Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A, B and C were partners in a firm having capitals of Rs. 50,000; Rs. 50,000 and Rs.1,00,000 respectively. Their Current Account balances were.

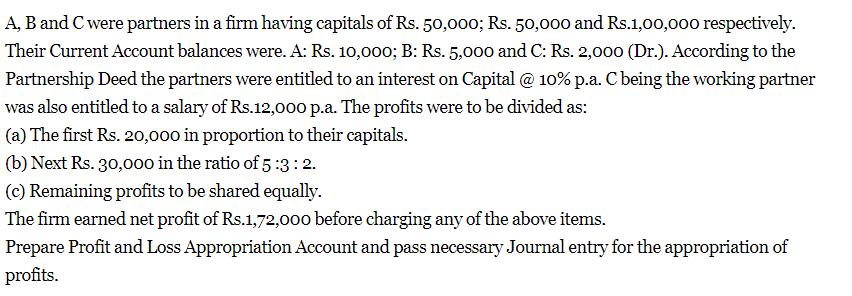

A, B and C were partners in a firm having capitals of Rs. 50,000; Rs. 50,000 and Rs.1,00,000 respectively. Their Current Account balances were. A: Rs. 10,000; B: Rs. 5,000 and C: Rs. 2,000 (Dr.). According to the Partnership Deed the partners were entitled to an interest on Capital @ 10% p.a. C being the working partner was also entitled to a salary of Rs.12,000 p.a. The profits were to be divided as: (a) The first Rs.20,000 in proportion to their capitals. (b) Next Rs. 30,000 in the ratio of 5:3:2. (c) Remaining profits to be shared equally. The firm earned net profit of Rs.1,72,000 before charging any of the above items. Prepare Profit and Loss Appropriation Account and pass necessary Journal entry for the appropriation of profits.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Dr Cr Particulars To Salary to C To Interest on Capital ac A B C To Pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started