Answered step by step

Verified Expert Solution

Question

1 Approved Answer

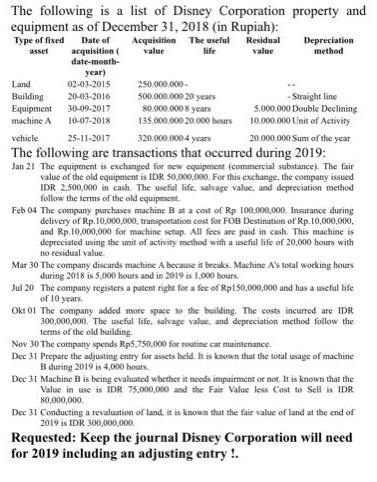

The following is a list of Disney Corporation property and equipment as of December 31, 2018 (in Rupiah): Type of fised Date of Acquisition

The following is a list of Disney Corporation property and equipment as of December 31, 2018 (in Rupiah): Type of fised Date of Acquisition The useful value Residual Depreciation method acquisition ( date-month- asset life value year) Land 02-03-2015 250.000.000- Building Equipment 500.000.000 20 years 80.000.000 8 years 135.000.000 20.000 hours - Straight line 5.000.000 Double Declining 10.000.000 Unit of Activity 20-03-2016 30-09-2017 machine A 10-07-2018 vehicle 25-11-2017 320.000.000 4 years 20.000.000 Sum of the year The following are transactions that occurred during 2019: Jan 21 The equipment is exchanged for new equipenent (commercial substance). The fair value of the old equipment is IDR 50,000,000. For this exchange, the company issued IDR 2,500,000 in cash. The useful life, salvage value, and depreciation method follow the terms of the old equipment. Feb 04 The company purchases machine B at a cost of Rp 100.000.000. Insurance during delivery of Rp.10,000,000, transportation cost for FOB Destination of Rp.10,000,000, and Rp. 10,000,000 for machine setup. All fees are paid in cash. This machine is depreciated using the unit of activity method with a useful life of 20,000 hours with no residual value. Mar 30 The company discards machine A because it breaks. Machine A's total working hours during 2018 is 5,00 hours and in 2019 is 1,000 hours. Jul 20 The company registers a patent right for a fee of Rp150,000,000 and has a useful life of 10 years. Okt 01 The company added more space to the building. The costs incurred are IDR 300,000,000. The useful life, salvage value, and depreciation method follow the terms of the old building. Nov 30 The company spends Rp5,750.000 for routine cat maintenance. Dec 31 Prepare the adjusting entry for assets beld. t is known that the total usage of machine B during 2019 is 4,000 hours. Dec 31 Machine B is being evaluated wbether it neods impairment or not. It is known that the Value in use is IDR 75,000,000 and the Fair Value less Cost to Sell is IDR 80,000,000. Dec 31 Conducting a revaluation of land, it is known that the fair value of land at the end of 2019 is IDR 300,000,000. Requested: Keep the journal Disney Corporation will need for 2019 including an adjusting entry !.

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Journal entry in the books of Disney Corporation for 2019 Date Particulars DebitIDR CreditIDR 21119 New Equipment at the FV of asset given up 50000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started