Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fiserv to buy First Data for $22 billion to boost payments business U.S. financial technology provider Fiserv Inc said on Wednesday it had agreed to

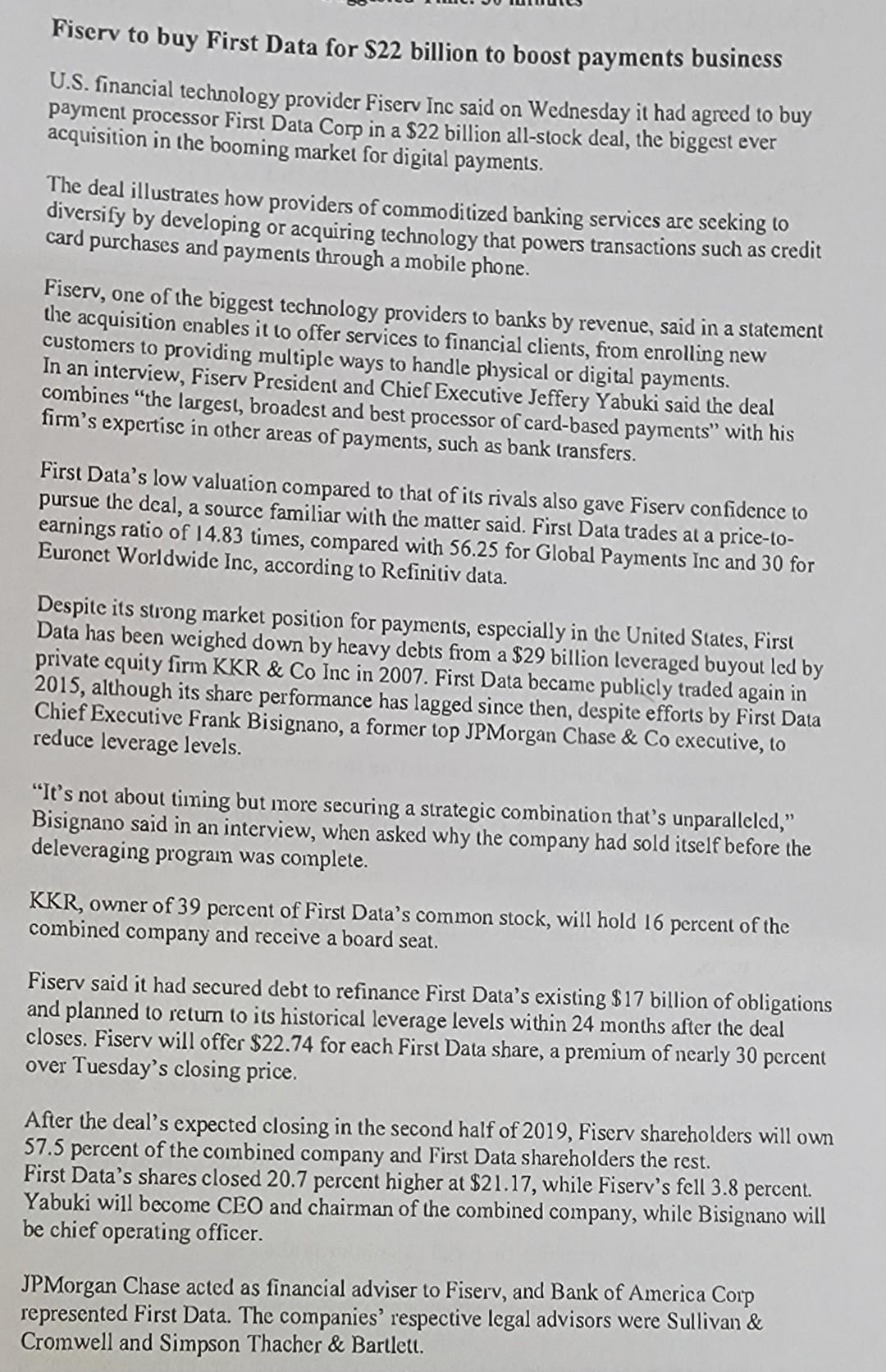

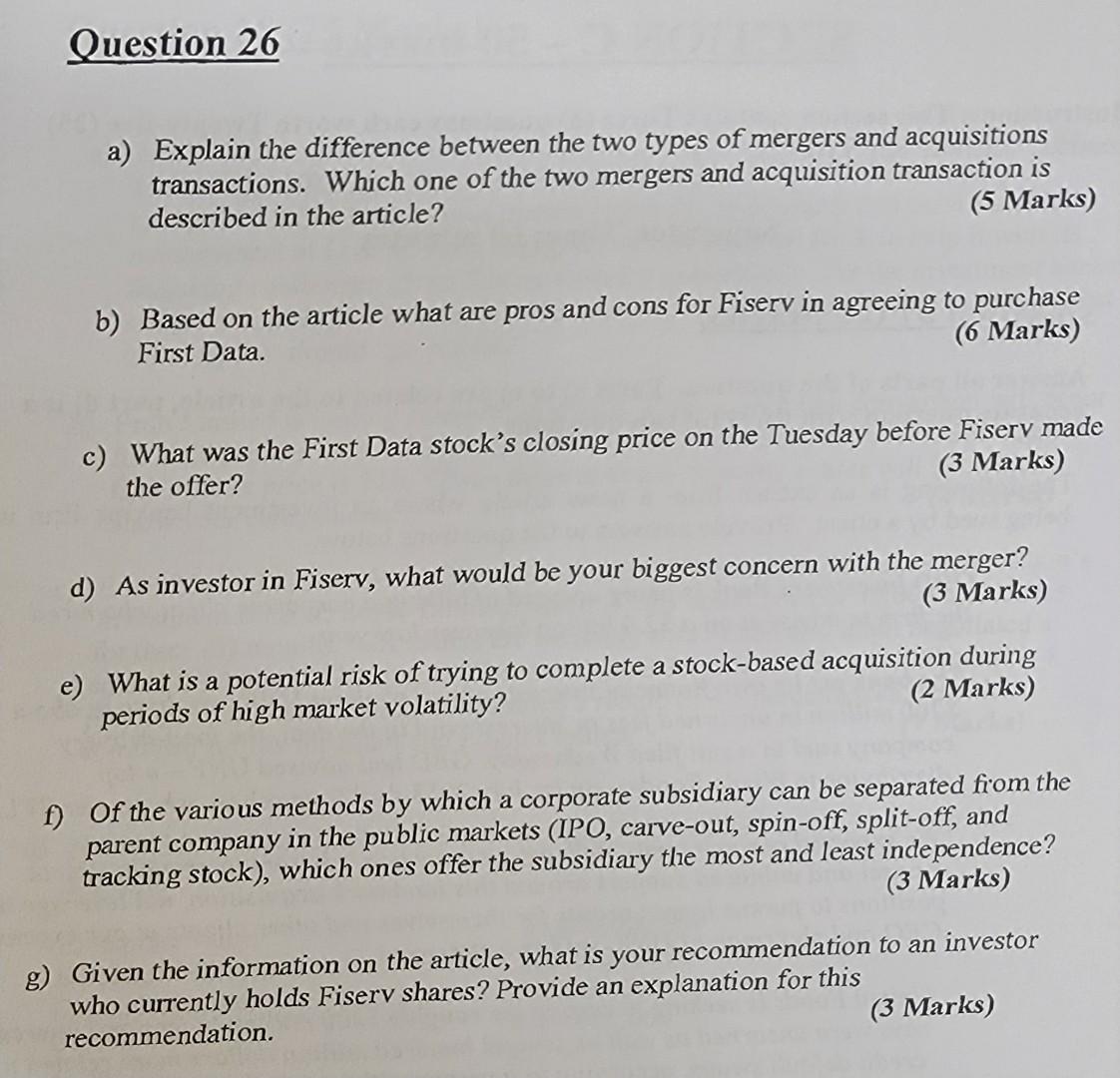

Fiserv to buy First Data for $22 billion to boost payments business U.S. financial technology provider Fiserv Inc said on Wednesday it had agreed to buy payment processor First Data Corp in a $22 billion all-stock deal, the biggest ever acquisition in the booming market for digital payments. The deal illustrates how providers of commoditized banking services are seeking to diversify by developing or acquiring technology that powers transactions such as credit card purchases and payments through a mobile phone. Fiserv, one of the biggest technology providers to banks by revenue, said in a statement the acquisition enables it to offer services to financial clients, from enrolling new customers to providing multiple ways to handle pluysical or digital payments. In an interview, Fiserv President and Chief Executive Jeffery Yabuki said the deal combines "the largest, broadest and best processor of card-based payments" with his firin's expertise in other areas of payments, such as bank transfers. First Data's low valuation compared to that of its rivals also gave Fiserv confidence to pursue the deal, a source familiar with the matter said. First Data trades al a price-lo- earnings ratio of 14.83 times, compared with 56.25 for Global Payments Inc and 30 for Euronet Worldwide Inc, according to Refinitiv data. Despite its strong market position for payments, especially in the United States, First Data has been weighed down by heavy debts from a $29 billion leveraged buyout led by private equity firm KKR & Co Inc in 2007. First Data became publicly traded again in 2015, although its share performance has lagged since then, despite efforts by First Data Chief Executive Frank Bisignano, a former top JPMorgan Chase & Co executive, to reduce leverage levels. "It's not about timing but more securing a strategic combination that's unparalleled," Bisignano said in an interview, when asked why the company had sold itself before the deleveraging prograin was complete. KKR, owner of 39 percent of First Data's common stock, will hold 16 percent of the combined company and receive a board seat. Fiserv said it had secured debt to refinance First Data's existing $17 billion of obligations and planned to return to its historical leverage levels within 24 months after the deal closes. Fiserv will offer $22.74 for each First Data share, a premium of nearly 30 percent over Tuesday's closing price. After the deal's expected closing in the second half of 2019, Fiserv shareholders will own 57.5 percent of the cornbined company and First Data shareholders the rest. First Data's shares closed 20.7 percent higher at $21.17, while Fiserv's fell 3.8 percent. Yabuki will become CEO and chairman of the combined company, while Bisignano will be chief operating officer. JPMorgan Chase acted as financial adviser to Fiserv, and Bank of America Corp represented First Data. The companies' respective legal advisors were Sullivan & Cromwell and Simpson Thacher & Bartlett. Question 26 a) Explain the difference between the two types of mergers and acquisitions transactions. Which one of the two mergers and acquisition transaction is described in the article? (5 Marks) b) Based on the article what are pros and cons for Fiserv in agreeing to purchase First Data. (6 Marks) c) What was the First Data stock's closing price on the Tuesday before Fiserv made the offer? (3 Marks) d) As investor in Fiserv, what would be your biggest concern with the merger? (3 Marks) e) What is a potential risk of trying to complete a stock-based acquisition during periods of high market volatility? (2 Marks) f) Of the various methods by which a corporate subsidiary can be separated from the parent company in the public markets (IPO, carve-out, spin-off, split-off, and tracking stock), which ones offer the subsidiary tlie most and least independence? (3 Marks) g) Given the information on the article, what is your recommendation to an investor who currently holds Fiserv shares? Provide an explanation for this recommendation. (3 Marks) Fiserv to buy First Data for $22 billion to boost payments business U.S. financial technology provider Fiserv Inc said on Wednesday it had agreed to buy payment processor First Data Corp in a $22 billion all-stock deal, the biggest ever acquisition in the booming market for digital payments. The deal illustrates how providers of commoditized banking services are seeking to diversify by developing or acquiring technology that powers transactions such as credit card purchases and payments through a mobile phone. Fiserv, one of the biggest technology providers to banks by revenue, said in a statement the acquisition enables it to offer services to financial clients, from enrolling new customers to providing multiple ways to handle pluysical or digital payments. In an interview, Fiserv President and Chief Executive Jeffery Yabuki said the deal combines "the largest, broadest and best processor of card-based payments" with his firin's expertise in other areas of payments, such as bank transfers. First Data's low valuation compared to that of its rivals also gave Fiserv confidence to pursue the deal, a source familiar with the matter said. First Data trades al a price-lo- earnings ratio of 14.83 times, compared with 56.25 for Global Payments Inc and 30 for Euronet Worldwide Inc, according to Refinitiv data. Despite its strong market position for payments, especially in the United States, First Data has been weighed down by heavy debts from a $29 billion leveraged buyout led by private equity firm KKR & Co Inc in 2007. First Data became publicly traded again in 2015, although its share performance has lagged since then, despite efforts by First Data Chief Executive Frank Bisignano, a former top JPMorgan Chase & Co executive, to reduce leverage levels. "It's not about timing but more securing a strategic combination that's unparalleled," Bisignano said in an interview, when asked why the company had sold itself before the deleveraging prograin was complete. KKR, owner of 39 percent of First Data's common stock, will hold 16 percent of the combined company and receive a board seat. Fiserv said it had secured debt to refinance First Data's existing $17 billion of obligations and planned to return to its historical leverage levels within 24 months after the deal closes. Fiserv will offer $22.74 for each First Data share, a premium of nearly 30 percent over Tuesday's closing price. After the deal's expected closing in the second half of 2019, Fiserv shareholders will own 57.5 percent of the cornbined company and First Data shareholders the rest. First Data's shares closed 20.7 percent higher at $21.17, while Fiserv's fell 3.8 percent. Yabuki will become CEO and chairman of the combined company, while Bisignano will be chief operating officer. JPMorgan Chase acted as financial adviser to Fiserv, and Bank of America Corp represented First Data. The companies' respective legal advisors were Sullivan & Cromwell and Simpson Thacher & Bartlett. Question 26 a) Explain the difference between the two types of mergers and acquisitions transactions. Which one of the two mergers and acquisition transaction is described in the article? (5 Marks) b) Based on the article what are pros and cons for Fiserv in agreeing to purchase First Data. (6 Marks) c) What was the First Data stock's closing price on the Tuesday before Fiserv made the offer? (3 Marks) d) As investor in Fiserv, what would be your biggest concern with the merger? (3 Marks) e) What is a potential risk of trying to complete a stock-based acquisition during periods of high market volatility? (2 Marks) f) Of the various methods by which a corporate subsidiary can be separated from the parent company in the public markets (IPO, carve-out, spin-off, split-off, and tracking stock), which ones offer the subsidiary tlie most and least independence? (3 Marks) g) Given the information on the article, what is your recommendation to an investor who currently holds Fiserv shares? Provide an explanation for this recommendation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started