Answered step by step

Verified Expert Solution

Question

1 Approved Answer

first picture is the instuctions and the secodn photo i need help with a,b, and c also with part d and e Please show your

first picture is the instuctions and the secodn photo i need help with a,b, and c

first picture is the instuctions and the secodn photo i need help with a,b, and c

also with part d and e

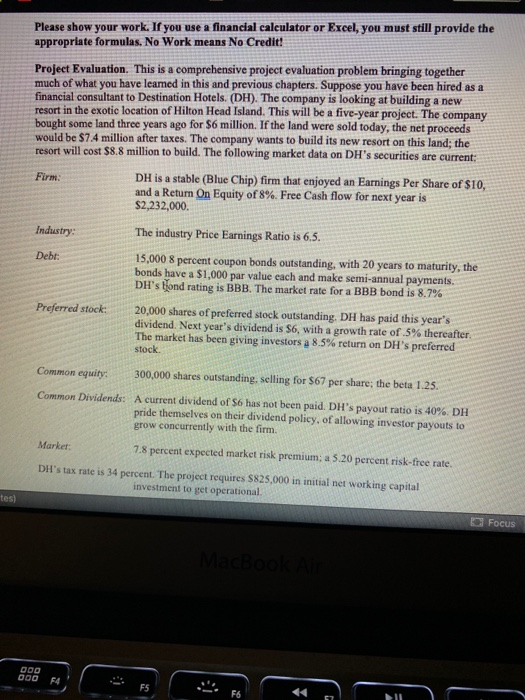

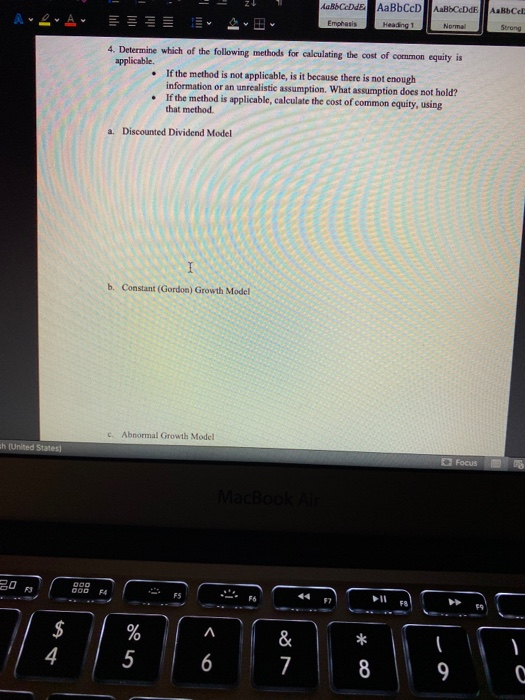

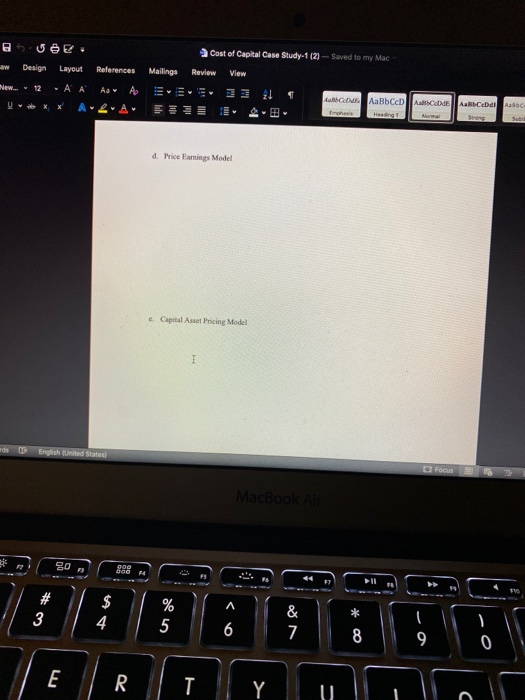

Please show your work. If you use a financial calculator or Excel, you must still provide the appropriate formulas. No Work means No Credit! Project Evaluation. This is a comprehensive project evaluation problem bringing together much of what you have leamed in this and previous chapters. Suppose you have been hired as a financial consultant to Destination Hotels. (DH). The company is looking at building a new resort in the exotic location of Hilton Head Island. This will be a five-year project. The company bought some land three years ago for $6 million. If the land were sold today, the net proceeds would be $7.4 million after taxes. The company wants to build its new resort on this land: the resort will cost $8.8 million to build. The following market data on DH's securities are current: Firm DH is a stable (Blue Chip) firm that enjoyed an Earnings Per Share of $10. and a Return On Equity of 8%. Free Cash flow for next year is $2,232,000. Industry: The industry Price Earnings Ratio is 6.5. Debt: 15,000 8 percent coupon bonds outstanding, with 20 years to maturity, the bonds have a $1,000 par value each and make semi-annual payments DH's hond rating is BBB. The market rate for a BBB bond is 8.7% Preferred stock: 20,000 shares of preferred stock outstanding. DH has paid this year's dividend. Next year's dividend is S6, with a growth rate of 5% thereafter. The market has been giving investors a 8.5% return on DH's preferred stock Common equity: 300,000 shares outstanding, selling for $67 per share the beta 1.25. Common Dividends: A current dividend of $6 has not been paid. DH's payout ratio is 40% DH pride themselves on their dividend policy, of allowing investor payouts to grow concurrently with the firm. Market: 7.8 percent expected market risk premium; a 5.20 percent risk-free rate. DH's tax rate is 34 percent. The project requires $825,000 in initial networking capital investment to get operational tes) Focus ABCDE AaRCEDE AaBbccb Emphasis Heading 1 4. Determine which of the following methods for calculating the cost of common equity is applicable. If the method is not applicable, is it because there is not enough information or an unrealistic assumption. What assumption does not hold? If the method is applicable, calculate the cost of common equity, using that method. a. Discounted Dividend Model b. Constant (Gordon) Growth Model 6. Aboormal Growth Model (United States) o Focus as Joe Cost of Capital Case Study-1 (2) - Saved to my Mac w Design Layout References Mailings Review View w... 2 AA AAEEE 13 COAaBCCD ARCADE ABCDI RIC d. Price Earnings Model e Capital Asset Pricing Model es English (United States Please show your work. If you use a financial calculator or Excel, you must still provide the appropriate formulas. No Work means No Credit! Project Evaluation. This is a comprehensive project evaluation problem bringing together much of what you have leamed in this and previous chapters. Suppose you have been hired as a financial consultant to Destination Hotels. (DH). The company is looking at building a new resort in the exotic location of Hilton Head Island. This will be a five-year project. The company bought some land three years ago for $6 million. If the land were sold today, the net proceeds would be $7.4 million after taxes. The company wants to build its new resort on this land: the resort will cost $8.8 million to build. The following market data on DH's securities are current: Firm DH is a stable (Blue Chip) firm that enjoyed an Earnings Per Share of $10. and a Return On Equity of 8%. Free Cash flow for next year is $2,232,000. Industry: The industry Price Earnings Ratio is 6.5. Debt: 15,000 8 percent coupon bonds outstanding, with 20 years to maturity, the bonds have a $1,000 par value each and make semi-annual payments DH's hond rating is BBB. The market rate for a BBB bond is 8.7% Preferred stock: 20,000 shares of preferred stock outstanding. DH has paid this year's dividend. Next year's dividend is S6, with a growth rate of 5% thereafter. The market has been giving investors a 8.5% return on DH's preferred stock Common equity: 300,000 shares outstanding, selling for $67 per share the beta 1.25. Common Dividends: A current dividend of $6 has not been paid. DH's payout ratio is 40% DH pride themselves on their dividend policy, of allowing investor payouts to grow concurrently with the firm. Market: 7.8 percent expected market risk premium; a 5.20 percent risk-free rate. DH's tax rate is 34 percent. The project requires $825,000 in initial networking capital investment to get operational tes) Focus ABCDE AaRCEDE AaBbccb Emphasis Heading 1 4. Determine which of the following methods for calculating the cost of common equity is applicable. If the method is not applicable, is it because there is not enough information or an unrealistic assumption. What assumption does not hold? If the method is applicable, calculate the cost of common equity, using that method. a. Discounted Dividend Model b. Constant (Gordon) Growth Model 6. Aboormal Growth Model (United States) o Focus as Joe Cost of Capital Case Study-1 (2) - Saved to my Mac w Design Layout References Mailings Review View w... 2 AA AAEEE 13 COAaBCCD ARCADE ABCDI RIC d. Price Earnings Model e Capital Asset Pricing Model es English (United States

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started