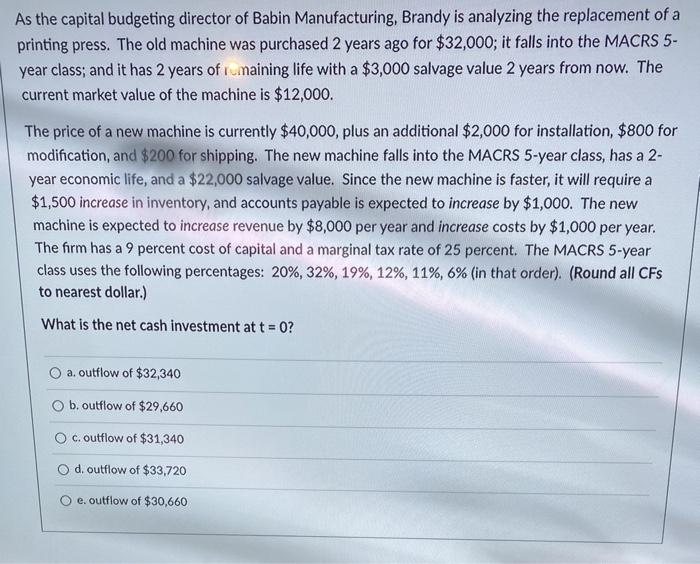

first photo for all 4 questions

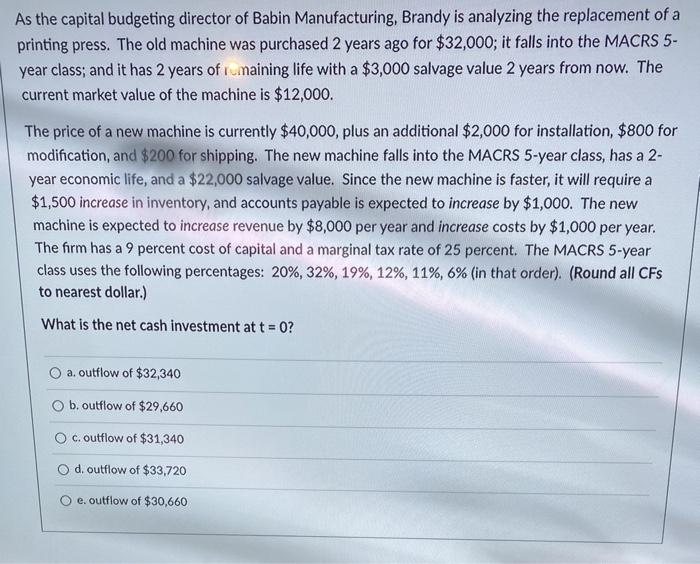

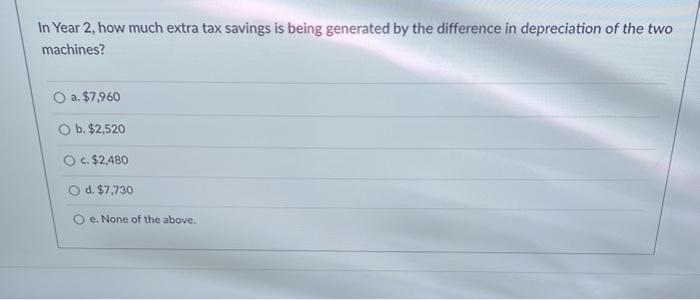

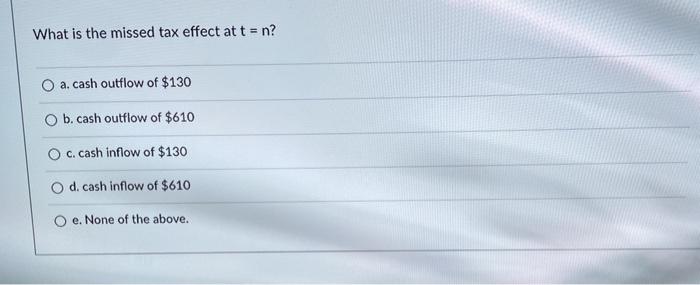

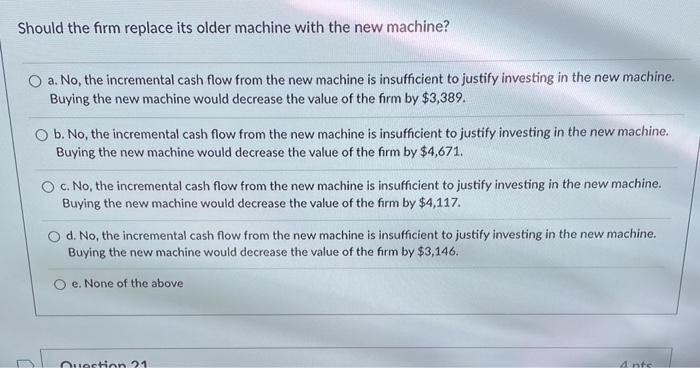

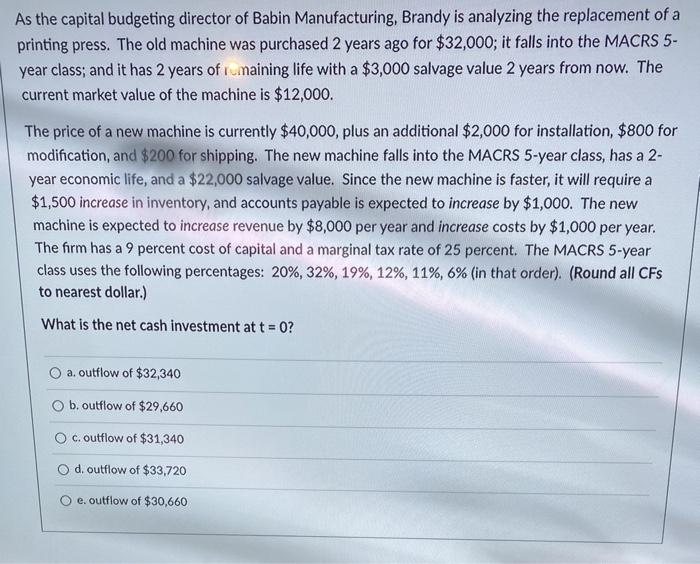

As the capital budgeting director of Babin Manufacturing, Brandy is analyzing the replacement of a printing press. The old machine was purchased 2 years ago for $32,000; it falls into the MACRS 5- year class; and it has 2 years of rumaining life with a $3,000 salvage value 2 years from now. The current market value of the machine is $12,000. The price of a new machine is currently $40,000, plus an additional $2,000 for installation, $800 for modification, and $200 for shipping. The new machine falls into the MACRS 5-year class, has a 2- year economic life, and a $22,000 salvage value. Since the new machine is faster, it will require a $1,500 increase in inventory, and accounts payable is expected to increase by $1,000. The new machine is expected to increase revenue by $8,000 per year and increase costs by $1,000 per year. The firm has a 9 percent cost of capital and a marginal tax rate of 25 percent. The MACRS 5-year class uses the following percentages: 20%, 32%, 19%, 12%, 11%, 6% (in that order). (Round all CFs to nearest dollar.) What is the net cash investment at t = 0? a. outflow of $32,340 b. outflow of $29,660 c. outflow of $31,340 d. outflow of $33,720 e. outflow of $30,660 In Year 2, how much extra tax savings is being generated by the difference in depreciation of the two machines? a. $7,960 b. $2,520 c. $2,480 O d. $7730 O e. None of the above. What is the missed tax effect at t = n? a. cash outflow of $130 b. cash outflow of $610 O c. cash inflow of $130 d. cash inflow of $610 O e. None of the above. Should the firm replace its older machine with the new machine? a. No, the incremental cash flow from the new machine is insufficient to justify investing in the new machine. Buying the new machine would decrease the value of the firm by $3,389. O b. No, the incremental cash flow from the new machine is insufficient to justify investing in the new machine. Buying the new machine would decrease the value of the firm by $4,671. c. No, the incremental cash flow from the new machine is insufficient to justify investing in the new machine. Buying the new machine would decrease the value of the firm by $4,117. d. No, the incremental cash flow from the new machine is insufficient to justify investing in the new machine. Buying the new machine would decrease the value of the firm by $3,146. e. None of the above Cuction 71 1 ts