Question

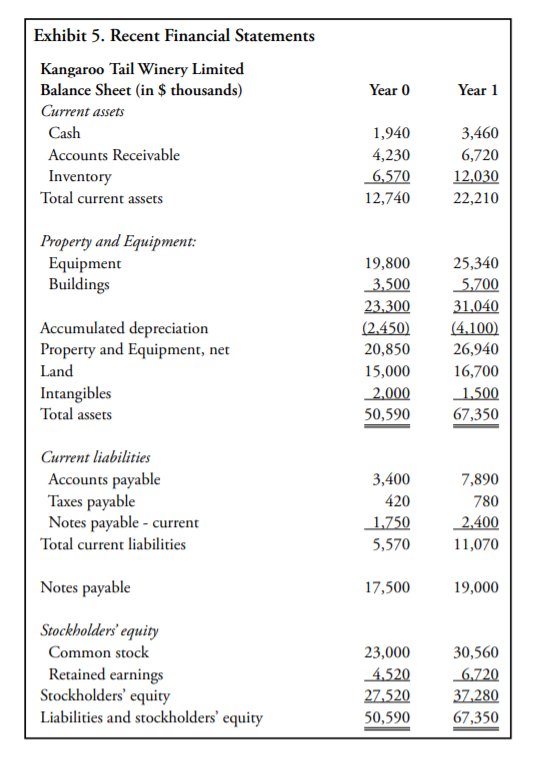

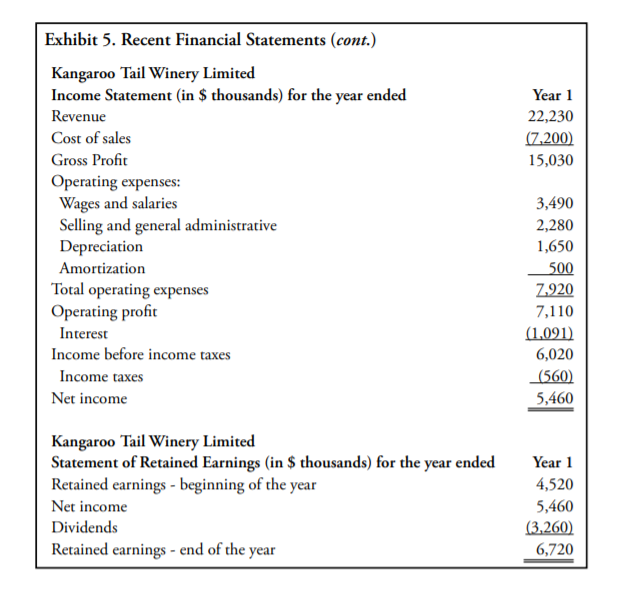

First, use the data in the Kangaroo Tail Winery Limited (C) case study to build the statement of cash flows (using the indirect method) for

First, use the data in the Kangaroo Tail Winery Limited (C) case study to build the statement of cash flows (using the indirect method) for the company's first year of operation.

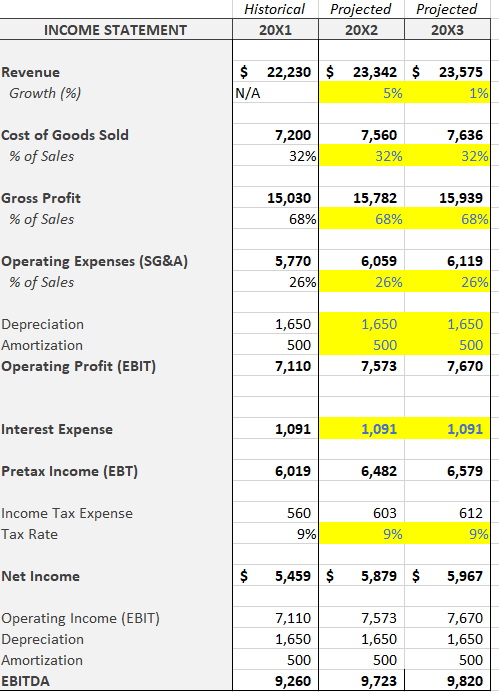

Next, build a simple Income Statement projection for Years 2 and 3. Use the following assumptions: Revenue growth of 5% in Year 2 and 1% in Year 3, constant expense margins (percent of expense item divided by revenue) in projected years, and a constant tax rate (taxes divided by earnings before taxes) in projected years.

I DON'T NEED THESE!! I finished everything and I missed one question, and I would like to know why I missed it. I'm hoping I can find the answer here. I am simply giving you all the information I have.

The question was: Your Net Income in Year 3 is ___________. A. 5,790; B. 6,384; C. 7,540; D.None of the above. I thought it was D. but it's wrong. The answer is A! If you find out what I did wrong in my projection please tell me.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started