Question

Five years ago a chemical plant invested $90,000 in a pumping station on a nearby river to provide the water required for their production process.

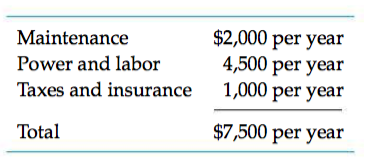

Five years ago a chemical plant invested $90,000 in a pumping station on a nearby river to provide the water required for their production process. Straight- line depreciation is employed for tax purposes, using a 30-year life and zero salvage value. During the past five years, operating costs have been as follows:

A nearby city has offered to purchase the pumping station for $75,000 as it is in the process of developing a city water distribution system. The city is willing to sign a 10-year contract with the plant to provide the plant with its required volume of water for a price of $10,000 per year. Plant officials estimate that the salvage value of the pumping station 10 years hence will be about $30,000. The before-tax MARR is 10% per year. An effective income tax rate of 50% is to be assumed. Compare the annual cost (after taxes) of the defender (keep the pumping station) to the challenger (sell station to the city) and help plant management determine the more economical course of action.

Maintenance $2,000 per year 4,500 per year Power and labor Taxes and insurance 1,000 per year Total $7,500 per yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started