Answered step by step

Verified Expert Solution

Question

1 Approved Answer

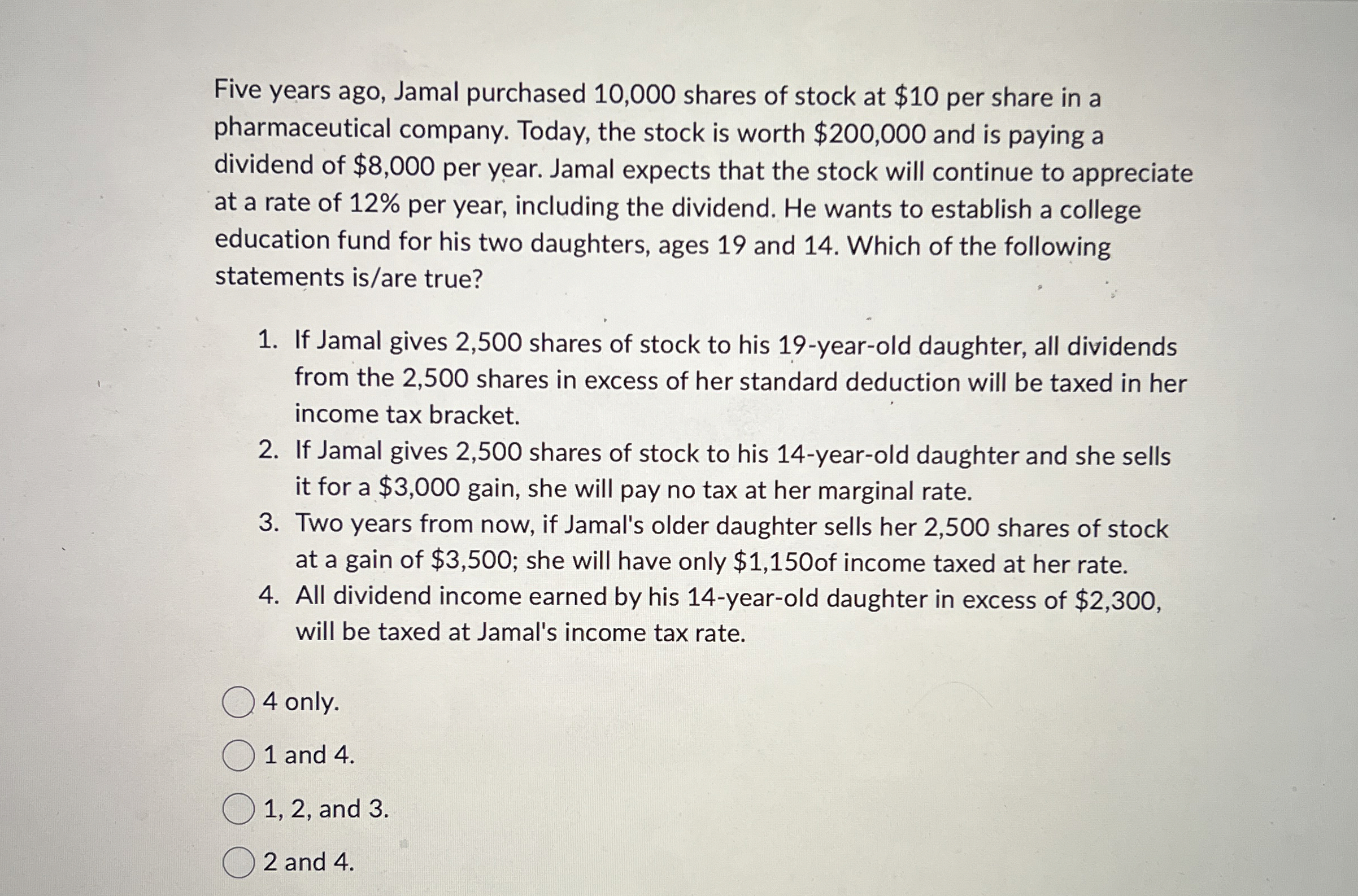

Five years ago, Jamal purchased 1 0 , 0 0 0 shares of stock at $ 1 0 per share in a pharmaceutical company. Today,

Five years ago, Jamal purchased shares of stock at $ per share in a

pharmaceutical company. Today, the stock is worth $ and is paying a

dividend of $ per year. Jamal expects that the stock will continue to appreciate

at a rate of per year, including the dividend. He wants to establish a college

education fund for his two daughters, ages and Which of the following

statements isare true?

If Jamal gives shares of stock to his yearold daughter, all dividends

from the shares in excess of her standard deduction will be taxed in her

income tax bracket.

If Jamal gives shares of stock to his yearold daughter and she sells

it for a $ gain, she will pay no tax at her marginal rate.

Two years from now, if Jamal's older daughter sells her shares of stock

at a gain of $; she will have only $ of income taxed at her rate.

All dividend income earned by his yearold daughter in excess of $

will be taxed at Jamal's income tax rate.

only.

and

and

and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started