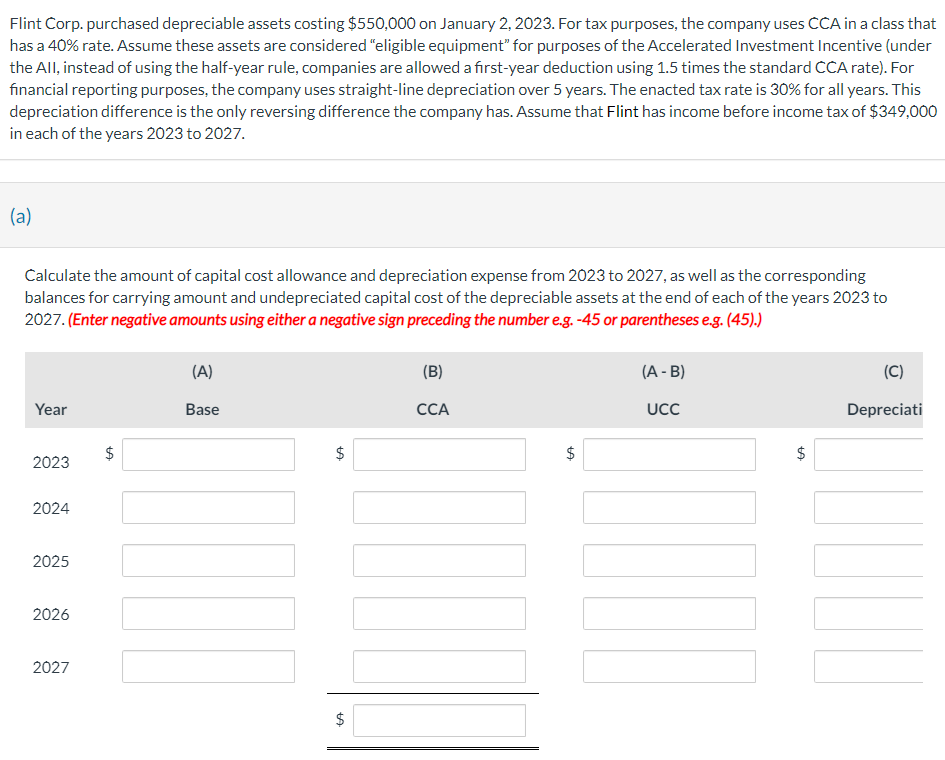

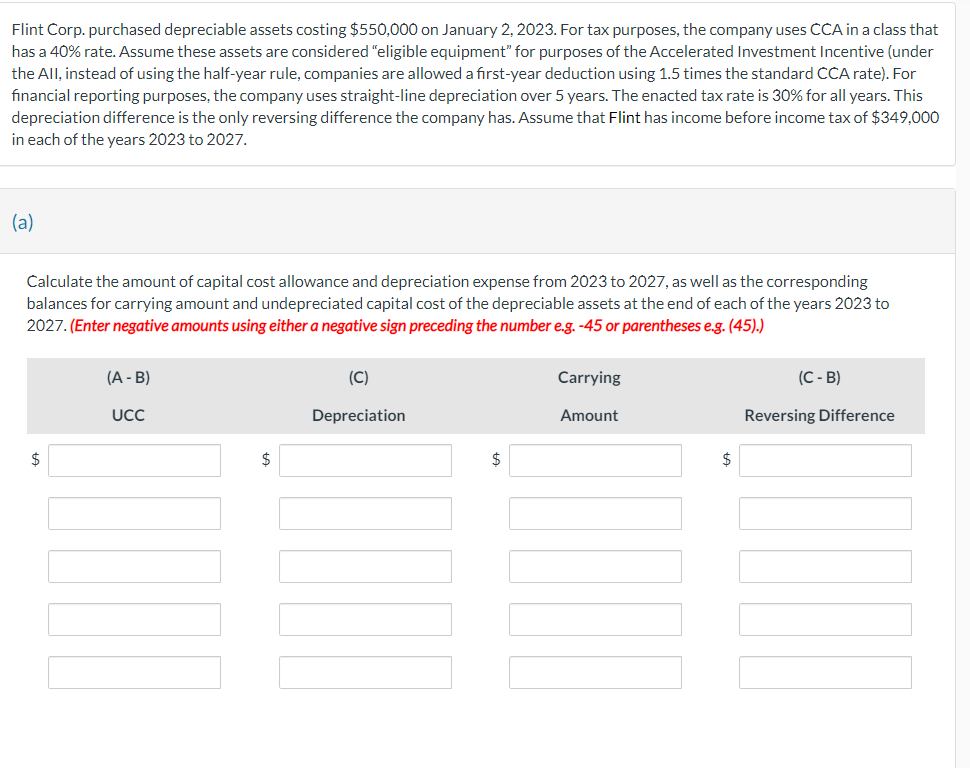

Flint Corp. purchased depreciable assets costing $550,000 on January 2, 2023. For tax purposes, the company uses CCA in a class that has a 40% rate. Assume these assets are considered "eligible equipment" for purposes of the Accelerated Investment Incentive (under the All, instead of using the half-year rule, companies are allowed a first-year deduction using 1.5 times the standard CCA rate). For financial reporting purposes, the company uses straight-line depreciation over 5 years. The enacted tax rate is 30% for all years. This depreciation difference is the only reversing difference the company has. Assume that Flint has income before income tax of $349,000 in each of the years 2023 to 2027. (a) Calculate the amount of capital cost allowance and depreciation expense from 2023 to 2027, as well as the corresponding balances for carrying amount and undepreciated capital cost of the depreciable assets at the end of each of the years 2023 to 2027. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Flint Corp. purchased depreciable assets costing $550,000 on January 2,2023 . For tax purposes, the company uses CCA in a class that has a 40% rate. Assume these assets are considered "eligible equipment" for purposes of the Accelerated Investment Incentive (under the All, instead of using the half-year rule, companies are allowed a first-year deduction using 1.5 times the standard CCA rate). For financial reporting purposes, the company uses straight-line depreciation over 5 years. The enacted tax rate is 30% for all years. This depreciation difference is the only reversing difference the company has. Assume that Flint has income before income tax of $349,000 in each of the years 2023 to 2027. (a) Calculate the amount of capital cost allowance and depreciation expense from 2023 to 2027 , as well as the corresponding balances for carrying amount and undepreciated capital cost of the depreciable assets at the end of each of the years 2023 to 2027. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)