Answered step by step

Verified Expert Solution

Question

1 Approved Answer

First part is true/false Practice Test 2 spring part 1 Saved to this PC esign Layout Refeences Mailings Review View Help Tell me what you

First part is true/false

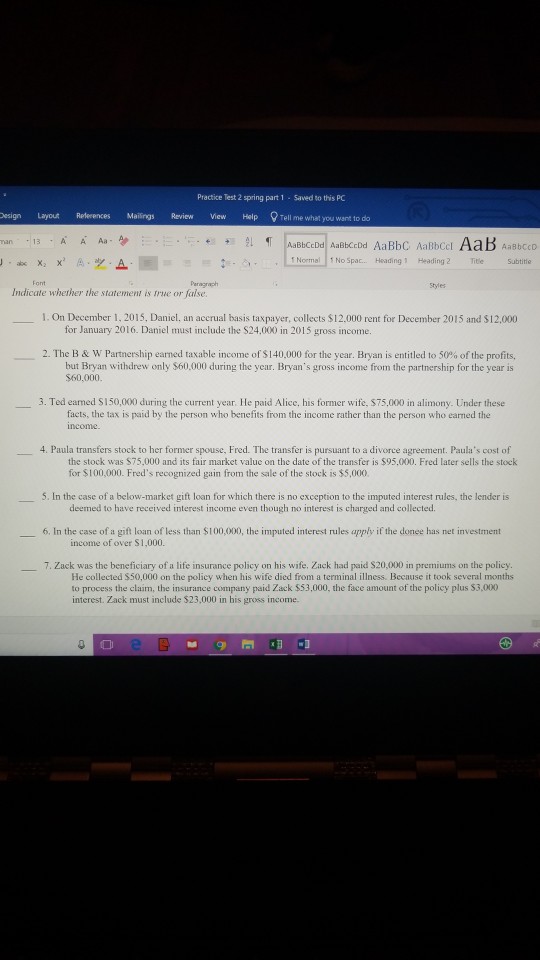

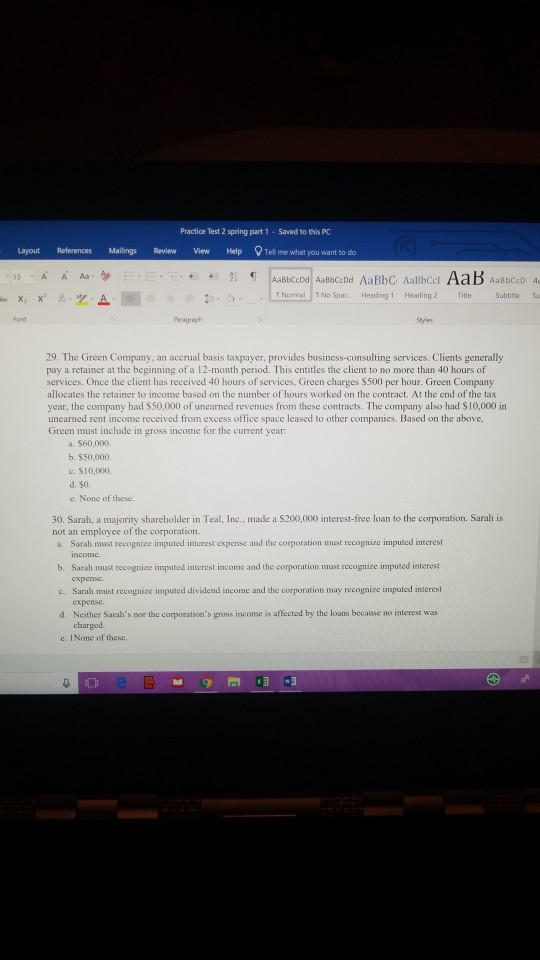

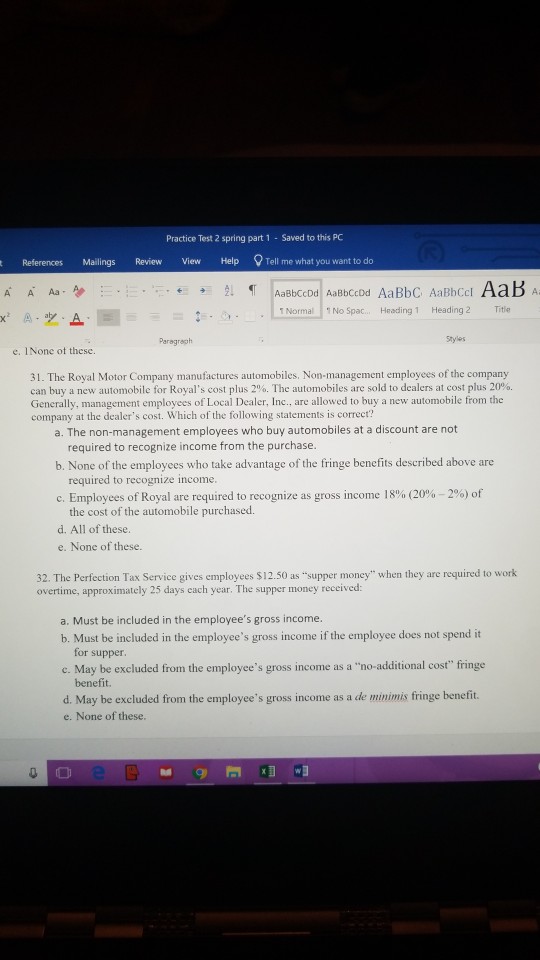

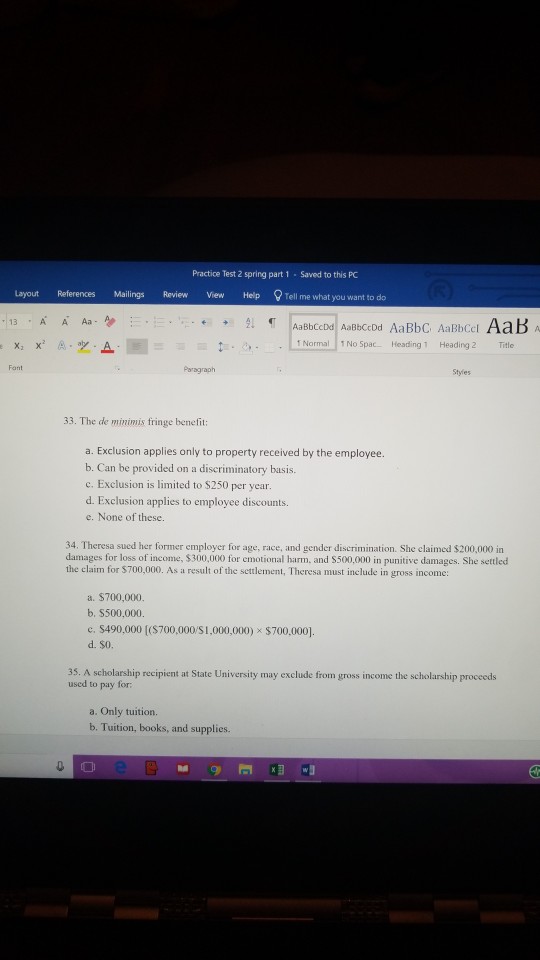

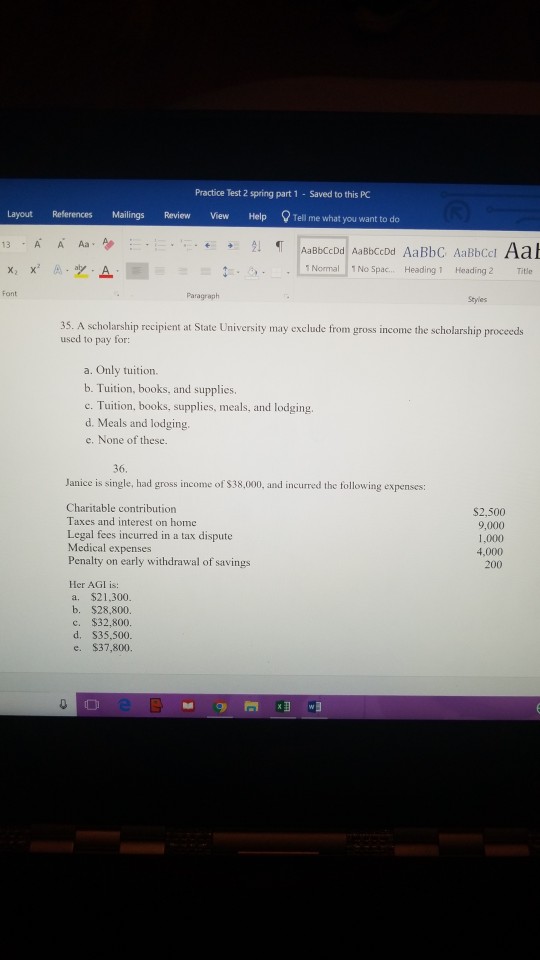

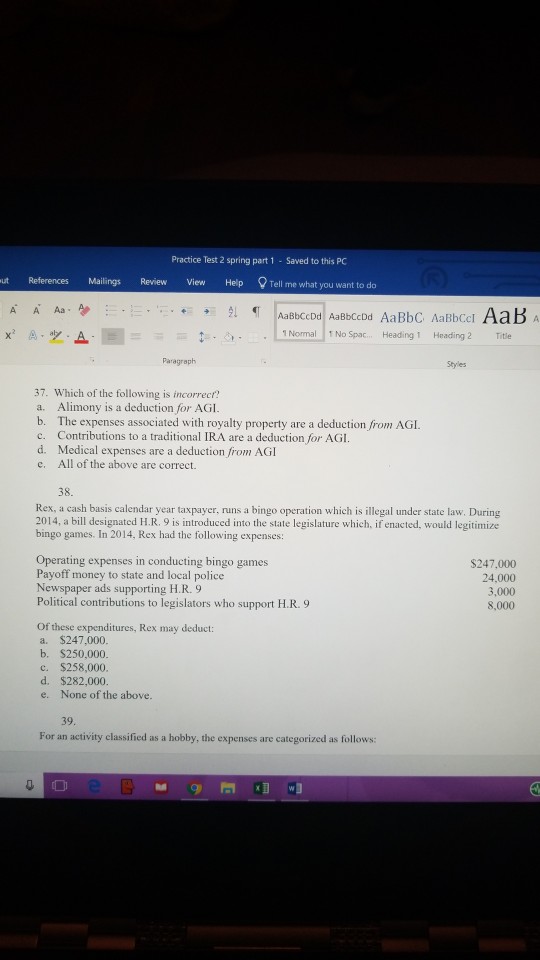

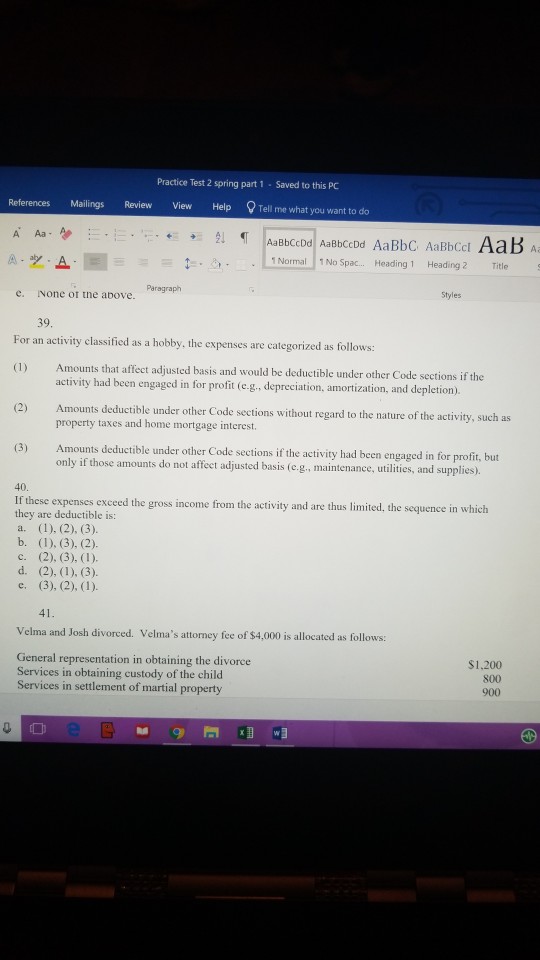

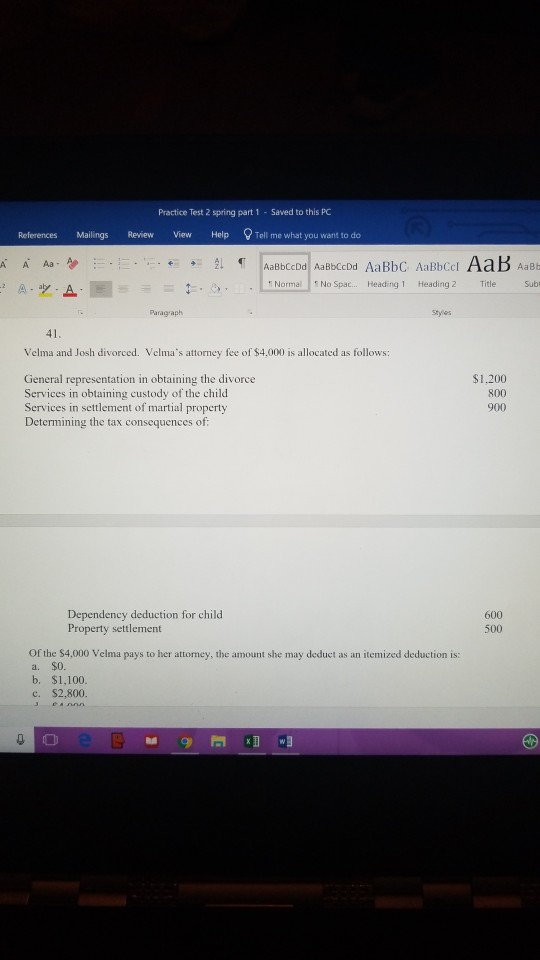

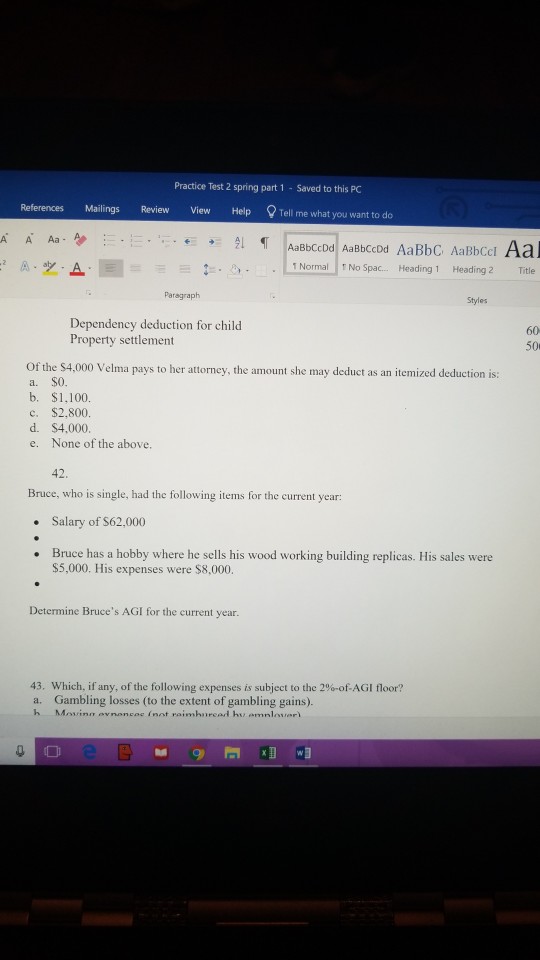

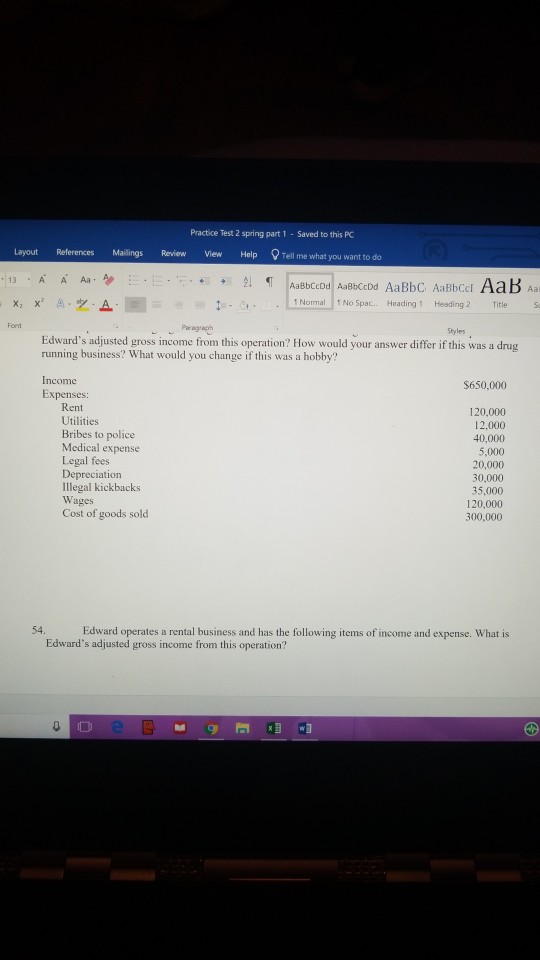

Practice Test 2 spring part 1 Saved to this PC esign Layout Refeences Mailings Review View Help Tell me what you want to do Norme No Spa. Heading Heading2Tite ubtitie Font Peragraph Styles Indicate whether the statement is rrue or false. 1. On December 1, 2015, Daniel, an accrual basis taxpayer, collects $12.000 rent for December 2015 and $12,000 for January 2016. Daniel must inelude the $24,000 in 2015 gross income. 2. The B & W Partnership earned taxable income of $140,000 for the year. Bryan is entitled to 50% of the profits, but Bryan withdrew only $60,000 during the year. Bryan's gross income from the partnership for the year is $60,000 3. Ted eaned S150,000 during the current year. He paid Alice, his former wife, $75,000 in alimony. Under these facts, the tax is paid by the person who benefits from the income rather than the person who earned the 4. Paula transfers stock to her former spouse, Fred. The transfer is pursuant to a divorce agreement. Paula's cost of the stock was $75,000 and its fair market valuc on the date of the transfer is $95.000. Fred later sells the stock for $100,000. Fred's recognized gain from the sale of the stock is $5,000. 5. In the case of a below-market gift loan for which there is no exception to the imputed interest rules, the lender is 6. In the case of a gift loan of less than $100,000, the imputed interest rules apply if the donee has net investment 7. Zack was the beneficiary of a life insurance policy on his wife. Zack had paid S20,000 in premiums on the policy. deemed to have received interest income even though no interest is charged and collected. income of over $1,000. He collected $50,000 on the policy when his wife died from a terminal illness. Because it took several months to process the claim, the insurance company paid Zack $53,000, the face amount of the policy plus $3,000 interest. Zack must include $23,000 in his gross incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started