Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Flint Corp. acquired a property on September 15, 2023, for $230,000, paying $3,500 in transfer taxes and a $1,700 real estate fee. Based on

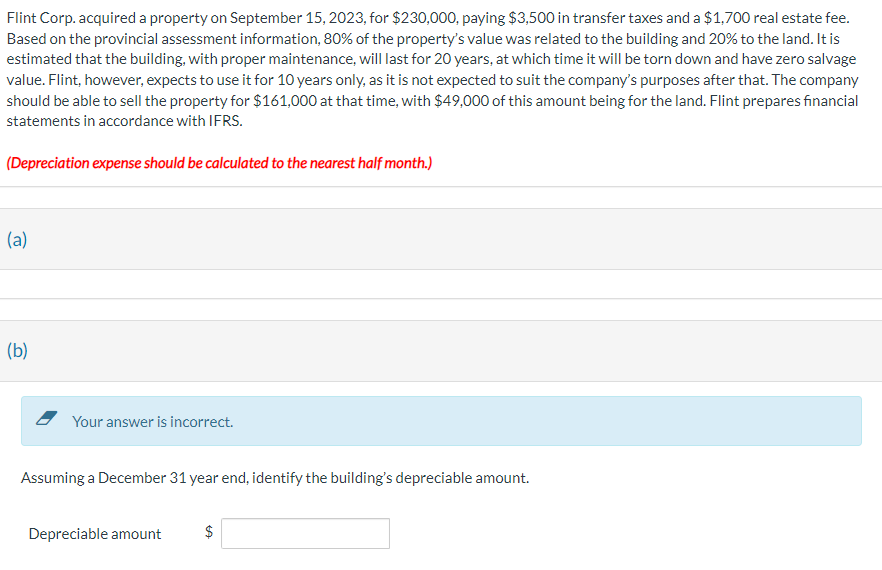

Flint Corp. acquired a property on September 15, 2023, for $230,000, paying $3,500 in transfer taxes and a $1,700 real estate fee. Based on the provincial assessment information, 80% of the property's value was related to the building and 20% to the land. It is estimated that the building, with proper maintenance, will last for 20 years, at which time it will be torn down and have zero salvage value. Flint, however, expects to use it for 10 years only, as it is not expected to suit the company's purposes after that. The company should be able to sell the property for $161,000 at that time, with $49,000 of this amount being for the land. Flint prepares financial statements in accordance with IFRS. (Depreciation expense should be calculated to the nearest half month.) (a) (b) Your answer is incorrect. Assuming a December 31 year end, identify the building's depreciable amount. Depreciable amount A $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To find the buildings depreciable amount we first need to calculate the initial cost of the b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d7ae156708_966476.pdf

180 KBs PDF File

663d7ae156708_966476.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started