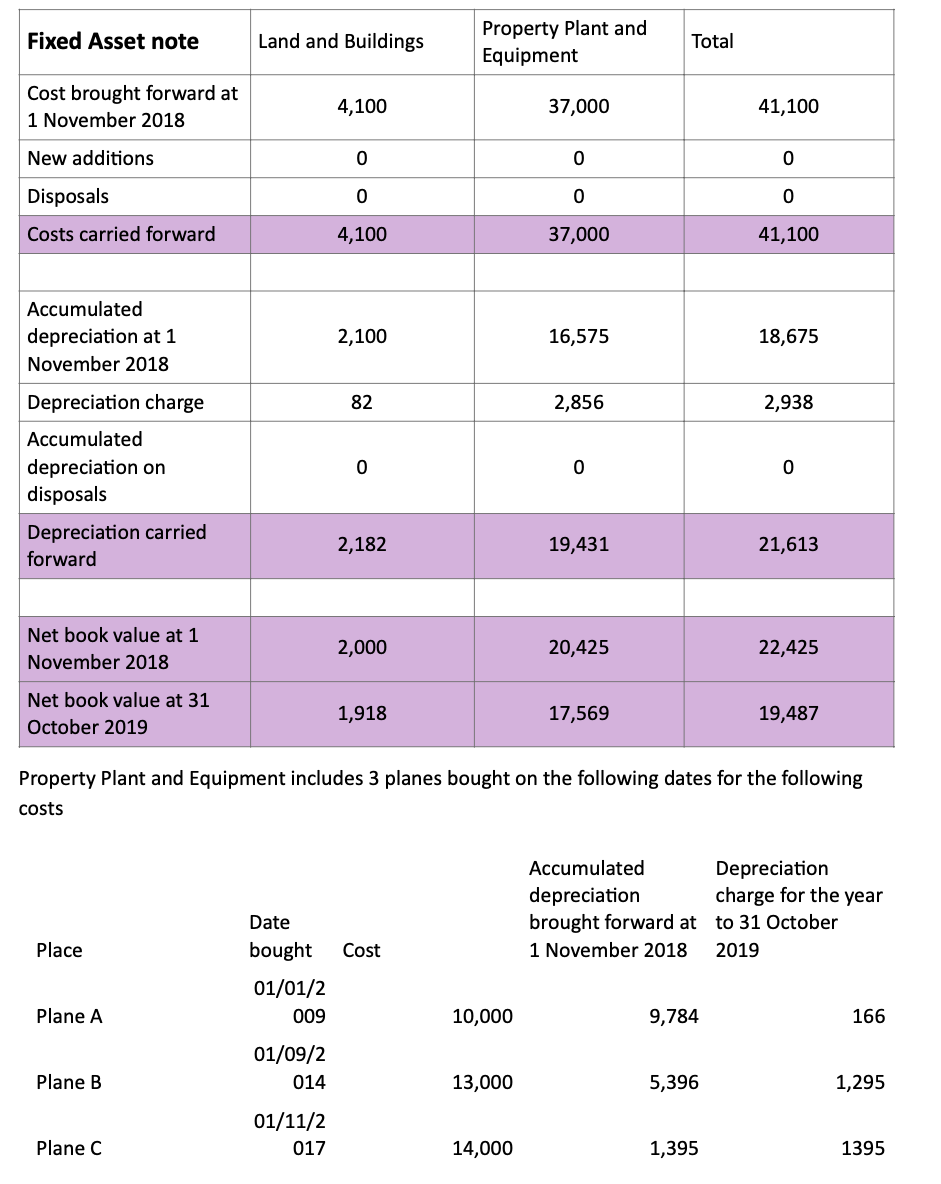

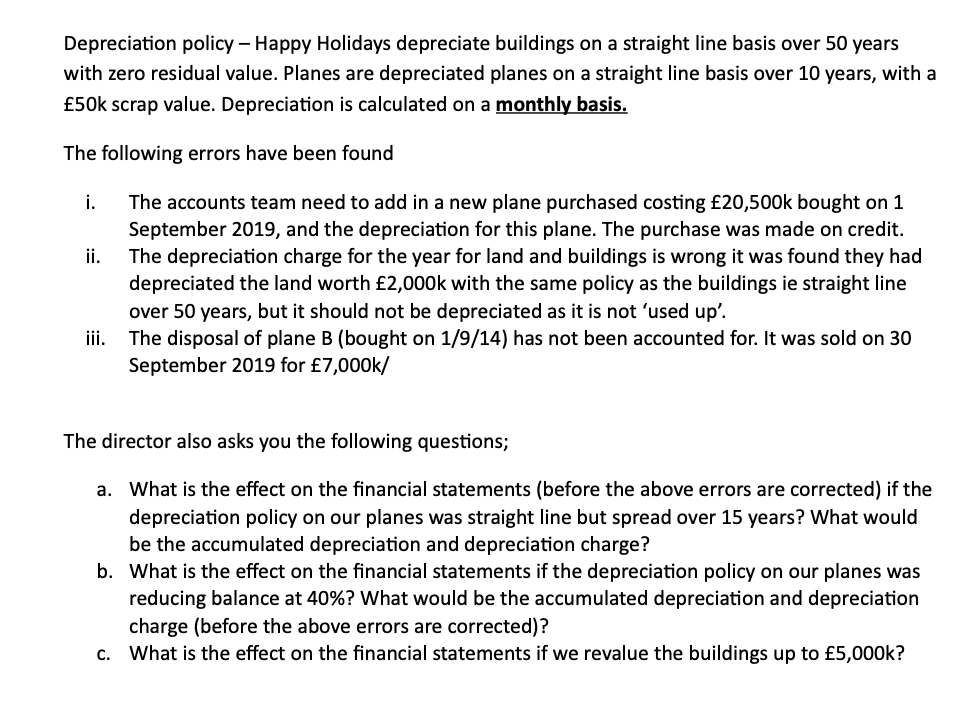

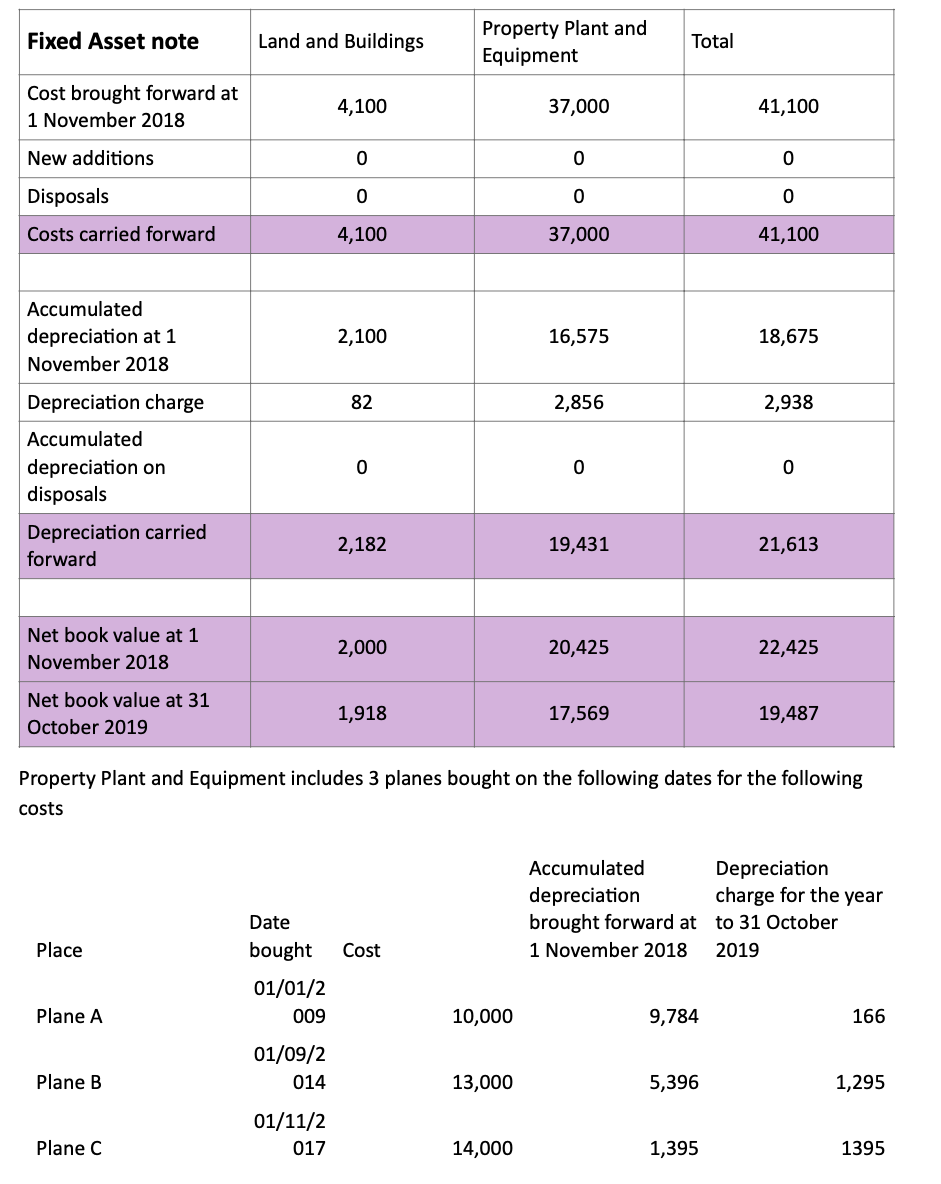

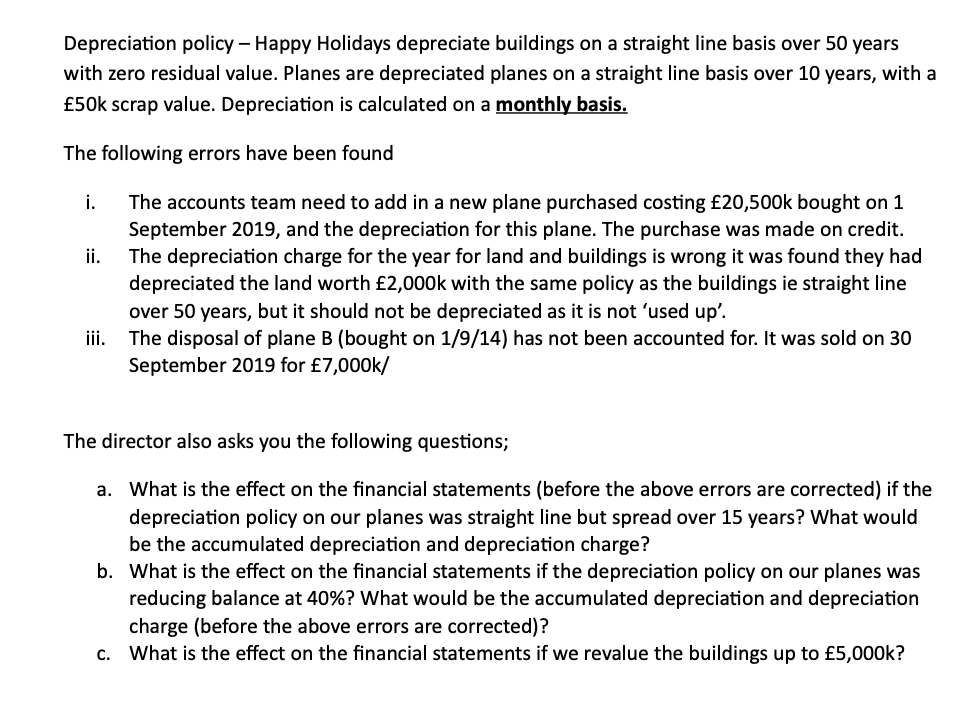

Fixed Asset note Land and Buildings Property Plant and Equipment Total Cost brought forward at 1 November 2018 4,100 37,000 41,100 New additions 0 0 0 0 0 0 Disposals Costs carried forward 4,100 37,000 41,100 Accumulated depreciation at 1 November 2018 2,100 16,575 18,675 82 2,856 2,938 0 0 0 Depreciation charge Accumulated depreciation on disposals Depreciation carried forward 2,182 19,431 21,613 Net book value at 1 November 2018 2,000 20,425 22,425 Net book value at 31 October 2019 1,918 17,569 19,487 Property Plant and Equipment includes 3 planes bought on the following dates for the following costs Accumulated Depreciation depreciation charge for the year brought forward at to 31 October 1 November 2018 2019 Date bought Place Cost 01/01/2 009 Plane A 10,000 9,784 166 01/09/2 014 Plane B 13,000 5,396 1,295 01/11/2 017 Plane C 14,000 1,395 1395 Depreciation policy - Happy Holidays depreciate buildings on a straight line basis over 50 years with zero residual value. Planes are depreciated planes on a straight line basis over 10 years, with a 50k scrap value. Depreciation is calculated on a monthly basis. The following errors have been found i. The accounts team need to add in a new plane purchased costing 20,500k bought on 1 September 2019, and the depreciation for this plane. The purchase was made on credit. ii. The depreciation charge for the year for land and buildings is wrong it was found they had depreciated the land worth 2,000k with the same policy as the buildings ie straight line over 50 years, but it should not be depreciated as it is not 'used up'. iii. The disposal of plane B (bought on 1/9/14) has not been accounted for. It was sold on 30 September 2019 for 7,000k/ The director also asks you the following questions; a. What is the effect on the financial statements (before the above errors are corrected) if the depreciation policy on our planes was straight line but spread over 15 years? What would be the accumulated depreciation and depreciation charge? b. What is the effect on the financial statements if the depreciation policy on our planes was reducing balance at 40%? What would be the accumulated depreciation and depreciation charge (before the above errors are corrected)? C. What is the effect on the financial statements if we revalue the buildings up to 5,000k