Question

Five Mile Electronics completed these selected transactions during March 2018 : Requirement 1. Report these items on Five Mile Electronics' balance sheet at March 31

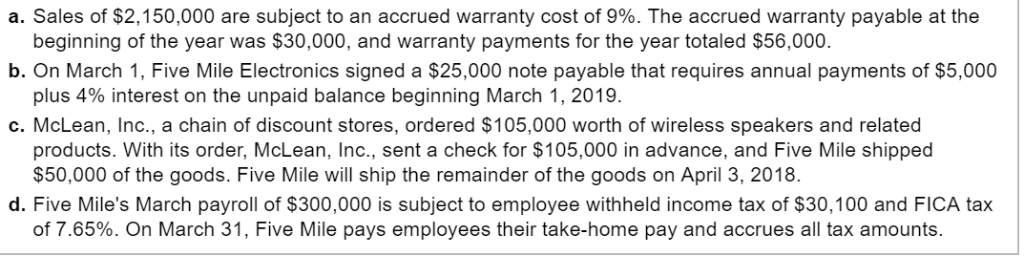

Five Mile Electronics completed these selected transactions during March 2018 :

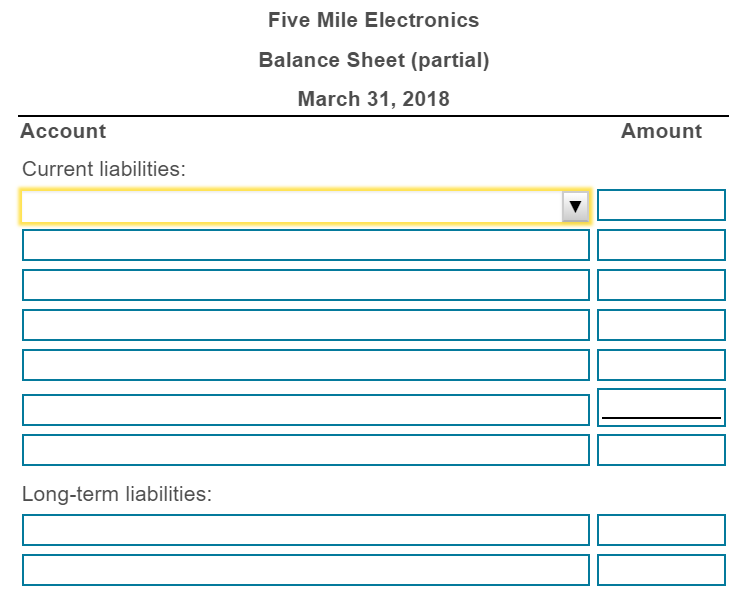

Requirement 1. Report these items on Five Mile Electronics' balance sheet at March 31 , 2018.

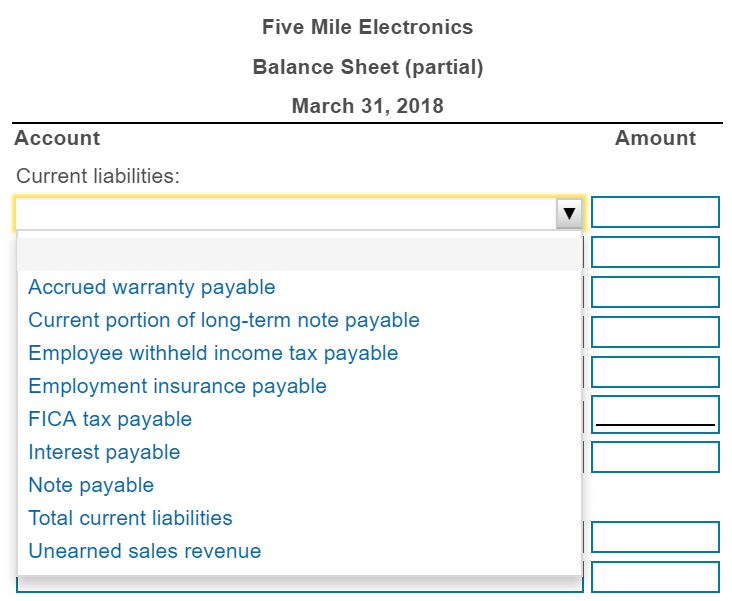

Select the balance sheet accounts, then calculate each accounts' balance and the total current liabilities amount at March 31 , 2018. (For the FICA tax, be sure to include both the employer and employee share of the tax. Round all amounts to the nearest whole dollar. If a box is not used in the table leave the box empty; do not select a label or enter a zero.)

drop down choices:

a. Sales of $2,150,000 are subject to an accrued warranty cost of 9%. The accrued warranty payable at the b. On March 1, Five Mile Electronics signed a $25,000 note payable that requires annual payments of $5,000 c. McLean, Inc., a chain of discount stores, ordered $105,000 worth of wireless speakers and related beginning of the year was $30,000, and warranty payments for the year totaled $56,000 plus 4% interest on the unpaid balance beginning March 1, 2019. products. With its order, McLean, Inc., sent a check for $105,000 in advance, and Five Mile shipped $50,000 of the goods. Five Mile will ship the remainder of the goods on April 3, 2018 d. Five Mile's March payroll of $300,000 is subject to employee withheld income tax of $30,100 and FICA tax of 7.65%. On March 31, Five Mile pays employees their take-home pay and accrues all tax amounts Five Mile Electronics Balance Sheet (partial) March 31, 2018 Account Amount Current liabilities: Long-term liabilities: Five Mile Electronics Balance Sheet (partial) March 31, 2018 Account Amount Current liabilities: Accrued warranty payable Current portion of long-term note payable Employee withheld income tax payable Employment insurance payable FICA tax payable Interest payable Note payable Total current liabilities Unearned sales revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started