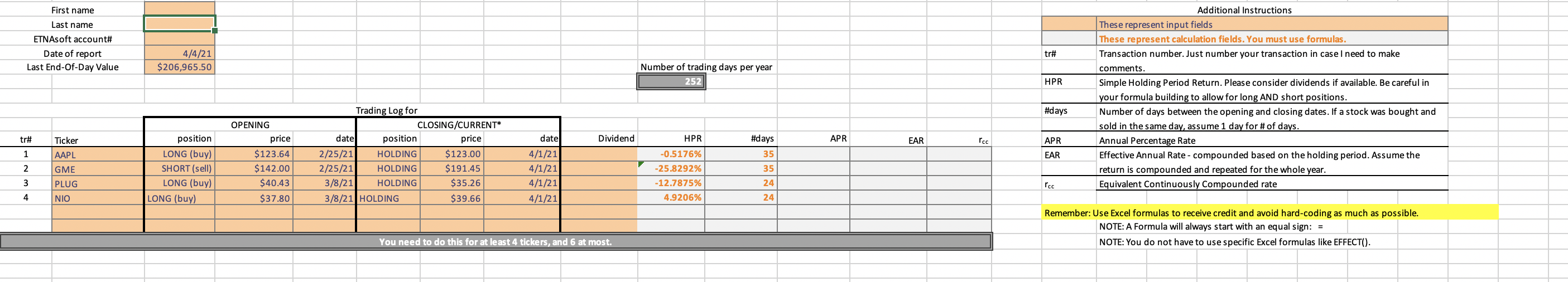

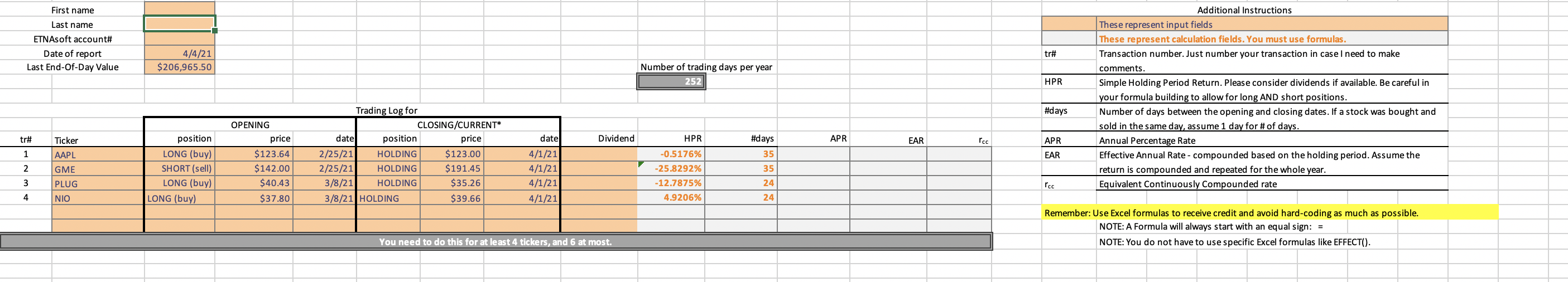

First name Last name ETNAs oft account# Date of report Last End-Of-Day Value tr# 4/4/21 $206,965.50 Number of trading days per year 252 HPR Additional Instructions These represent input fields These represent calculation fields. You must use formulas. Transaction number. Just number your transaction in case I need to make comments. Simple Holding Period Return. Please consider dividends if available. Be careful in your formula building to allow for long AND short positions. Number of days between the opening and closing dates. If a stock was bought and sold in the same day, assume 1 day for # of days. Annual Percentage Rate Effective Annual Rate - compounded based on the holding period. Assume the return is compounded and repeated for the whole year. Equivalent Continuously Compounded rate #days tr# Ticker date Dividend HPR APR EAR rcc #days 35 APR EAR 1 AAPL Trading Log for CLOSING/CURRENT* date position price 2/25/21 HOLDING $123.00 2/25/21 HOLDING $191.45 3/8/21 HOLDING $35.26 3/8/21 HOLDING $39.66 OPENING price $123.64 $142.00 $40.43 $37.80 position LONG (buy) SHORT (sell) LONG (buy) LONG (buy) 2 GME 35 4/1/21 4/1/21 4/1/21 4/1/21 -0.5176% -25.8292% -12.7875% 4.9206% 3 PLUG [{cc 24 24 4 | NIO Remember: Use Excel formulas to receive credit and avoid hard-coding as much as possible. NOTE: A Formula will always start with an equal sign: = NOTE: You do not have to use specific Excel formulas like EFFECT(). You need to do this for at least 4 tickers, and 6 at most. First name Last name ETNAs oft account# Date of report Last End-Of-Day Value tr# 4/4/21 $206,965.50 Number of trading days per year 252 HPR Additional Instructions These represent input fields These represent calculation fields. You must use formulas. Transaction number. Just number your transaction in case I need to make comments. Simple Holding Period Return. Please consider dividends if available. Be careful in your formula building to allow for long AND short positions. Number of days between the opening and closing dates. If a stock was bought and sold in the same day, assume 1 day for # of days. Annual Percentage Rate Effective Annual Rate - compounded based on the holding period. Assume the return is compounded and repeated for the whole year. Equivalent Continuously Compounded rate #days tr# Ticker date Dividend HPR APR EAR rcc #days 35 APR EAR 1 AAPL Trading Log for CLOSING/CURRENT* date position price 2/25/21 HOLDING $123.00 2/25/21 HOLDING $191.45 3/8/21 HOLDING $35.26 3/8/21 HOLDING $39.66 OPENING price $123.64 $142.00 $40.43 $37.80 position LONG (buy) SHORT (sell) LONG (buy) LONG (buy) 2 GME 35 4/1/21 4/1/21 4/1/21 4/1/21 -0.5176% -25.8292% -12.7875% 4.9206% 3 PLUG [{cc 24 24 4 | NIO Remember: Use Excel formulas to receive credit and avoid hard-coding as much as possible. NOTE: A Formula will always start with an equal sign: = NOTE: You do not have to use specific Excel formulas like EFFECT(). You need to do this for at least 4 tickers, and 6 at most