first two pictures are the question

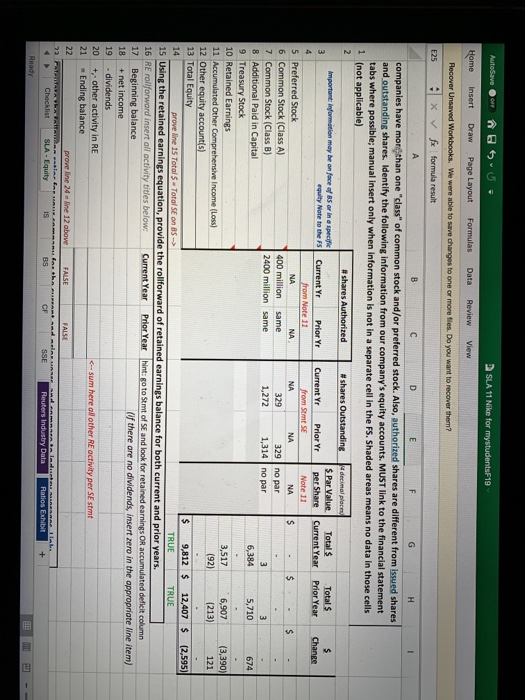

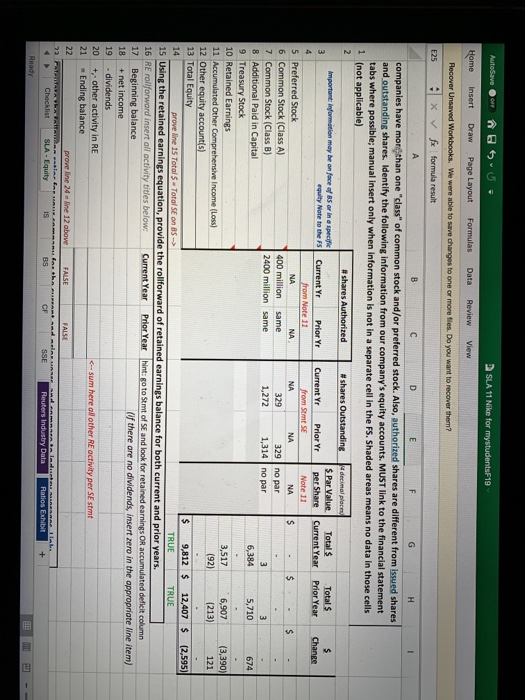

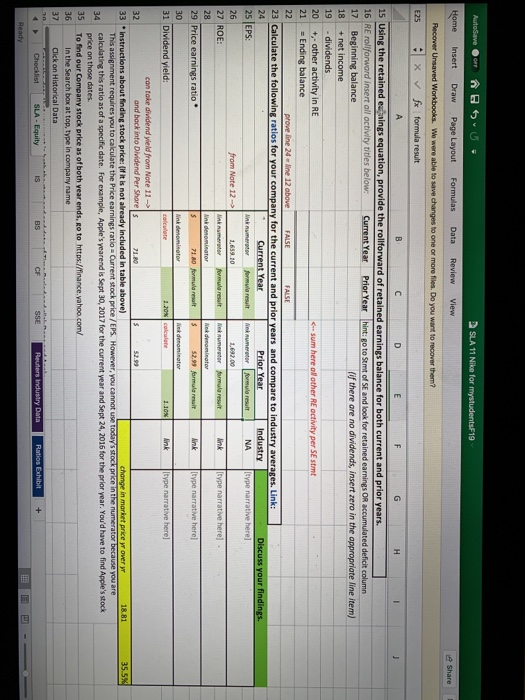

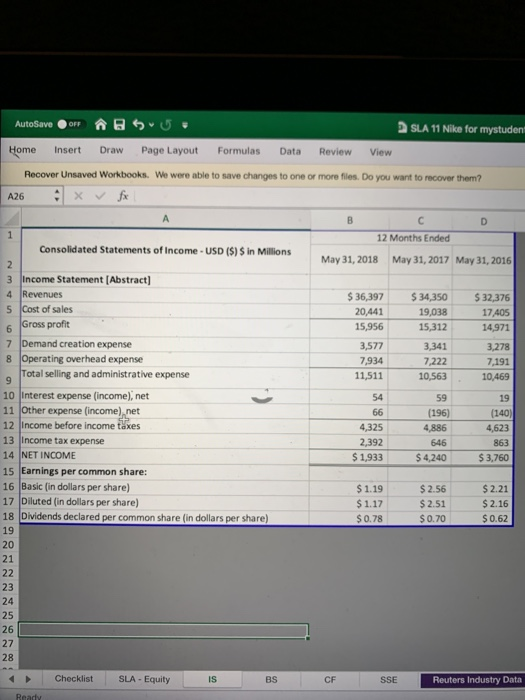

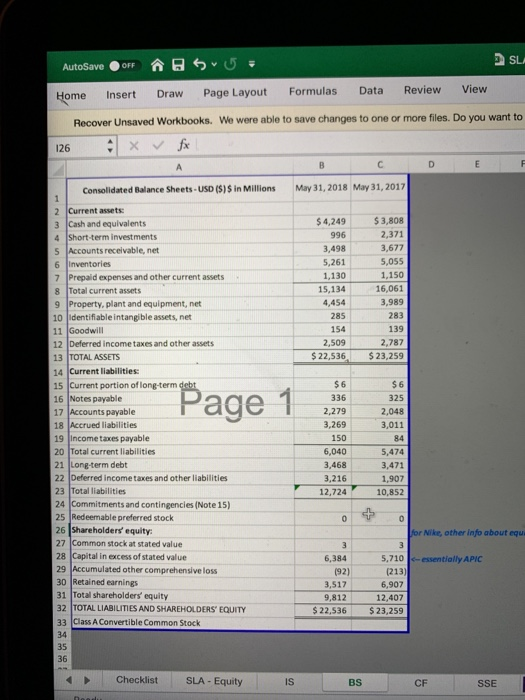

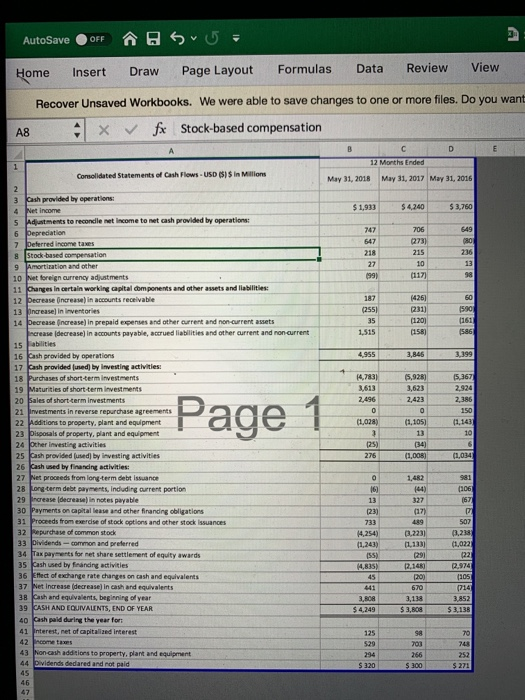

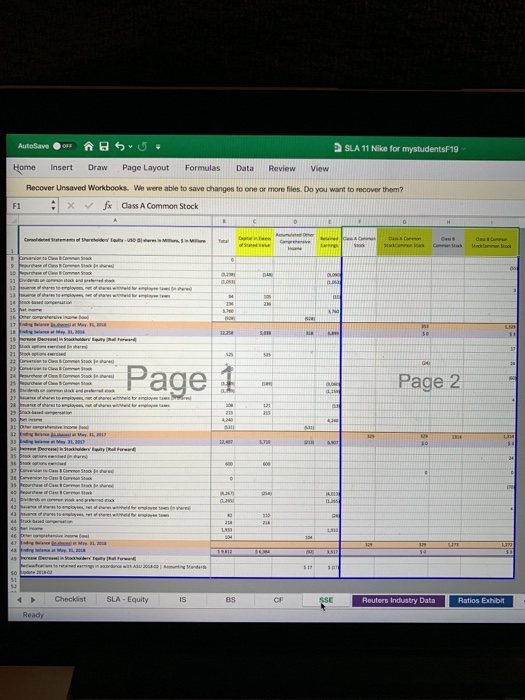

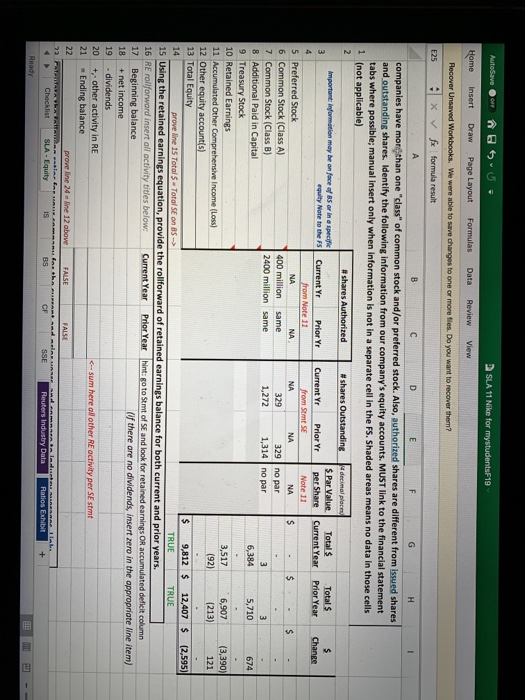

D SLA 11 Nike for mystudentsF19 AutoSave Home Insert Draw Page Layout Formulas Data Review View Recover Unsaved Workbooks. We were able to save changes to one or more fies. Do you want to recover them? E25 X v f formula result D. H. companies have monthan one "class" of common stock and/or preferred stock. Also, authorized shares are different from issued shares and outstanding shares. Identify the following information from our company's equity accounts. MUST link to the financial statement tabs where possible; manual insert only when information is not in a separate cell in the FS. Shaded areas means no data in those cells (not applicable) # shares Authorized # shares Outstanding 4 decimal pleces Important: information may be on face of BS or in a specifie S Par Value Total $ Total $ equity Nate to the FS Current Yr Prior Yr Current Yr Prior Yr per Share Current Year Prior Year Change from Note 11 from Stmt SE Note 11 5 Preferred Stock 6 Common Stock (Class A) 7 Common Stock (Class B) 8 Additional Paid in Capital 9 Treasury Stock 10 Retained Earnings 11 Accumulated Other Comprehensive Income (Loss) 12 Other equity account(s) 13 Total Equity NA NA NA NA NA 400 million same 329 329 no par 2400 million same 1,272 1,314 no par 6,384 5,710 674 3,517 6,907 (3,390) (92) (213) 121 9,812 $ 12,407 $ (2,595) 14 prove line 15 Total $- Total SE on BS-> TRUE TRUE 15 Using the retained earnings equation, provide the rollforward of retained earnings balance for both current and prior years. 16 RE rollforward insert all activity titles below: 17 Beginning balance Current Year Prior Year hint: go to Stmt of SE and look for retained earnings OR accumulated deficit column Of there are no dividends, insert zero in the appropriate line item) + net income - dividends 18 19 20 +, other activity in RE 1,659.10 1,692.00 27 ROE: Aink numerator formula result Nnk numerator formula resuit link [type narrative here) 28 Aink denominator Nek denaminator 29 Price earnings ratio 71.80 formula resalt 52.99 formula result Ank [type narrative here] 30 Aink denominator nk denaminator 31 Dividend yield: 1.20% calculate Aink [type narrative here] calculete 1.10% can take dividend yield from Note 11- and back into Dividend Per Shares 32 71.80 52.99 33 * instructions about finding stock price: (if it is not already included in table above) This assignment requires you to calculate the Price earnings ratio Current stock price / EPS. However, you cannot use today's stock price in the numerator because you are calculating this ratio as of a specific date. For example, Apple's yearend is Sept 30, 2017 for the current year and Sept 24, 2016 for the prior year. You'd have to find Apple's stock price on those dates. To find our Company stock price as of both vear ends, Ro to https://finance.yahoo.com/ 36 change in market price yr over yr 18.81 35.5% 34 35 In the Search box at top, type in company name 37 Click on Historical Data SLA - Equity Ratios Exhibit Checklist IS BS CF SSE Reuters Industry Data Ready AutoSave a SLA 11 Nike for mystuden Home Insert Draw Page Layout Formulas Data Review View Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? A26 D. 12 Months Ended Consolidated Statements of Income - USD ($) S in Millions May 31, 2017 May 31, 2016 May 31, 2018 3 Income Statement [Abstract] 4 Revenues 5 Cost of sales Gross profit $ 36,397 $ 34,350 $ 32,376 20,441 19,038 17,405 15,956 15,312 14,971 7 Demand creation expense 8 Operating overhead expense Total selling and administrative expense 3,278 7,191 3,577 3,341 7,934 7,222 11,511 10,563 10,469 10 Interest expense (income), net 11 Other expense (income), net 12 Income before income taxes 13 Income tax expense 14 NET INCOME 15 Earnings per common share: 16 Basic (in dollars per share) 17 Diluted (in dollars per share) 18 Dividends declared per common share (in dollars per share) 54 59 19 66 (196) (140| 4,325 4,886 4,623 2,392 646 863 $1,933 $4,240 $ 3,760 $1.19 $2.56 $2.21 $1.17 $2.51 $2.16 $0.70 $0.78 $0.62 19 20 21 22 23 24 25 26 27 28 SLA - Equity Checklist IS BS CF SE Reuters Industry Data Ready SLA AutoSave OFF Review View Page Layout Formulas Data Draw Insert Home We were able to save changes to one or more files. Do you want to Recover Unsaved Workbooks. 126 May 31, 2018 May 31, 2017 Consolidated Balance Sheets - USD (S)S in Millions 2 Current assets: $ 3,808 $ 4,249 3 Cash and equivalents 4 Short-term investments 5 Accounts receivable, net 6 Inventories 7 Prepaid expenses and other current assets 8 Total current assets 9 Property, plant and equipment, net 10 identifiable intangible assets, net 11 Goodwill 12 Deferred income taxes and other assets 13 TOTAL ASSETS 14 Current liabilities: 15 Current portion of long-term debt 16 Notes payable 17 Accounts payable 18 Accrued liabilities 19 Income taxes payable 20 Total current liabilities 21 Long-term debt 22 Deferred income taxes and other liabilities 23 Total liabilities 24 Commitments and contingencies (Note 15) 25 Redeemable preferred stock 26 Shareholders equity: 27 Common stock at stated value 28 Capital in excess of stated value 29 Accumulated other comprehensive loss 30 Retained earnings 31 Total shareholders' equity 32 TOTAL LIABILITIES AND SHAREHOLDERS EQUITY 33 Class A Convertible Common Stock 2,371 996 3,498 3,677 5,055 5,261 1,150 1,130 16,061 15,134 3,989 4,454 283 285 154 139 2,509 2,787 $22,536 $23,259 $6 $6 "Page 1 336 325 2,279 2,048 3,269 3,011 150 84 6,040 5,474 3,468 3,471 3,216 1,907 12,724 10,852 for Nike, other info about eque 5,710 -essentially APIC (213) 6,384 (92) 3,517 6,907 9,812 12.407 $ 22,536 $ 23,259 34 35 36 SLA - Equity Checklist IS BS CF SSE OFF AutoSave View Review Data Formulas Page Layout Draw Home Insert We were able to save changes to one or more files. Do you want Recover Unsaved Workbooks. Stock-based compensation : x v fx A8 12 Months Ended Consolidated Statements of Cash Flows- USD SIS in Mllions May 31, 2016 May 31, 2017 May 31, 2018 Cash provided by operations: Net income 5 Adjustments to recondile net income to net cash provided by operations: $1,933 $4.240 $3,760 4. 649 747 706 6 Depreciation (273) 647 7 Deferred income taxes 215 236 218 8 Stock-based compensation 27 10 13 9 Amortization and other (117) 98 10 Net foreign currency adjustments 11 Changes in certain working capital domponents and other assets and liabilitles: 12 becrease (ncrease) in accounts receivable 13 ncrease) in inventories 14 Decrease (increase) in prepaid expenses and other current and non-current assets ncrease (decrease) in accounts payable, accrued liabilities and other aurrent and non current 15 abilities 16 Cash provided by operations 17 Cash provided jused) by investing activities: 18 Purchases of short-term investments 19 Maturities of short term investments 20 Sales of short term investments 21 investments in reverse repurchase agreements 22 Additions to property, plant and equipment 23 Disposals of property, plant and equipment 24 other investing activities 25 Cash provided (used) by investing activities 26 Cash used by financing activities: 27 Net proceeds from long-term debt issuance 28 Long term debt payments, Induding ourrent portion 29 ncrease (decrease) in notes payable 30 Payments on capital lease and other firanding obligations 31 Proceeds from exercise of stock options and other stock issuances (99) (426) 187 60 (590 (255) (231) (161 35 (120) (586 1,515 (158) 3,846 3,399 4,955 (5,928) (5,367 14,783) 3,613 3,623 2.924 Page 1 2,496 2,386 2,423 150 (1,028) (1,105) (1,143 13 10 (25) (34) (1,008) (1,034 276 1,482 981 (106 (6) (44) 13 327 (67 (17) (23) 489 507 733 32 epurchase of common stock 33 Dividends - common and preferred 34 Tax payments for net share settlement of equity awards 35 Cash used by finanding activities 36 Eftect of exchange rate changes on cash and equivalents 37 Net Increase (decrease) in cash and equivalents 38 kash and equivalents, beginning of year 3,223) (1,238 (4,254) (1,022 (1,243) (1,133) (55) (29) (22 2.9741 (4,835) (2,148) (105 45 (20) 441 670 (714) 3,808 3,138 3,852 39 CASH AND EQUIVALENTS, END OF YEAR $ 3,808 $3,138 $4,249 40 Cash paid during the year for 41 Interest, net of capitalized interest 125 S8 70 42 ncome taxes 529 703 748 43 Non-cash additions to property, plant and equipment 44 pividends dedared and not paid 294 266 252 $ 320 $ 300 $ 271 45 46 47 AutoSave a SLA 11 Nike for mystudentsF19 Home Draw Page Layout Formulas Review Insert Data View Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? X v fx alass A Common Stock F1 Amumulete e Caital Carelded Stteme er e ty o r M M Cen Ca Coon O Canan Yotal Camrhene Came ta ame 8aneant C Conen Sta 9rseof Caen S re orhe of C Commen Sa 11 pvidnd on an nd 12 ersharstemlye o ed e 14 dtd ompenation 15 het ie 16 per compreterive i o 17 l My, AND 12.25 19 Deoin leny er 20 taer nsherm 21 tsred 22 en CCommen Sao jeeg 23 aner a ClCemen 24 erhene of CnComen Stad hre 25 ourd of Cleneen St 26 dents on n nd 27 retmpiyeet of hareweie tor employe 24 othartoayo afares emlay ta 29 a d tion Page 1 Page 2 121 213 4.240 3: ber rershenve inor b 2dan My. , 33 a M L 2p 34 Dereein Staalde tty Farw as bo oerigrresedin arn 2134 12,4 24 36 prk oions e d 32 kaneanteCeComen Sta in re s00 karvenion te CamGarynon ita 38 41 bv en 42 hrtmply, e re t her 41 etthares t lays retfPer w d rn te 44 brakeedoetio 45 t ine 46 ber eteme ine 4dinga M , a 48 ding belanaMay. , a 49 re Deoin Sader tt at terwa S04 104 329 ASIP fotio retederingin dnwth Au 20 Aunting Standar $1 51 SLA - Equity Checklist IS BS CF SSE Reuters Industry Data Ratios Exhibit Ready D SLA 11 Nike for mystudentsF19 AutoSave Home Insert Draw Page Layout Formulas Data Review View Recover Unsaved Workbooks. We were able to save changes to one or more fies. Do you want to recover them? E25 X v f formula result D. H. companies have monthan one "class" of common stock and/or preferred stock. Also, authorized shares are different from issued shares and outstanding shares. Identify the following information from our company's equity accounts. MUST link to the financial statement tabs where possible; manual insert only when information is not in a separate cell in the FS. Shaded areas means no data in those cells (not applicable) # shares Authorized # shares Outstanding 4 decimal pleces Important: information may be on face of BS or in a specifie S Par Value Total $ Total $ equity Nate to the FS Current Yr Prior Yr Current Yr Prior Yr per Share Current Year Prior Year Change from Note 11 from Stmt SE Note 11 5 Preferred Stock 6 Common Stock (Class A) 7 Common Stock (Class B) 8 Additional Paid in Capital 9 Treasury Stock 10 Retained Earnings 11 Accumulated Other Comprehensive Income (Loss) 12 Other equity account(s) 13 Total Equity NA NA NA NA NA 400 million same 329 329 no par 2400 million same 1,272 1,314 no par 6,384 5,710 674 3,517 6,907 (3,390) (92) (213) 121 9,812 $ 12,407 $ (2,595) 14 prove line 15 Total $- Total SE on BS-> TRUE TRUE 15 Using the retained earnings equation, provide the rollforward of retained earnings balance for both current and prior years. 16 RE rollforward insert all activity titles below: 17 Beginning balance Current Year Prior Year hint: go to Stmt of SE and look for retained earnings OR accumulated deficit column Of there are no dividends, insert zero in the appropriate line item) + net income - dividends 18 19 20 +, other activity in RE 1,659.10 1,692.00 27 ROE: Aink numerator formula result Nnk numerator formula resuit link [type narrative here) 28 Aink denominator Nek denaminator 29 Price earnings ratio 71.80 formula resalt 52.99 formula result Ank [type narrative here] 30 Aink denominator nk denaminator 31 Dividend yield: 1.20% calculate Aink [type narrative here] calculete 1.10% can take dividend yield from Note 11- and back into Dividend Per Shares 32 71.80 52.99 33 * instructions about finding stock price: (if it is not already included in table above) This assignment requires you to calculate the Price earnings ratio Current stock price / EPS. However, you cannot use today's stock price in the numerator because you are calculating this ratio as of a specific date. For example, Apple's yearend is Sept 30, 2017 for the current year and Sept 24, 2016 for the prior year. You'd have to find Apple's stock price on those dates. To find our Company stock price as of both vear ends, Ro to https://finance.yahoo.com/ 36 change in market price yr over yr 18.81 35.5% 34 35 In the Search box at top, type in company name 37 Click on Historical Data SLA - Equity Ratios Exhibit Checklist IS BS CF SSE Reuters Industry Data Ready AutoSave a SLA 11 Nike for mystuden Home Insert Draw Page Layout Formulas Data Review View Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? A26 D. 12 Months Ended Consolidated Statements of Income - USD ($) S in Millions May 31, 2017 May 31, 2016 May 31, 2018 3 Income Statement [Abstract] 4 Revenues 5 Cost of sales Gross profit $ 36,397 $ 34,350 $ 32,376 20,441 19,038 17,405 15,956 15,312 14,971 7 Demand creation expense 8 Operating overhead expense Total selling and administrative expense 3,278 7,191 3,577 3,341 7,934 7,222 11,511 10,563 10,469 10 Interest expense (income), net 11 Other expense (income), net 12 Income before income taxes 13 Income tax expense 14 NET INCOME 15 Earnings per common share: 16 Basic (in dollars per share) 17 Diluted (in dollars per share) 18 Dividends declared per common share (in dollars per share) 54 59 19 66 (196) (140| 4,325 4,886 4,623 2,392 646 863 $1,933 $4,240 $ 3,760 $1.19 $2.56 $2.21 $1.17 $2.51 $2.16 $0.70 $0.78 $0.62 19 20 21 22 23 24 25 26 27 28 SLA - Equity Checklist IS BS CF SE Reuters Industry Data Ready SLA AutoSave OFF Review View Page Layout Formulas Data Draw Insert Home We were able to save changes to one or more files. Do you want to Recover Unsaved Workbooks. 126 May 31, 2018 May 31, 2017 Consolidated Balance Sheets - USD (S)S in Millions 2 Current assets: $ 3,808 $ 4,249 3 Cash and equivalents 4 Short-term investments 5 Accounts receivable, net 6 Inventories 7 Prepaid expenses and other current assets 8 Total current assets 9 Property, plant and equipment, net 10 identifiable intangible assets, net 11 Goodwill 12 Deferred income taxes and other assets 13 TOTAL ASSETS 14 Current liabilities: 15 Current portion of long-term debt 16 Notes payable 17 Accounts payable 18 Accrued liabilities 19 Income taxes payable 20 Total current liabilities 21 Long-term debt 22 Deferred income taxes and other liabilities 23 Total liabilities 24 Commitments and contingencies (Note 15) 25 Redeemable preferred stock 26 Shareholders equity: 27 Common stock at stated value 28 Capital in excess of stated value 29 Accumulated other comprehensive loss 30 Retained earnings 31 Total shareholders' equity 32 TOTAL LIABILITIES AND SHAREHOLDERS EQUITY 33 Class A Convertible Common Stock 2,371 996 3,498 3,677 5,055 5,261 1,150 1,130 16,061 15,134 3,989 4,454 283 285 154 139 2,509 2,787 $22,536 $23,259 $6 $6 "Page 1 336 325 2,279 2,048 3,269 3,011 150 84 6,040 5,474 3,468 3,471 3,216 1,907 12,724 10,852 for Nike, other info about eque 5,710 -essentially APIC (213) 6,384 (92) 3,517 6,907 9,812 12.407 $ 22,536 $ 23,259 34 35 36 SLA - Equity Checklist IS BS CF SSE OFF AutoSave View Review Data Formulas Page Layout Draw Home Insert We were able to save changes to one or more files. Do you want Recover Unsaved Workbooks. Stock-based compensation : x v fx A8 12 Months Ended Consolidated Statements of Cash Flows- USD SIS in Mllions May 31, 2016 May 31, 2017 May 31, 2018 Cash provided by operations: Net income 5 Adjustments to recondile net income to net cash provided by operations: $1,933 $4.240 $3,760 4. 649 747 706 6 Depreciation (273) 647 7 Deferred income taxes 215 236 218 8 Stock-based compensation 27 10 13 9 Amortization and other (117) 98 10 Net foreign currency adjustments 11 Changes in certain working capital domponents and other assets and liabilitles: 12 becrease (ncrease) in accounts receivable 13 ncrease) in inventories 14 Decrease (increase) in prepaid expenses and other current and non-current assets ncrease (decrease) in accounts payable, accrued liabilities and other aurrent and non current 15 abilities 16 Cash provided by operations 17 Cash provided jused) by investing activities: 18 Purchases of short-term investments 19 Maturities of short term investments 20 Sales of short term investments 21 investments in reverse repurchase agreements 22 Additions to property, plant and equipment 23 Disposals of property, plant and equipment 24 other investing activities 25 Cash provided (used) by investing activities 26 Cash used by financing activities: 27 Net proceeds from long-term debt issuance 28 Long term debt payments, Induding ourrent portion 29 ncrease (decrease) in notes payable 30 Payments on capital lease and other firanding obligations 31 Proceeds from exercise of stock options and other stock issuances (99) (426) 187 60 (590 (255) (231) (161 35 (120) (586 1,515 (158) 3,846 3,399 4,955 (5,928) (5,367 14,783) 3,613 3,623 2.924 Page 1 2,496 2,386 2,423 150 (1,028) (1,105) (1,143 13 10 (25) (34) (1,008) (1,034 276 1,482 981 (106 (6) (44) 13 327 (67 (17) (23) 489 507 733 32 epurchase of common stock 33 Dividends - common and preferred 34 Tax payments for net share settlement of equity awards 35 Cash used by finanding activities 36 Eftect of exchange rate changes on cash and equivalents 37 Net Increase (decrease) in cash and equivalents 38 kash and equivalents, beginning of year 3,223) (1,238 (4,254) (1,022 (1,243) (1,133) (55) (29) (22 2.9741 (4,835) (2,148) (105 45 (20) 441 670 (714) 3,808 3,138 3,852 39 CASH AND EQUIVALENTS, END OF YEAR $ 3,808 $3,138 $4,249 40 Cash paid during the year for 41 Interest, net of capitalized interest 125 S8 70 42 ncome taxes 529 703 748 43 Non-cash additions to property, plant and equipment 44 pividends dedared and not paid 294 266 252 $ 320 $ 300 $ 271 45 46 47 AutoSave a SLA 11 Nike for mystudentsF19 Home Draw Page Layout Formulas Review Insert Data View Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? X v fx alass A Common Stock F1 Amumulete e Caital Carelded Stteme er e ty o r M M Cen Ca Coon O Canan Yotal Camrhene Came ta ame 8aneant C Conen Sta 9rseof Caen S re orhe of C Commen Sa 11 pvidnd on an nd 12 ersharstemlye o ed e 14 dtd ompenation 15 het ie 16 per compreterive i o 17 l My, AND 12.25 19 Deoin leny er 20 taer nsherm 21 tsred 22 en CCommen Sao jeeg 23 aner a ClCemen 24 erhene of CnComen Stad hre 25 ourd of Cleneen St 26 dents on n nd 27 retmpiyeet of hareweie tor employe 24 othartoayo afares emlay ta 29 a d tion Page 1 Page 2 121 213 4.240 3: ber rershenve inor b 2dan My. , 33 a M L 2p 34 Dereein Staalde tty Farw as bo oerigrresedin arn 2134 12,4 24 36 prk oions e d 32 kaneanteCeComen Sta in re s00 karvenion te CamGarynon ita 38 41 bv en 42 hrtmply, e re t her 41 etthares t lays retfPer w d rn te 44 brakeedoetio 45 t ine 46 ber eteme ine 4dinga M , a 48 ding belanaMay. , a 49 re Deoin Sader tt at terwa S04 104 329 ASIP fotio retederingin dnwth Au 20 Aunting Standar $1 51 SLA - Equity Checklist IS BS CF SSE Reuters Industry Data Ratios Exhibit Ready