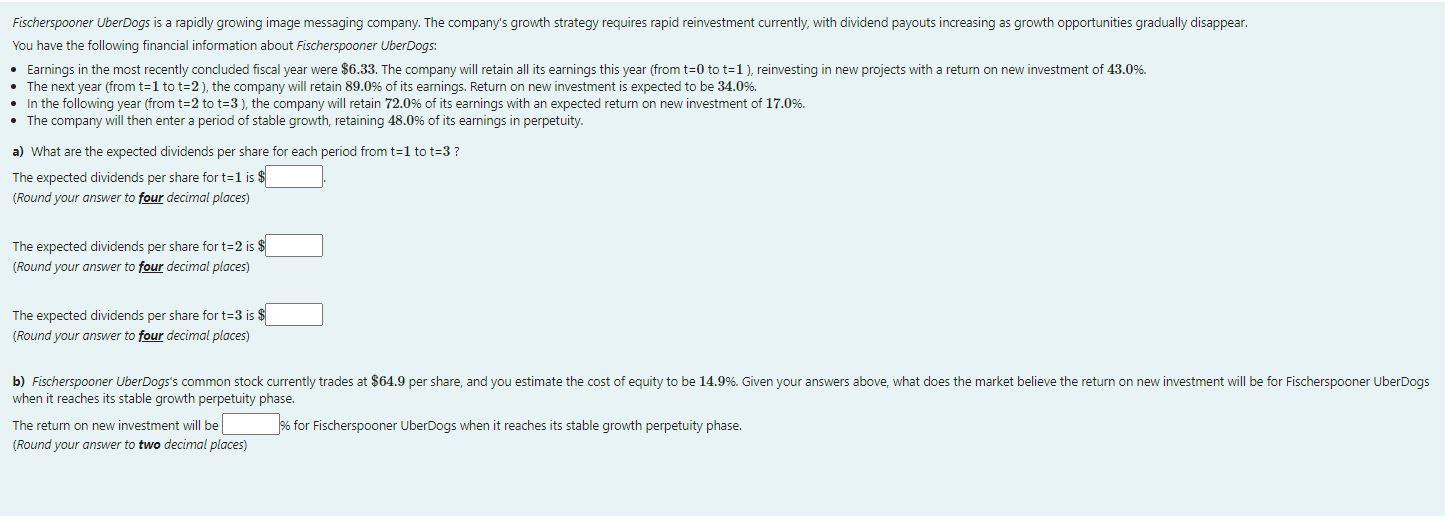

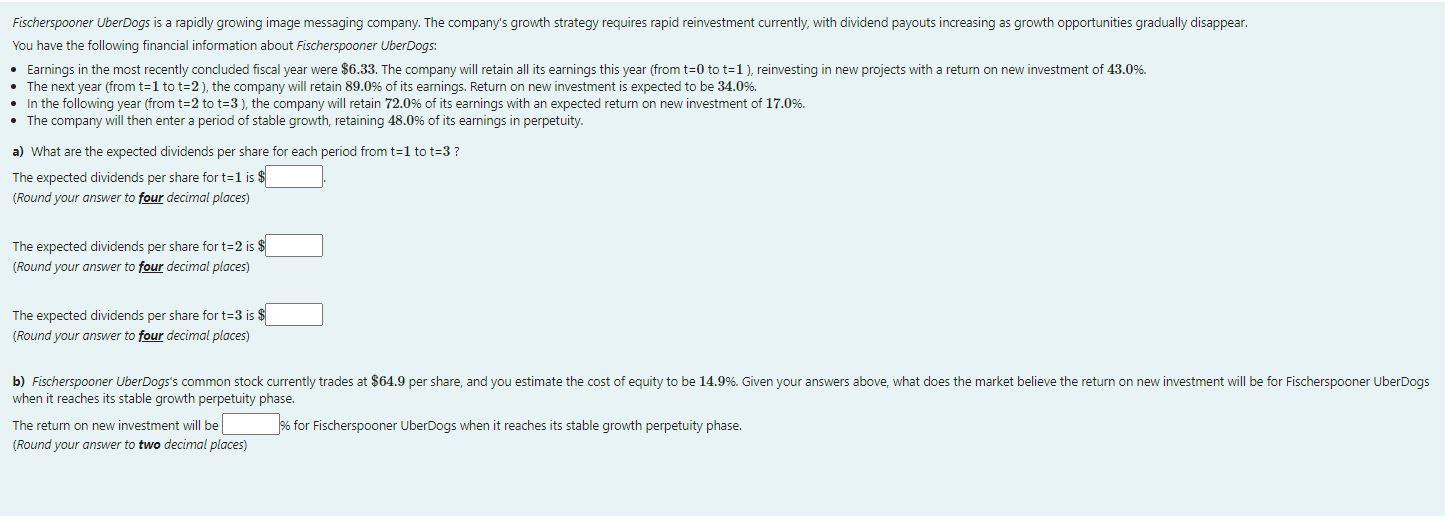

Fischerspooner UberDogs is a rapidly growing image messaging company. The company's growth strategy requires rapid reinvestment currently, with dividend payouts increasing as growth opportunities gradually disappear. You have the following financial information about Fischerspooner UberDogs: Earnings in the most recently concluded fiscal year were $6.33. The company will retain all its earnings this year (from t=0 to t=1), reinvesting in new projects with a return on new investment of 43.0%. The next year (from t=1 to t=2), the company will retain 89.0% of its earnings. Return on new investment is expected to be 34.0%. In the following year (from t=2 to t=3), the company will retain 72.0% of its earnings with an expected return on new investment of 17.0%. The company will then enter a period of stable growth, retaining 48.0% of its earnings in perpetuity. a) What are the expected dividends per share for each period from t=1 to t=3? The expected dividends per share for t=1 is $ (Round your answer to four decimal places) The expected dividends per share for t=2 is $ (Round your answer to four decimal places) The expected dividends per share for t=3 is $ (Round your answer to four decimal places) b) Fischerspooner UberDogs's common stock currently trades at $64.9 per share, and you estimate the cost of equity to be 14.9%. Given your answers above, what does the market believe the return on new investment will be for Fischerspooner UberDogs when it reaches its stable growth perpetuity phase. The return on new investment will be % for Fischerspooner UberDogs when it reaches its stable growth perpetuity phase. (Round your answer to two decimal places) Fischerspooner UberDogs is a rapidly growing image messaging company. The company's growth strategy requires rapid reinvestment currently, with dividend payouts increasing as growth opportunities gradually disappear. You have the following financial information about Fischerspooner UberDogs: Earnings in the most recently concluded fiscal year were $6.33. The company will retain all its earnings this year (from t=0 to t=1), reinvesting in new projects with a return on new investment of 43.0%. The next year (from t=1 to t=2), the company will retain 89.0% of its earnings. Return on new investment is expected to be 34.0%. In the following year (from t=2 to t=3), the company will retain 72.0% of its earnings with an expected return on new investment of 17.0%. The company will then enter a period of stable growth, retaining 48.0% of its earnings in perpetuity. a) What are the expected dividends per share for each period from t=1 to t=3? The expected dividends per share for t=1 is $ (Round your answer to four decimal places) The expected dividends per share for t=2 is $ (Round your answer to four decimal places) The expected dividends per share for t=3 is $ (Round your answer to four decimal places) b) Fischerspooner UberDogs's common stock currently trades at $64.9 per share, and you estimate the cost of equity to be 14.9%. Given your answers above, what does the market believe the return on new investment will be for Fischerspooner UberDogs when it reaches its stable growth perpetuity phase. The return on new investment will be % for Fischerspooner UberDogs when it reaches its stable growth perpetuity phase. (Round your answer to two decimal places)