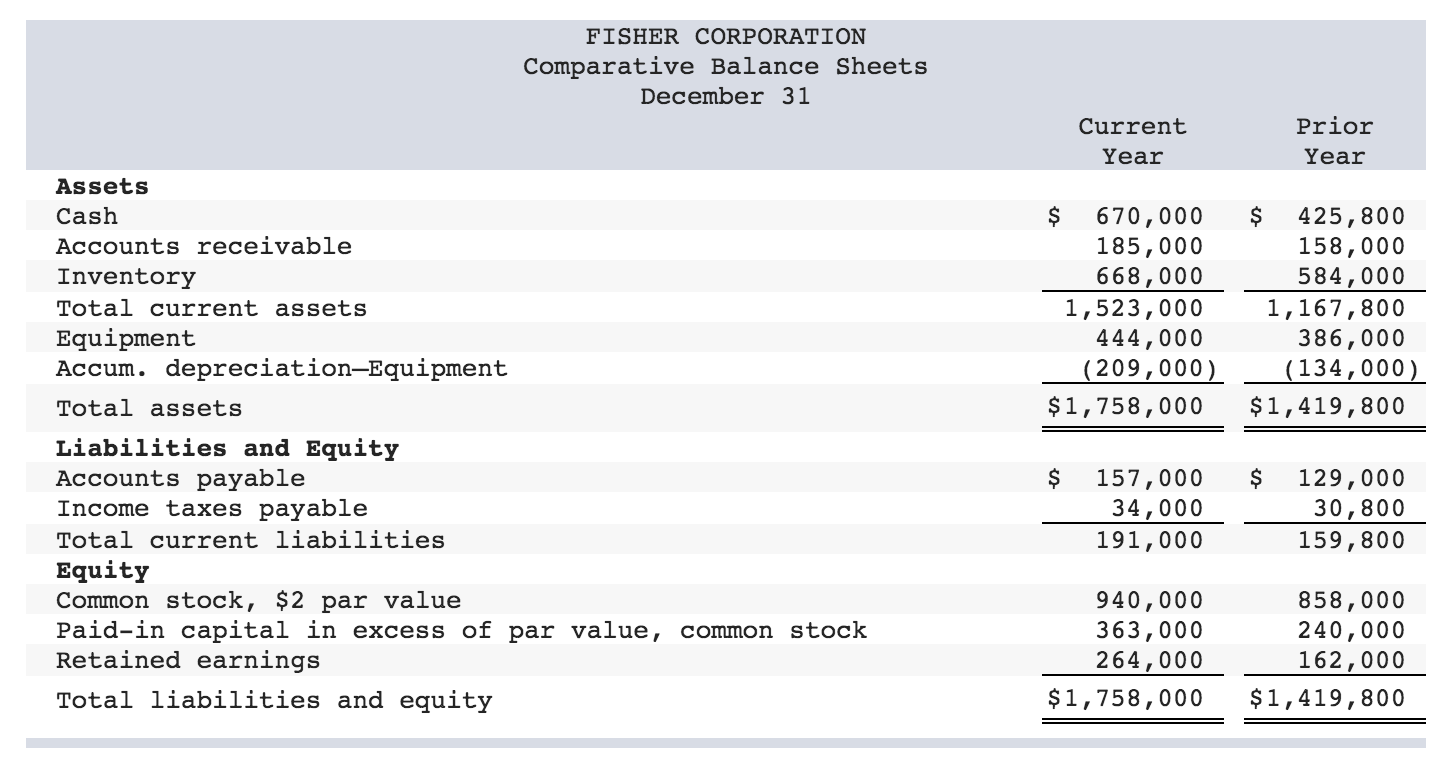

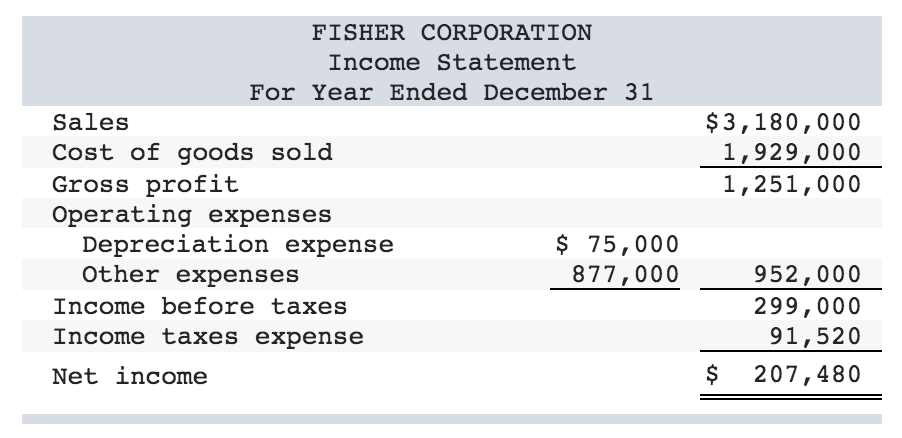

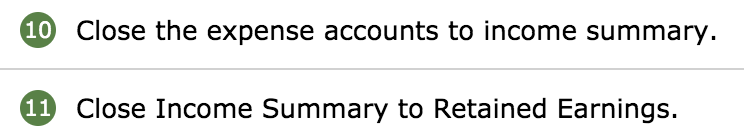

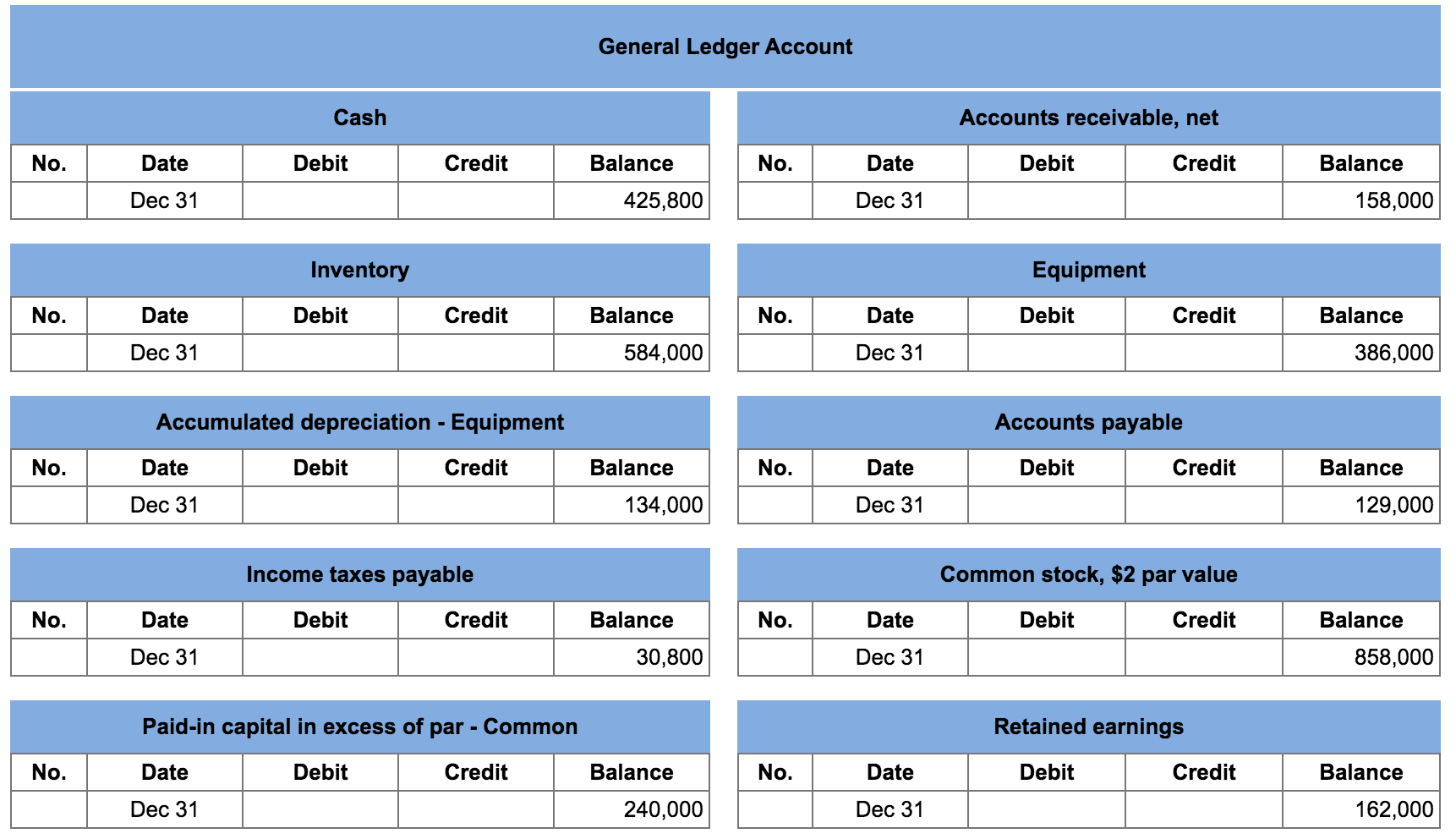

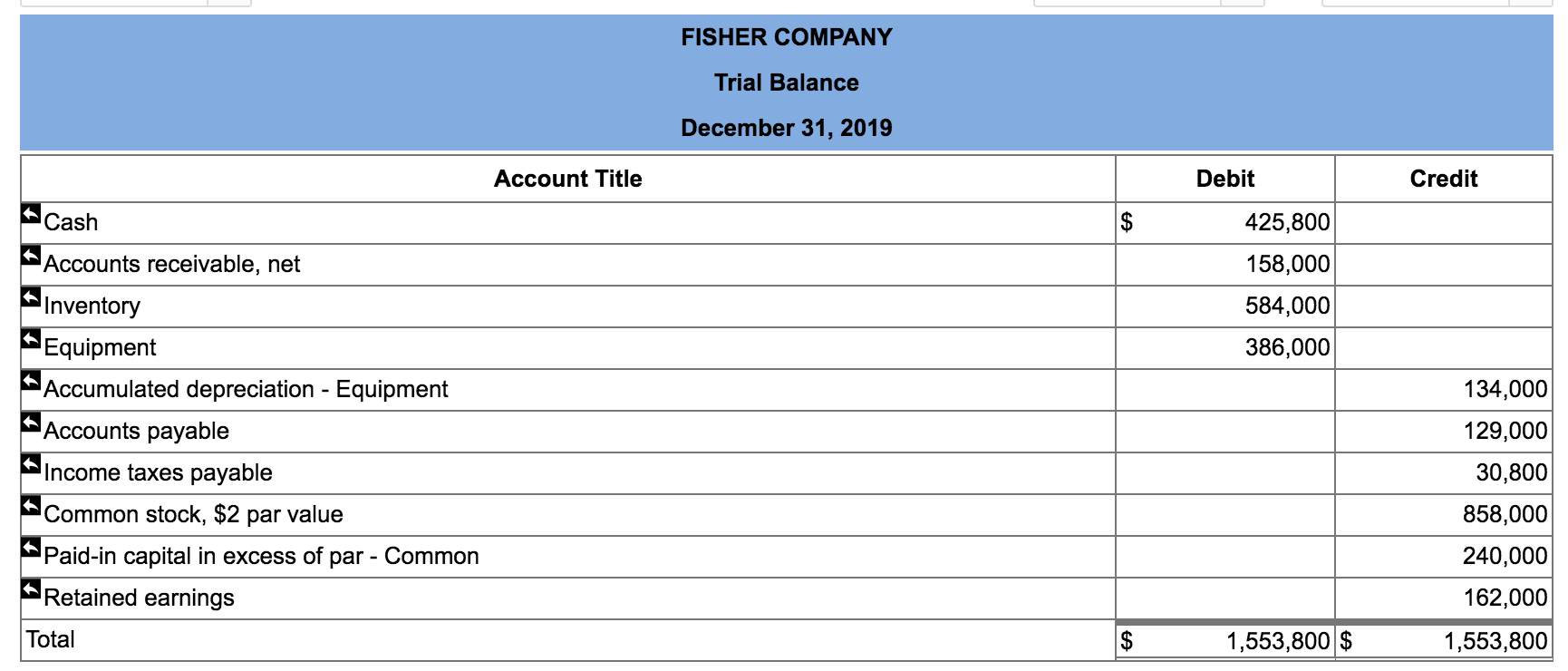

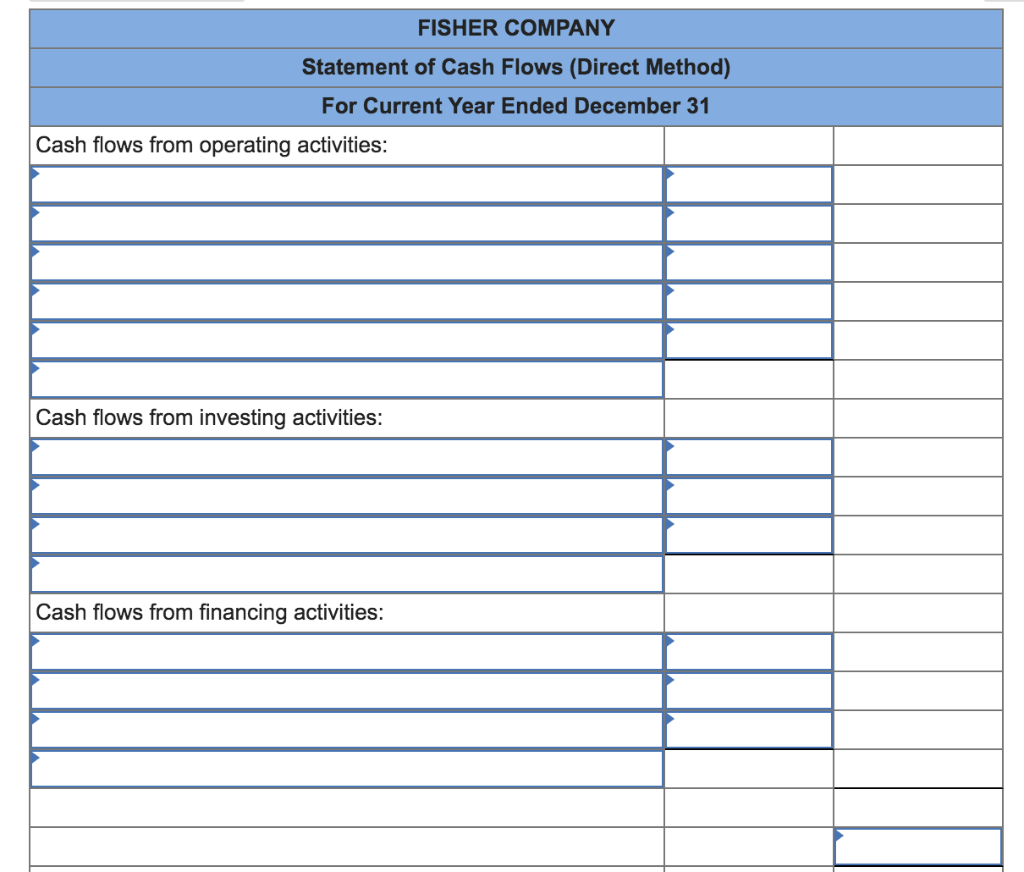

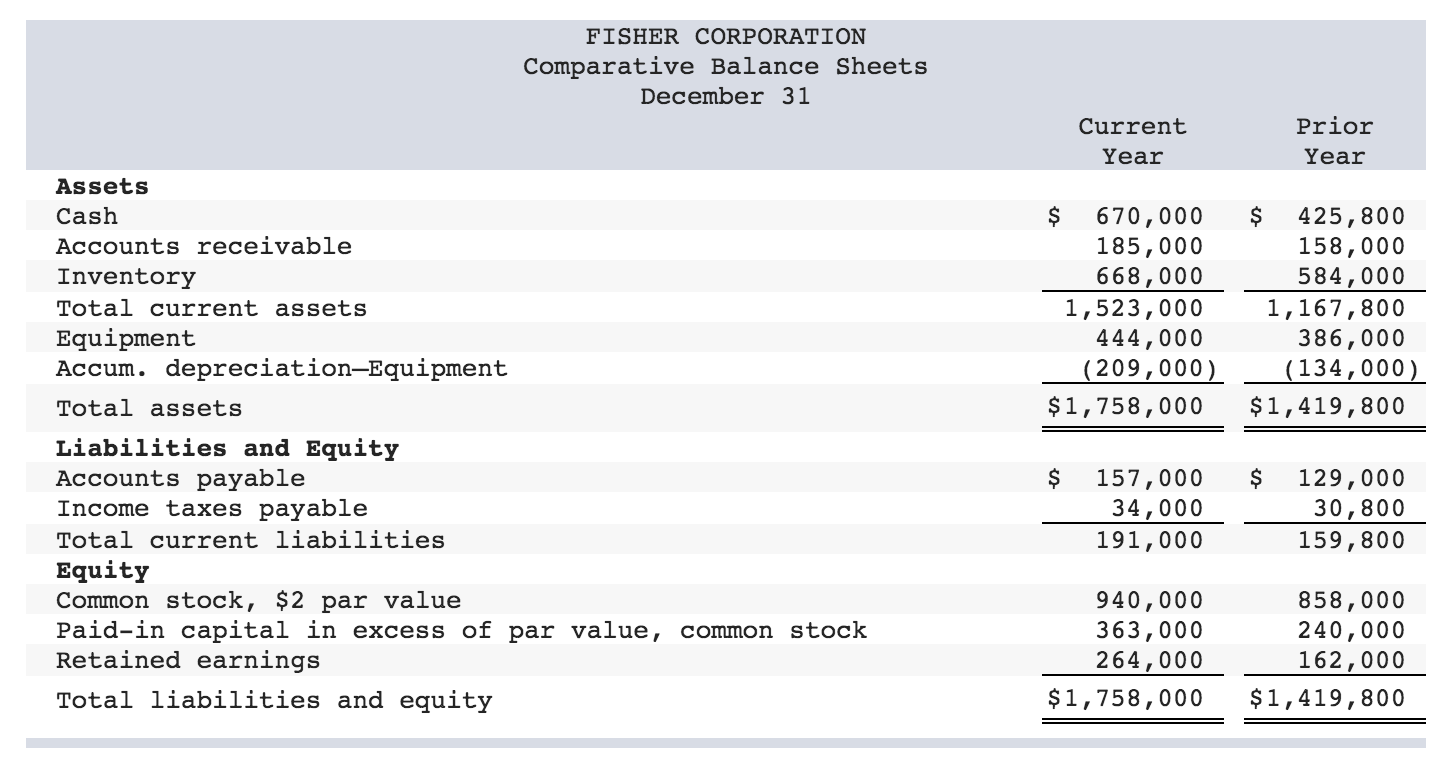

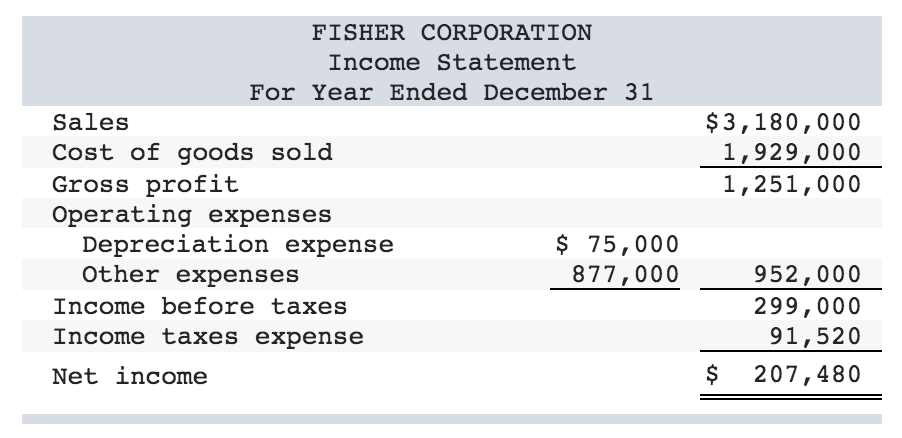

Fisher Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, (5) Other Expenses are all cash expenses, and (6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes.

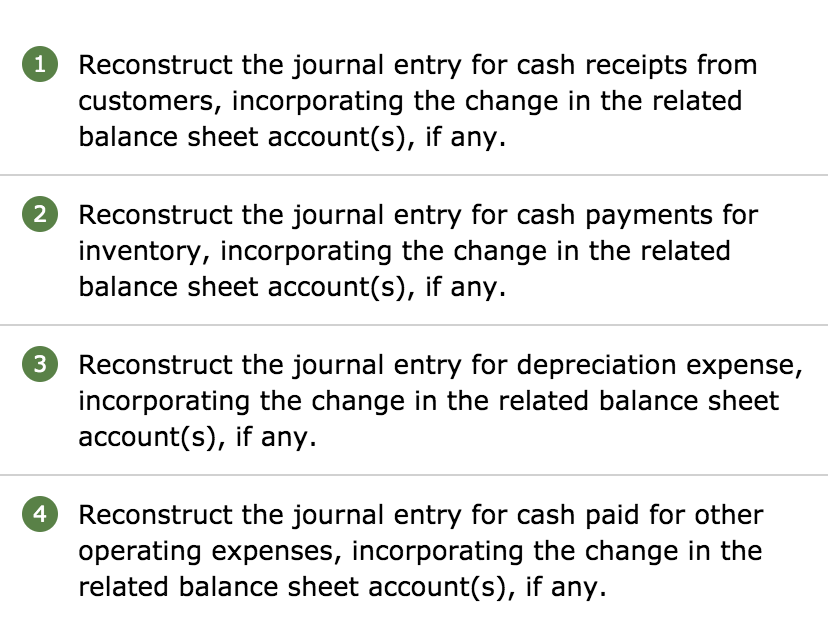

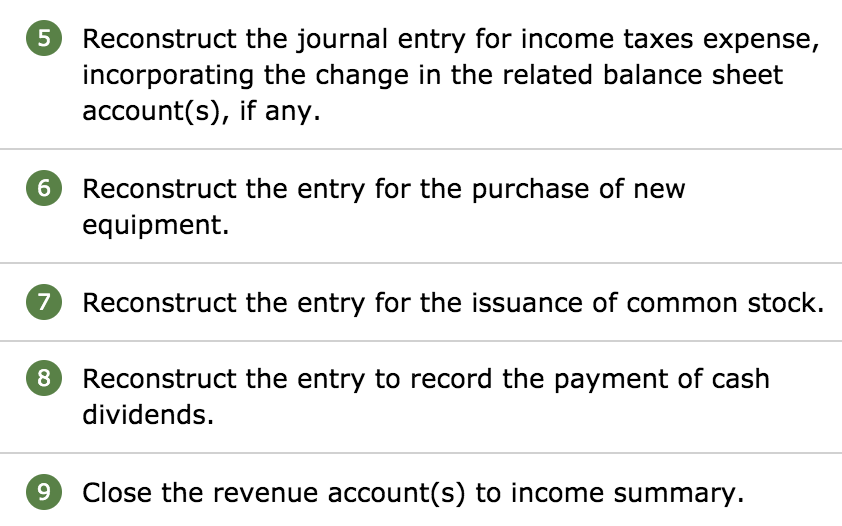

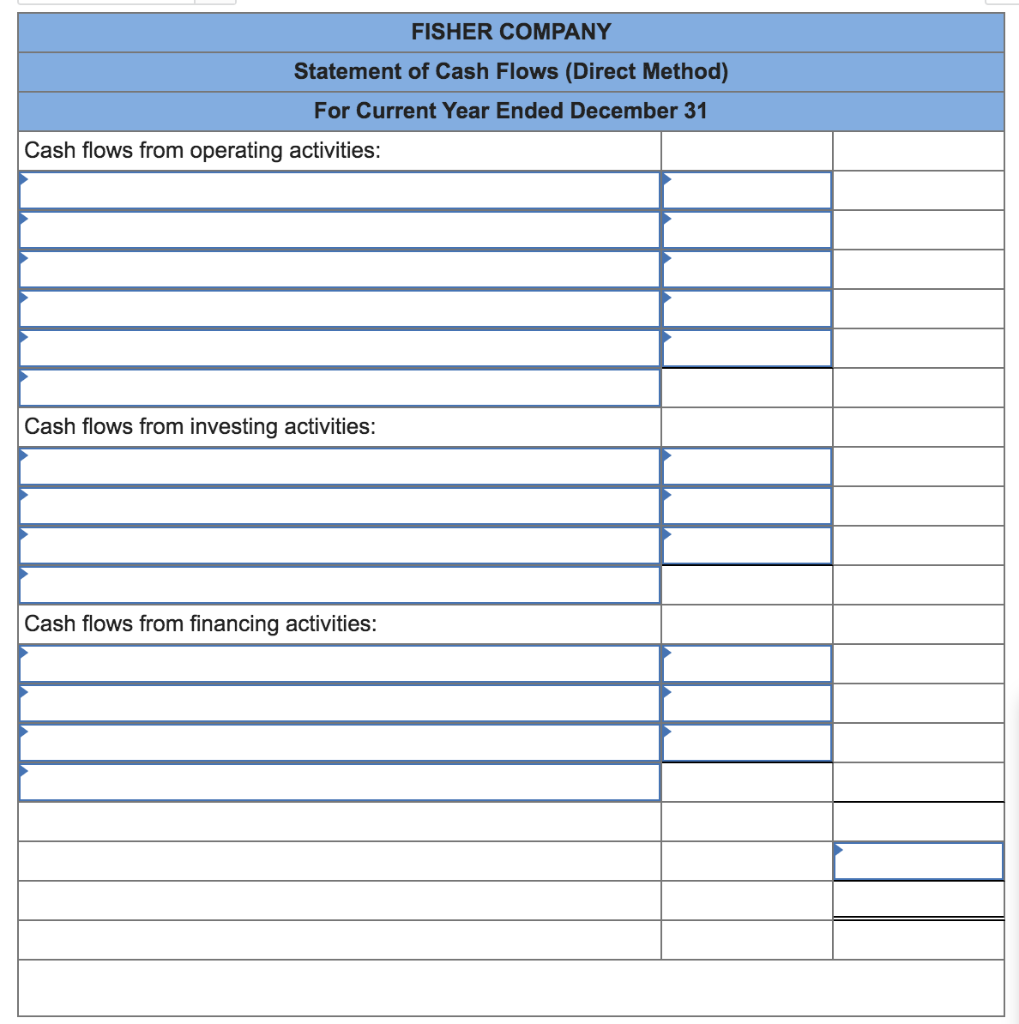

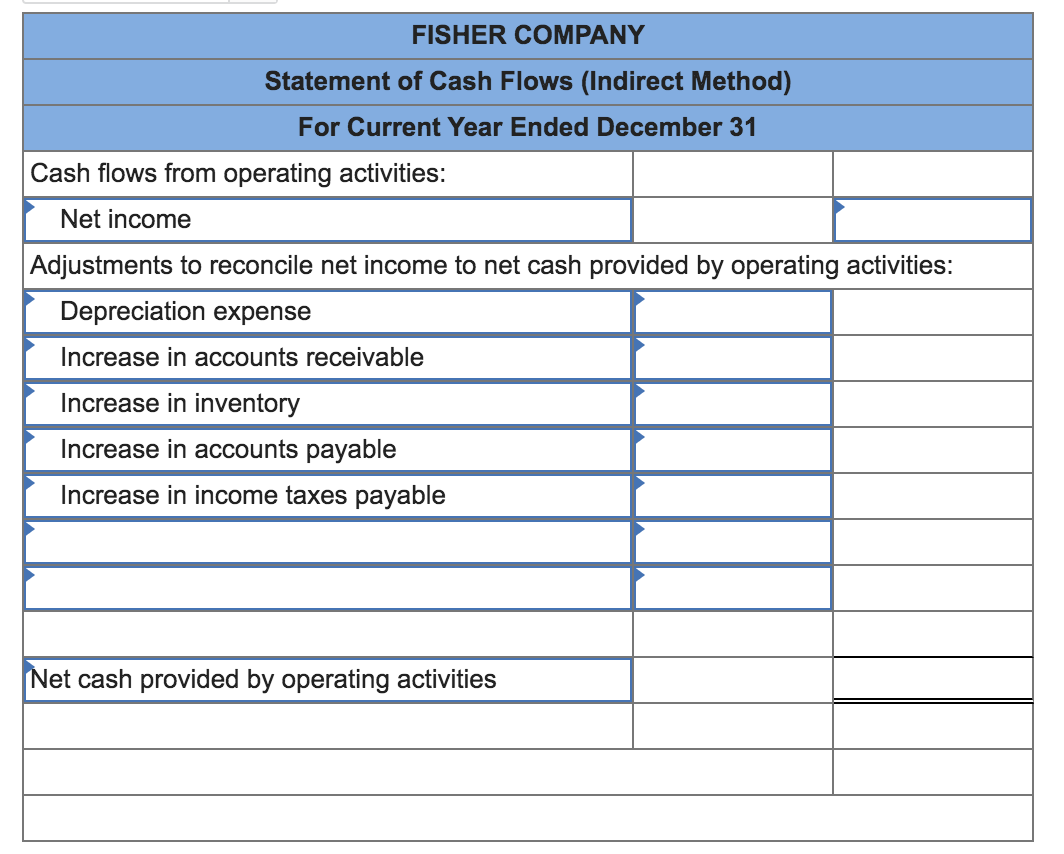

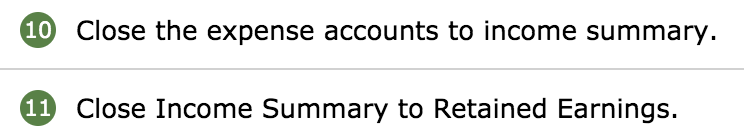

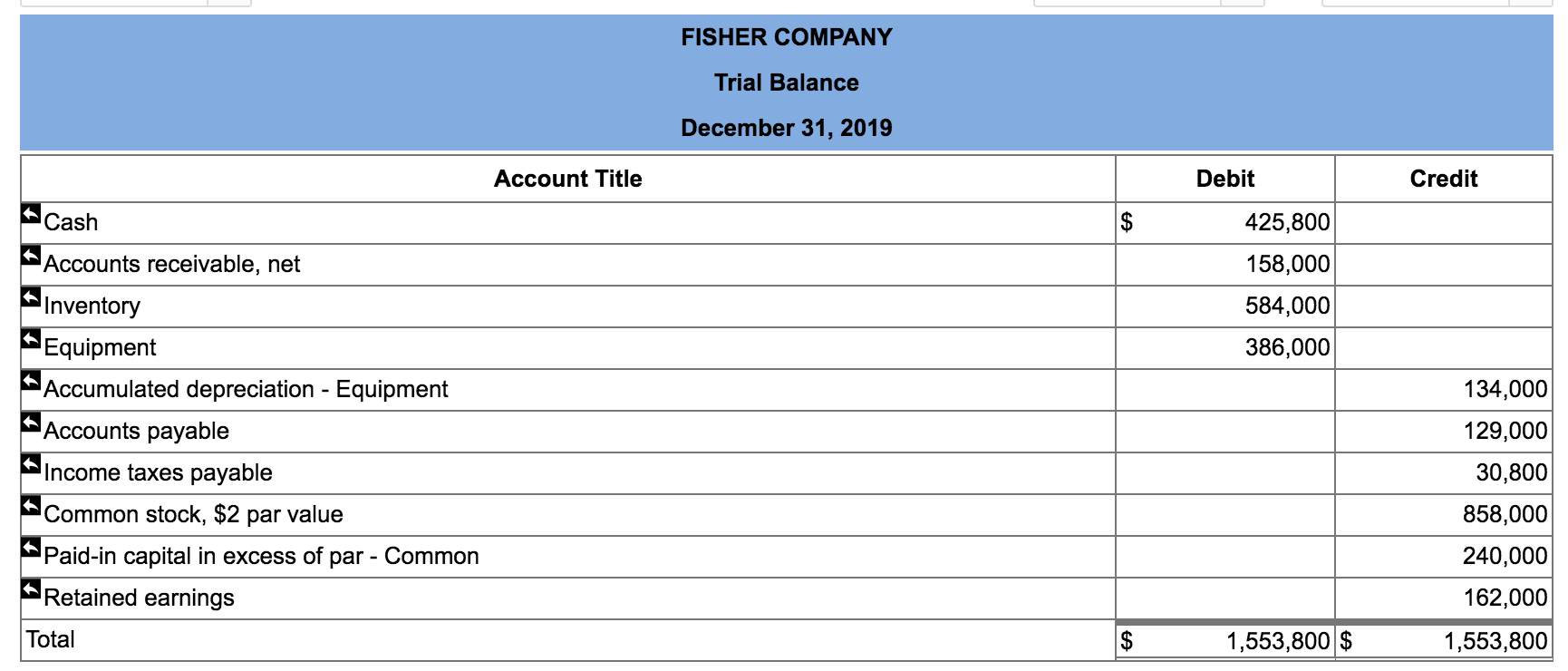

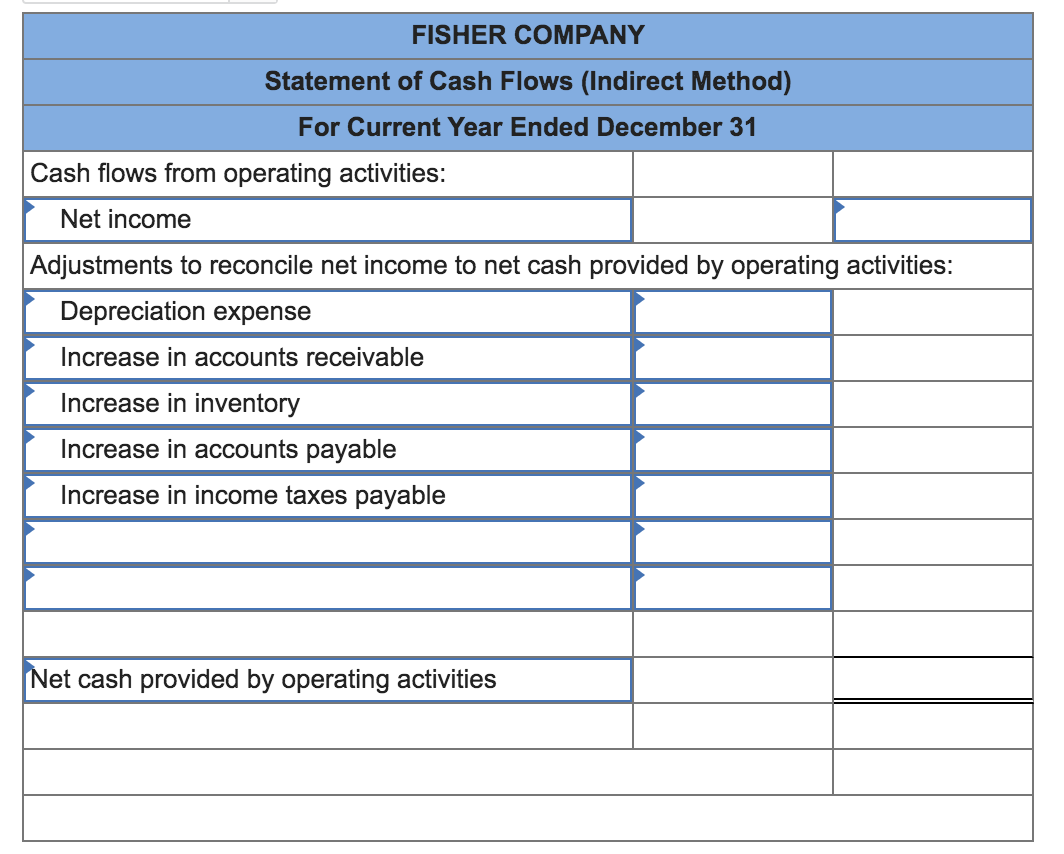

FISHER CORPORATION Comparative Balance Sheets December 31 Current Year Prior Year $ 670,000 185,000 668,000 1,523,000 444,000 (209,000) $1,758,000 425,800 158,000 584,000 1,167,800 386,000 (134,000) $1,419,800 Assets Cash Accounts receivable Inventory Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabilities Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity $ $ 157,000 34,000 191,000 129,000 30,800 159,800 940,000 363,000 264,000 $1,758,000 858,000 240,000 162,000 $1,419,800 $3,180,000 1,929,000 1,251,000 FISHER CORPORATION Income Statement For Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $ 75,000 Other expenses 877,000 Income before taxes Income taxes expense Net income 952,000 299,000 91,520 207,480 $ 1 Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any. 2 Reconstruct the journal entry for cash payments for inventory, incorporating the change in the related balance sheet account(s), if any. 3 Reconstruct the journal entry for depreciation expense, incorporating the change in the related balance sheet account(s), if any. 4 Reconstruct the journal entry for cash paid for other operating expenses, incorporating the change in the related balance sheet account(s), if any. 5 Reconstruct the journal entry for income taxes expense, incorporating the change in the related balance sheet account(s), if any. 6 Reconstruct the entry for the purchase of new equipment. 7 Reconstruct the entry for the issuance of common stock. 8 Reconstruct the entry to record the payment of cash dividends. 9 Close the revenue account(s) to income summary. 10 Close the expense accounts to income summary. 11 Close Income Summary to Retained Earnings. General Ledger Account Cash Accounts receivable, net No. Date Debit Credit Balance No. Date Debit Credit Balance Dec 31 425,800 Dec 31 158,000 Inventory Equipment No. Date Debit Credit Balance No. Date Debit Credit Balance Dec 31 584,000 Dec 31 386,000 Accumulated depreciation - Equipment Accounts payable No. Date Debit Credit Balance No. Date Debit Credit Balance Dec 31 134,000 Dec 31 129,000 Income taxes payable Common stock, $2 par value No. Date Debit Credit Balance No. Date Debit Credit Balance Dec 31 30,800 Dec 31 858,000 Paid-in capital in excess of par - Common Retained earnings No. Date Debit Credit Balance No. Date Debit Credit Balance Dec 31 240,000 Dec 31 162,000 FISHER COMPANY Trial Balance December 31, 2019 Account Title Debit Credit Cash $ 425,800 158,000 584,000 386,000 Accounts receivable, net Inventory Equipment Accumulated depreciation - Equipment Accounts payable Income taxes payable Common stock, $2 par value Paid-in capital in excess of par - Common Retained earnings t tt 134,000 129,000 30,800 858,000 240,000 162,000 1,553,800 Total $ 1,553,800 $ FISHER COMPANY Statement of Cash Flows (Direct Method) For Current Year Ended December 31 Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities: FISHER COMPANY Statement of Cash Flows (Direct Method) For Current Year Ended December 31 Cash flows from operating activities: Cash flows from investing activities: Cash flows from financing activities: FISHER COMPANY Statement of Cash Flows (Indirect Method) For Current Year Ended December 31 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense Increase in accounts receivable Increase in inventory Increase in accounts payable Increase in income taxes payable Net cash provided by operating activities