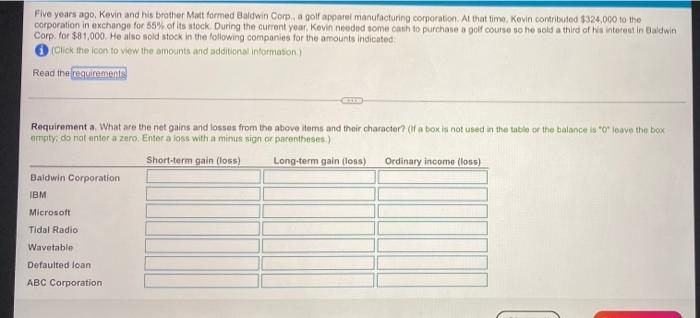

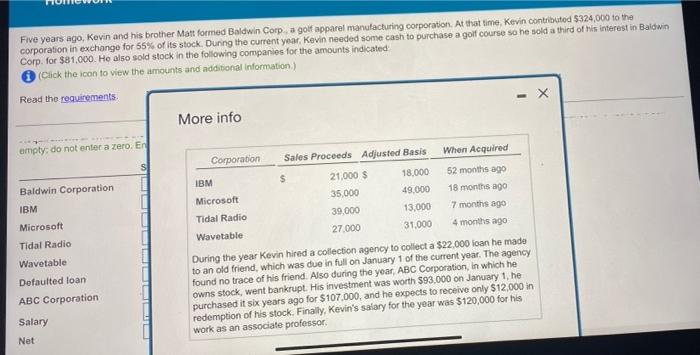

Five years ago. Kevin and his brother Matt formed Baldwin Com a golf apparel manufacturing corporation. At that time, Kovin contributed $324,000 to the corporation in exchange for 55% of its stock. During the current year, Kevin needed some cath to purchase a golf course so he sold a third of interest in Baldwin Corp. for $81,000. He also sold stock in the following companies for the amounts indicated (Click the icon to view the amounts and additional Information Read the requirements Requirement a, What are the net gains and losses from the above items and their character? (if a box is not used in the table or the balance is leave the box empty, do not enter a zero, Enter a loss with a minus sign or parentheses) Short-term gain (loss) Long-term gain (loss) Ordinary income (loss) Baldwin Corporation IBM Microsoft Tidal Radio Wavetable Defaulted loan ABC Corporation Five years ago, Kevin and his brother Matt formed Baldwin Corp. a golf apparel manufacturing corporation. At that time, Kevin contributed 5324,000 to the corporation in exchange for 55% of its stock. During the current year, Kevin needed some cash to purchase a golf course so he sold a third of his interest in Baldwin Corp. for $81,000. He also sold stock in the following companies for the amounts indicated Click the icon to view the amounts and additional Information) Read the requirements - X More info empty: do not enter a zero. En When Acquired Corporation Sales Proceeds Adjusted Basis IBM $ Microsoft Tidal Radio Wavetable 21,000 $ 35,000 39,000 27.000 18.000 49.000 13,000 31,000 52 months ago 18 months ago 7 months ago 4 months ago Baldwin Corporation IBM Microsoft Tidal Radio Wavetable Defaulted loan ABC Corporation During the year Kevin hired a collection agency to collect a $22,000 loan he made to an old friend, which was due in full on January 1 of the current year. The agency found no trace of his friend. Also during the year, ABC Corporation, in which he owns stock, went bankrupt. His investment was worth $93.000 on January 1, he purchased it six years ago for $107.000, and he expects to receive only $12,000 in redemption of his stock. Finally, Kevin's salary for the year was $120,000 for his work as an associate professor, Salary Net