Answered step by step

Verified Expert Solution

Question

1 Approved Answer

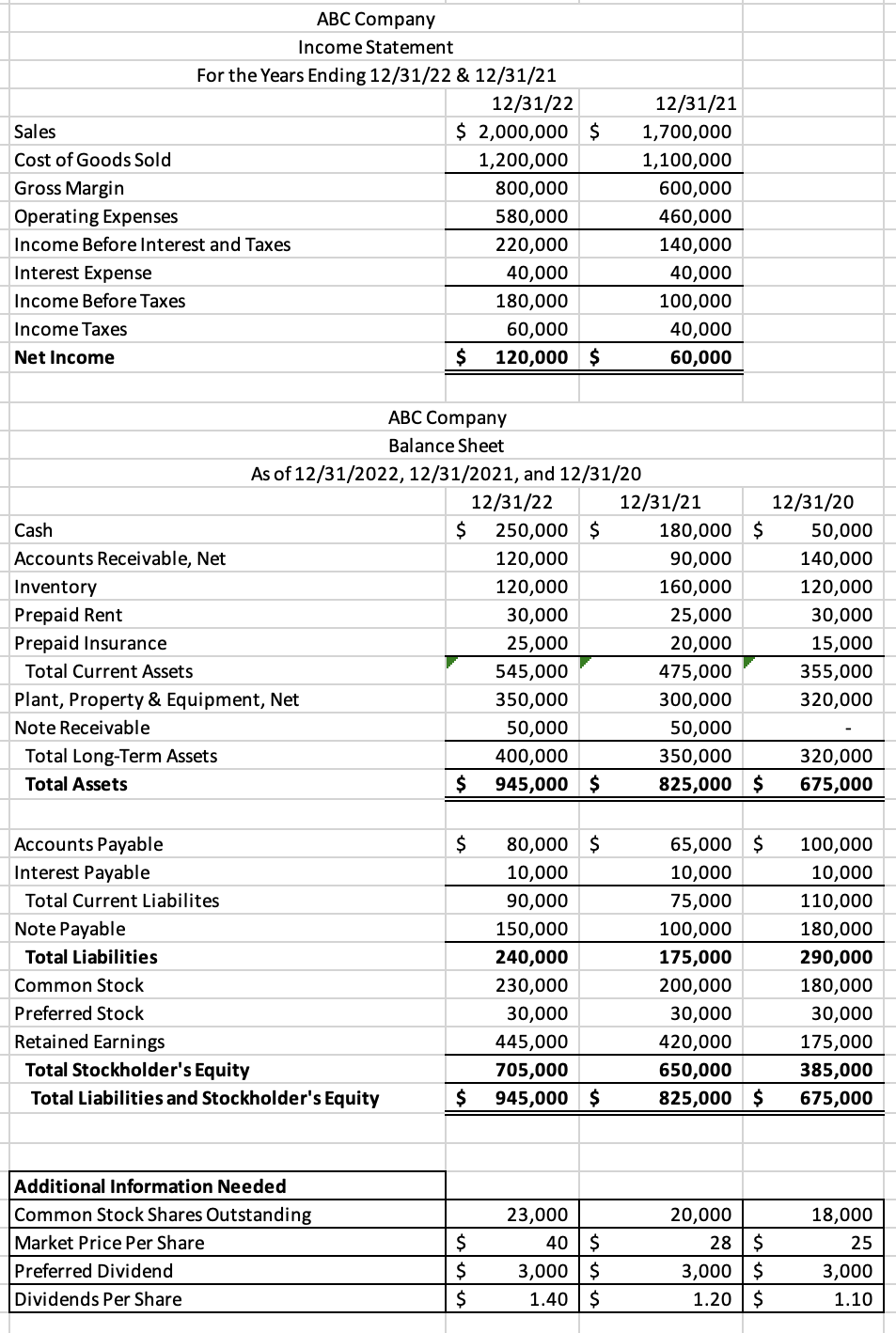

First one is what was provided and the 2nd one is what needs answered. begin{tabular}{|c|c|c|c|c|c|c|} hline multicolumn{5}{|c|}{ ABC Company } & & hline multicolumn{7}{|c|}{

First one is what was provided and the 2nd one is what needs answered.

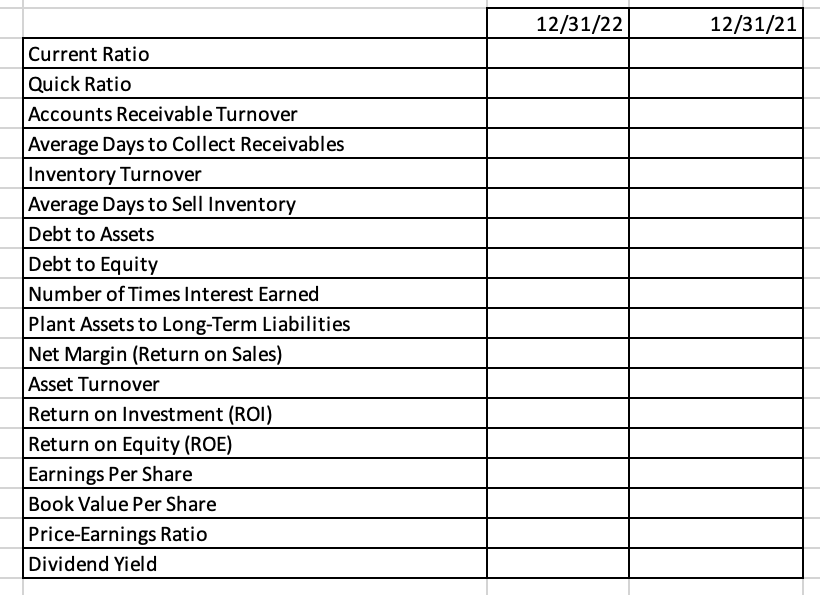

\begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ ABC Company } & & \\ \hline \multicolumn{7}{|c|}{ Income Statement } \\ \hline \multicolumn{7}{|c|}{ For the Years Ending 12/31/22 \& 12/31/21 } \\ \hline & & 12/31/22 & & 12/31/21 & & \\ \hline Sales & & 2,000,000 & $ & 1,700,000 & & \\ \hline Cost of Goods Sold & & 1,200,000 & & 1,100,000 & & \\ \hline Gross Margin & & 800,000 & & 600,000 & & \\ \hline Operating Expenses & & 580,000 & & 460,000 & & \\ \hline Income Before Interest and Taxes & & 220,000 & & 140,000 & & \\ \hline Interest Expense & & 40,000 & & 40,000 & & \\ \hline Income Before Taxes & & 180,000 & & 100,000 & & \\ \hline Income Taxes & & 60,000 & & 40,000 & & \\ \hline Net Income & $ & 120,000 & $ & 60,000 & & \\ \hline \multicolumn{7}{|c|}{ ABC Company } \\ \hline \multicolumn{7}{|c|}{ Balance Sheet } \\ \hline \multicolumn{7}{|c|}{ As of 12/31/2022,12/31/2021, and 12/31/20} \\ \hline & \multicolumn{2}{|c|}{12/31/22} & \multicolumn{2}{|r|}{12/31/21} & \multicolumn{2}{|c|}{12/31/20} \\ \hline Cash & $ & 250,000 & $ & 180,000 & $ & 50,000 \\ \hline Accounts Receivable, Net & & 120,000 & & 90,000 & & 140,000 \\ \hline Inventory & & 120,000 & & 160,000 & & 120,000 \\ \hline Prepaid Rent & & 30,000 & & 25,000 & & 30,000 \\ \hline Prepaid Insurance & & 25,000 & & 20,000 & & 15,000 \\ \hline Total Current Assets & & 545,000 & & 475,000 & & 355,000 \\ \hline Plant, Property \& Equipment, Net & & 350,000 & & 300,000 & & 320,000 \\ \hline Note Receivable & & 50,000 & & 50,000 & & - \\ \hline Total Long-Term Assets & & 400,000 & & 350,000 & & 320,000 \\ \hline Total Assets & $ & 945,000 & $ & 825,000 & $ & 675,000 \\ \hline Accounts Payable & $ & 80,000 & $ & 65,000 & $ & 100,000 \\ \hline Interest Payable & & 10,000 & & 10,000 & & 10,000 \\ \hline Total Current Liabilites & & 90,000 & & 75,000 & & 110,000 \\ \hline Note Payable & & 150,000 & & 100,000 & & 180,000 \\ \hline Total Liabilities & & 240,000 & & 175,000 & & 290,000 \\ \hline Common Stock & & 230,000 & & 200,000 & & 180,000 \\ \hline Preferred Stock & & 30,000 & & 30,000 & & 30,000 \\ \hline Retained Earnings & & 445,000 & & 420,000 & & 175,000 \\ \hline Total Stockholder's Equity & & 705,000 & & 650,000 & & 385,000 \\ \hline Total Liabilities and Stockholder's Equity & $ & 945,000 & $ & 825,000 & $ & 675,000 \\ \hline \multicolumn{7}{|l|}{ Additional Information Needed } \\ \hline Common Stock Shares Outstanding & & 23,000 & & 20,000 & & 18,000 \\ \hline Market Price Per Share & $ & 40 & $ & 28 & $ & 25 \\ \hline Preferred Dividend & $ & 3,000 & $ & 3,000 & $ & 3,000 \\ \hline Dividends Per Share & $ & 1.40 & $ & 1.20 & $ & 1.10 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \cline { 2 - 3 } \multicolumn{1}{l|}{} & 12/31/22 & 12/31/21 \\ \hline Qurrent Ratio & & \\ \hline Quick Ratio & & \\ \hline Average Days to Collect Receivables & & \\ \hline Inventory Turnover & & \\ \hline Average Days to Sell Inventory & & \\ \hline Debt to Assets & & \\ \hline Debt to Equity & & \\ \hline Number of Times Interest Earned & & \\ \hline Plant Assets to Long-Term Liabilities & & \\ \hline Net Margin (Return on Sales) & & \\ \hline Asset Turnover & & \\ \hline Return on Investment (ROI) & & \\ \hline Return on Equity (ROE) & & \\ \hline Earnings Per Share & & \\ \hline Book Value Per Share & & \\ \hline Price-Earnings Ratio & & \\ \hline Dividend Yield & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started