Question

Flexibility and Coordination When Reactive Capacity is available, this means that we have a second order opportunity once the season has begun. This second order

Flexibility and Coordination

When Reactive Capacity is available, this means that we have a second order opportunity once the season has begun. This second order comes with a premium: we must pay more (c2) than we pay for an order before the season begins (c1). However, this gives us the chance to order more during the season if sales are better than expected, without taking the inventory risk before the season starts.

1. When a reordering opportunity is available during a single selling season but at a higher cost (a

premium) than for the pre-season order, this is an example of Reactive Capacity. How do the optimal (profit-maximizing) first order quantities differ with and without Reactive Capacity, where only one, pre-season order can take place?

Hint: if you have a chance to buy during the season (= Reactive Capacity) do you think you need to buy more or less than if you dont have that opportunity?

- The optimal (first) order quantity without Reactive Capacity is smaller than the optimal (first) order quantity with Reactive Capacity.

- The optimal (first) order quantity without Reactive Capacity is larger than the optimal (first) order quantity with Reactive Capacity.

- The optimal (first) order quantities are the same.

2. For our online store for gadgets, we know that one new products demand is normally distributed with an expected mean demand for the season of 300 and a standard deviation of 300. The product sells for $100, the cost of the product is $50, and the salvage is $20.

We have now, however, a second supplier, which is more expensive, but which is very close and can provide a second order with a short lead time after the beginning of the season (Reactive Capacity). The cost of the product for this supplier is $60 (c2).

2a. What is the cost of underage and the cost of overage for the gadget store with this second supplier?

Cu = c2 c1 (this is the premium the online store pays for the second order vs. the first order)

Co = c1 v (no change)

Select one:

- Cu = $50, Co = $30

- Cu = $10, Co = $20

- Cu = $10, Co = $30

2b. What is now the optimal order quantity for the gadget store with the second supplier?

Hint: Critical Ratio = Cu/(Cu + Co). In this case the critical ratio = 0.2500.

Then look up the corresponding z value and convert to Q *= + z

Select one:

a) 99

b) 150

c) 396

d)410

Supply Chain Coordination: Contracts

Suboptimal supply chain performance occurs because

- Each firm makes decisions based on their own margin, not the supply chains margin.

- This is called double marginalization.

A typical example of double marginalization is when, within one conglomerate of many companies where each company is a profit center, maximizing the profit of one company can hurt the profit of another. Say, for example, that one company within the conglomerate sells screens to the company which makes VR headsets. If the price for the screens is set too high (to maximize the profit center for the screen company), then the VR headset company could face price competition and see its profits fall.

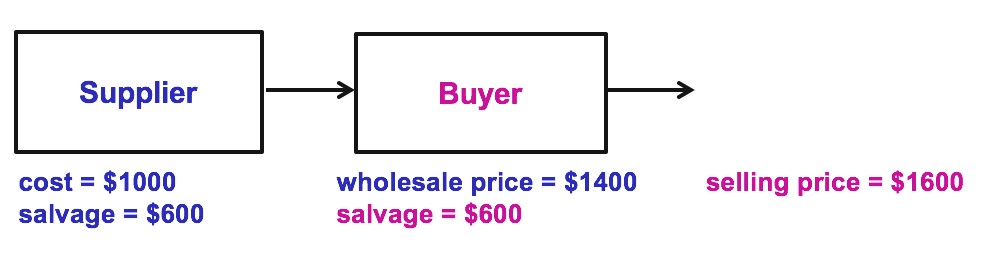

3. Given the following supply chain made up of a manufacturer and a supplier:

Demand is normally distributed with mean = 500 and standard deviation = 100.

3a. What is the optimal order quantity for the supplier in this supply chain?

Hint: for the supplier

Cu = w - c = 1400 1000 = 400

Co = c - v = 1000 600 = 400

Select one:

- 400

- 500

- 530

- 590

3b. What is the optimal order quantity for the buyer in this supply chain?

Hint: for the buyer

Cu = p - w = 1600 1400 = 200

Co = w - v = 1400 - 600 = 800

Select one:

- 400

- 416

- 584

- 600

The optimal order quantity for the entire supply chain can be calculated as:

Cu = p - c = 1600 1000 = 600

Co = c - v = 1000 600 = 400 Critical Ratio = 0.6000 z (round up rule) = 0.26 Q* = 500 +0.26*100 = 526

Here we see that considering the supply chain as a whole, instead of two separate entities, results in a higher critical ratio and a higher optimal order quantity. This is the best we can do!

3c. Which statement is correct?

Select one:

- The supplier would like the buyer to order less.

- The supplier would like the buyer to order more.

- The situation is optimized.

3d. How can this situation be optimized?

Select one:

- The buyer offers the supplier a buy-back price b, offering to buy-back any unsold goods for this buyback price.

- The supplier offers the buyer a buy-back price b, offering to buy-back any unsold goods for this buyback price.

3e. What is the optimal buy back price for this supply chain given (assume shipping costs are zero) rounded to the nearest dollar?

b = Shipping costs + Price

(Price Wholesale Price) (Price SalvageValue@retailer)/(Price Cost)

Select one:

- 1200

- 1267

- 1430

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started