Answered step by step

Verified Expert Solution

Question

1 Approved Answer

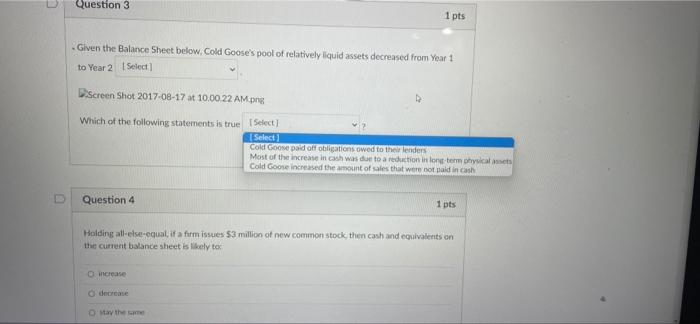

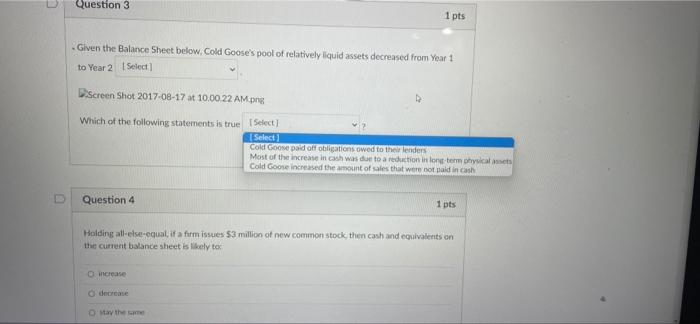

first one is true or false Question 3 1 pts Given the Balance Sheet below, Cold Goose's pool of relatively liquid assets decreased from Year

first one is true or false

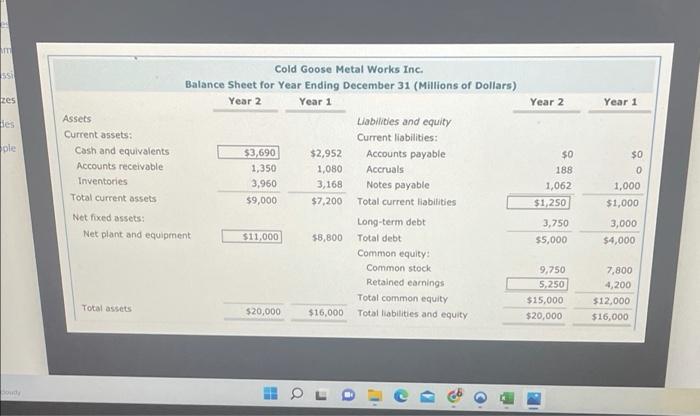

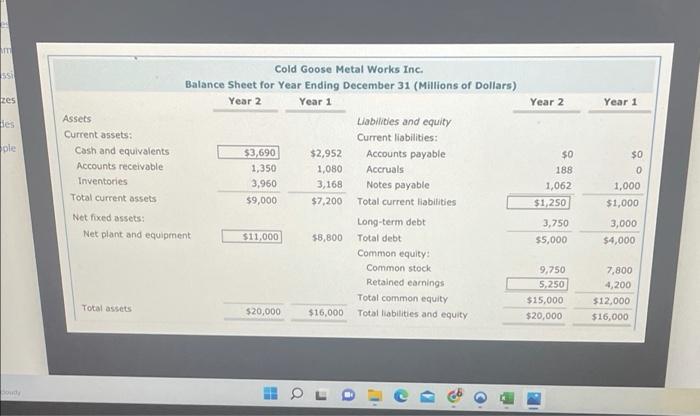

Question 3 1 pts Given the Balance Sheet below, Cold Goose's pool of relatively liquid assets decreased from Year 1 to Year 2 Select] Screen Shot 2017-08-17 at 10.00.22 AM.png Which of the following statements is true [Select) Select Cold Goose paid off obligations owed to their lenders Most of the increase in cash was due to a reduction in long-term physical assets Cold Goose increased the amount of sales that were not paid in cash Question 4 1pts Holding all-else-equal, if a firm issues $3 million of new common stock, then cash and equivalents on the current balance sheet is likely to increase decrease Ostay the same m ssi zes des ple Soudy Assets Current assets: Cold Goose Metal Works Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Liabilities and equity Current liabilities: $2,952 Accounts payable 1,080 Accruals 3,168 Notes payable $7,200 Total current liabilities Long-term debt $8,800 Total debt Common equity: Common stock Retained earnings Total common equity $16,000 Total liabilities and equity Cash and equivalents Accounts receivable Inventories Total current assets Net fixed assets: Net plant and equipment Total assets $3,690 1,350 3,960 $9,000 $11,000 $20,000 Year 2 $0 188 1,062 $1,250 3,750 $5,000 9,750 5,250 $15,000 $20,000 Year 1 $0 0 1,000 $1,000 3,000 $4,000 7,800 4,200 $12,000 $16,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started