Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Five Stars Manufacturing expects to spend $ 8 0 0 , 0 0 0 in 2 0 2 2 in appraisal costs if it does

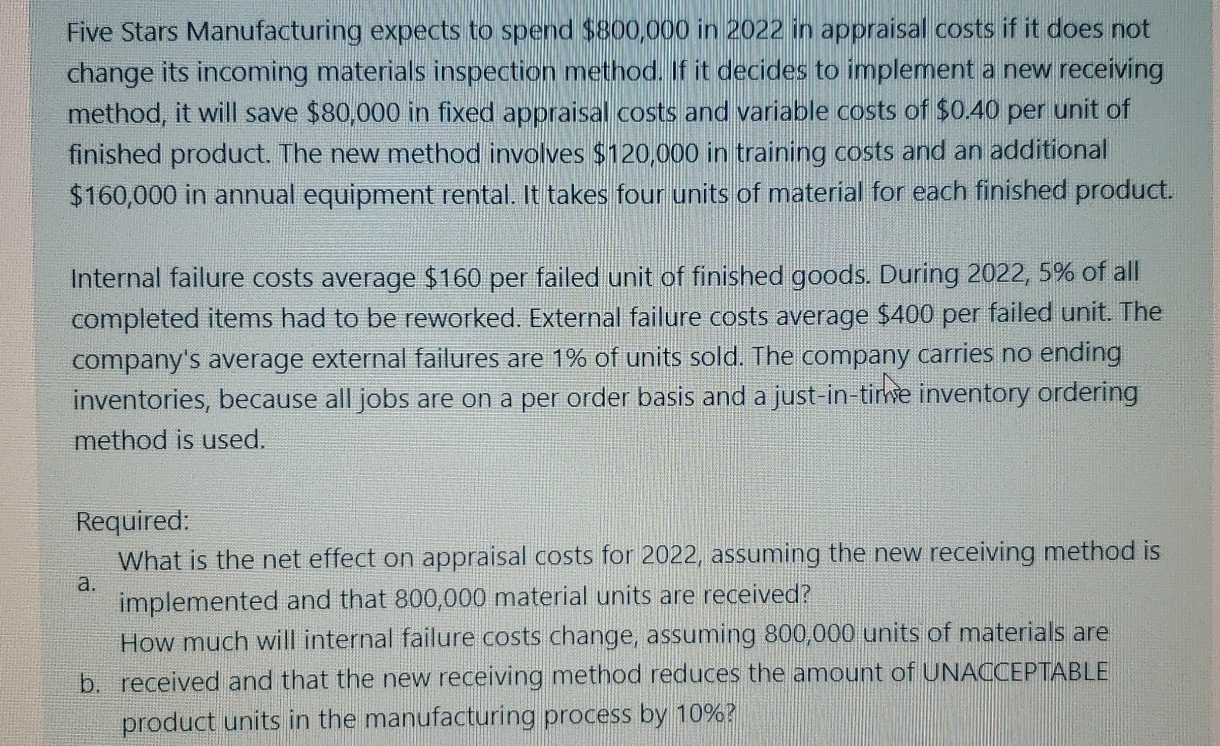

Five Stars Manufacturing expects to spend $ in in appraisal costs if it does not change its incoming materials inspection method. If it decides to implement a new receiving method, it will save $ in fixed appraisal costs and variable costs of $ per unit of finished product. The new method involves $ in training costs and an additional $ in annual equipment rental. It takes four units of material for each finished product.

Internal failure costs average $ per failed unit of finished goods. During of all completed items had to be reworked. External failure costs average $ per failed unit. The company's average external failures are of units sold. The company carries no ending inventories, because all jobs are on a per order basis and a justintimse inventory ordering method is used.

Required:

a

What is the net effect on appraisal costs for assuming the new receiving method is implemented and that material units are received?

How much will internal failure costs change, assuming units of materials are

b received and that the new receiving method reduces the amount of UNACCEPTABLE product units in the manufacturing process by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started