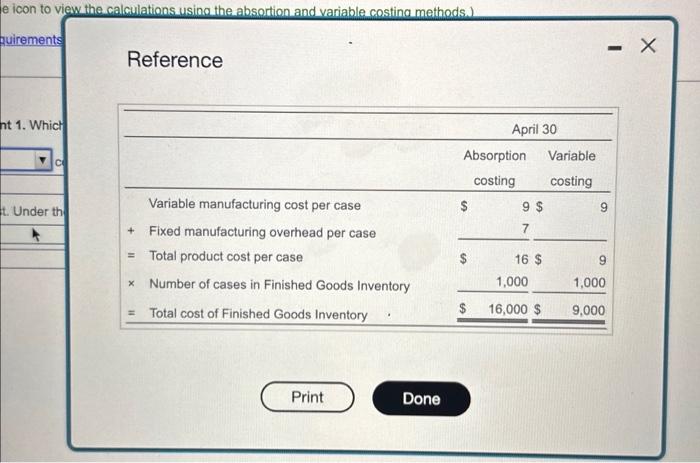

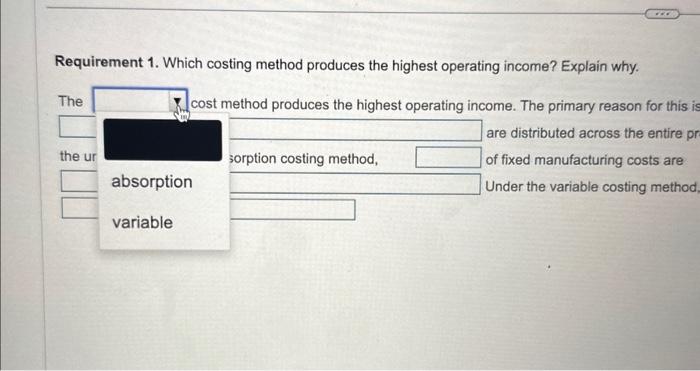

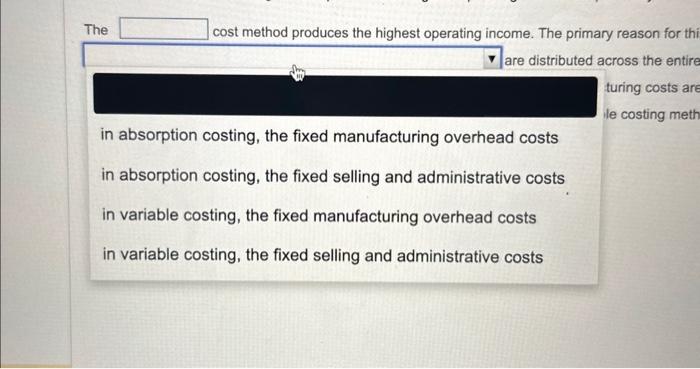

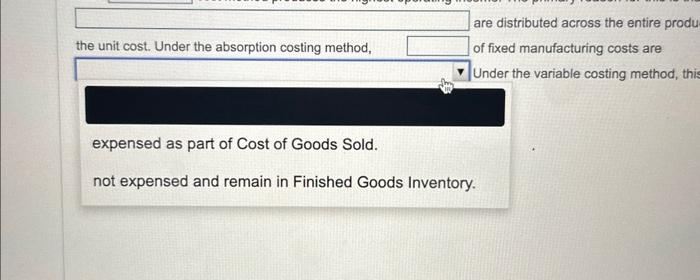

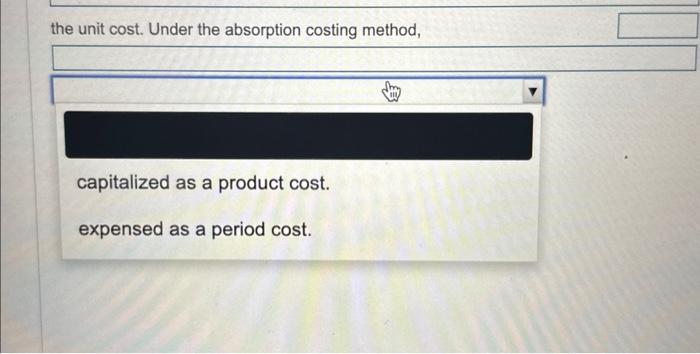

FleValAde produced 13,000 cases of poedered drink mox and sold 12,000 cases in Apri. The sules price was $29, variabie costs were $12 per case i\$9 manulachuring and 53 seling and administratwe), and total foed costs were $100,000 (\$91,000 manufacturing overhead and $9,000 seling and adminisvatve). The company tad no begirning Finished Goods ivventary. preseried below. (Click the icon to vew the ealculakions using the abportion shd varable costing reethods.) Read the reaurvoents: Requirement 1. Which cesting method produces the highest opersing income? Explain why The covi method produces the highest coserating income. The promary reason for the is that Jare datrbuted across the entre preducten nen as part of of fieed mandacturing costs are Under the variable costna metrod, nis atount is Requirements 1. Which costing method produces the highest operating income? Explain why. 2. Which costing method produces the highest April 30 balance in Finished Goods Inventory? Explain why. Reference equirement 1. Which costing method produces the highest operating income? Explain why. cost method produces the highest operating income. The primary reason for this are distributed across the entire sorption costing method, of fixed manufacturing costs are absorption Under the variable costing meth variable The cost method produces the highest operating income. The primary reason for thi are distributed across the entire turing costs are le costing meth in absorption costing, the fixed manufacturing overhead costs in absorption costing, the fixed selling and administrative costs in variable costing, the fixed manufacturing overhead costs in variable costing, the fixed selling and administrative costs are distributed across the entire produ the unit cost. Under the absorption costing method, of fixed manufacturing costs are der the variable costing method, this the unit cost. Under the absorption costing method, FleValAde produced 13,000 cases of poedered drink mox and sold 12,000 cases in Apri. The sules price was $29, variabie costs were $12 per case i\$9 manulachuring and 53 seling and administratwe), and total foed costs were $100,000 (\$91,000 manufacturing overhead and $9,000 seling and adminisvatve). The company tad no begirning Finished Goods ivventary. preseried below. (Click the icon to vew the ealculakions using the abportion shd varable costing reethods.) Read the reaurvoents: Requirement 1. Which cesting method produces the highest opersing income? Explain why The covi method produces the highest coserating income. The promary reason for the is that Jare datrbuted across the entre preducten nen as part of of fieed mandacturing costs are Under the variable costna metrod, nis atount is Requirements 1. Which costing method produces the highest operating income? Explain why. 2. Which costing method produces the highest April 30 balance in Finished Goods Inventory? Explain why. Reference equirement 1. Which costing method produces the highest operating income? Explain why. cost method produces the highest operating income. The primary reason for this are distributed across the entire sorption costing method, of fixed manufacturing costs are absorption Under the variable costing meth variable The cost method produces the highest operating income. The primary reason for thi are distributed across the entire turing costs are le costing meth in absorption costing, the fixed manufacturing overhead costs in absorption costing, the fixed selling and administrative costs in variable costing, the fixed manufacturing overhead costs in variable costing, the fixed selling and administrative costs are distributed across the entire produ the unit cost. Under the absorption costing method, of fixed manufacturing costs are der the variable costing method, this the unit cost. Under the absorption costing method