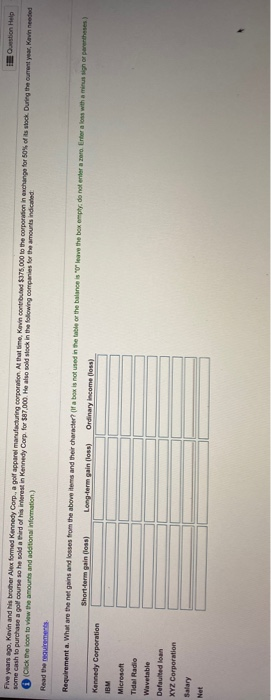

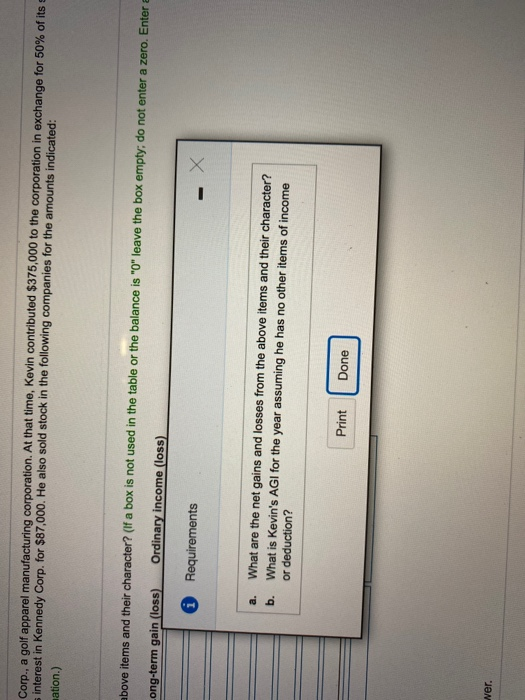

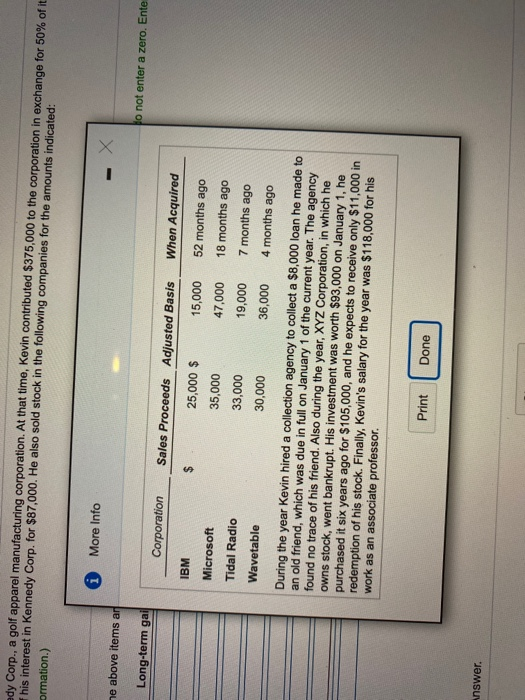

Five years ago, Kevin and his brother Alex formed Kennety Corp. a golf apparel manufacturing corporation. At that time, Kevin contributed $375,000 to the corporation in exchange for 50% of its stock. During the current year, Kevin needed some cash to purchase a golf course she soldated of his interest in Kennedy Corp. for 587.000. He also sold stock in the following companies for the amounts indicated Cick the icon to view the amounts and additional Information) Read the requirements Requirement a. What are the net gains and losses from the above items and their character? (a box is not used in the table or the balance is "Oleave the box empty do not enter a zo Enter a loss with a minus signor parentheses) Short-term gain floss) Long-term gain floss) Ordinary income foss) Kennedy Corporation Microsoft Tidal Radio Wavetable Defaulted loan XYZ Corporation Salary Net Corp., a golf apparel manufacturing corporation. At that time, Kevin contributed $375,000 to the corporation in exchange for 50% of its interest in Kennedy Corp. for $87,000. He also sold stock in the following companies for the amounts indicated: nation.) above items and their character? (If a box is not used in the table or the balance is "0" leave the box empty, do not enter a zero. Enter ong-term gain (loss) Ordinary income (loss) 0 Requirements - X a. b. What are the net gains and losses from the above items and their character? What is Kevin's AGI for the year assuming he has no other items of income or deduction? Print Done wer. edy Corp., a golf apparel manufacturing corporation. At that time, Kevin contributed $375,000 to the corporation in exchange for 50% of it his interest in Kennedy Corp. for $87,000. He also sold stock in the following companies for the amounts indicated: ormation.) * More Info me above items ar Long-term gai Ho not enter a zero. Ente Corporation Sales Proceeds Adjusted Basis When Acquired IBM $ 25,000 $ 15,000 52 months ago Microsoft 35,000 47,000 18 months ago Tidal Radio 33,000 19,000 7 months ago Wavetable 30,000 36,000 4 months ago During the year Kevin hired a collection agency to collect a $8,000 loan he made to an old friend, which was due in full on January 1 of the current year. The agency found no trace of his friend. Also during the year, XYZ Corporation, in which he owns stock, went bankrupt. His investment was worth $93,000 on January 1, he purchased it six years ago for $105,000, and he expects to receive only $11,000 in redemption of his stock. Finally, Kevin's salary for the year was $118,000 for his work as an associate professor. Print Done nswer