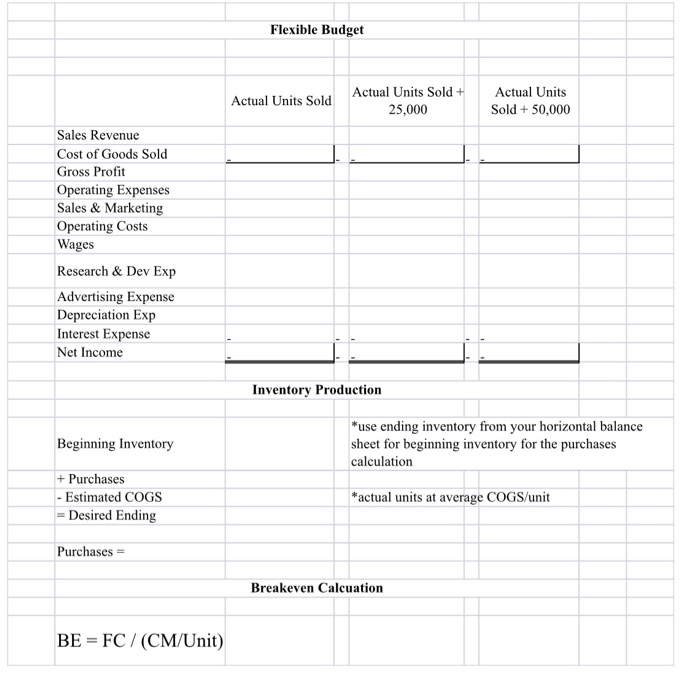

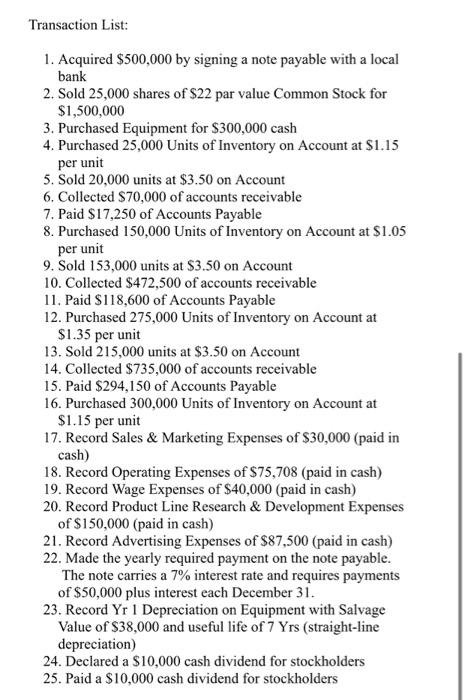

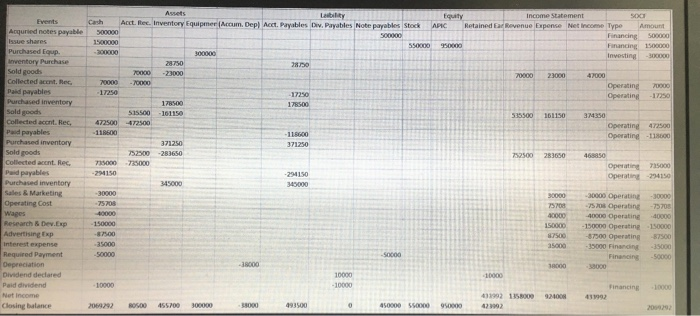

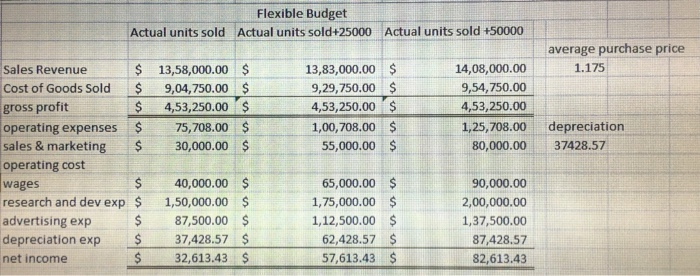

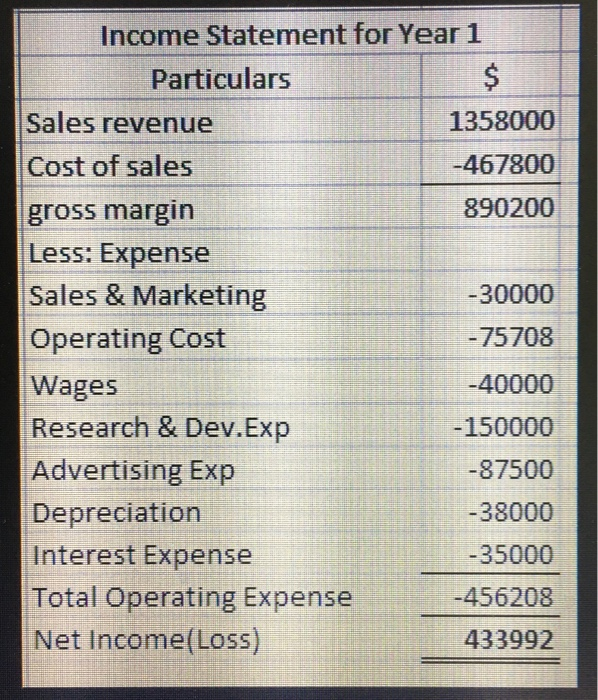

Flexible Budget Actual Units Sold Actual Units Sold + 25,000 Actual Units Sold + 50,000 Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Sales & Marketing Operating Costs Wages Research & Dev Exp Advertising Expense Depreciation Exp Interest Expense Net Income Inventory Production Beginning Inventory *use ending inventory from your horizontal balance sheet for beginning inventory for the purchases calculation + Purchases - Estimated COGS - Desired Ending *actual units at average COGS/unit Purchases = Breakeven Calcuation BE = FC/(CM/Unit) Transaction List: 1. Acquired $500,000 by signing a note payable with a local bank 2. Sold 25,000 shares of $22 par value Common Stock for $1,500,000 3. Purchased Equipment for $300,000 cash 4. Purchased 25,000 Units of Inventory on Account at $1.15 per unit 5. Sold 20,000 units at $3.50 on Account 6. Collected $70,000 of accounts receivable 7. Paid $17,250 of Accounts Payable 8. Purchased 150,000 Units of Inventory on Account at $1.05 per unit 9. Sold 153,000 units at $3.50 on Account 10. Collected $472,500 of accounts receivable 11. Paid $118,600 of Accounts Payable 12. Purchased 275,000 Units of Inventory on Account at $1.35 per unit 13. Sold 215,000 units at $3.50 on Account 14. Collected $735,000 of accounts receivable 15. Paid $294,150 of Accounts Payable 16. Purchased 300,000 Units of Inventory on Account at $1.15 per unit 17. Record Sales & Marketing Expenses of $30,000 (paid in cash) 18. Record Operating Expenses of $75,708 (paid in cash) 19. Record Wage Expenses of $40,000 (paid in cash) 20. Record Product Line Research & Development Expenses of $150,000 (paid in cash) 21. Record Advertising Expenses of $87,500 (paid in cash) 22. Made the yearly required payment on the note payable. The note carries a 7% interest rate and requires payments of $50,000 plus interest each December 31. 23. Record Yr 1 Depreciation on Equipment with Salvage Value of $38,000 and useful life of 7 Yrs (straight-line depreciation) 24. Declared a $10,000 cash dividend for stockholders 25. Paid a $10,000 cash dividend for stockholders Acct. Hec. Inventory Equipmer Accum. Dep) AcctPayables Div. Payables Note payables Stock Income Statement Retained revenue 50000 Acquried notes payable issue shares Purchased Equp. Inventory Purchase Sold goods Collected act. Rec Pald payables Purchased inventory 28330 28750 -23000 10000 17250 -17250 Operating Operating 17250 515500 101150 535500 101150 472500 3 74350 Operating 472500 Operating -118000 371250 283650 371250 752500 75000 752500 283650 735000 -294150 468850 Operating 75000 Operating 294150 Collected acent. Rec, Paid payables Purchased inventory Sold goods Collected acent. Rec. Padpayables Purchased inventory Sales & Marketing Operating cost Wages Research & Dev.Exp Advertising Exp Interest expense Required Payment Depreciation Dividend declared Paid dividend Net Income Closing balance -30000 Operating 520 Operating -40000 Operating - 150000 Operating -87500 Operating - 35000 Financing 30000 -75703 40000 150000 57500 -35000 -50000 10000 2008 Financing 01992 2069202 BOSCO 46520 BODO DO 437) 15000 471992 491500 450000 5000 50000 200922 Flexible Budget Actual units sold Actual units sold+25000 Actual units sold +50000 average purchase price 1.175 13,58,000.00 $ 9,04,750.00 $ 4,53,250.00 $ 75,708.00 $ 30,000.00 $ 13,83,000.00 9,29,750.00 4,53,250.00 1,00,708.00 55,000.00 $ $ $ $ $ 14,08,000.00 9,54,750.00 4,53,250.00 1,25,708.00 80,000.00 depreciation 37428.57 Sales Revenue $ Cost of Goods Sold $ gross profit $ operating expenses $ sales & marketing $ operating cost wages research and dev exp $ advertising exp depreciation exp net income $ 40,000.00 1,50,000.00 87,500.00 $ 37,428.57 $ 32,613.43 $ 65,000.00 $ 1,75,000.00 $ 1,12,500.00 $ 62,428.57 $ 57,613.43 $ 90,000.00 2,00,000.00 1,37,500.00 87,428.57 82,613.43 alus Income Statement for Year 1 1358000 -467800 890200 -30000 -75708 Particulars Sales revenue Cost of sales gross margin Less: Expense Sales & Marketing Operating Cost Wages Research & Dev.Exp Advertising Exp Depreciation Interest Expense Total Operating Expense Net Income(Loss) -40000 - 150000 -87500 -38000 -35000 456208 433992