Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fleet Foot buys hiking socks for $6 a pair and sells them for $10. Management budgets monthly fixed expenses of $10,000 for sales volumes

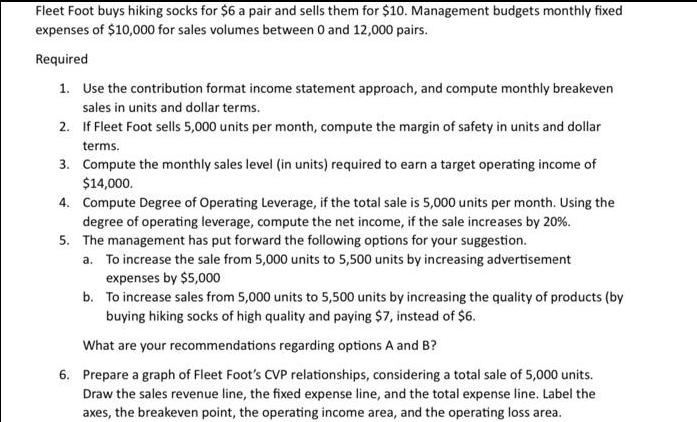

Fleet Foot buys hiking socks for $6 a pair and sells them for $10. Management budgets monthly fixed expenses of $10,000 for sales volumes between 0 and 12,000 pairs. Required 1. Use the contribution format income statement approach, and compute monthly breakeven sales in units and dollar terms. 2. If Fleet Foot sells 5,000 units per month, compute the margin of safety in units and dollar terms. 3. Compute the monthly sales level (in units) required to earn a target operating income of $14,000. 4. Compute Degree of Operating Leverage, if the total sale is 5,000 units per month. Using the degree of operating leverage, compute the net income, if the sale increases by 20%. 5. The management has put forward the following options for your suggestion. a. To increase the sale from 5,000 units to 5,500 units by increasing advertisement expenses by $5,000 b. To increase sales from 5,000 units to 5,500 units by increasing the quality of products (by buying hiking socks of high quality and paying $7, instead of $6. What are your recommendations regarding options A and B? 6. Prepare a graph of Fleet Foot's CVP relationships, considering a total sale of 5,000 units. Draw the sales revenue line, the fixed expense line, and the total expense line. Label the axes, the breakeven point, the operating income area, and the operating loss area.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the monthly breakeven sales in units and dollar terms we need to consider the fixed expenses and the contribution margin per unit Fixed Expenses 10000 Selling Price per Unit 10 Variable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started