Question

Fizer Pharmaceutical paid $87 million on January 2, 2024, for 7 million shares of Carne Cosmetics common stock. The investment represents a 25% interest in

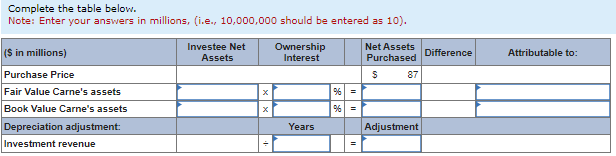

Fizer Pharmaceutical paid $87 million on January 2, 2024, for 7 million shares of Carne Cosmetics common stock. The investment represents a 25% interest in the net assets of Carne and gave Fizer the ability to exercise significant influence over Carnes operations. Fizer received dividends of $1 per share on December 21, 2024, and Carne reported net income of $60 million for the year ended December 31, 2024. The fair value of Carnes common stock at December 31, 2024, was $37.50 per share.

- The book value of Carne's net assets was $152 million.

- The fair value of Carne's depreciable assets exceeded their book value by $40 million. These assets had an average remaining useful life of ten years.

- The remainder of the excess of the cost of the investment over the book value of net assets purchased was attributable to goodwill.

Required:

1a. Complete the table below and prepare the appropriate journal entries related to the investment during 2024.

1b. Prepare the appropriate journal entries related to the investment during 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10).

Journal entries:

- Record the investment in Carne Cosmetics shares.

- Record the investor's share of net income.

- Record the cash dividends.

- Record the depreciation adjustment.

- Record the fair value adjustment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started