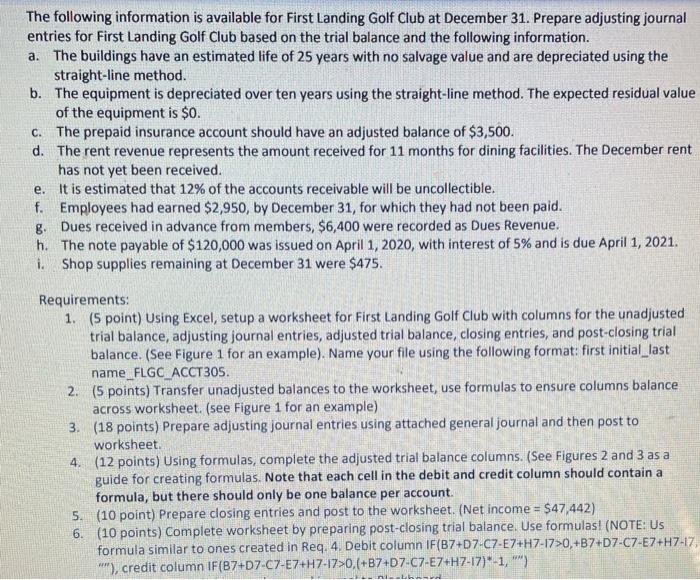

First Landing Golf Club Trial Balance December 31, 2020 Unadjusted Debit Credit Cash 21,300 Accounts Receivable - Members 9,800 Allowance for Doubtful Accounts 243 Rent Receivable Prepaid Insurance 9,000 Shop Supplies 3,600 Land 342,000 Buildings 120,000 Accumulated Depreciation - Buildings 40,000 Equipment 160,000 Accumulated Depreciation - Equipment 80,000 Interest Payable Salaries and Wages Payable Unearned Dues Note Payable 120,000 Common Stock 280,000 Retained Earnings 55,607 Dues Revenue 266,000 Green Fees Revenue 21,300 Rent Revenue 19,800 Bad Debt Expense Depreciation Expense - Buildings Depreciation Expense - Equipment Insurance Expense Interest Expense Salaries and Wages Expense 150,000 Shop Supplies Expense Utilities Expenses 43,250 Maintenance and Repairs Expense 24,000 Income Summary TOTALS 882,950 882,950 The following information is available for First Landing Golf Club at December 31. Prepare adjusting journal entries for First Landing Golf Club based on the trial balance and the following information. a. The buildings have an estimated life of 25 years with no salvage value and are depreciated using the straight-line method. b. The equipment is depreciated over ten years using the straight-line method. The expected residual value of the equipment is $0. C. The prepaid insurance account should have an adjusted balance of $3,500. d. The rent revenue represents the amount received for 11 months for dining facilities. The December rent has not yet been received. e. It is estimated that 12% of the accounts receivable will be uncollectible. f. Employees had earned $2,950, by December 31, for which they had not been paid. g. Dues received in advance from members, $6,400 were recorded as Dues Revenue. h. The note payable of $120,000 was issued on April 1, 2020, with interest of 5% and is due April 1, 2021. i. Shop supplies remaining at December 31 were $475. Requirements: 1. (5 point) Using Excel, setup a worksheet for First Landing Golf Club with columns for the unadjusted trial balance, adjusting journal entries, adjusted trial balance, closing entries, and post-closing trial balance. (See Figure 1 for an example). Name your file using the following format: first initial_last name_FLGC_ACCT305. 2. (5 points) Transfer unadjusted balances to the worksheet, use formulas to ensure columns balance across worksheet. (see Figure 1 for an example) 3. (18 points) Prepare adjusting journal entries using attached general journal and then post to worksheet. 4. (12 points) Using formulas, complete the adjusted trial balance columns. (See Figures 2 and 3 as a guide for creating formulas. Note that each cell in the debit and credit column should contain a formula, but there should only be one balance per account. 5. (10 point) Prepare closing entries and post to the worksheet. (Net income = $47,442) 6. (10 points) Complete worksheet by preparing post-closing trial balance. Use formulas! (NOTE: Us formula similar to ones created in Reg. 4. Debit column IF(B7+D7-C7-E7+H7-17>0,+B7+D7-C7-E7+H7-17, *), credit column IF(87+D7-C7-E7+H7-17>0,+B7+D7-C7-E7+H7-17)*-1, ")