Answered step by step

Verified Expert Solution

Question

1 Approved Answer

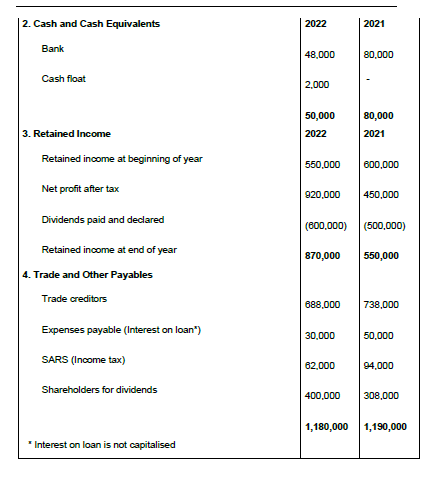

Fixed Asset Land & Building Vehicles Equipment Total Carrying value at beginning of year 2,700 000 - 2,300 000 5 000 000 Cost 2,700 000

| Fixed Asset | Land & Building | Vehicles | Equipment | Total |

| Carrying value at beginning of year

| 2,700 000 | - | 2,300 000 | 5 000 000 |

| Cost | 2,700 000 | - | 3,100 000 | 5,800 000 |

| Accumulated depreciation

| (800 000) | (800 000) | ||

| Movements | ||||

| Additions at cost | 2,450 000 | 350 000 | ||

| Depreciation for the year | (200 000) | (200 000) | ||

| Disposals at carrying value | (600 000) | - | (600 000) | |

| Carrying value at end of year | 2,100 000 | 2,450 000 | 2,450 000 | 7, 000 000 |

| Cost | 2,100 000 | 2,450 000 | 3,450 000 | 800 000 |

| Accumulated depreciation | - | - | 1,000 000 | 1,000 000 |

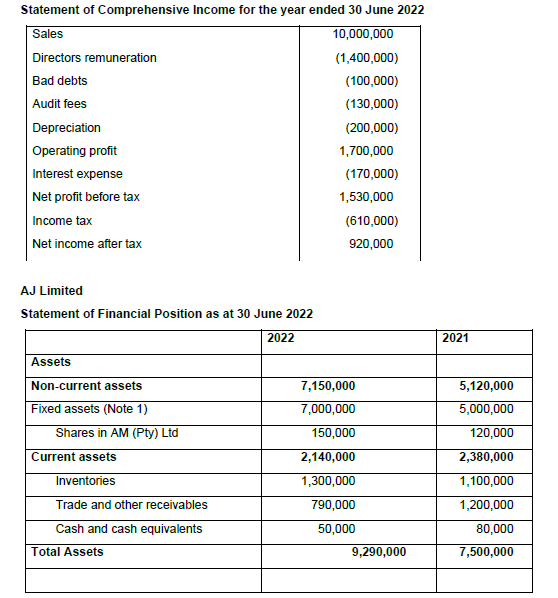

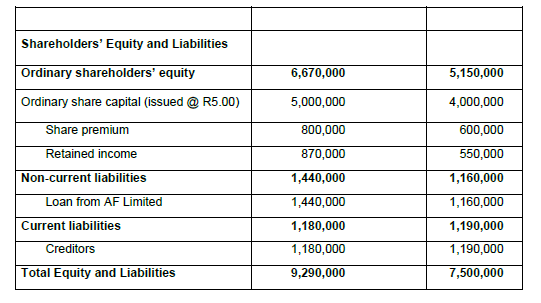

1st Question: Prepare a cash flow statement year ended June 2022

2nd Question : The business bought a significant amount of new fixed assets. What did they buy and how did they pay for these fixed assets? Provide figures to support your answer. -this is for 20 marks I need all the figures

Statement of Comprehensive Income for the year ended 30 June 2022 AJ Limited Statement of Financial Position as at 30 June 2022 \begin{tabular}{|c|c|c|} \hline & & \\ \hline Shareholders' Equity and Liabilities & & \\ \hline Ordinary shareholders' equity & 6,670,000 & 5,150,000 \\ \hline Ordinary share capital (issued @ R5.00) & 5,000,000 & 4,000,000 \\ \hline Share premium & 800,000 & 600,000 \\ \hline Retained income & 870,000 & 550,000 \\ \hline Non-current liabilities & 1,440,000 & 1,160,000 \\ \hline Loan from AF Limited & 1,440,000 & 1,160,000 \\ \hline Current liabilities & 1,180,000 & 1,190,000 \\ \hline Creditors & 1,180,000 & 1,190,000 \\ \hline Total Equity and Liabilities & 9,290,000 & 7,500,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline 2. Cash and Cash Equivalents & 2022 & 2021 \\ Bank & 48,000 & 80,000 \\ Cash float & 2,000 & - \\ 3. Retained Income & 50,000 & 80,000 \\ Retained income at beginning of year & 2022 & 2021 \\ Net profit after tax & 550,000 & 600,000 \\ Dividends paid and declared & 920,000 & 450,000 \\ Retained income at end of year & (600,000) & (500,000) \\ 4. Trade and Other Payables & 870,000 & 550,000 \\ Trade creditors & 1,180,000 & 1,190,000 \\ Expenses payable (Interest on loan") & 688,000 & 738,000 \\ SARS (Income tax) & 30,000 & 50,000 \\ Shareholders for dividends & 62,000 & 94,000 \\ \end{tabular} Statement of Comprehensive Income for the year ended 30 June 2022 AJ Limited Statement of Financial Position as at 30 June 2022 \begin{tabular}{|c|c|c|} \hline & & \\ \hline Shareholders' Equity and Liabilities & & \\ \hline Ordinary shareholders' equity & 6,670,000 & 5,150,000 \\ \hline Ordinary share capital (issued @ R5.00) & 5,000,000 & 4,000,000 \\ \hline Share premium & 800,000 & 600,000 \\ \hline Retained income & 870,000 & 550,000 \\ \hline Non-current liabilities & 1,440,000 & 1,160,000 \\ \hline Loan from AF Limited & 1,440,000 & 1,160,000 \\ \hline Current liabilities & 1,180,000 & 1,190,000 \\ \hline Creditors & 1,180,000 & 1,190,000 \\ \hline Total Equity and Liabilities & 9,290,000 & 7,500,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline 2. Cash and Cash Equivalents & 2022 & 2021 \\ Bank & 48,000 & 80,000 \\ Cash float & 2,000 & - \\ 3. Retained Income & 50,000 & 80,000 \\ Retained income at beginning of year & 2022 & 2021 \\ Net profit after tax & 550,000 & 600,000 \\ Dividends paid and declared & 920,000 & 450,000 \\ Retained income at end of year & (600,000) & (500,000) \\ 4. Trade and Other Payables & 870,000 & 550,000 \\ Trade creditors & 1,180,000 & 1,190,000 \\ Expenses payable (Interest on loan") & 688,000 & 738,000 \\ SARS (Income tax) & 30,000 & 50,000 \\ Shareholders for dividends & 62,000 & 94,000 \\ \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started