Please answer Question 5 and 10 and let me know if all other answers are correct. Thank you much appreciated .

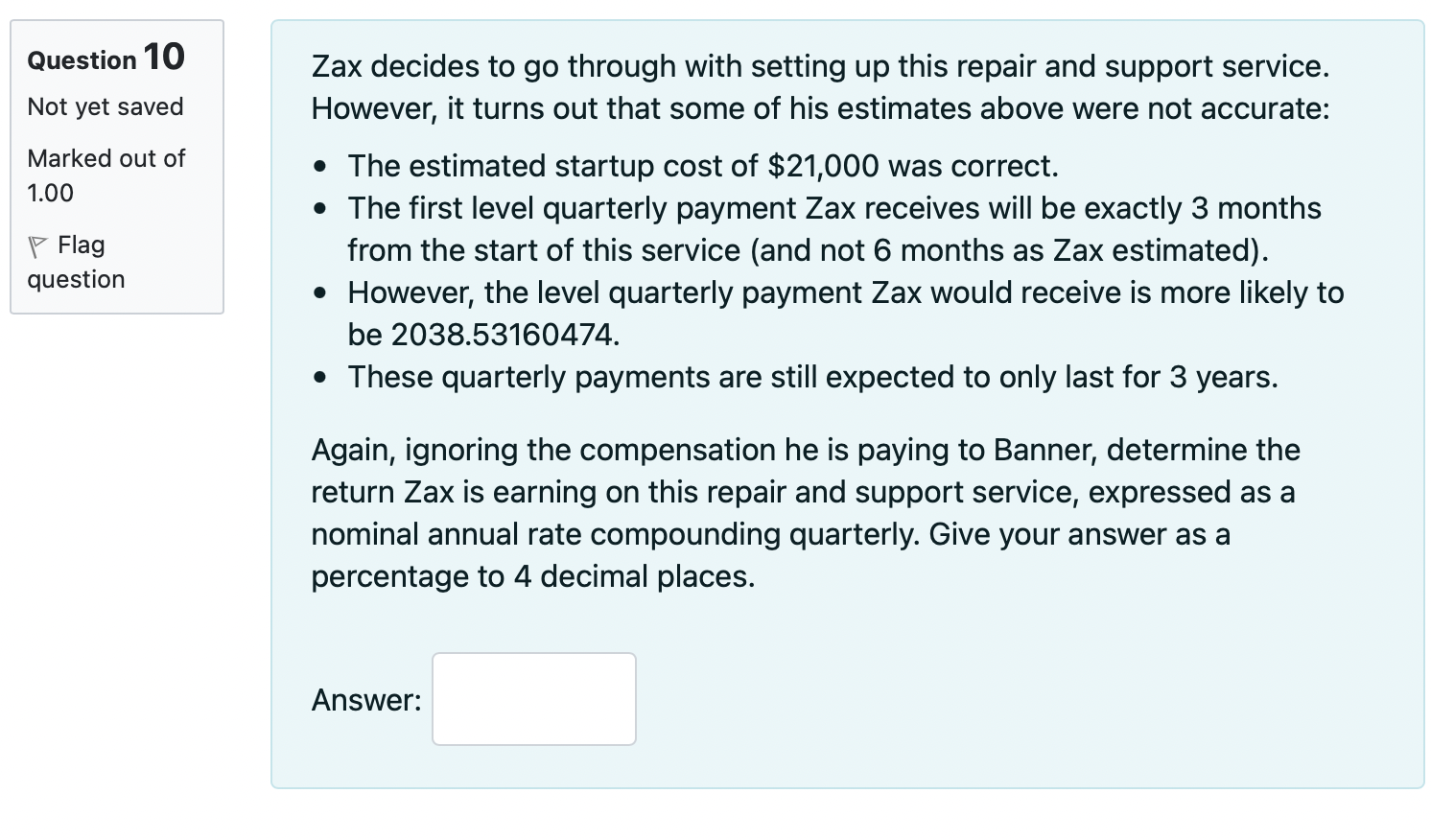

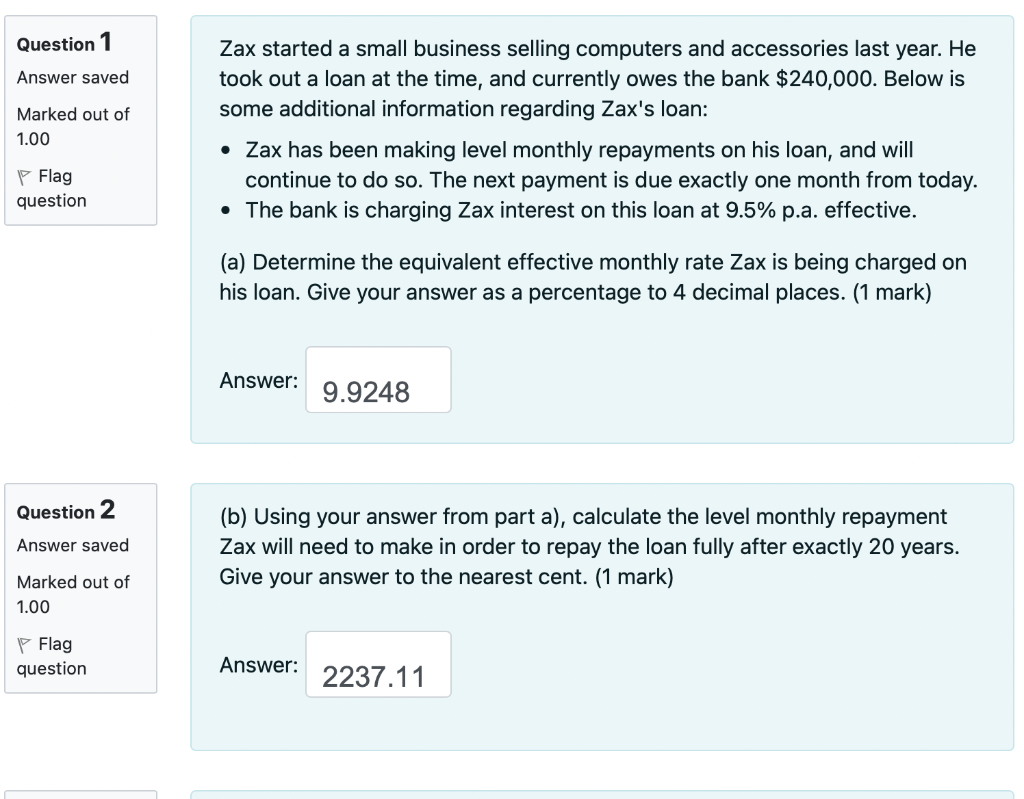

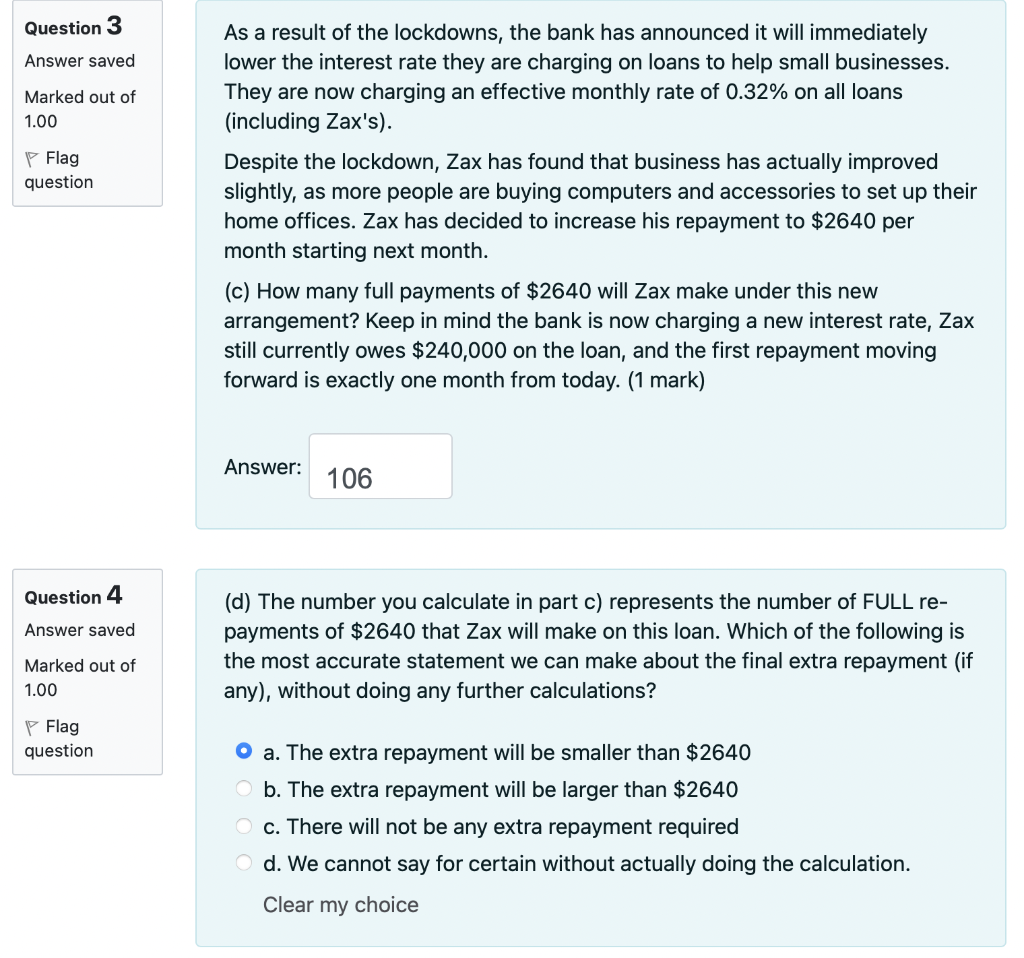

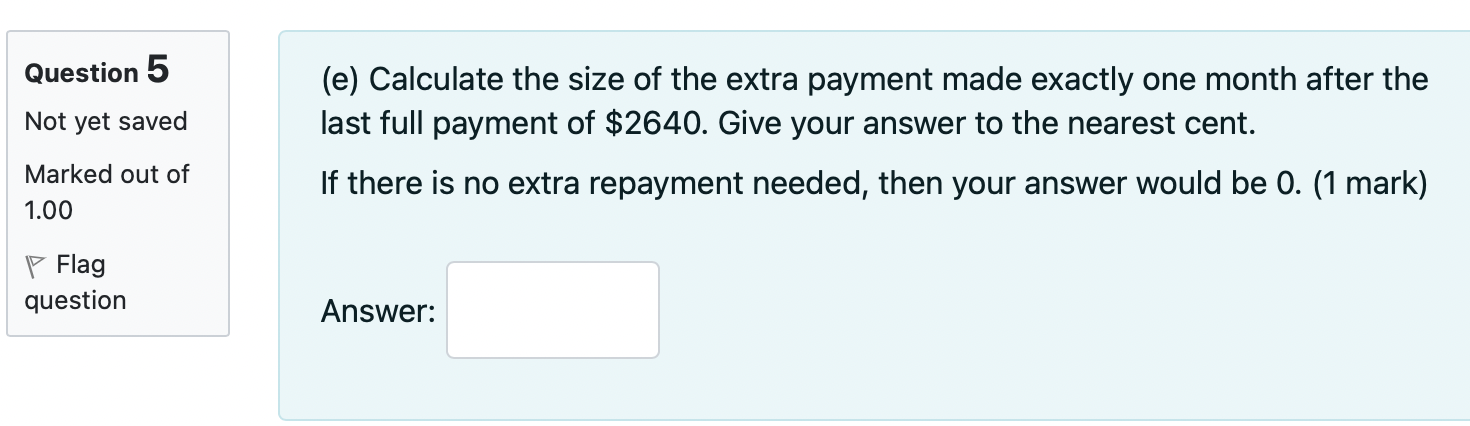

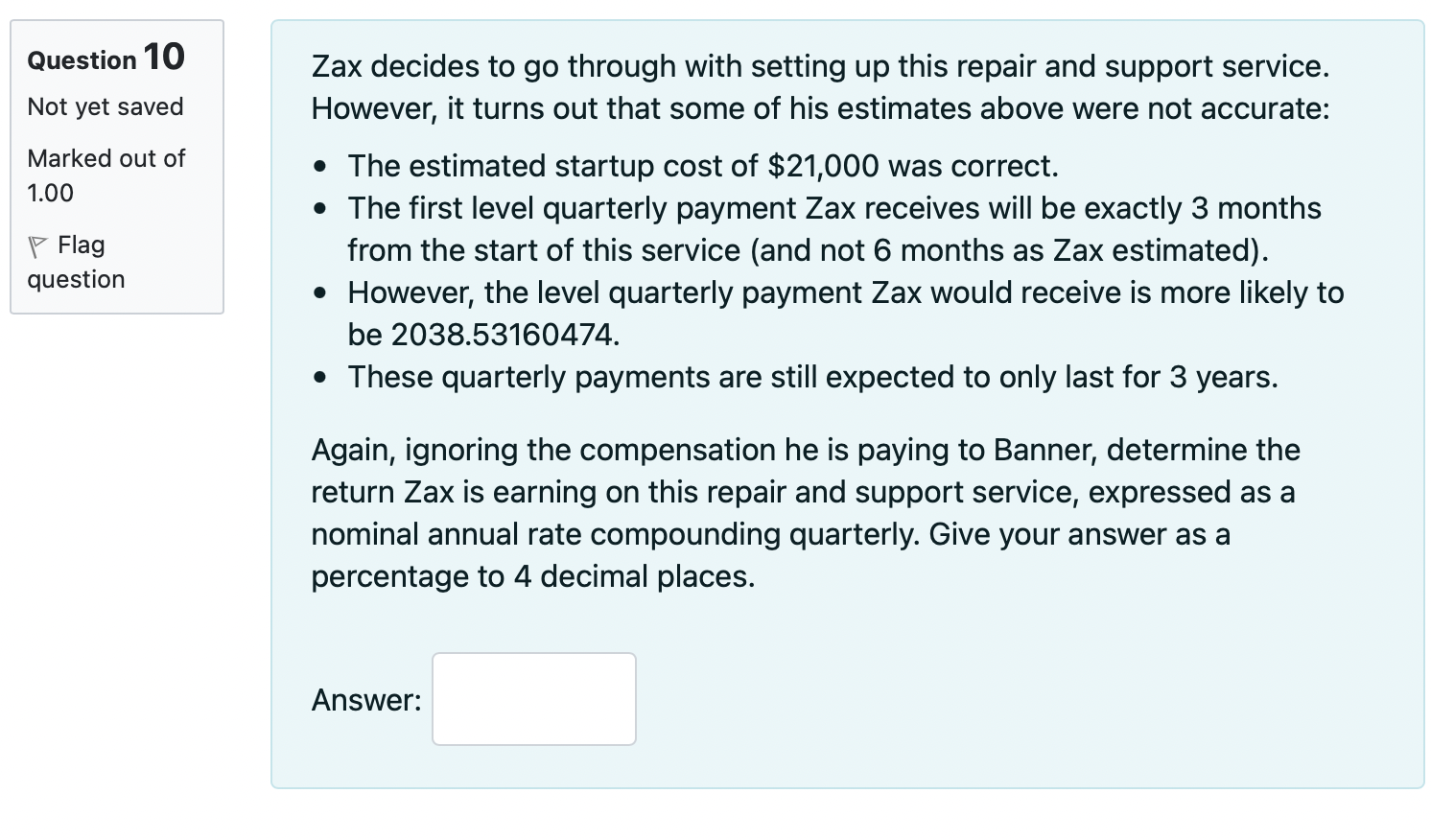

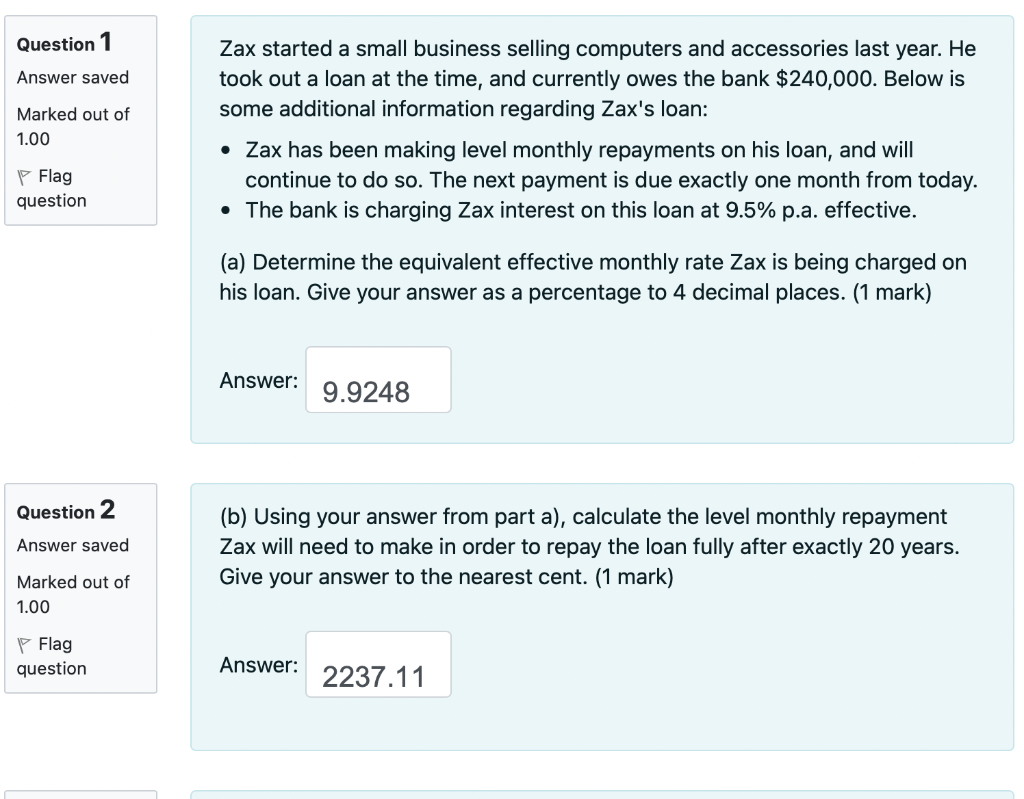

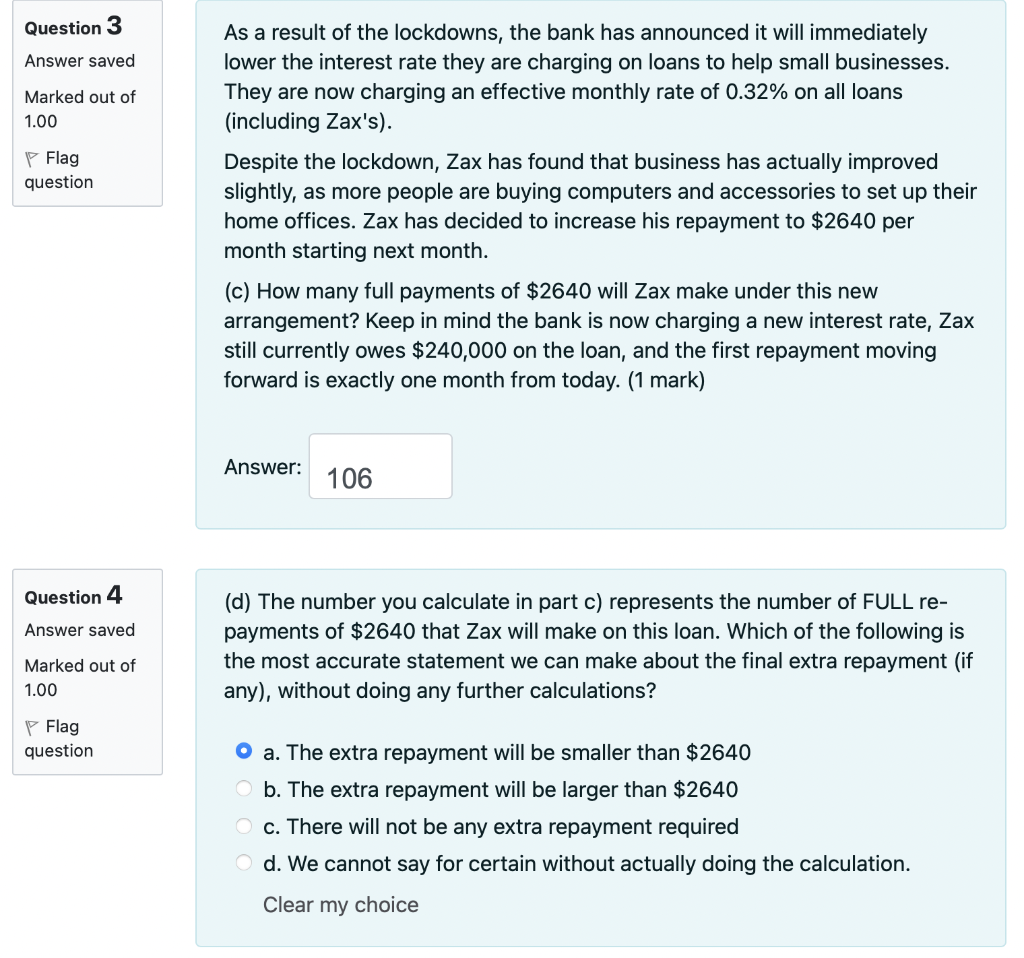

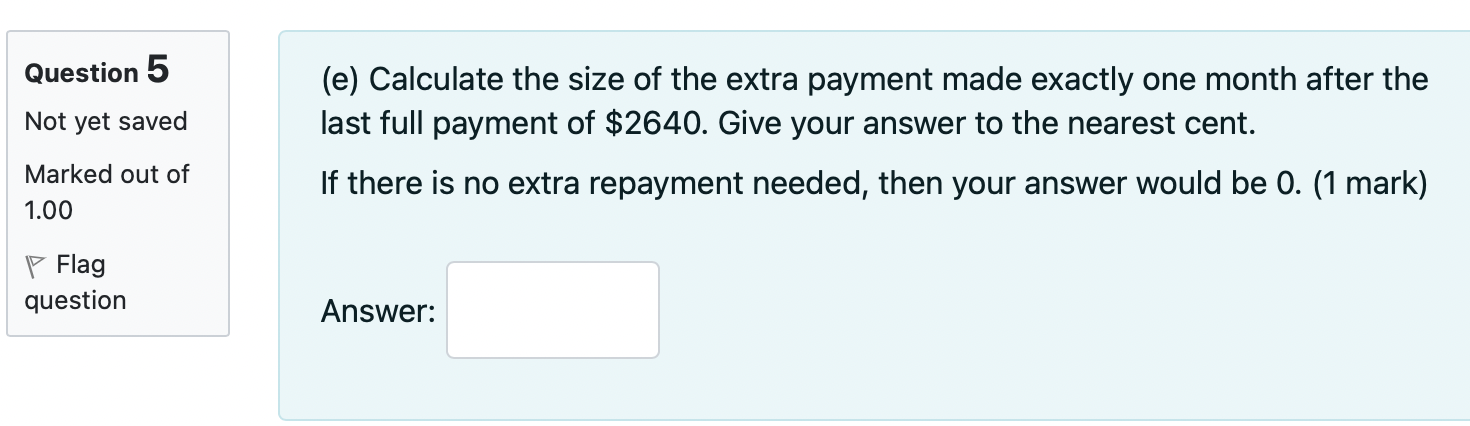

Question 10 Not yet saved Marked out of 1.00 Zax decides to go through with setting up this repair and support service. However, it turns out that some of his estimates above were not accurate: The estimated startup cost of $21,000 was correct. The first level quarterly payment Zax receives will be exactly 3 months from the start of this service (and not 6 months as Zax estimated). However, the level quarterly payment Zax would receive is more likely to be 2038.53160474. These quarterly payments are still expected to only last for 3 years. Flag question Again, ignoring the compensation he is paying to Banner, determine the return Zax is earning on this repair and support service, expressed as a nominal annual rate compounding quarterly. Give your answer as a percentage to 4 decimal places. Answer: Question 1 Answer saved Marked out of 1.00 Zax started a small business selling computers and accessories last year. He took out a loan at the time, and currently owes the bank $240,000. Below is some additional information regarding Zax's loan: Zax has been making level monthly repayments on his loan, and will continue to do so. The next payment is due exactly one month from today. The bank is charging Zax interest on this loan at 9.5% p.a. effective. P Flag question (a) Determine the equivalent effective monthly rate Zax is being charged on his loan. Give your answer as a percentage to 4 decimal places. (1 mark) Answer: 9.9248 Question 2 Answer saved (b) Using your answer from part a), calculate the level monthly repayment Zax will need to make in order to repay the loan fully after exactly 20 years. Give your answer to the nearest cent. (1 mark) Marked out of 1.00 P Flag question Answer: 2237.11 Question 3 Answer saved Marked out of 1.00 Flag question As a result of the lockdowns, the bank has announced it will immediately lower the interest rate they are charging on loans to help small businesses. They are now charging an effective monthly rate of 0.32% on all loans (including Zax's). Despite the lockdown, Zax has found that business has actually improved slightly, as more people are buying computers and accessories to set up their home offices. Zax has decided to increase his repayment to $2640 per month starting next month. (c) How many full payments of $2640 will Zax make under this new arrangement? Keep in mind the bank is now charging a new interest rate, Zax still currently owes $240,000 on the loan, and the first repayment moving forward is exactly one month from today. (1 mark) Answer: 106 Question 4 Answer saved (d) The number you calculate in part c) represents the number of FULL re- payments of $2640 that Zax will make on this loan. Which of the following is the most accurate statement we can make about the final extra repayment (if any), without doing any further calculations? Marked out of 1.00 Flag question O a. The extra repayment will be smaller than $2640 b. The extra repayment will be larger than $2640 c. There will not be any extra repayment required d. We cannot say for certain without actually doing the calculation. Clear my choice Question 5 Not yet saved (e) Calculate the size of the extra payment made exactly one month after the last full payment of $2640. Give your answer to the nearest cent. If there is no extra repayment needed, then your answer would be 0. (1 mark) Marked out of 1.00 P Flag