Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Flint Limited purchased an oil tanker depot on July 2 , 2 0 2 3 , at a cost of $ 5 2 8 ,

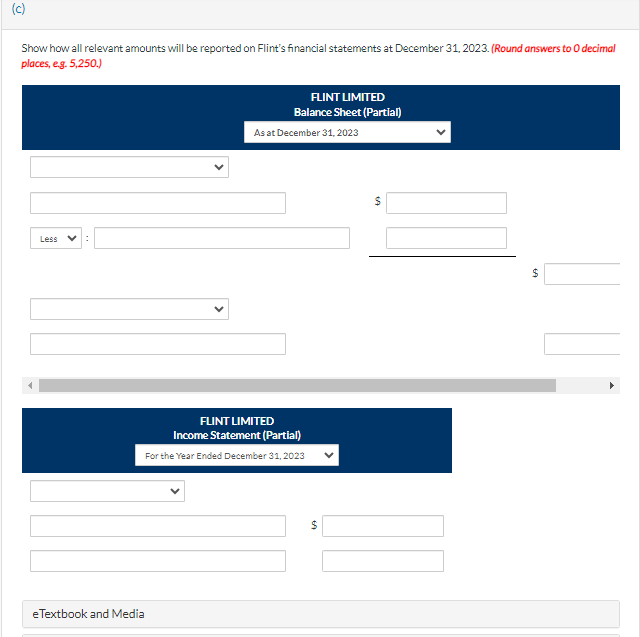

Flint Limited purchased an oil tanker depot on July at a cost of $ and expects to operate the depot for years. After the years, Flint is legally required the dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $ to do this at the end of the depot's useful life. Flint follows ASPE. c

Show how all relevant amounts will be reported on Flint's financial statements at December Round answers to decimal

places, eg

FLINT LIMITED

Balance Sheet Partial

As at December

FLINT LIMITED

Income Statement Partial

For the Year Ended December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started