Answered step by step

Verified Expert Solution

Question

1 Approved Answer

First, pick a company you like, then collect its latest financial statements. 1. Collect information: We need the company's credit rating, stock price per

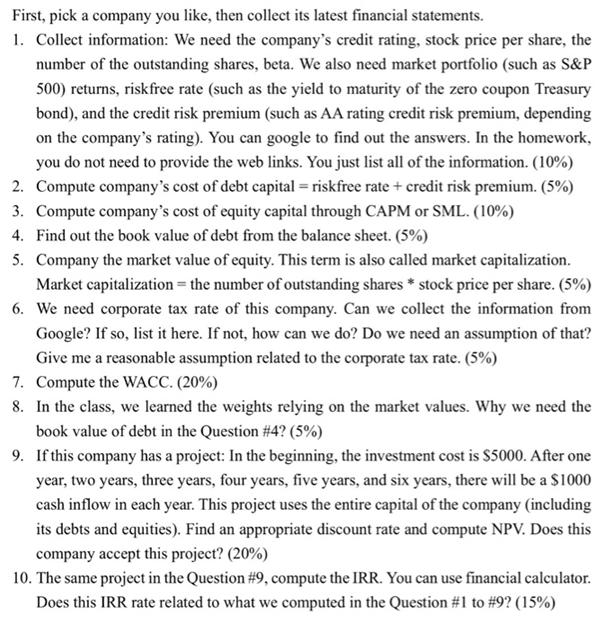

First, pick a company you like, then collect its latest financial statements. 1. Collect information: We need the company's credit rating, stock price per share, the number of the outstanding shares, beta. We also need market portfolio (such as S&P 500) returns, riskfree rate (such as the yield to maturity of the zero coupon Treasury bond), and the credit risk premium (such as AA rating credit risk premium, depending on the company's rating). You can google to find out the answers. In the homework, you do not need to provide the web links. You just list all of the information. (10%) 2. Compute company's cost of debt capital = riskfree rate + credit risk premium. (5%) 3. Compute company's cost of equity capital through CAPM or SML. (10%) 4. Find out the book value of debt from the balance sheet. (5%) 5. Company the market value of equity. This term is also called market capitalization. Market capitalization = the number of outstanding shares * stock price per share. (5%) 6. We need corporate tax rate of this company. Can we collect the information from Google? If so, list it here. If not, how can we do? Do we need an assumption of that? Give me a reasonable assumption related to the corporate tax rate. (5%) 7. Compute the WACC. (20%) 8. In the class, we learned the weights relying on the market values. Why we need the book value of debt in the Question # 4? (5%) 9. If this company has a project: In the beginning, the investment cost is $5000. After one year, two years, three years, four years, five years, and six years, there will be a $1000 cash inflow in each year. This project uses the entire capital of the company (including its debts and equities). Find an appropriate discount rate and compute NPV. Does this company accept this project? (20%) 10. The same project in the Question #9, compute the IRR. You can use financial calculator. Does this IRR rate related to what we computed in the Question #1 to #9? (15%)

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 ANSWER Company Apple Credit Rating Aa1 Stock Price per Share 20748 Number of Outstanding Shares 4829926000 Beta 122 Market Portfolio Returns 679 Ris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started