Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FlameMaster, a leading manufacturer in the gas grill industry, is dedicated to producing top-quality gas grills. With an expected production of 20,000 units for the

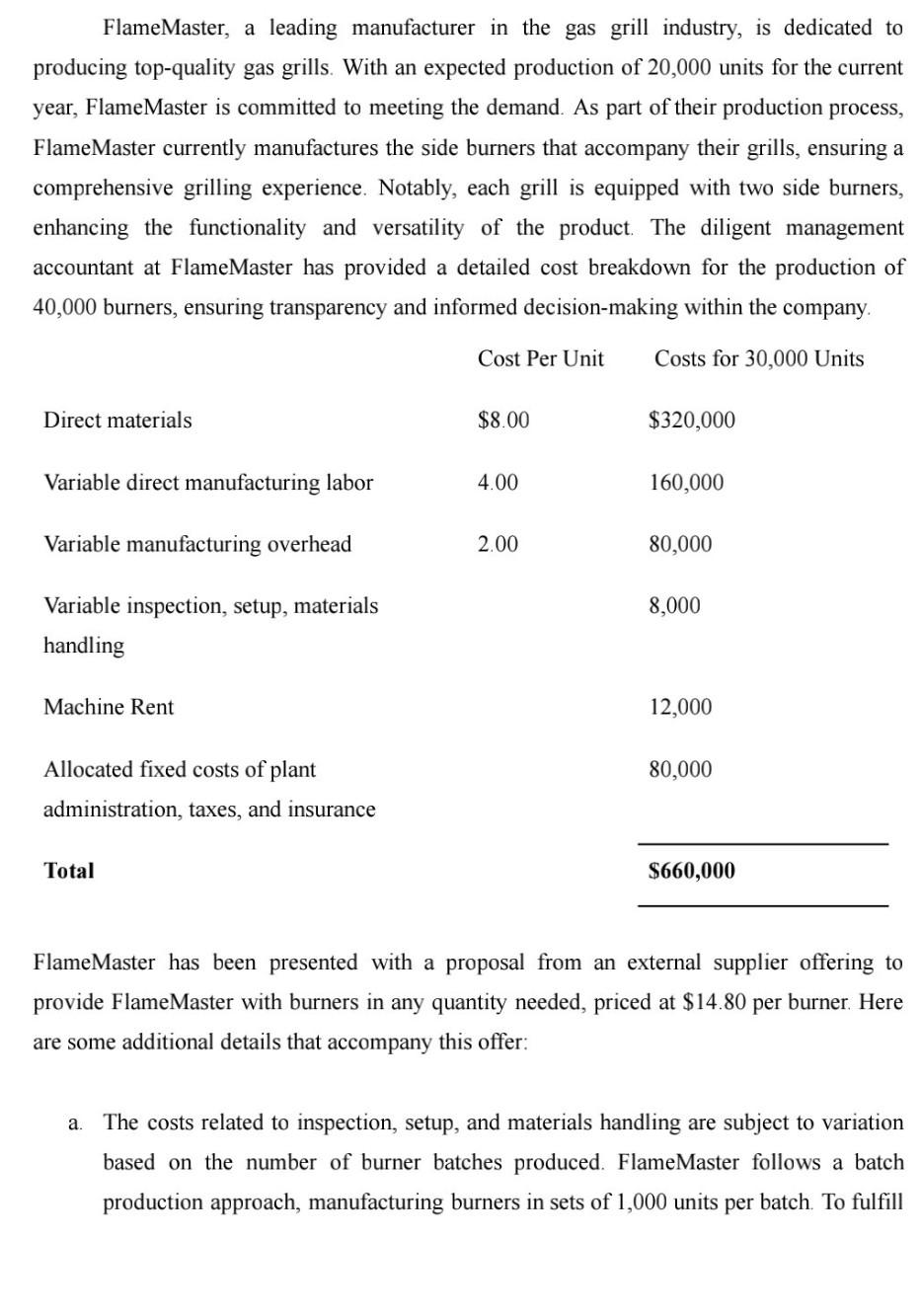

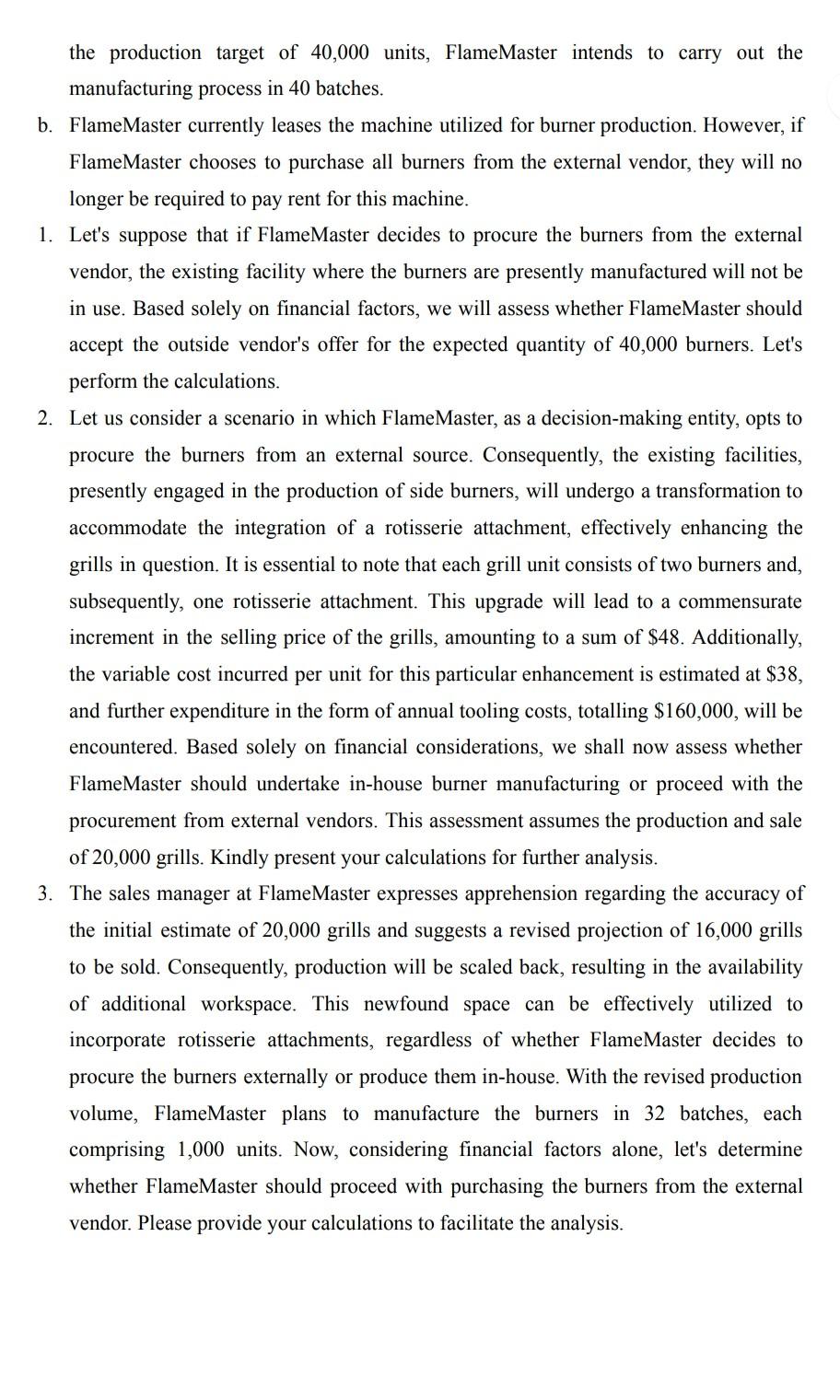

FlameMaster, a leading manufacturer in the gas grill industry, is dedicated to producing top-quality gas grills. With an expected production of 20,000 units for the current year, FlameMaster is committed to meeting the demand. As part of their production process, FlameMaster currently manufactures the side burners that accompany their grills, ensuring a comprehensive grilling experience. Notably, each grill is equipped with two side burners, enhancing the functionality and versatility of the product. The diligent management accountant at FlameMaster has provided a detailed cost breakdown for the production of 40,000 burners, ensuring transparency and informed decision-making within the company. FlameMaster has been presented with a proposal from an external supplier offering to provide FlameMaster with burners in any quantity needed, priced at $14.80 per burner. Here are some additional details that accompany this offer: a. The costs related to inspection, setup, and materials handling are subject to variation based on the number of burner batches produced. FlameMaster follows a batch production approach, manufacturing burners in sets of 1,000 units per batch. To fulfill b. FlameMaster currently leases the machine utilized for burner production. However, if FlameMaster chooses to purchase all burners from the external vendor, they will no longer be required to pay rent for this machine. 1. Let's suppose that if FlameMaster decides to procure the burners from the external vendor, the existing facility where the burners are presently manufactured will not be in use. Based solely on financial factors, we will assess whether FlameMaster should accept the outside vendor's offer for the expected quantity of 40,000 burners. Let's perform the calculations. 2. Let us consider a scenario in which FlameMaster, as a decision-making entity, opts to procure the burners from an external source. Consequently, the existing facilities, presently engaged in the production of side burners, will undergo a transformation to accommodate the integration of a rotisserie attachment, effectively enhancing the grills in question. It is essential to note that each grill unit consists of two burners and, subsequently, one rotisserie attachment. This upgrade will lead to a commensurate increment in the selling price of the grills, amounting to a sum of $48. Additionally, the variable cost incurred per unit for this particular enhancement is estimated at $38, and further expenditure in the form of annual tooling costs, totalling $160,000, will be encountered. Based solely on financial considerations, we shall now assess whether FlameMaster should undertake in-house burner manufacturing or proceed with the procurement from external vendors. This assessment assumes the production and sale of 20,000 grills. Kindly present your calculations for further analysis. 3. The sales manager at FlameMaster expresses apprehension regarding the accuracy of the initial estimate of 20,000 grills and suggests a revised projection of 16,000 grills to be sold. Consequently, production will be scaled back, resulting in the availability of additional workspace. This newfound space can be effectively utilized to incorporate rotisserie attachments, regardless of whether FlameMaster decides to procure the burners externally or produce them in-house. With the revised production volume, FlameMaster plans to manufacture the burners in 32 batches, each comprising 1,000 units. Now, considering financial factors alone, let's determine whether FlameMaster should proceed with purchasing the burners from the external vendor. Please provide your calculations to facilitate the analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started