Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fit-for-Life Foods reports the following income statement accounts for the year ended December 31. Gain on sale of equipment $ 6,250 Depreciation expenseOffice copier $

Fit-for-Life Foods reports the following income statement accounts for the year ended December 31.

| Gain on sale of equipment | $ | 6,250 | Depreciation expenseOffice copier | $ | 420 | |

| Office supplies expense | 790 | Sales discounts | 15,200 | |||

| Insurance expense | 1,240 | Sales returns and allowances | 3,900 | |||

| Sales | 225,000 | TV advertising expense | 3,000 | |||

| Office salaries expense | 32,100 | Interest revenue | 660 | |||

| Rent expenseSelling space | 10,500 | Cost of goods sold | 88,800 | |||

| Sales staff wages | 22,400 | Sales commission expense | 13,600 |

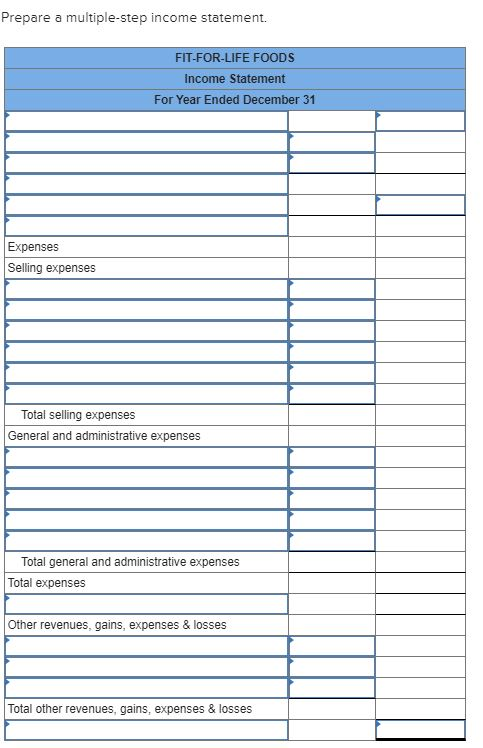

Prepare a multiple-step income statement. FIT-FOR-LIFE FOODS Income Statement For Year Ended December 31 Expenses Selling expenses Total selling expenses General and administrative expenses Total general and administrative expenses Total expenses Other revenues, gains, expenses & losses Total other revenues, gains, expenses & losses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started