Answered step by step

Verified Expert Solution

Question

1 Approved Answer

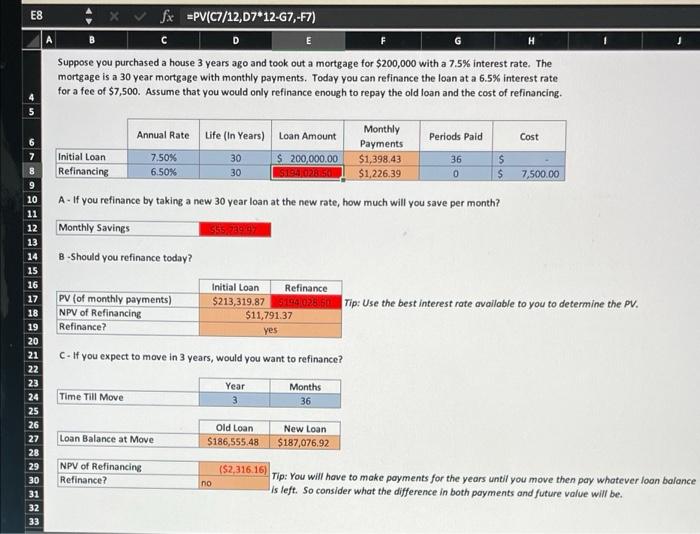

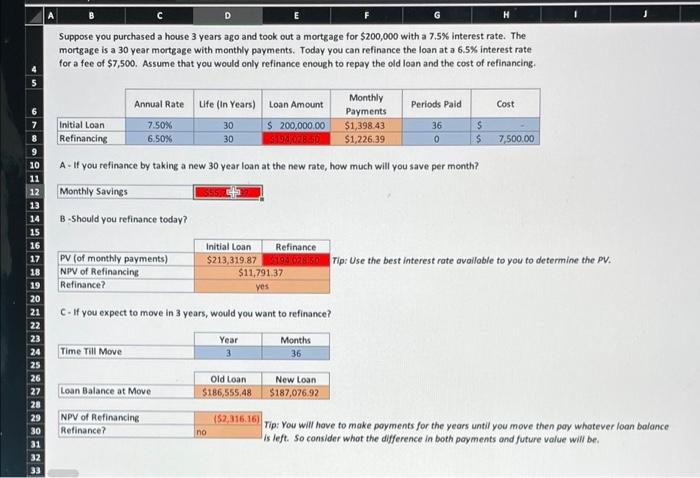

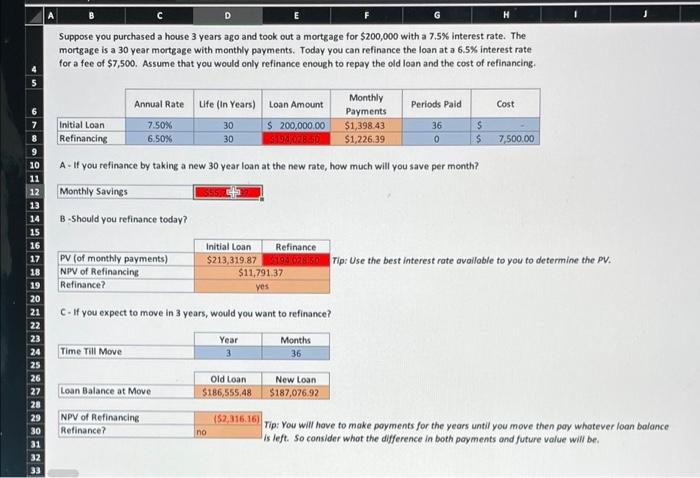

fix red cells incorrect equations and nimbers first equation is supposed to use cumprinc equation , seconf equation need correct values and third equation needs

fix red cells incorrect equations and nimbers

first equation is supposed to use cumprinc equation , seconf equation need correct values and third equation needs to include f8 cell

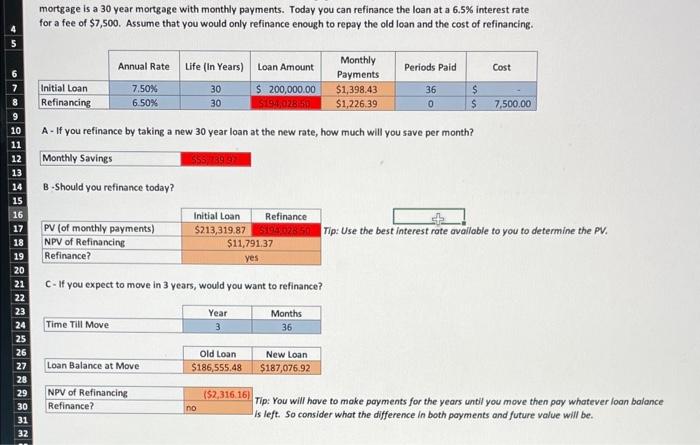

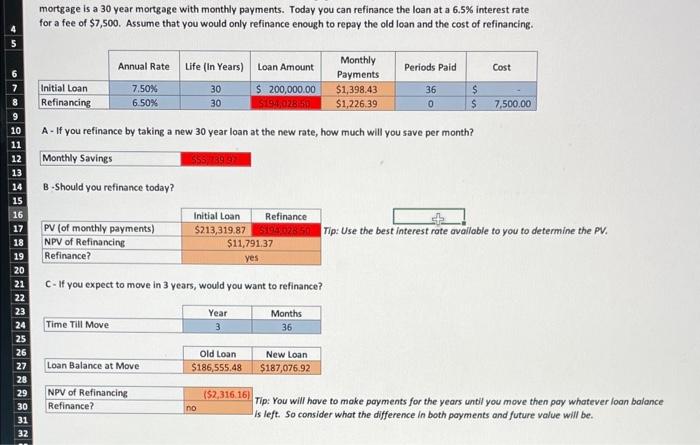

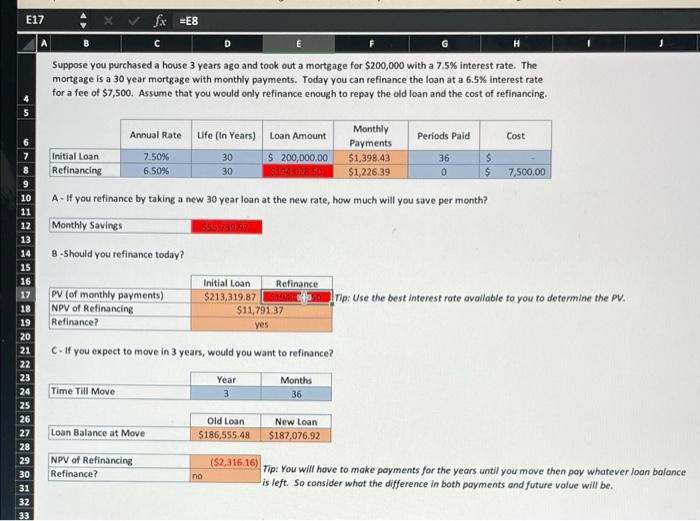

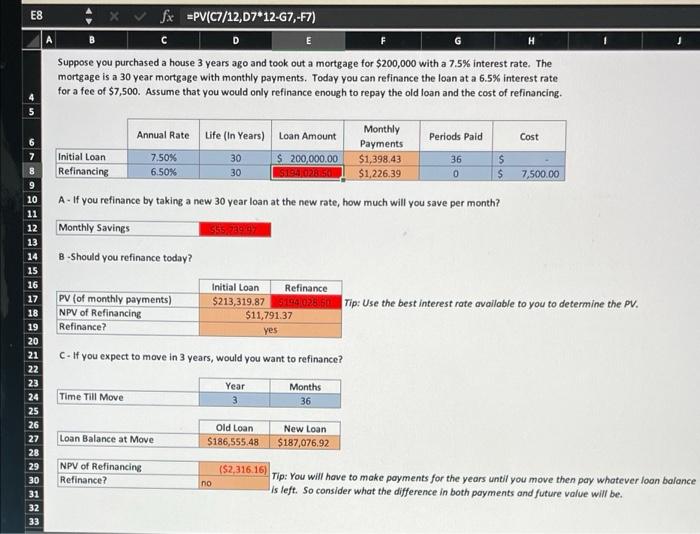

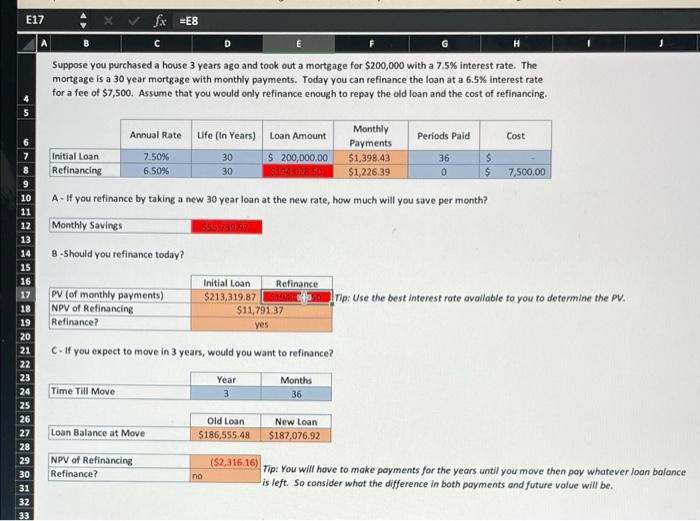

mortgage is a 30 year mortgage with monthly payments. Today you can refinance the loan at a 6.5% interest rate for a fee of $7,500. Assume that you would only refinance enough to repay the old loan and the cost of refinancing Cost 0 $ 7,500.00 Annual Rate Life (in Years) Loan Amount Monthly Payments Periods Paid Initial Loan 7.50% 30 $ 200,000.00 $1,398.43 36 $ Refinancing 6.50% 30 S19402850 $1,226.39 A - If you refinance by taking a new 30 year loan at the new rate, how much will you save per month? Monthly Savings 10 11 12 13 14 B-Should you refinance today? Initial Loan Refinance $213,319.871002850 Tip: Use the best interest rate avallable $11,791.37 yes PV (of monthly payments) NPV of Refinancing Refinance? you to determine the PV. C- If you expect to move in 3 years, would you want to refinance? Year 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Time Till Move Months 36 Loan Balance at Move Old Loan $186,555.48 New Loan $187,076.92 NPV of Refinancing Refinance? no ($2,316.16) Tip: You will have to make payments for the years until you move then pay whatever loan balance is left. So consider what the difference in both payments and future value will be E8 . E F H x 5x =PV(C7/12,07*12-67,-F7) Suppose you purchased a house 3 years ago and took out a mortgage for $200,000 with a 7.5% interest rate. The mortgage is a 30 year mortgage with monthly payments. Today you can refinance the loan at a 6.5% interest rate for a fee of $7,500. Assume that you would only refinance enough to repay the old loan and the cost of refinancing. Cost 7,500.00 Annual Rate Life (In Years) Loan Amount Monthly Payments Periods Paid Initial Loan 7.50% 30 $ 200,000.00 $1,398.43 36 $ Refinancing 6.50% 30 S194028.50 $1,226.39 0 $ A- If you refinance by taking a new 30 year loan at the new rate, how much will you save per month? Monthly Savings 5552200 B-Should you refinance today? 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Initial Loan Refinance PV (of monthly payments) NPV of Refinancing Refinance? $213,319.87 9100028160 Tip: Use the best interest rate available to you to determine the pv. $11,791.37 yes C- If you expect to move in 3 years, would you want to refinance? Time Till Move Year 3 Months 36 Loan Balance at Move Old Loan $186,555.48 New Loan $187,076.92 28 29 30 31 32 33 NPV of Refinancing Refinance? no ($2,316.16) Tip: You will have to make payments for the years until you move then pay whatever loan balance is left. So consider what the difference in both payments and future value will be. Suppose you purchased a house 3 years ago and took out a mortgage for $200,000 with a 7.5% interest rate. The mortgage is a 30 year mortgage with monthly payments. Today you can refinance the loan at a 6.5% interest rate for a fee of $7,500. Assume that you would only refinance enough to repay the old loan and the cost of refinancing, Cost 7,500.00 Annual Rate Life (In Years) Loan Amount Monthly Periods Paid Payments Initial Loan 7.50% 30 $ 200,000.00 $1,398.43 36 $ Refinancing 6.50% 30 $19.40ZB 50 $1,226,39 0 $ A - If you refinance by taking a new 30 year loan at the new rate, how much will you save per month? Monthly Savings B-Should you refinance today? Initial Loan Refinance PV (of monthly payments) $213,319.87 3194 028.60 Tip: Use the best interest rate available to you to determine the PV. NPV of Refinancing $11,791.37 Refinance? yes C. If you expect to move in 3 years, would you want to refinance? Year 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Time Till Move Months 36 Loan Balance at Move Old Loan $186,555,48 New Loan $187,07692 NPV of Refinancing Refinance? no ($2,316.16) Tip: You will have to make payments for the years until you move then pay whatever loan balance is left. So consider whot the difference in both payments and future value will be E17 Sxe =E8 a a Suppose you purchased a house 3 years ago and took out a mortgage for $200,000 with a 7.5% interest rate. The mortgage is a 30 year mortgage with monthly payments. Today you can refinance the loan at a 6.5% interest rate for a fee of $7,500. Assume that you would only refinance enough to repay the old loan and the cost of refinancing Cost Initial Loan Refinancing Annual Rate Life (In Years) Loan Amount 7.50% 30 $ 200,000.00 6.50% 30 $194 ORRISO Monthly Payments $1,398.43 $1,226.39 Periods Paid 36 0 $ s 7,500.00 A - If you refinance by taking a new 30 year loan at the new rate, how much will you save per month? Monthly Savings 5959 8-Should you refinance today? 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 Initial Loan Refinance PV (of monthly payments) $213,319.87 Tip: Use the best interest rate available to you to determine the Pv. NPV of Refinancing $11,79137 Refinance? yes C- If you expect to move in 3 years, would you want to refinance? Time Till Move Year 3 Months 36 Loan Balance at Move old Loan $186,555.48 New Loan $187,076.92 NPV of Refinancing Refinance? no ($2,316.16) Tip: You will have to make payments for the years until you move then pay whatever loan balance is left. So consider what the difference in both payments and future value will be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started