Question

Flint Ltd. is a Canadian publicly-traded business with a December 31 fiscal year end. In order to get a better return on some of its

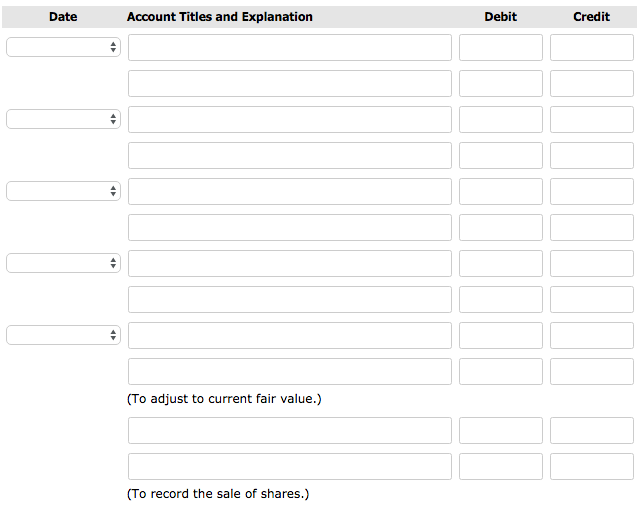

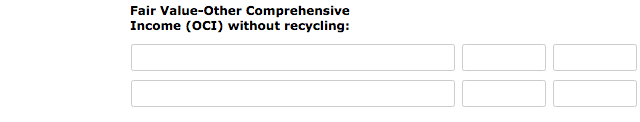

Flint Ltd. is a Canadian publicly-traded business with a December 31 fiscal year end. In order to get a better return on some of its excess cash, Flint purchased 190 common shares of AFS Corporation on July 1, 2017 at a price of $5.87 per share. On the day of acquisition, Flint elected to account for the investment using the fair-value through other comprehensive income (FV-OCI) without recycling model. On August 1, 2017, AFS declared dividends of $0.60/share, and paid those dividends on August 20, 2017. On December 31, 2017, shares in AFS were trading at $6.80 per share. On September 15, 2018, Flint sold the shares in AFS for $7.80 per share. Prepare the journal entries required to record the above transactions on the books of Flint Ltd.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started