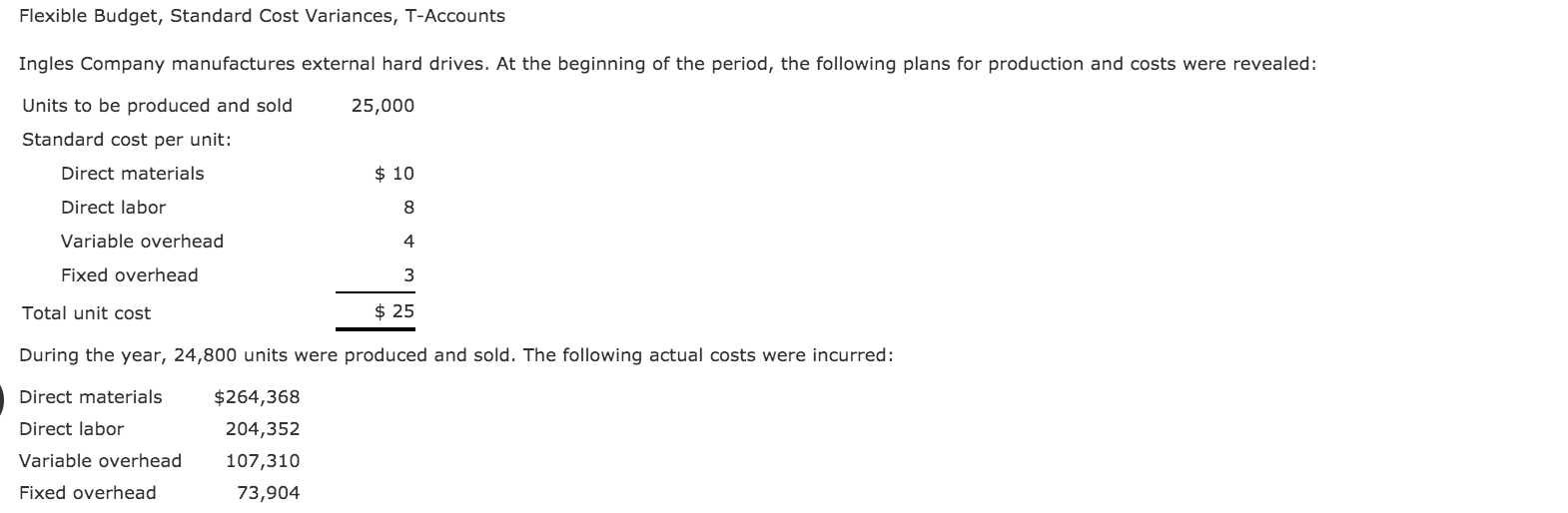

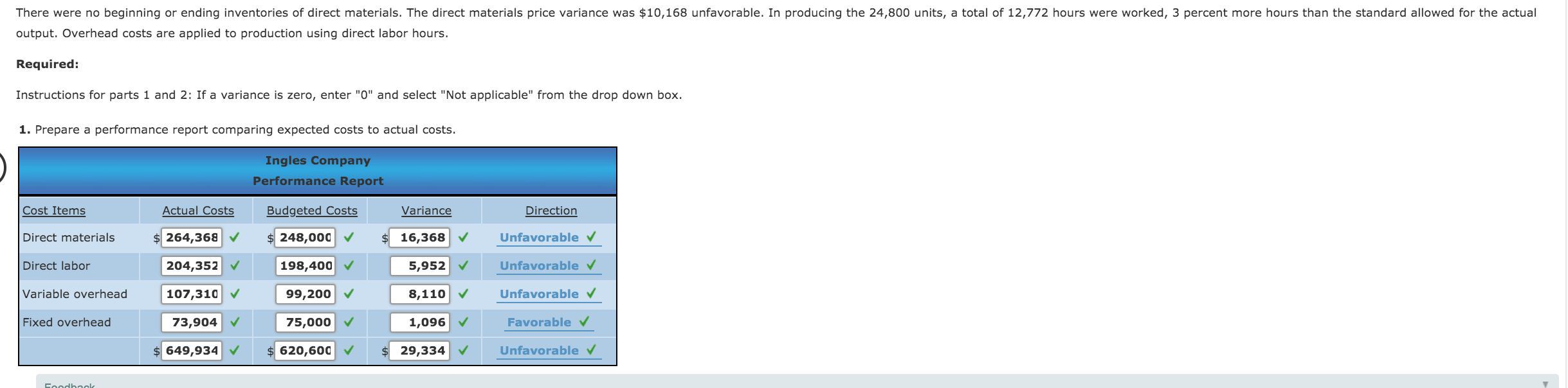

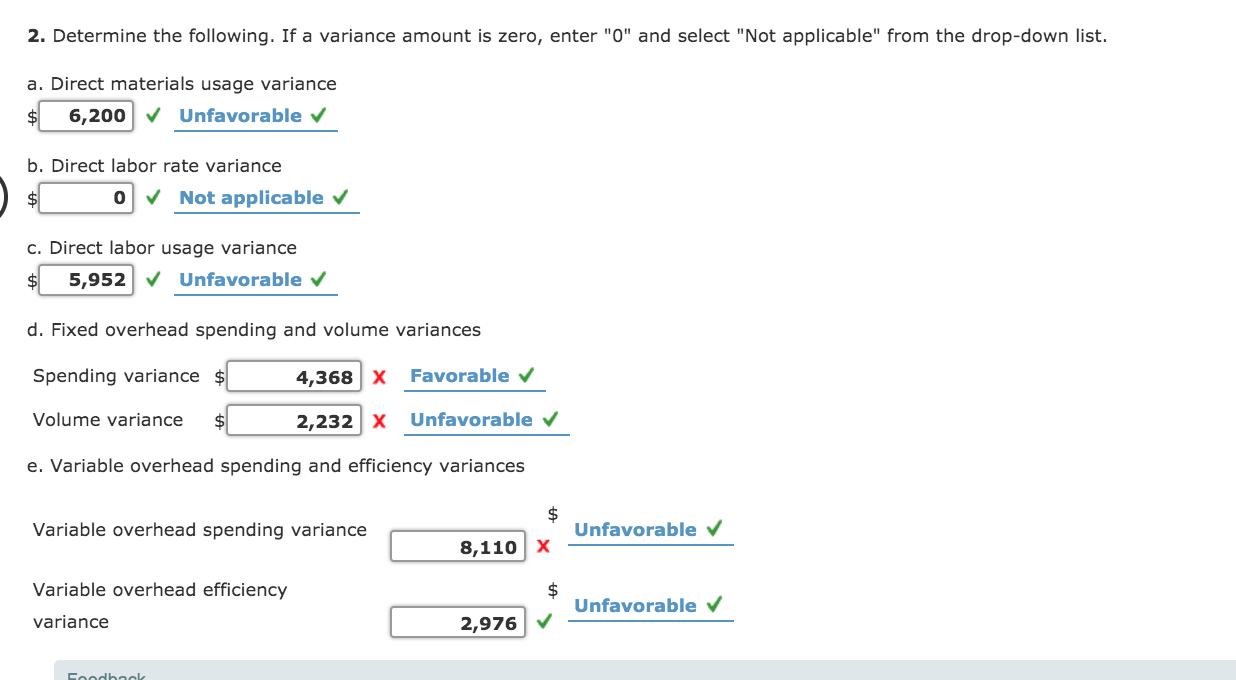

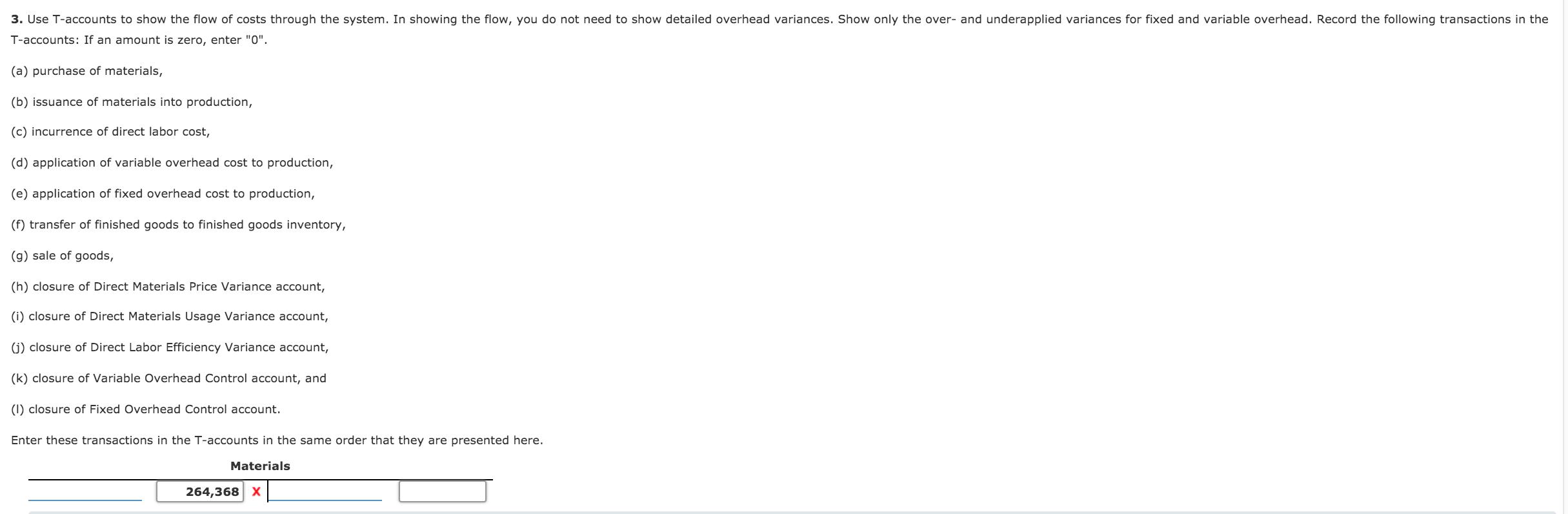

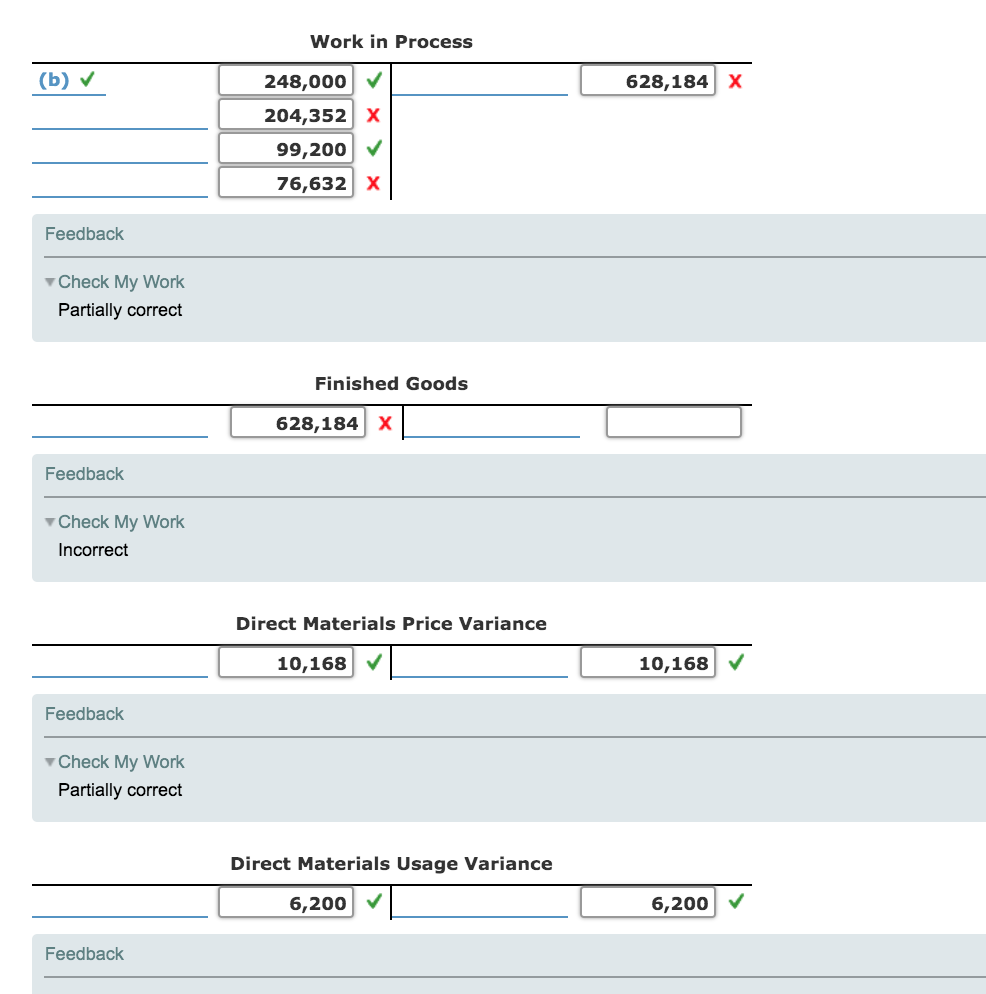

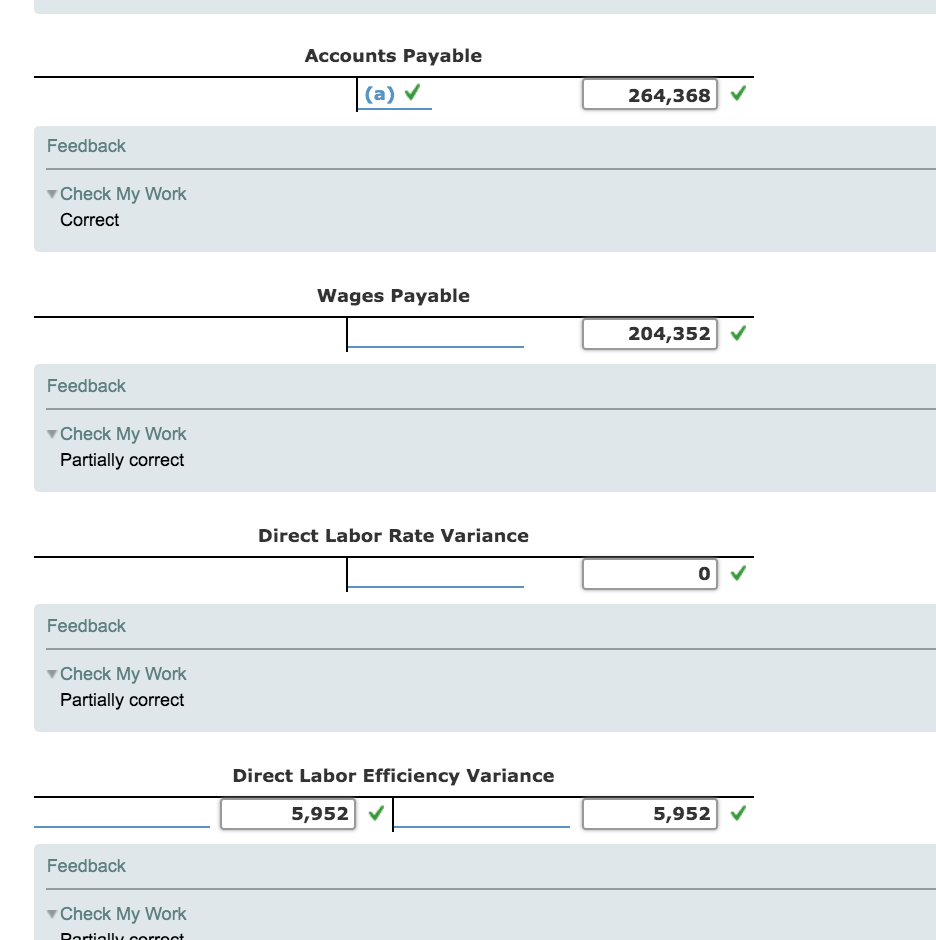

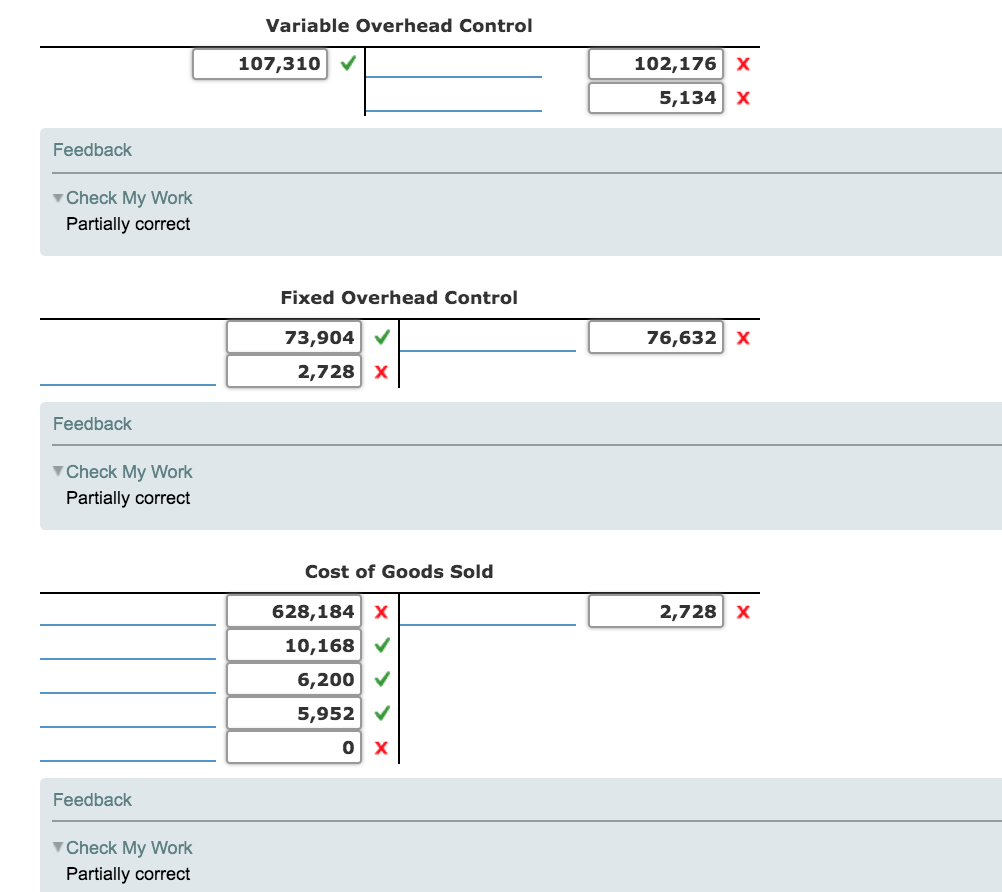

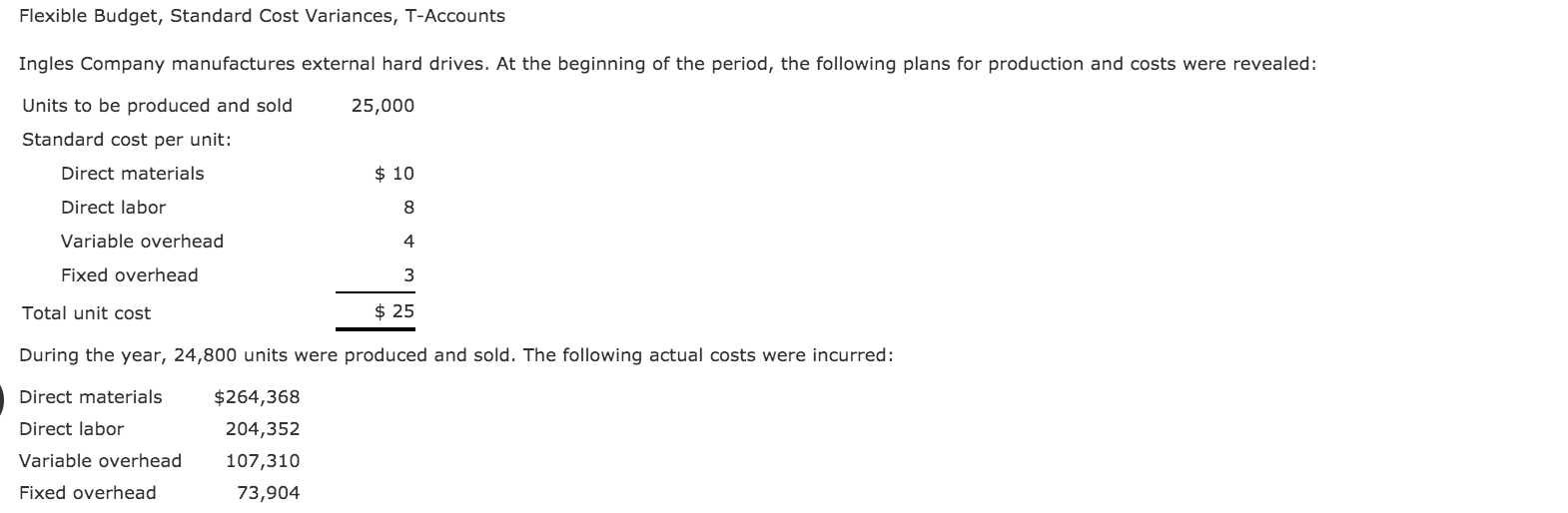

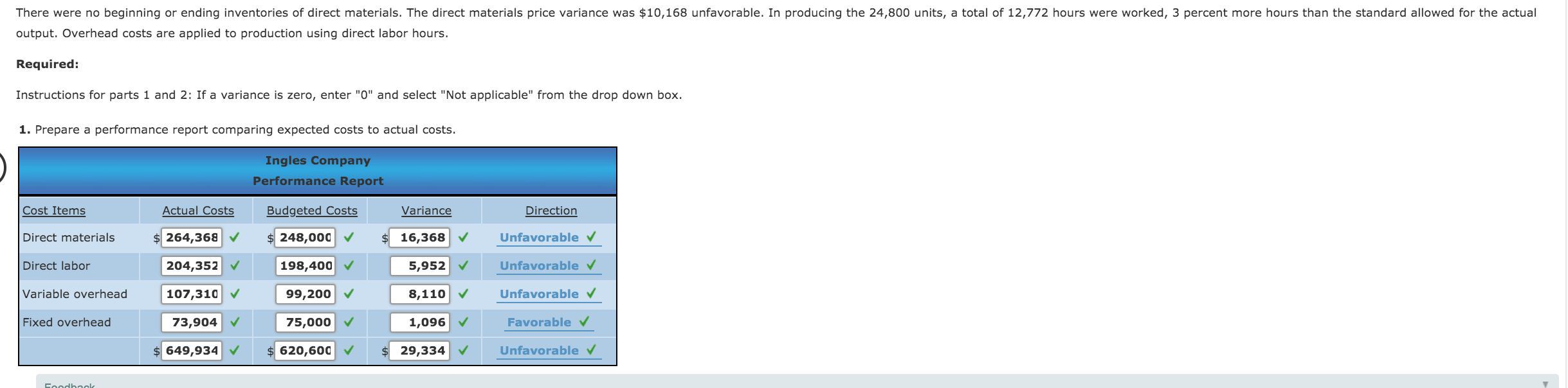

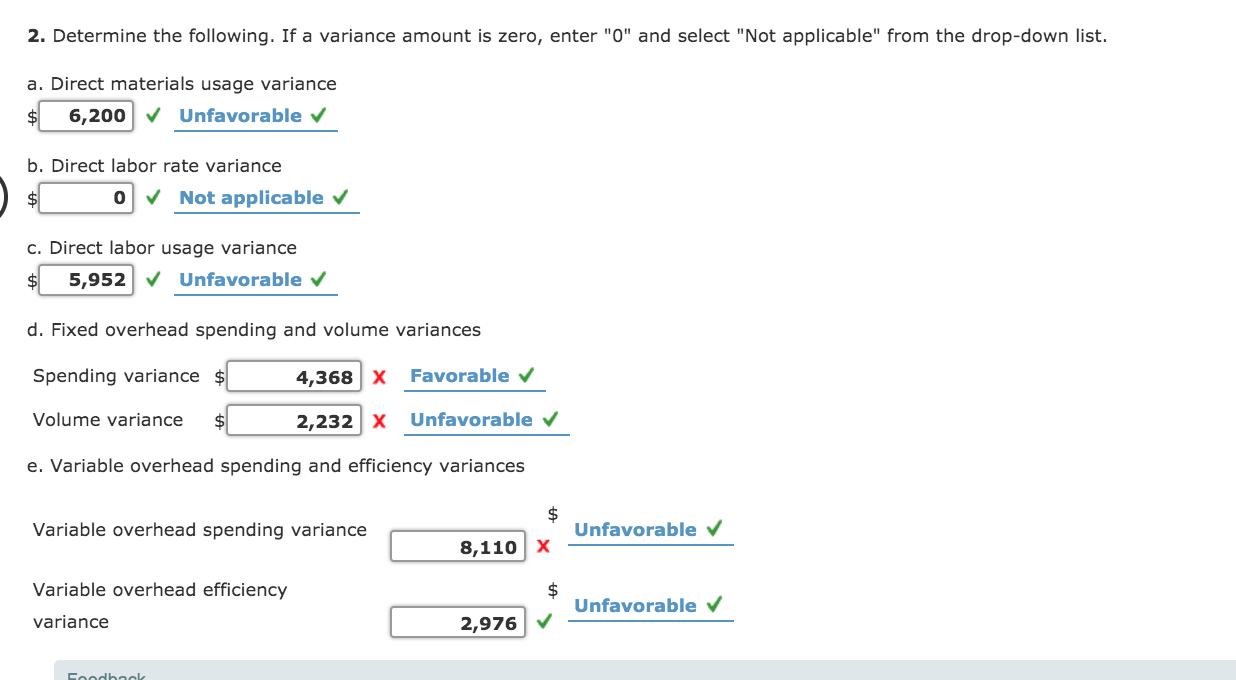

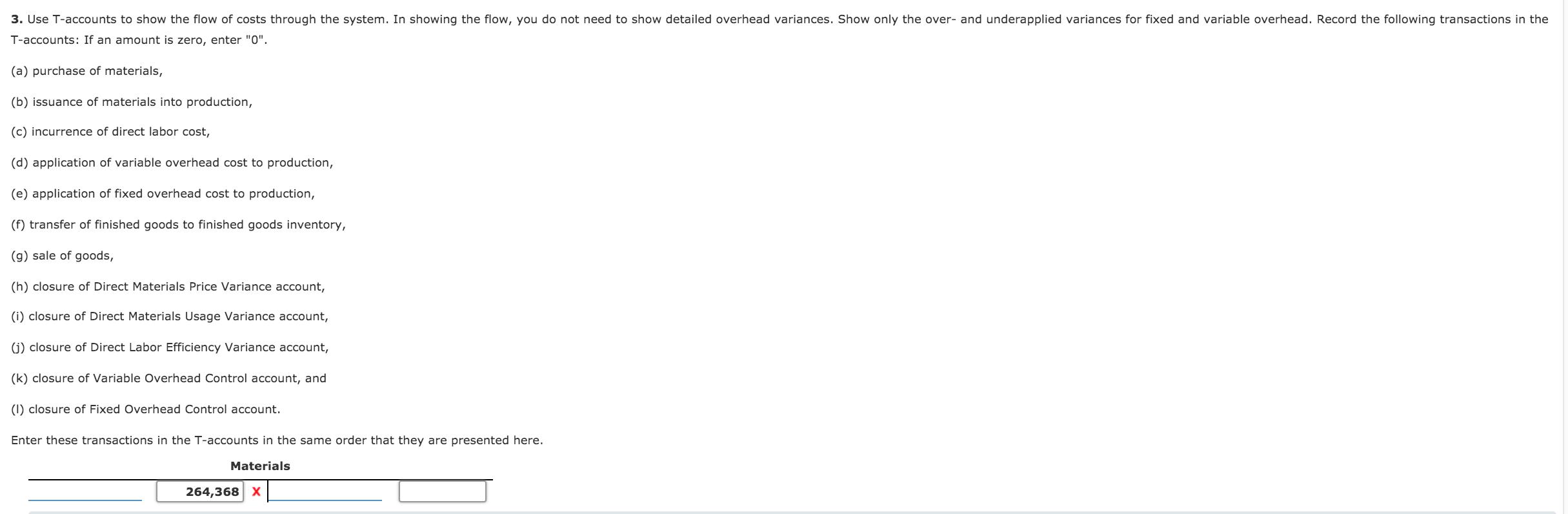

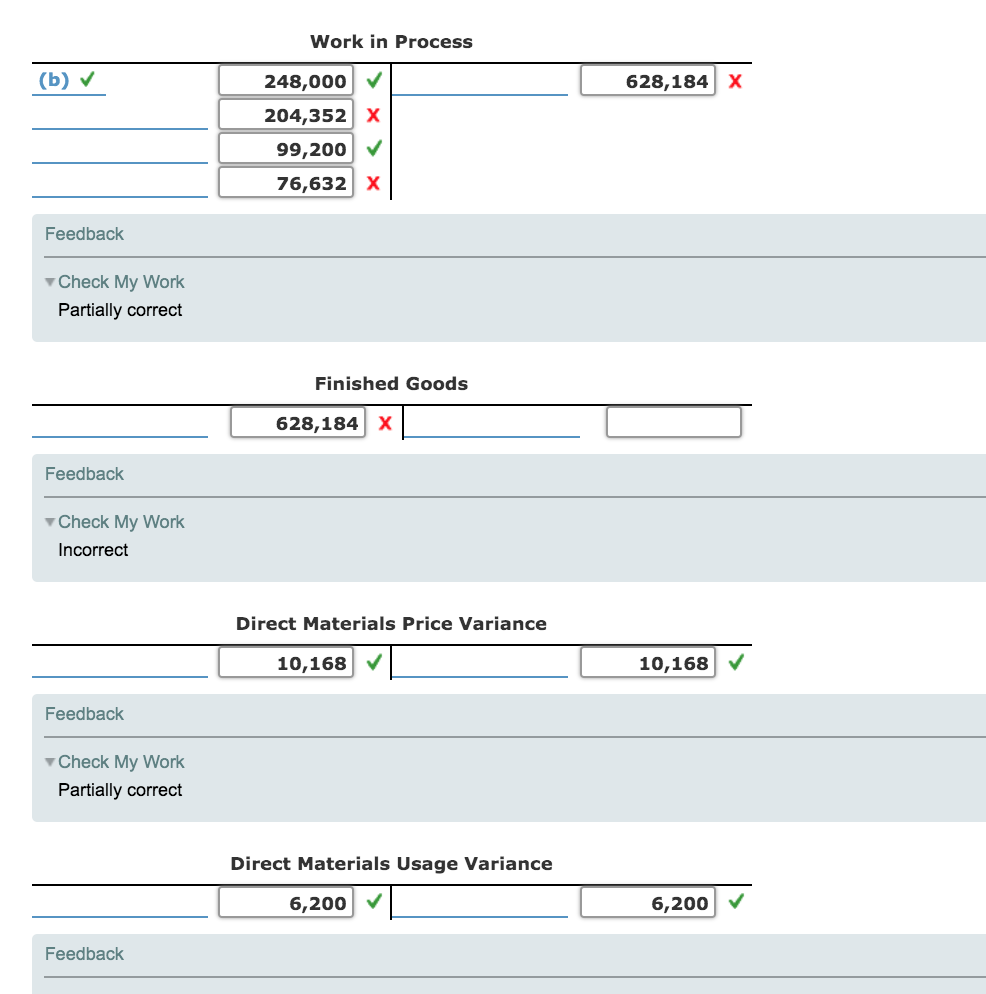

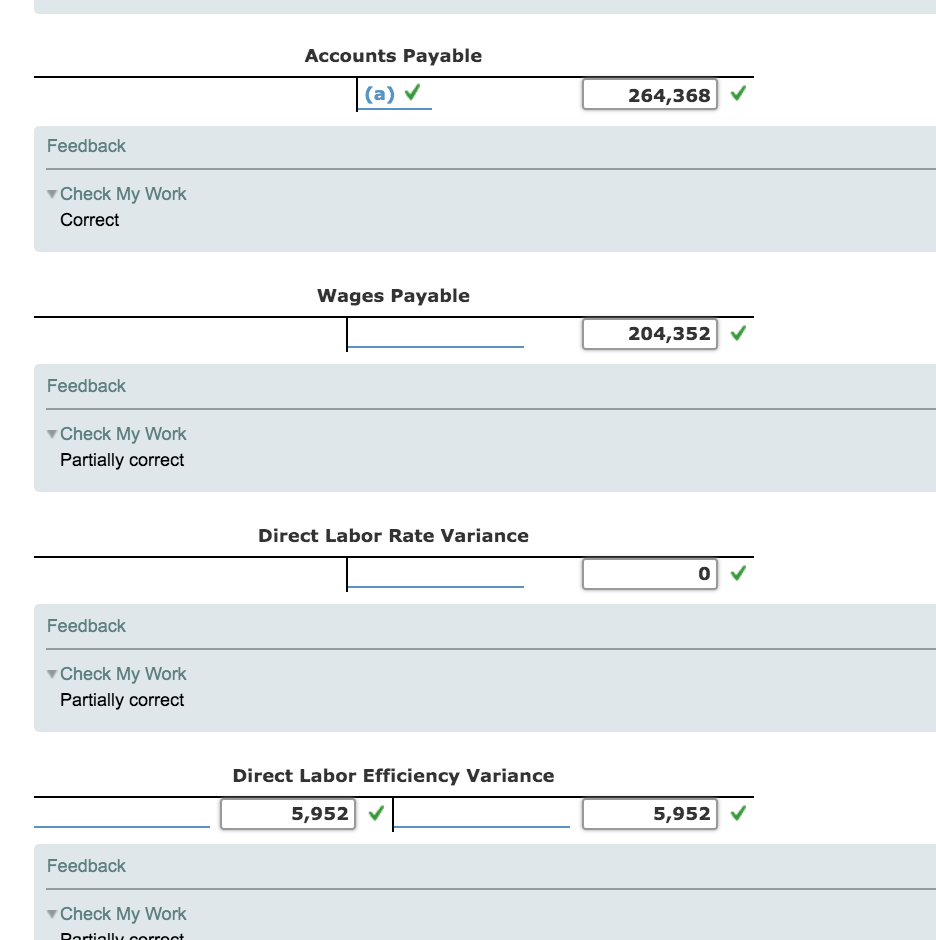

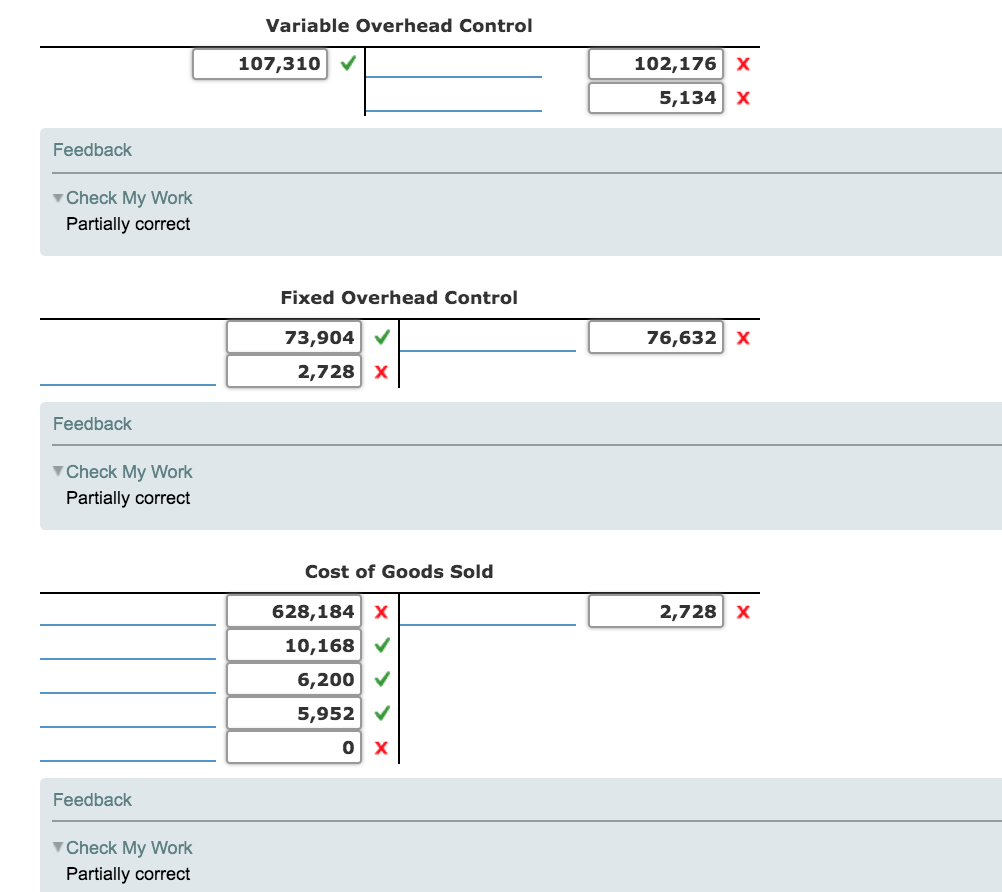

Flexible Budget, Standard Cost Variances, T-Accounts Ingles Company manufactures external hard drives. At the beginning of the period, the following plans for production and costs were revealed: Units to be produced and sold 25,000 Standard cost per unit: $10 Direct materials Direct labor 8 Variable overhead 4 Fixed overhead 3 $25 Total unit cost During the year, 24,800 units were produced and sold. The following actual costs were incurred: Direct materials $264,368 Direct labor 204,352 Variable overhead 107,310 Fixed overhead 73,904 2. Determine the following. If a variance amount is zero, enter "0" and select "Not applicable" from the drop-down list. a. Direct materials usage variance 6,200 Unfavorable b. Direct labor rate variance 0 Not applicable c. Direct labor usage variance 5,952 Unfavorable v d. Fixed overhead spending and volume variances Spending variance $ Favorable 4,368 X Volume variance Unfavorable $ 2,232 X e. Variable overhead spending and efficiency variances $ Unfavorable Variable overhead spending variance 8,110 X Variable overhead efficiency $ Unfavorable variance 2,976 Foodbaok 3. Use T-acCounts to show the flow of costs through the system. In showing the flow, you do not need to show detailed overhead variances. Show only the over- and underapplied variances for fixed and variable overhead. Record the following transactions in the T-accounts: If an amount is zero, enter "0". (a) purchase of materials, (b) issuance of materials into production, (c) incurrence of direct labor cost, (d) application of variable overhead cost to production, (e) application of fixed overhead cost to production, (f) transfer of finished goods to finished goods inventory, (g) sale of goods, (h) closure of Direct Materials Price Variance account, (i) closure of Direct Materials Usage Variance account, (i) closure of Direct Labor Efficiency Variance account, (k) closure of Variable Overhead Control account, and (I) closure of Fixed Overhead Control account. Enter these transactions in the T-accounts in the same order that they are presented here. Materials 264,368 X Work in Process (b) 628,184 X 248,000 204,352 X 99,200 76,632 X Feedback Check My Work Partially correct Finished Goods 628,184 X Feedback Check My Work Incorrect Direct Materials Price Variance 10,168 10,168 Feedback Check My Work Partially correct Direct Materials Usage Variance 6,200 6,200 Feedback Accounts Payable (a) 264,368 Feedback Check My Work Correct Wages Payable 204,352 Feedback Check My Work Partially correct Direct Labor Rate Variance Feedback Check My Work Partially correct Direct Labor Efficiency Variance 5,952 5,952 Feedback Check My Work Rortinlly corroot Variable Overhead Control 102,176 X 5,134 X 107,310 Feedback Check My Work Partially correct Fixed Overhead Control 76,632 X 73,904 2,728 X Feedback Check My Work Partially correct Cost of Goods Sold 2,728 X 628,184 X 10,168 6,200 5,952 O X Feedback Check My Work Partially correct Flexible Budget, Standard Cost Variances, T-Accounts Ingles Company manufactures external hard drives. At the beginning of the period, the following plans for production and costs were revealed: Units to be produced and sold 25,000 Standard cost per unit: $10 Direct materials Direct labor 8 Variable overhead 4 Fixed overhead 3 $25 Total unit cost During the year, 24,800 units were produced and sold. The following actual costs were incurred: Direct materials $264,368 Direct labor 204,352 Variable overhead 107,310 Fixed overhead 73,904 2. Determine the following. If a variance amount is zero, enter "0" and select "Not applicable" from the drop-down list. a. Direct materials usage variance 6,200 Unfavorable b. Direct labor rate variance 0 Not applicable c. Direct labor usage variance 5,952 Unfavorable v d. Fixed overhead spending and volume variances Spending variance $ Favorable 4,368 X Volume variance Unfavorable $ 2,232 X e. Variable overhead spending and efficiency variances $ Unfavorable Variable overhead spending variance 8,110 X Variable overhead efficiency $ Unfavorable variance 2,976 Foodbaok 3. Use T-acCounts to show the flow of costs through the system. In showing the flow, you do not need to show detailed overhead variances. Show only the over- and underapplied variances for fixed and variable overhead. Record the following transactions in the T-accounts: If an amount is zero, enter "0". (a) purchase of materials, (b) issuance of materials into production, (c) incurrence of direct labor cost, (d) application of variable overhead cost to production, (e) application of fixed overhead cost to production, (f) transfer of finished goods to finished goods inventory, (g) sale of goods, (h) closure of Direct Materials Price Variance account, (i) closure of Direct Materials Usage Variance account, (i) closure of Direct Labor Efficiency Variance account, (k) closure of Variable Overhead Control account, and (I) closure of Fixed Overhead Control account. Enter these transactions in the T-accounts in the same order that they are presented here. Materials 264,368 X Work in Process (b) 628,184 X 248,000 204,352 X 99,200 76,632 X Feedback Check My Work Partially correct Finished Goods 628,184 X Feedback Check My Work Incorrect Direct Materials Price Variance 10,168 10,168 Feedback Check My Work Partially correct Direct Materials Usage Variance 6,200 6,200 Feedback Accounts Payable (a) 264,368 Feedback Check My Work Correct Wages Payable 204,352 Feedback Check My Work Partially correct Direct Labor Rate Variance Feedback Check My Work Partially correct Direct Labor Efficiency Variance 5,952 5,952 Feedback Check My Work Rortinlly corroot Variable Overhead Control 102,176 X 5,134 X 107,310 Feedback Check My Work Partially correct Fixed Overhead Control 76,632 X 73,904 2,728 X Feedback Check My Work Partially correct Cost of Goods Sold 2,728 X 628,184 X 10,168 6,200 5,952 O X Feedback Check My Work Partially correct