Answered step by step

Verified Expert Solution

Question

1 Approved Answer

floating interest rate that changes every year, the interest rate that Micro-Technology agreed to pay is LIBOR plus 400 basis points (4%). At the

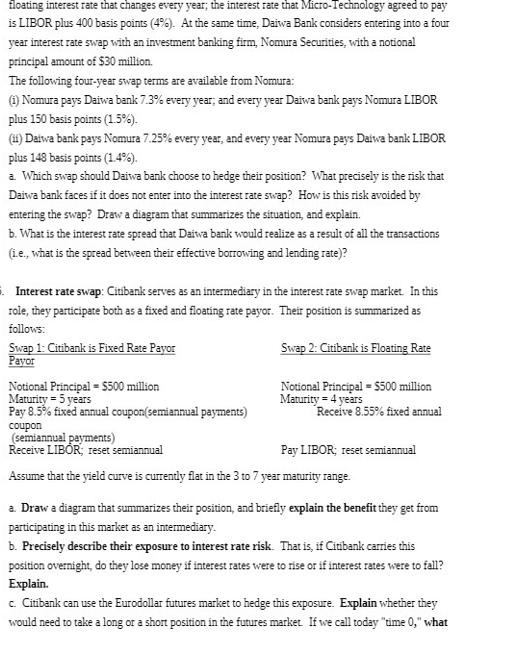

floating interest rate that changes every year, the interest rate that Micro-Technology agreed to pay is LIBOR plus 400 basis points (4%). At the same time, Daiwa Bank considers entering into a four year interest rate swap with an investment banking firm, Nomura Securities, with a notional principal amount of $30 million. The following four-year swap terms are available from Nomura: (i) Nomura pays Daiwa bank 7.3% every year; and every year Daiwa bank pays Nomura LIBOR plus 150 basis points (1.5%). (ii) Daiwa bank pays Nomura 7.25% every year, and every year Nomura pays Daiwa bank LIBOR plus 148 basis points (1.4%). a. Which swap should Daiwa bank choose to hedge their position? What precisely is the risk that Daiwa bank faces if it does not enter into the interest rate swap? How is this risk avoided by entering the swap? Draw a diagram that summarizes the situation, and explain. b. What is the interest rate spread that Daiwa bank would realize as a result of all the transactions (i.e., what is the spread between their effective borrowing and lending rate)? . Interest rate swap: Citibank serves as an intermediary in the interest rate swap market. In this role, they participate both as a fixed and floating rate payor. Their position is summarized as follows: Swap 1: Citibank is Fixed Rate Payor Payor Notional Principal = $500 million Maturity = 5 years Pay 8.5% fixed annual coupon(semiannual payments) coupon Swap 2: Citibank is Floating Rate Notional Principal = $500 million Maturity = 4 years Receive 8.55% fixed annual (semiannual payments) Receive LIBOR; reset semiannual Assume that the yield curve is currently flat in the 3 to 7 year maturity range. Pay LIBOR; reset semiannual a. Draw a diagram that summarizes their position, and briefly explain the benefit they get from participating in this market as an intermediary. b. Precisely describe their exposure to interest rate risk. That is, if Citibank carries this position overnight, do they lose money if interest rates were to rise or if interest rates were to fall? Explain. c. Citibank can use the Eurodollar futures market to hedge this exposure. Explain whether they would need to take a long or a short position in the futures market. If we call today "time 0," what

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The image contains a case study scenario in which the company MicroTechnology needs to pay a floating interest rate that changes every year tied to LI...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started