Answered step by step

Verified Expert Solution

Question

1 Approved Answer

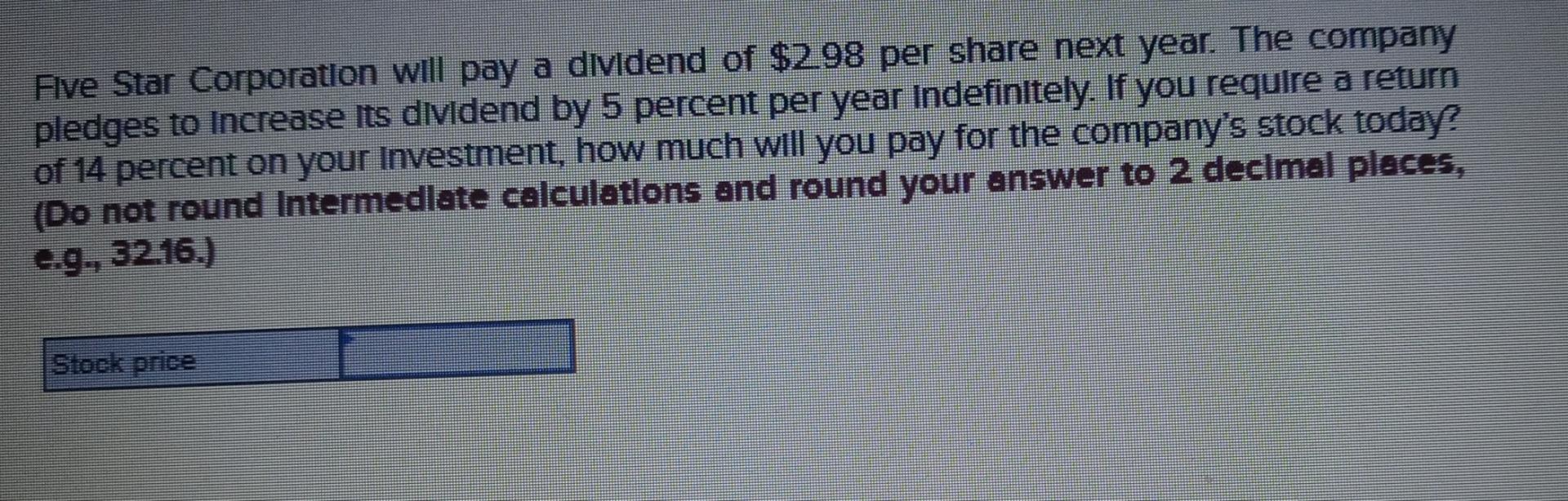

Five Star Corporation will pay a dividend of $298 per share next year. The company pledges to Increase its dividend by 5 percent per year

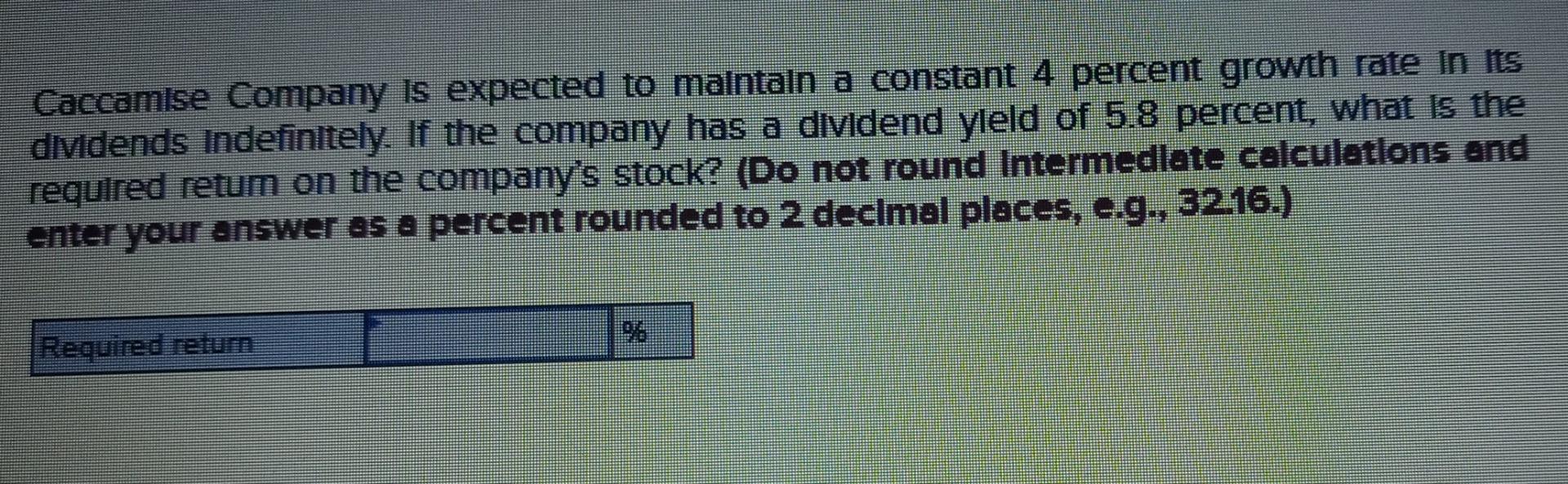

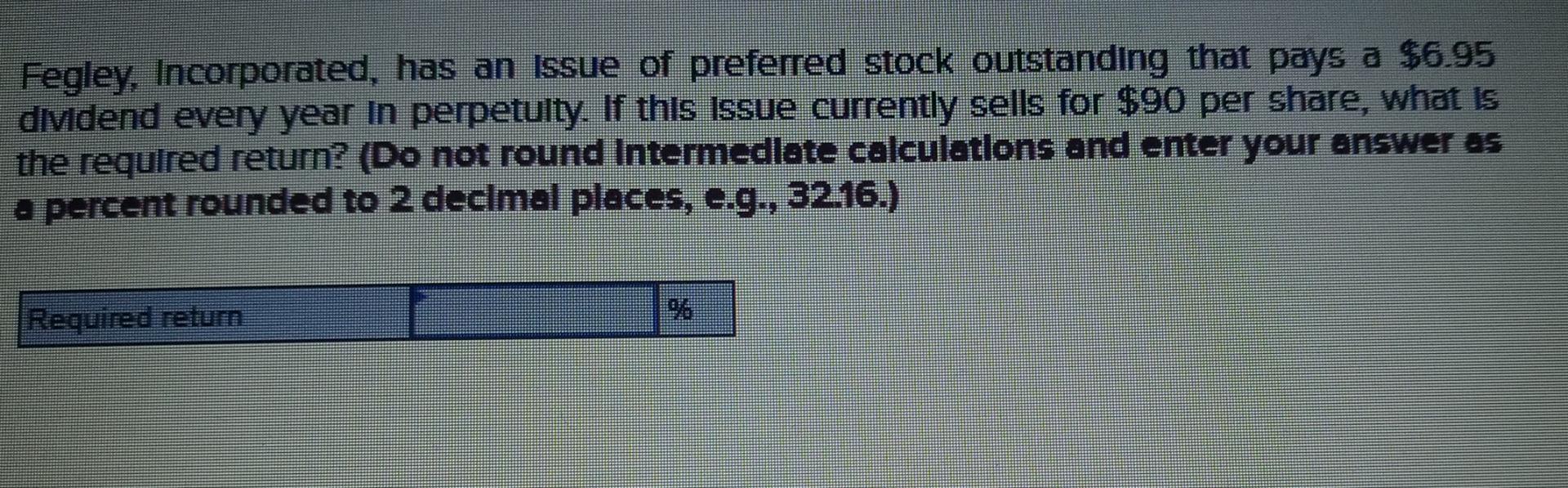

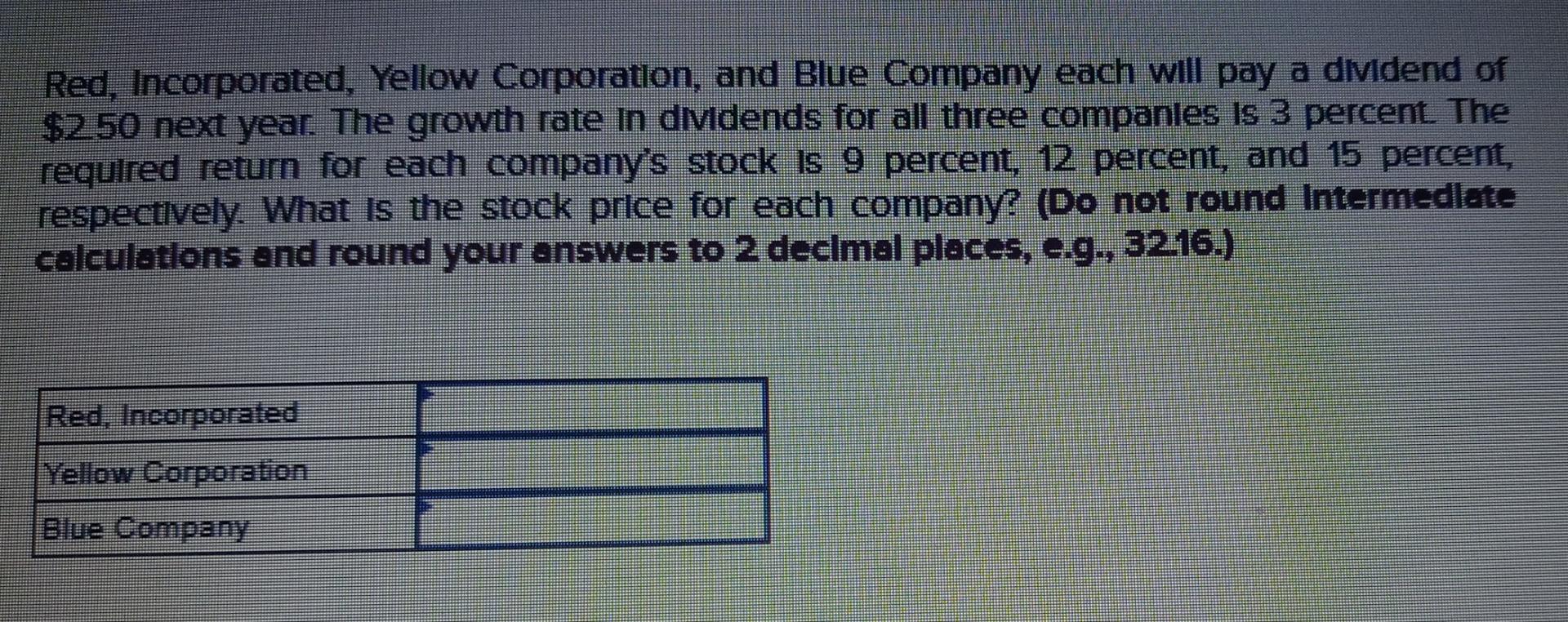

Five Star Corporation will pay a dividend of $298 per share next year. The company pledges to Increase its dividend by 5 percent per year Indefinitely. If you require a return of 14 percent on your Investment, how much will you pay for the company's stock today? (Do not round Intermedlate calculations and round your answer to 2 decimal places, e.g., 32.16.) Caccamise Company is expected to maintain a constant 4 percent growth rate in its dividends Indefinitely. If the company has a dividend yleld of 5.8 percent, what is the required retum on the company's stock? (Do not round Intermedlate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 3216.) Required retum Fegley, Incorporated, has an issue of preferred stock outstanding that pays a $6.95 dMdend every year in perpetulty. If this issue currently sells for $90 per share, what is the required return? (Do not round Intermedlate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 3216.) Required return Red, Incorporated, Yellow Corporation, and Blue Company each will pay a dividend of $250 next year. The growth rate in dividends for all three companles is 3 percent. The required return for each company's stock is 9 percent, 12 percent, and 15 percent, respectively. What is the stock price for each company? (Do not round Intermedlate calculations and round your answers to 2 decimal places, e.g., 3216.) Red, Incorporated Yellow Corporation Blue Company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started