first two

increase / decraese

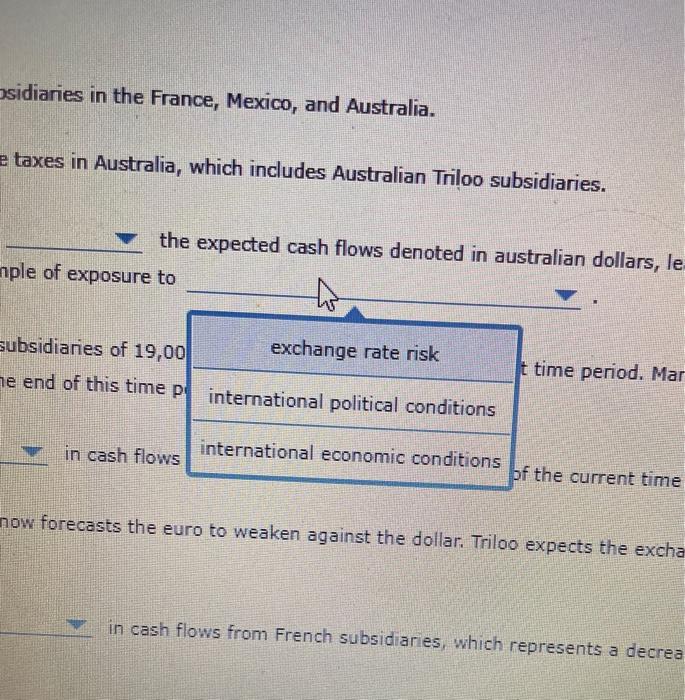

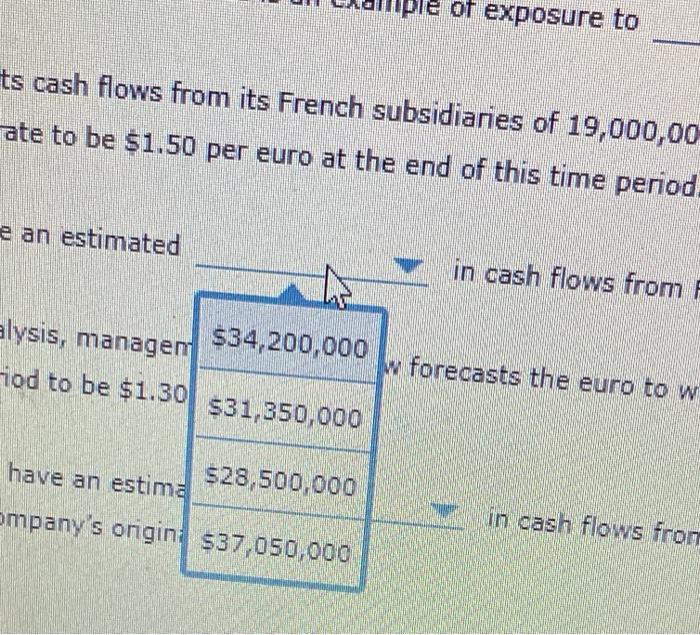

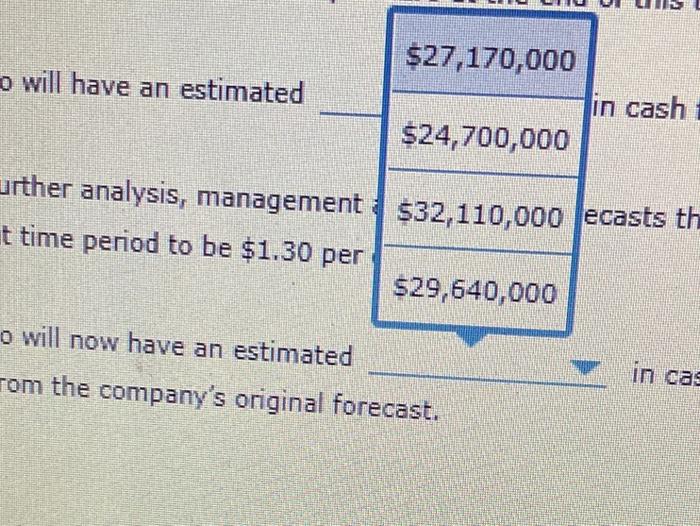

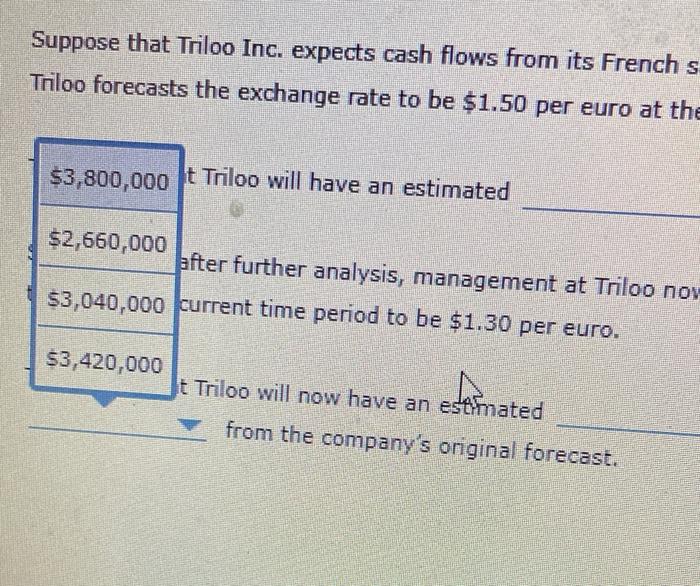

7. Sources of uncertainty of MNC's Cash Flows Consider a U.S.-based MNC parent, Thico Inc., that owns subsidiaries in the France, Mexico, and Australia, Suppose that the Australian government decreases corporate taxes in Australia, which includes Australian Triso subsidianes. This decrease in corporate taxes in Australia will most likely the expected cash flows denoted in australian dollard, leading to in the value of Tolco Inc. This is an example of exposure to Suppose that Thioo incexpects cash flows from its French subsidiaries of 19,000,000 euros at the end of the current time period. Management Triloo forecasts the exchange rate to be 11.50 per euro at the end of this time period, This means that Thoo will have an estimated in cash flows from French Subtidianes at the end of the current time period, Suppose that after further analyso, management at Trio now forecasts to euro to weaken against the dollar. This expects the change rates the thid of the current time period to be $1.30 per euro in cash ons from French a which represent. decrease This means that the wol now have an estimates from the company's origine forecast sidiaries in the France, Mexico, and Australia. e taxes in Australia, which includes Australian Triloo subsidiaries. the expected cash flows denoted in australian dollars, le nple of exposure to subsidiaries of 19,00 exchange rate risk he end of this time pe international political conditions It time period. Mar in cash flows international economic conditions of the current time now forecasts the euro to weaken against the dollar. Triloo expects the excha in cash flows from French subsidiaries, which represents a decrea uple of exposure to ts cash flows from its French subsidiaries of 19,000,00 ate to be $1.50 per euro at the end of this time period. e an estimated in cash flows from F alysis, manager $34,200,000 w forecasts the euro to w iod to be $1.30 $31,350,000 528,500,000 have an estima ompany's origin: 537,050,000 en in cash flows from $27,170,000 o will have an estimated in cash $24,700,000 urther analysis, management $32,110,000 ecasts th t time period to be $1.30 per $29,640,000 o will now have an estimated rom the company's original forecast. in cas Suppose that Triloo Inc. expects cash flows from its French s Triloo forecasts the exchange rate to be $1.50 per euro at the $3,800,000 t Triloo will have an estimated $2,660,000 after further analysis, management at Triloo nov 53,040,000 current time period to be $1.30 per euro. $3,420,000 t Triloo will now have an estimated from the company's original forecast