Answered step by step

Verified Expert Solution

Question

1 Approved Answer

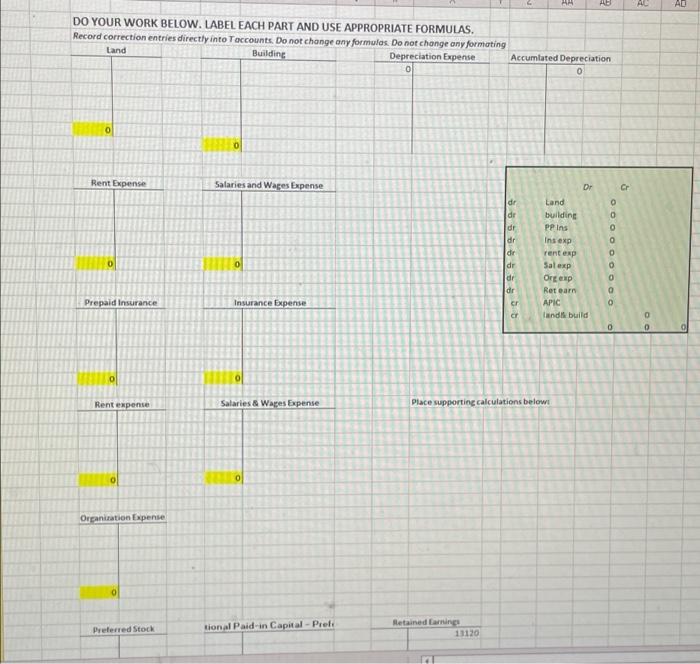

first picture is the question please help with the highlighted areas that is where i must show the entries. Help me with these entries please

first picture is the question please help with the highlighted areas that is where i must show the entries. Help me with these entries please

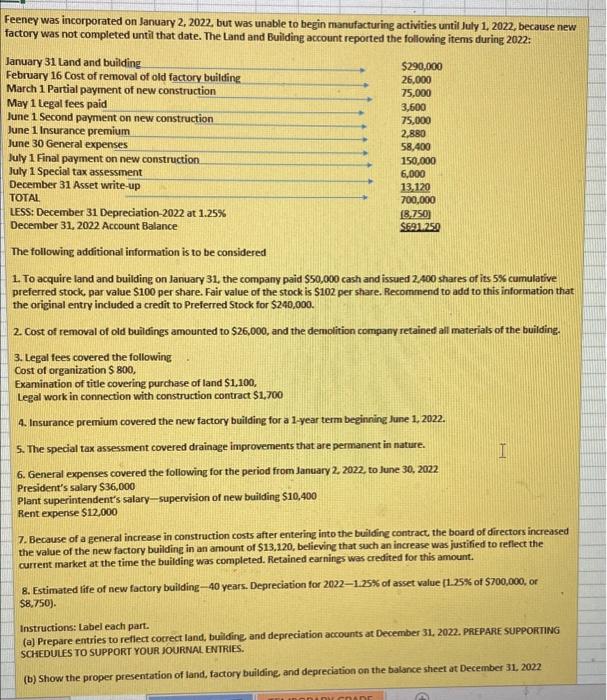

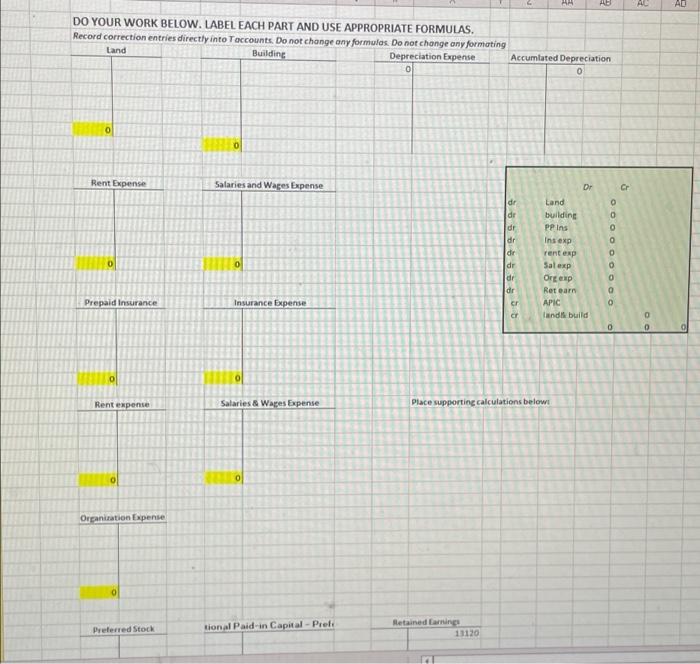

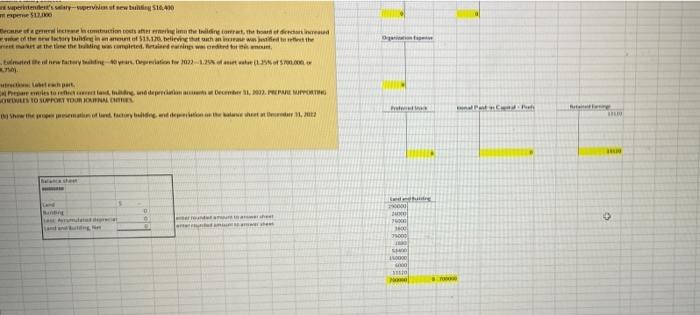

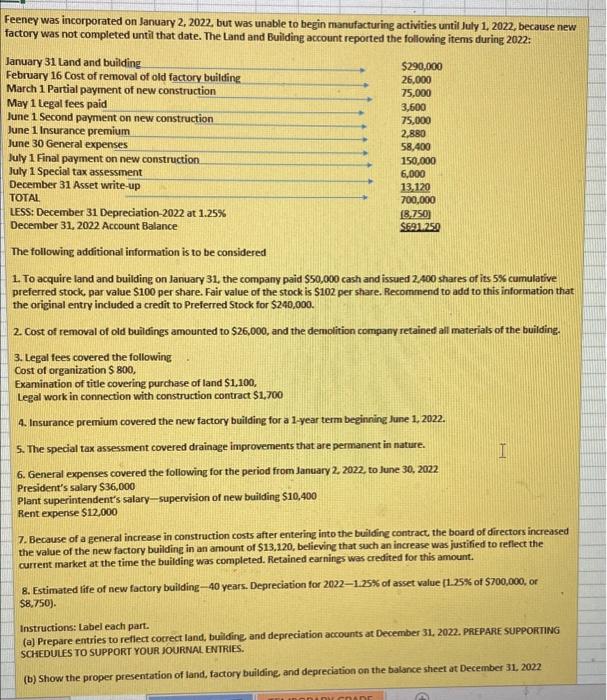

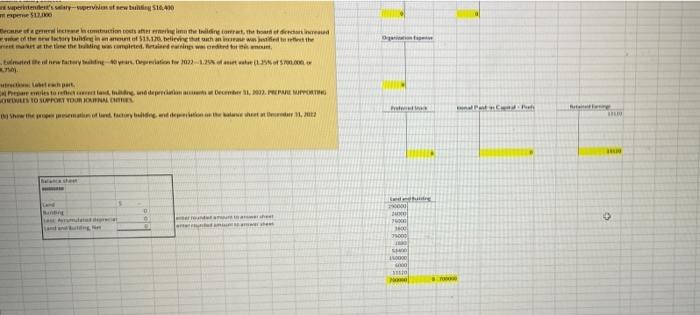

Feeney was incorporated on January 2, 2022, but was unable to begin manufacturing activities until July 1, 2022, because new factory was not completed until that date. The Land and Building account reported the following items during 2022: January 31 Land and building $290,000 February 16 Cost of removal of old factory building 26.000 March 1 Partial payment of new construction 75,000 May 1 Legal fees paid 3,600 June 1 Second payment on new construction 75,000 June 1 Insurance premium 2.880 June 30 General expenses 58.400 July 1 Final payment on new construction 150.000 July 1 Special tax assessment 6,000 December 31 Asset write-up 13.120 TOTAL 700,000 LESS: December 31 Depreciation-2022 at 1.25% (8,750) December 31, 2022 Account Balance S691.25.0 The following additional information is to be considered 1. To acquire land and building on January 31, the company paid $50,000 cash and issued 2400 shares of its 5% cumulative preferred stock, par value $100 per share. Fair value of the stock is $102 per share. Recommend to add to this information that the original entry included a credit to Preferred Stock for $240,000. 2. Cost of removal of old buildings amounted to $26,000, and the demolition company retained all materials of the building, 3. Legal fees covered the following Cost of organization S 800, Examination of title covering purchase of land $1,100, Legal work in connection with construction contract $1,700 4. Insurance premium covered the new factory building for a 1-year term beginning June 1, 2022. 5. The special tax assessment covered drainage improvements that are permanent in nature. I 6. General expenses covered the following for the period from January 2, 2022, to June 30, 2022 President's salary S36,000 Plant superintendent's salary-supervision of new building S10,400 Rent expense $12.000 7. Because of a general increase in construction costs after entering into the building contract, the board of directors increased the value of the new factory building in an amount of $13.120, believing that such an increase was justified to reflect the current market at the time the building was completed. Retained earnings was credited for this amount. 8. Estimated tife of new factory building 40 years. Depreciation for 20221.25% of asset value (1.35% of $700,000, or $8,750). Instructions: Label each part. (a) Prepare entries to reflect correct land, building and depreciation accounts at December 31, 2022. PREPARE SUPPORTING SCHEDULES TO SUPPORT YOUR JOURNAL ENTRIES. (b) Show the proper presentation of land, factory building and depreciation on the balance sheet at December 31, 2022 nircnen HA AD AL AD DO YOUR WORK BELOW. LABEL EACH PART AND USE APPROPRIATE FORMULAS. Record correction entries directly into accounts. Do not change any formulosDo not change any formating Land Building Depreciation Expense Accumlated Depreciation 0 0 0 0 Rent Expense Salaries and Wages Expense & Cr dr dr 999999 Dr Land building PP in Indexp rent exp Sal exp Orep Reteam APIC and build 0 0 dr dr dr Prepaid Insurance Insurance Expense er CT 0 0 0 Rent expense Salaries & Wares Expense Place supporting calculations below 0 Organization Expense Preferred Stock tional Paid in Capital - Prel Retained ning 13120 Superintendentieren sow18.48 e os mening om het of the factory buildinni. Believe that there wieder etter the at the time the big wasted. Het ein wendiked to tulede water. Dis 22.1.2 Wheels to renewed... December , 2007. REUE PORTING OWN TO SUPPORT VOOR BONITE Show much that, boten fee 000 0 h! 9000 IM w Feeney was incorporated on January 2, 2022, but was unable to begin manufacturing activities until July 1, 2022, because new factory was not completed until that date. The Land and Building account reported the following items during 2022: January 31 Land and building $290,000 February 16 Cost of removal of old factory building 26.000 March 1 Partial payment of new construction 75,000 May 1 Legal fees paid 3,600 June 1 Second payment on new construction 75,000 June 1 Insurance premium 2.880 June 30 General expenses 58.400 July 1 Final payment on new construction 150.000 July 1 Special tax assessment 6,000 December 31 Asset write-up 13.120 TOTAL 700,000 LESS: December 31 Depreciation-2022 at 1.25% (8,750) December 31, 2022 Account Balance S691.25.0 The following additional information is to be considered 1. To acquire land and building on January 31, the company paid $50,000 cash and issued 2400 shares of its 5% cumulative preferred stock, par value $100 per share. Fair value of the stock is $102 per share. Recommend to add to this information that the original entry included a credit to Preferred Stock for $240,000. 2. Cost of removal of old buildings amounted to $26,000, and the demolition company retained all materials of the building, 3. Legal fees covered the following Cost of organization S 800, Examination of title covering purchase of land $1,100, Legal work in connection with construction contract $1,700 4. Insurance premium covered the new factory building for a 1-year term beginning June 1, 2022. 5. The special tax assessment covered drainage improvements that are permanent in nature. I 6. General expenses covered the following for the period from January 2, 2022, to June 30, 2022 President's salary S36,000 Plant superintendent's salary-supervision of new building S10,400 Rent expense $12.000 7. Because of a general increase in construction costs after entering into the building contract, the board of directors increased the value of the new factory building in an amount of $13.120, believing that such an increase was justified to reflect the current market at the time the building was completed. Retained earnings was credited for this amount. 8. Estimated tife of new factory building 40 years. Depreciation for 20221.25% of asset value (1.35% of $700,000, or $8,750). Instructions: Label each part. (a) Prepare entries to reflect correct land, building and depreciation accounts at December 31, 2022. PREPARE SUPPORTING SCHEDULES TO SUPPORT YOUR JOURNAL ENTRIES. (b) Show the proper presentation of land, factory building and depreciation on the balance sheet at December 31, 2022 nircnen HA AD AL AD DO YOUR WORK BELOW. LABEL EACH PART AND USE APPROPRIATE FORMULAS. Record correction entries directly into accounts. Do not change any formulosDo not change any formating Land Building Depreciation Expense Accumlated Depreciation 0 0 0 0 Rent Expense Salaries and Wages Expense & Cr dr dr 999999 Dr Land building PP in Indexp rent exp Sal exp Orep Reteam APIC and build 0 0 dr dr dr Prepaid Insurance Insurance Expense er CT 0 0 0 Rent expense Salaries & Wares Expense Place supporting calculations below 0 Organization Expense Preferred Stock tional Paid in Capital - Prel Retained ning 13120 Superintendentieren sow18.48 e os mening om het of the factory buildinni. Believe that there wieder etter the at the time the big wasted. Het ein wendiked to tulede water. Dis 22.1.2 Wheels to renewed... December , 2007. REUE PORTING OWN TO SUPPORT VOOR BONITE Show much that, boten fee 000 0 h! 9000 IM w

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started