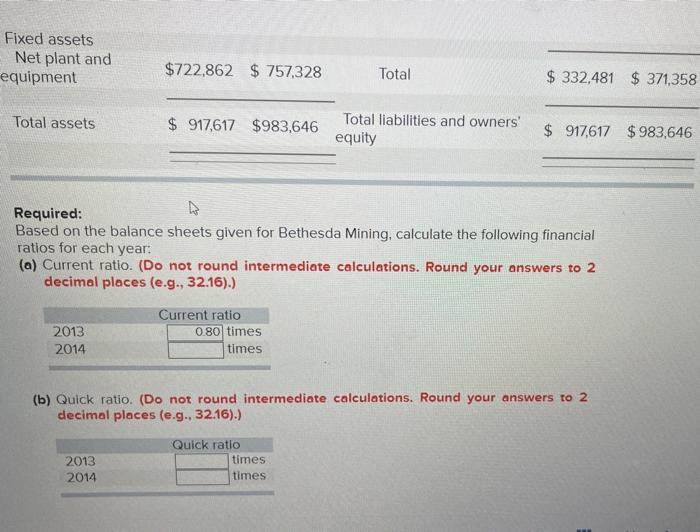

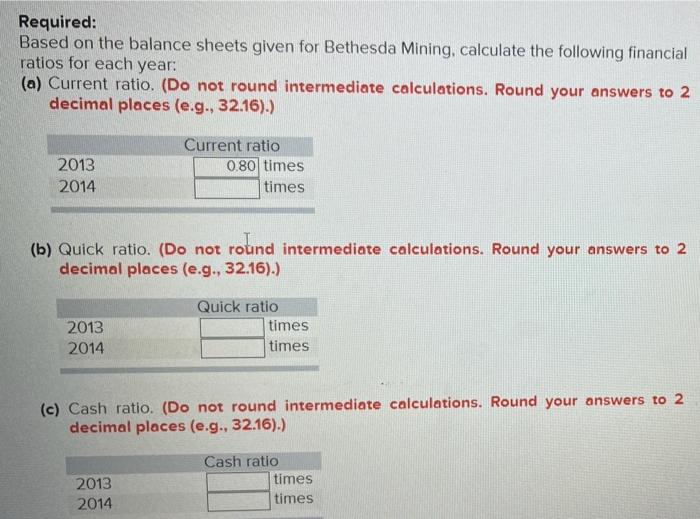

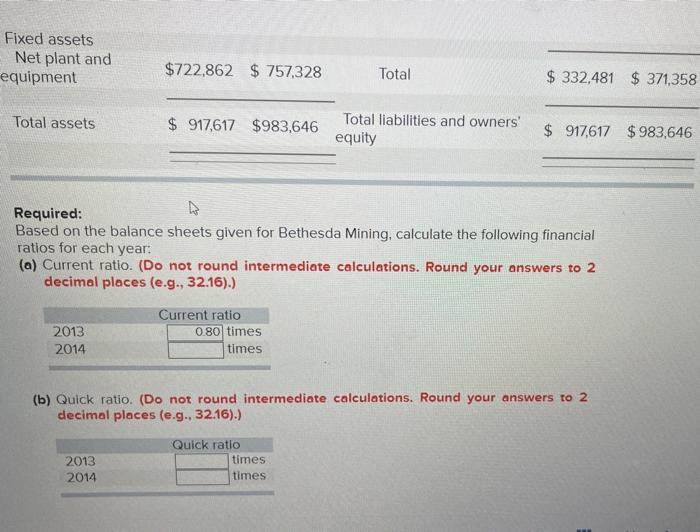

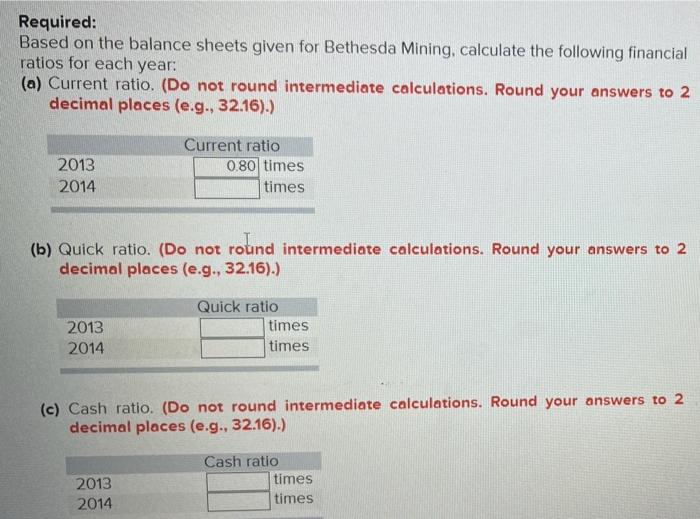

Fixed assets Net plant and equipment $722,862 $ 757,328 Total $ 332,481 $ 371,358 Total assets $ 917,617 $983,646 Total liabilities and owners' equity $ 917,617 $983,646 Required: B Based on the balance sheets given for Bethesda Mining, calculate the following financial ratios for each year: (a) Current ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 2014 Current ratio 0.80 times times (b) Quick ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) Quick ratio times 2013 2014 times Required: Based on the balance sheets given for Bethesda Mining, calculate the following financial ratios for each year: (a) Current ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 Current ratio 0.80 times times 2014 (b) Quick ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 2014 Quick ratio times times (c) Cash ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) Cash ratio times 2013 2014 times Fixed assets Net plant and equipment $722,862 $ 757,328 Total $ 332,481 $ 371,358 Total assets $ 917,617 $983,646 Total liabilities and owners' equity $ 917,617 $983,646 Required: B Based on the balance sheets given for Bethesda Mining, calculate the following financial ratios for each year: (a) Current ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 2014 Current ratio 0.80 times times (b) Quick ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) Quick ratio times 2013 2014 times Required: Based on the balance sheets given for Bethesda Mining, calculate the following financial ratios for each year: (a) Current ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 Current ratio 0.80 times times 2014 (b) Quick ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) 2013 2014 Quick ratio times times (c) Cash ratio. (Do not round intermediate calculations. Round your answers to 2 decimal places (e.g., 32.16).) Cash ratio times 2013 2014 times