Answered step by step

Verified Expert Solution

Question

1 Approved Answer

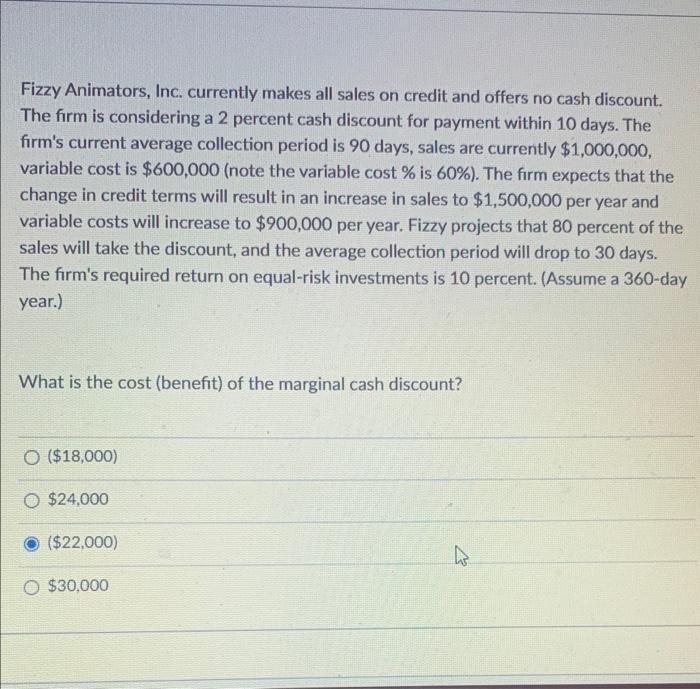

Fizzy Animators, Inc. currently makes all sales on credit and offers no cash discount. The firm is considering a 2 percent cash discount for

Fizzy Animators, Inc. currently makes all sales on credit and offers no cash discount. The firm is considering a 2 percent cash discount for payment within 10 days. The firm's current average collection period is 90 days, sales are currently $1,000,000, variable cost is $600,000 (note the variable cost % is 60%). The firm expects that the change in credit terms will result in an increase in sales to $1,500,000 per year and variable costs will increase to $900,000 per year. Fizzy projects that 80 percent of the sales will take the discount, and the average collection period will drop to 30 days. The firm's required return on equal-risk investments is 10 percent. (Assume a 360-day year.) What is the cost (benefit) of the marginal cash discount? O ($18,000) O $24,000 ($22,000) O $30,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to calculate the cost or benefit of the cash discount The steps are outlined as follows Step 1 Calculate Original and Ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started