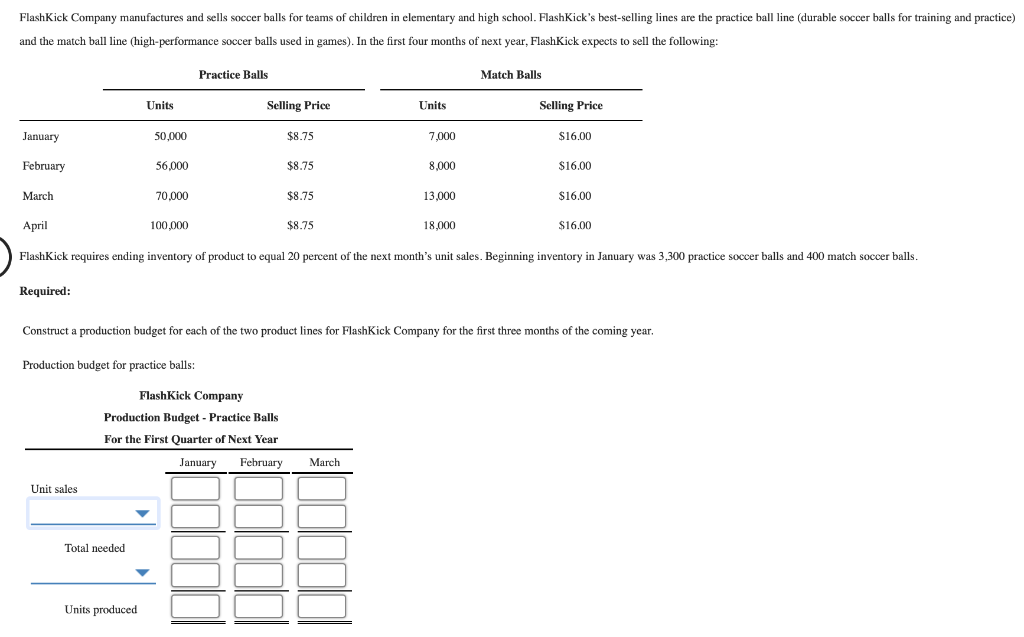

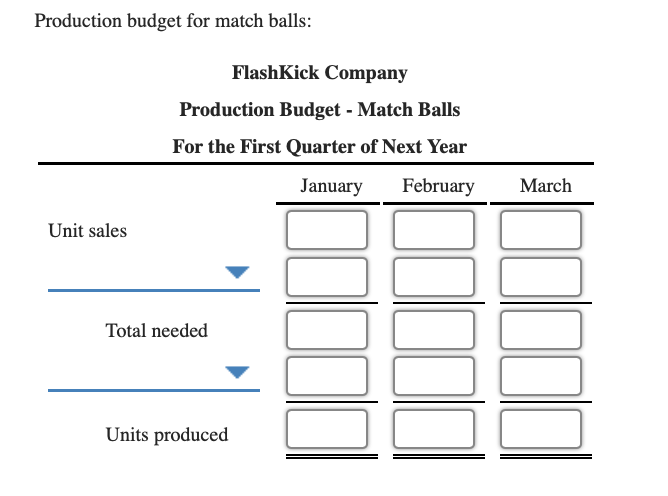

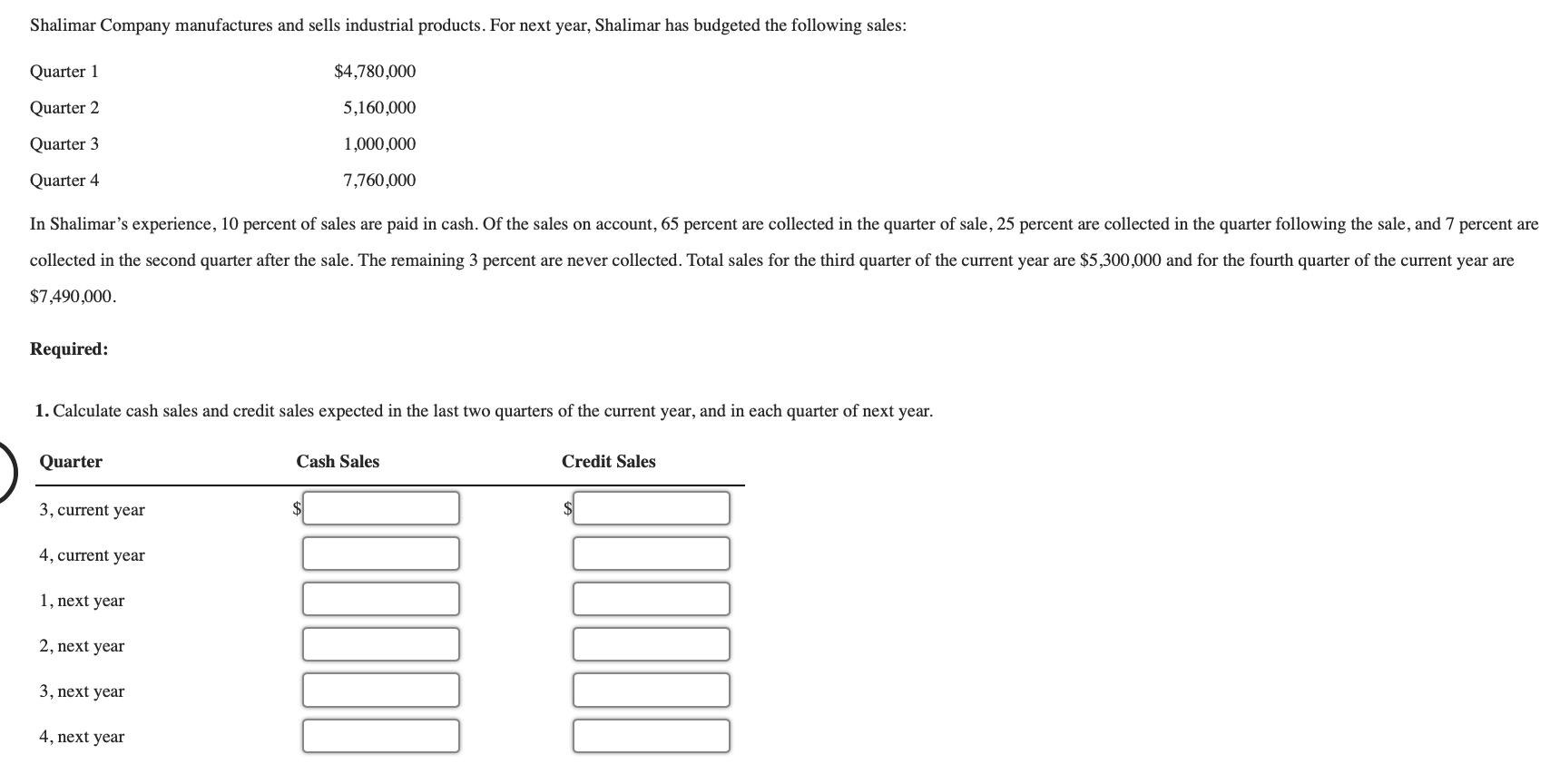

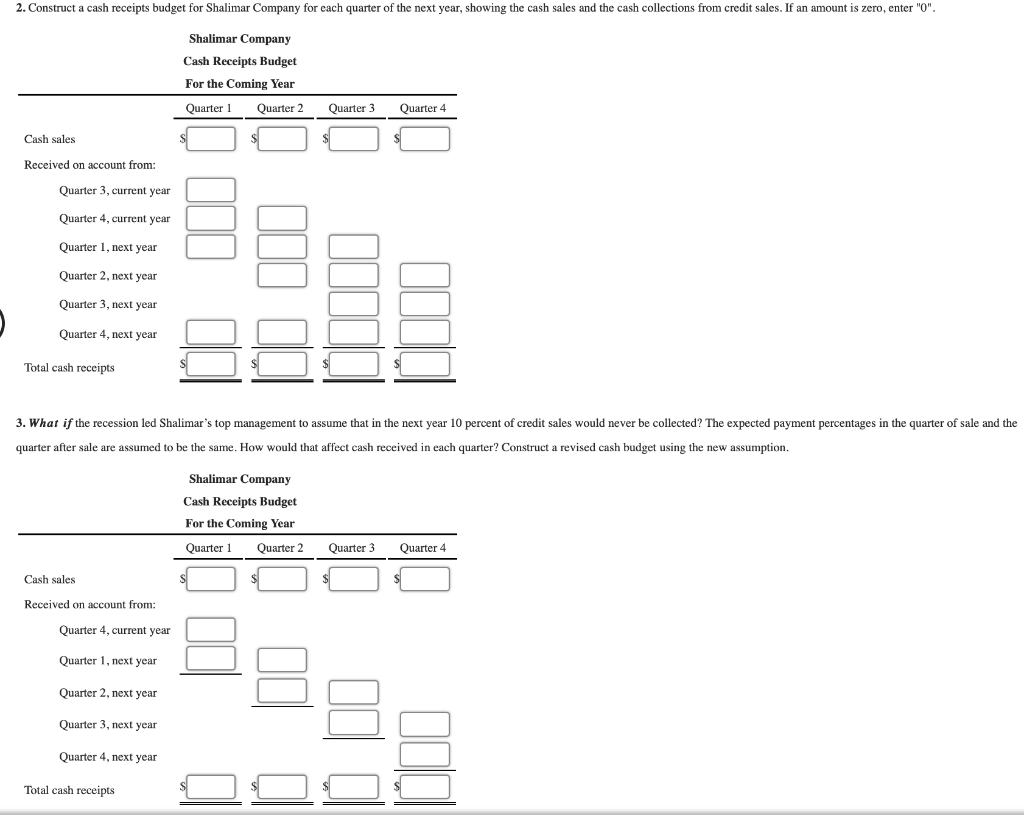

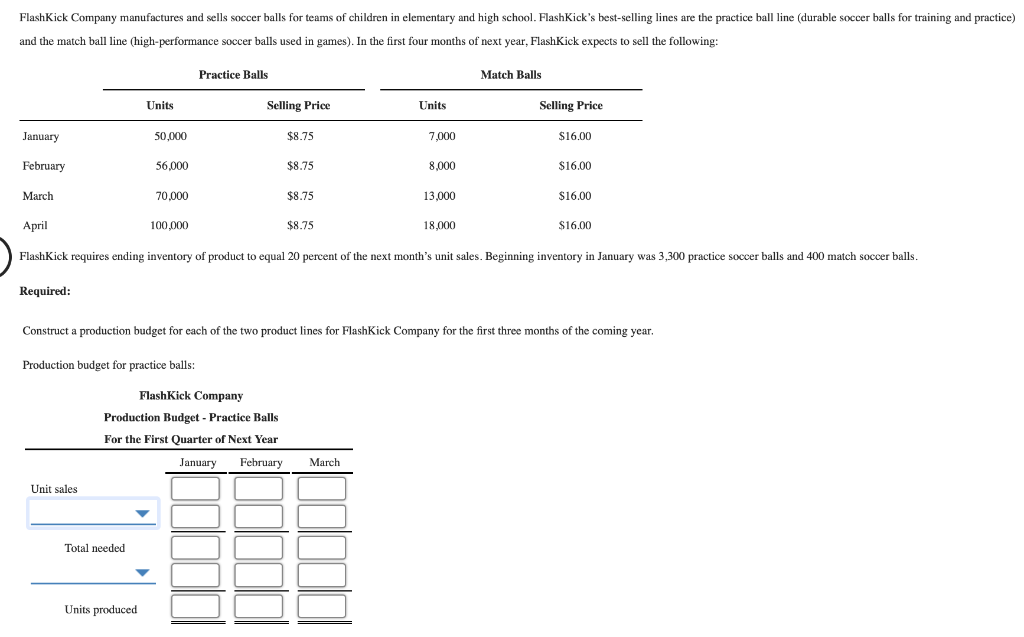

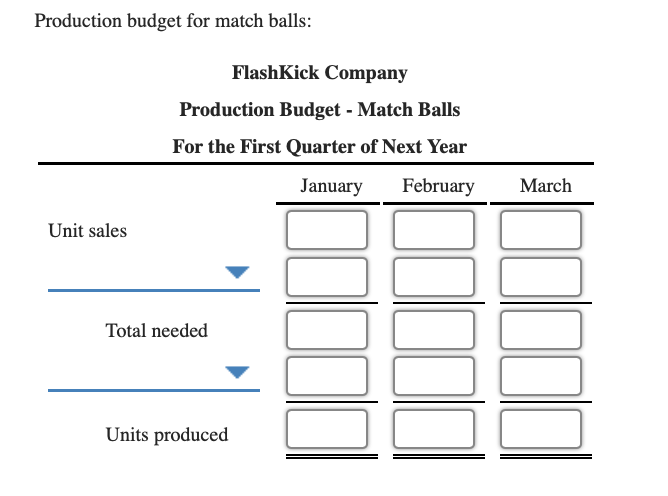

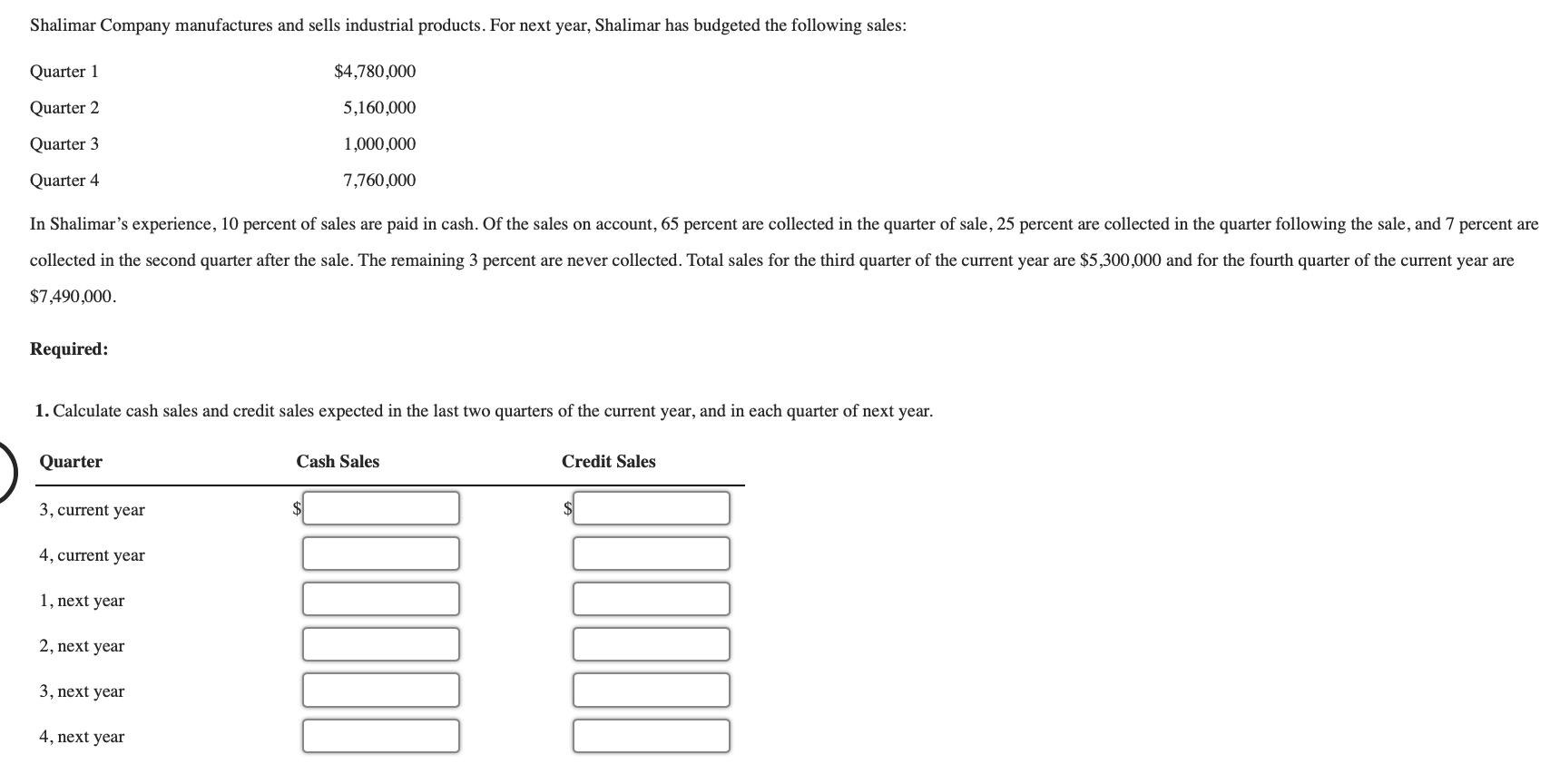

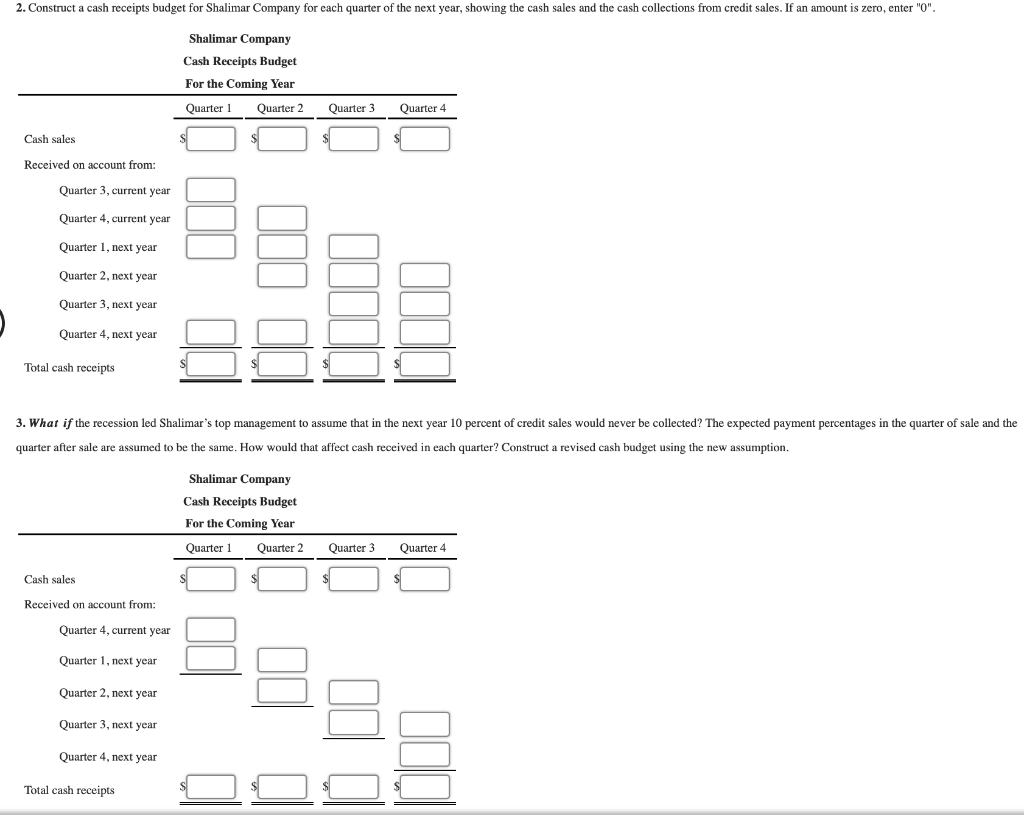

FlashKick Company manufactures and sells soccer balls for teams of children in elementary and high school. FlashKick's best-selling lines are the practice ball line (durable soccer balls for training and practice) and the match ball line (high-performance soccer balls used in games). In the first four months of next year, Flash Kick expects to sell the following: Practice Balls Match Balls Units Selling Price Units Selling Price January 50,000 $8.75 7,000 $16.00 February 56,000 $8.75 8,000 $16.00 March 70.000 $8.75 13,000 $16.00 April 100,000 $8.75 18,000 $16.00 FlashKick requires ending inventory of product to equal 20 percent of the next month's unit sales. Beginning inventory in January was 3,300 practice soccer balls and 400 match soccer balls. Required: Construct a production budget for each of the two product lines for FlashKick Company for the first three months of the coming year. Production budget for practice balls: Flash Kick Company Production Budget - Practice Balls For the First Quarter of Next Year January February March Unit sales Total needed Units produced Production budget for match balls: FlashKick Company Production Budget - Match Balls For the First Quarter of Next Year January February March Unit sales 10 Total needed 11 Units produced Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 $4,780,000 Quarter 2 5,160,000 Quarter 3 1,000,000 Quarter 4 7,760,000 In Shalimar's experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are $5,300,000 and for the fourth quarter of the current year are $7,490,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. Quarter Cash Sales Credit Sales 3, current year $ $ 4, current year 1, next year 2, next year TUTT III 3, next year 4, next year 2. Construct a cash receipts budget for Shalimar Company for each quarter of the next year, showing the cash sales and the cash collections from credit sales. If an amount is zero, enter "0". Shalimar Company Cash Receipts Budget For the Coming Year Quarter 1 Quarter 2 Quarter 3 Quarter 4 Cash sales Received on account from: Quarter current year Quarter current year Quarter 1, next year Quarter 2, next year Quarter 3, next year Quarter 4, next year Total cash receipts 3. What if the recession led Shalimar's top management to assume that in the next year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter? Construct a revised cash budget using the new assumption. Shalimar Company Cash Receipts Budget For the Coming Year Quarter 1 Quarter 2 Quarter 3 Quarter 4 Cash sales Received on account from: Quarter current year Quarter 1, next year Quarter 2, next year Quarter 3, next year Quarter 4, next year Total cash receipts