Answered step by step

Verified Expert Solution

Question

1 Approved Answer

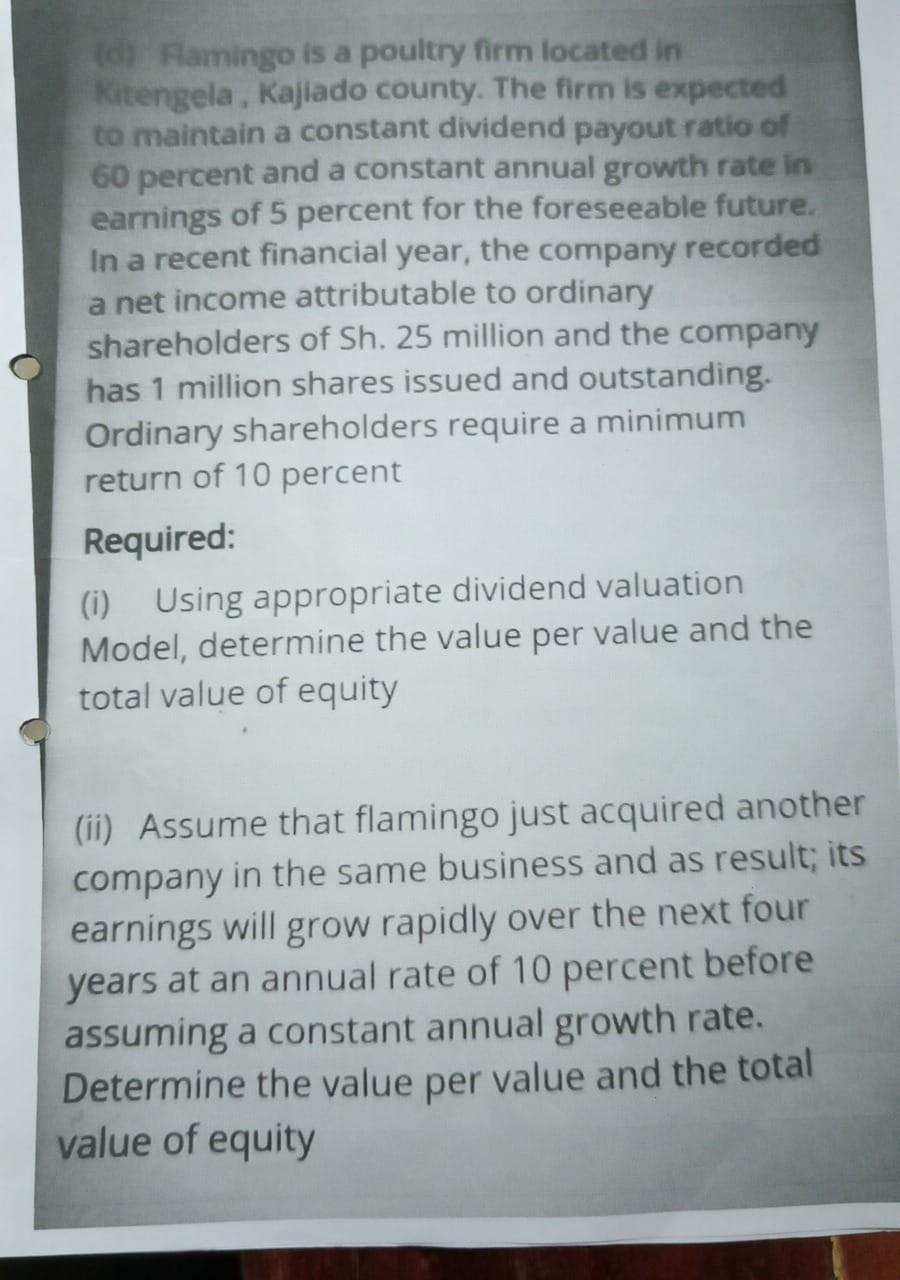

Flamingo is a poultry firm located in Kitengela, Kajlado county. The firm is expected to maintain a constant dividend payout ratio of 60 percent and

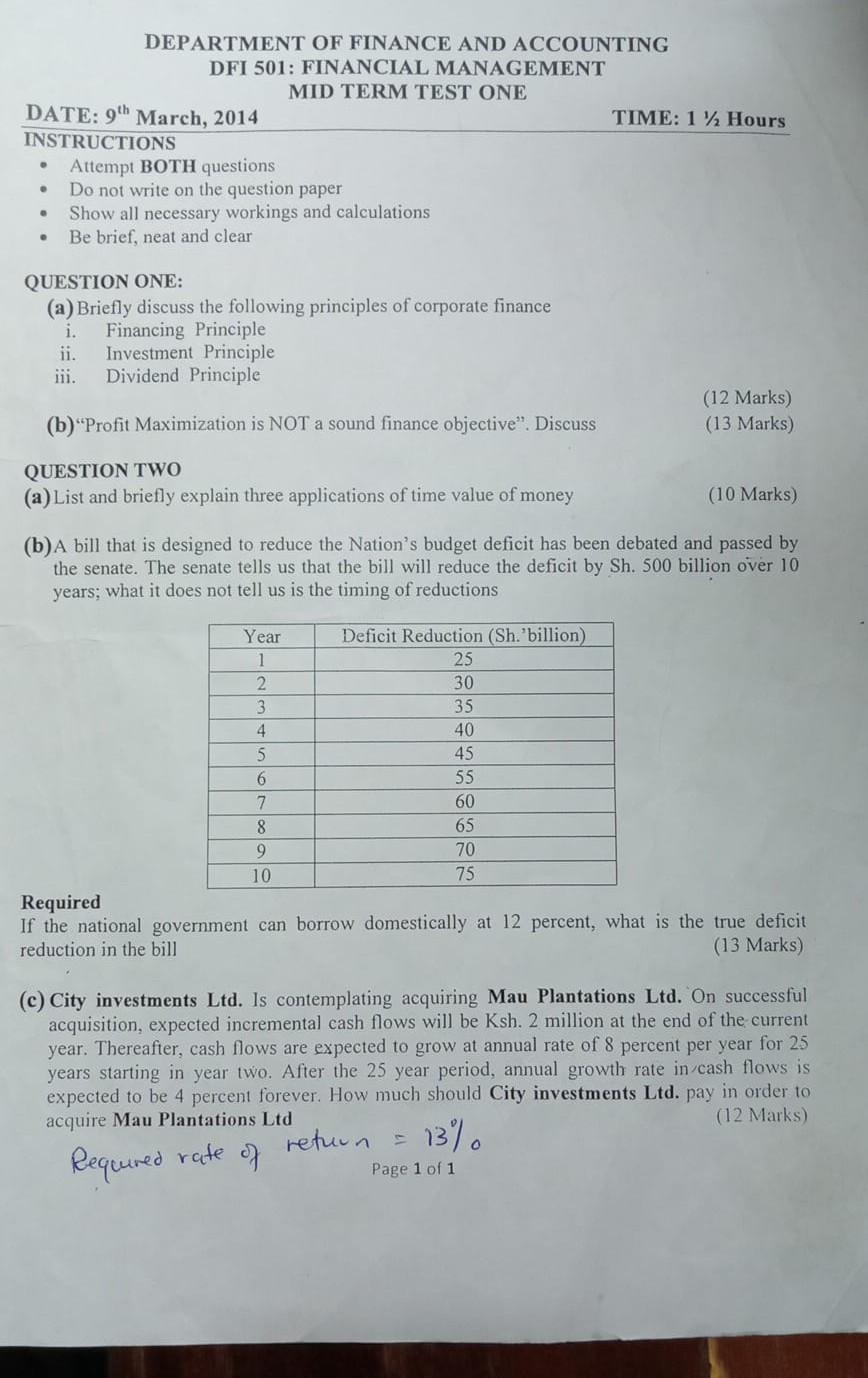

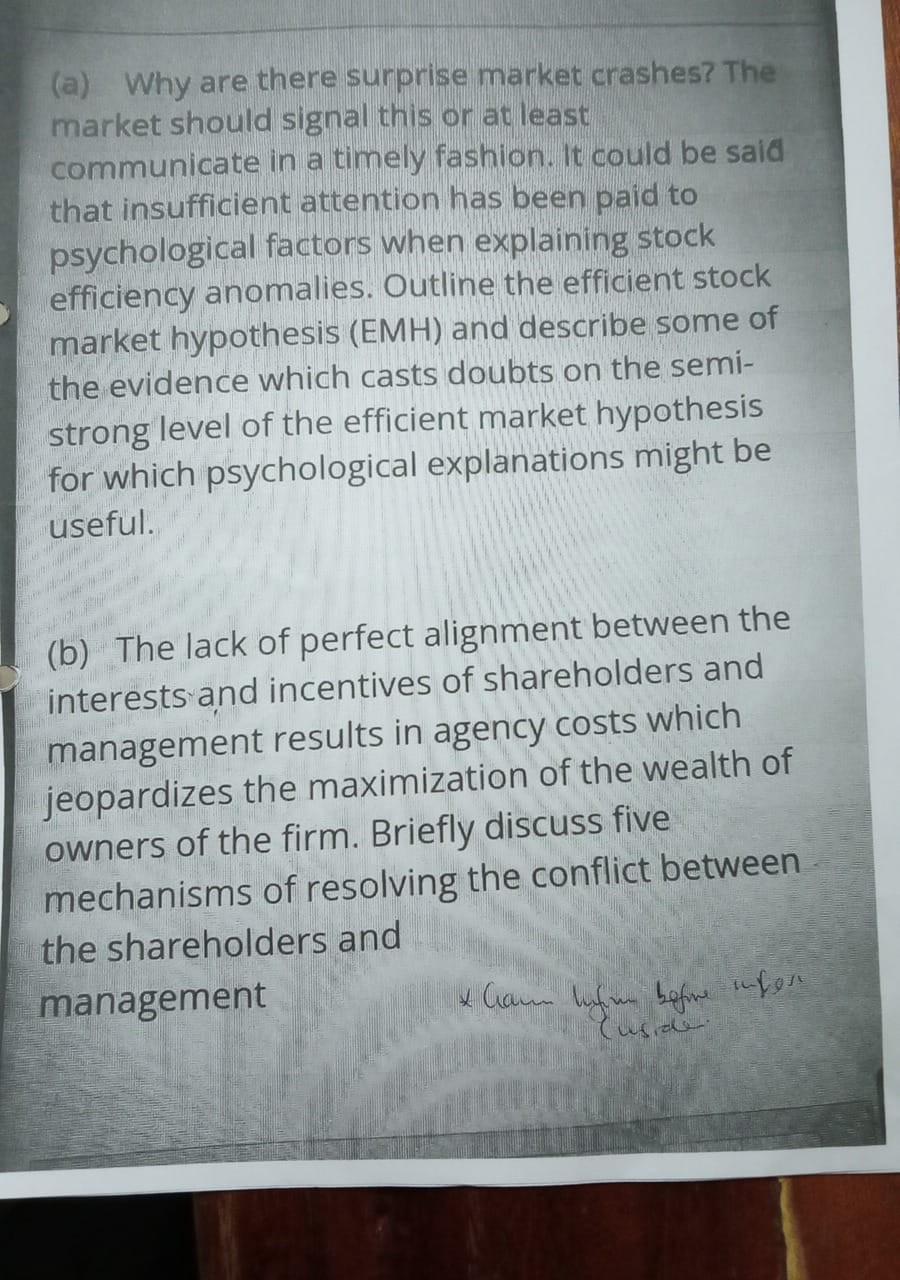

Flamingo is a poultry firm located in Kitengela, Kajlado county. The firm is expected to maintain a constant dividend payout ratio of 60 percent and a constant annual growth rate in earnings of 5 percent for the foreseeable future. In a recent financial year, the company recorded a net income attributable to ordinary shareholders of Sh. 25 million and the company has 1 million shares issued and outstanding. Ordinary shareholders require a minimum return of 10 percent Required: (i) Using appropriate dividend valuation Model, determine the value per value and the total value of equity (ii) Assume that flamingo just acquired another company in the same business and as result; its earnings will grow rapidly over the next four years at an annual rate of 10 percent before assuming a constant annual growth rate. Determine the value per value and the total value of equity DATE: \\( 9^{\\text {th }} \\) March, 2014 TIME: \\( 1 \\frac{1}{2} \\) Hours INSTRUCTIONS - Attempt BOTH questions - Do not write on the question paper - Show all necessary workings and calculations - Be brief, neat and clear QUESTION ONE: (a) Briefly discuss the following principles of corporate finance i. Financing Principle ii. Investment Principle iii. Dividend Principle (b) \"Profit Maximization is NOT a sound finance objective\". Discuss (12 Marks) (13 Marks) QUESTION TWO (a) List and briefly explain three applications of time value of money (10 Marks) (b) A bill that is designed to reduce the Nation's budget deficit has been debated and passed by the senate. The senate tells us that the bill will reduce the deficit by Sh. 500 billion over 10 years; what it does not tell us is the timing of reductions Required If the national government can borrow domestically at 12 percent, what is the true deficit reduction in the bill (13 Marks) (c) City investments Ltd. Is contemplating acquiring Mau Plantations Ltd. On successful acquisition, expected incremental cash flows will be Ksh. 2 million at the end of the current year. Thereafter, cash flows are expected to grow at annual rate of 8 percent per year for 25 years starting in year two. After the 25 year period, annual growth rate in cash flows is expected to be 4 percent forever. How much should City investments Ltd. pay in order to acquire Mau Plantations Ltd (12 Marks) Required rate of retuun \=13 (a) Why are there surprise market crashes? The market should signal this or at least communicate in a timely fashion. It could be said that insufficient attention has been paid to psychological factors when explaining stock efficiency anomalies. Outline the efficient stock market hypothesis (EMH) and describe some of the evidence which casts doubts on the semistrong level of the efficient market hypothesis for which psychological explanations might be useful. (b) The lack of perfect alignment between the interests and incentives of shareholders and management results in agency costs which jeopardizes the maximization of the wealth of owners of the firm. Briefly discuss five mechanisms of resolving the conflict between the shareholders and management

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started