Answered step by step

Verified Expert Solution

Question

1 Approved Answer

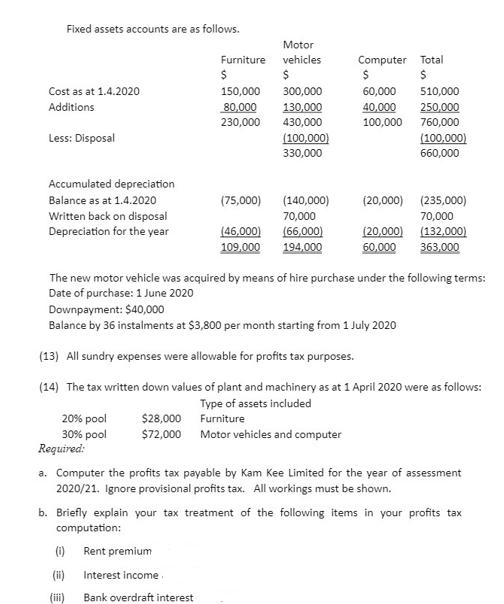

Fixed assets accounts are as follows. Cost as at 1.4.2020 Additions Less: Disposal Accumulated depreciation Balance as at 1.4.2020 Written back on disposal Depreciation

Fixed assets accounts are as follows. Cost as at 1.4.2020 Additions Less: Disposal Accumulated depreciation Balance as at 1.4.2020 Written back on disposal Depreciation for the year Furniture $ 150,000 80,000 230,000 20% pool 30% pool (75,000) (46,000) 109,000 Required: Motor vehicles $ 300,000 130,000 430,000 (100,000) 330,000 (140,000) 70,000 (66,000) 194,000 Computer $ 60,000 40,000 100,000 (20,000) (20,000) 60,000 Total $ 510,000 250,000 760,000 (100,000) 660,000 (235,000) 70,000 The new motor vehicle was acquired by means of hire purchase under the following terms: Date of purchase: 1 June 2020 (132,000) 363,000 Downpayment: $40,000 Balance by 36 instalments at $3,800 per month starting from 1 July 2020 (13) All sundry expenses were allowable for profits tax purposes. (14) The tax written down values of plant and machinery as at 1 April 2020 were as follows: Type of assets included $28,000 Furniture $72,000 Motor vehicles and computer a. Computer the profits tax payable by Kam Kee Limited for the year of assessment 2020/21. Ignore provisional profits tax. All workings must be shown. b. Briefly explain your tax treatment of the following items in your profits tax computation: (i) Rent premium (ii) Interest income (iii) Bank overdraft interest

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Profits Tax Payable by Kam Kee Limited for Year of Assessment 202021 Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started