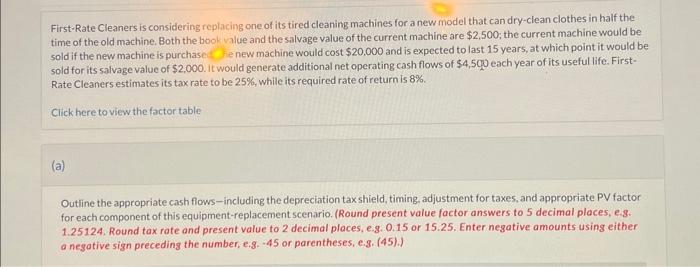

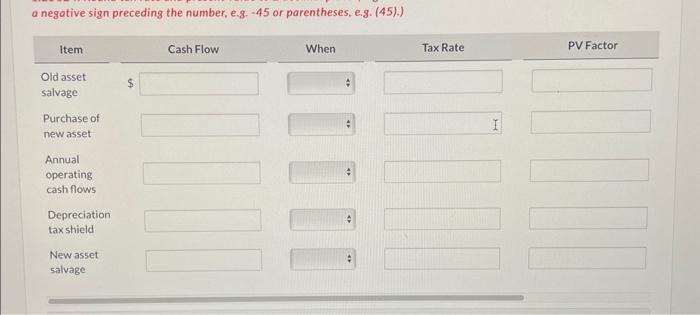

First-Rate Cleaners is considering replacing one of its tired cleaning machines for a new model that can dry-clean clothes in half the time of the old machine. Both the book value and the salvage value of the current machine are $2,500; the current machine would be sold if the new machine is purchased he new machine would cost $20,000 and is expected to last 15 years, at which point it would be sold for its salvage value of $2,000. It would generate additional net operating cash flows of $4,5q0 each year of its useful life. FirstRate Cleaners estimates its tax rate to be 25%, while its required rate of return is 8%. Click here to view the factor table (a) Outline the appropriate cash flows-including the depreciation tax shield, timing, adjustment for taxes, and appropriate PV factor for each component of this equipment-replacement scenario. (Round present value factor answers to 5 decimal places, e.s. 1.25124. Round tax rate and present value to 2 decimal places, e.g. 0.15 or 15.25 . Enter negative amounts using either a negative sign preceding the number, e.g. -45 or parentheses, e.g. (45).) a negative sign preceding the number, e.g. -45 or parentheses, e.g. (45).) First-Rate Cleaners is considering replacing one of its tired cleaning machines for a new model that can dry-clean clothes in half the time of the old machine. Both the book value and the salvage value of the current machine are $2,500; the current machine would be sold if the new machine is purchased he new machine would cost $20,000 and is expected to last 15 years, at which point it would be sold for its salvage value of $2,000. It would generate additional net operating cash flows of $4,5q0 each year of its useful life. FirstRate Cleaners estimates its tax rate to be 25%, while its required rate of return is 8%. Click here to view the factor table (a) Outline the appropriate cash flows-including the depreciation tax shield, timing, adjustment for taxes, and appropriate PV factor for each component of this equipment-replacement scenario. (Round present value factor answers to 5 decimal places, e.s. 1.25124. Round tax rate and present value to 2 decimal places, e.g. 0.15 or 15.25 . Enter negative amounts using either a negative sign preceding the number, e.g. -45 or parentheses, e.g. (45).) a negative sign preceding the number, e.g. -45 or parentheses, e.g. (45).)