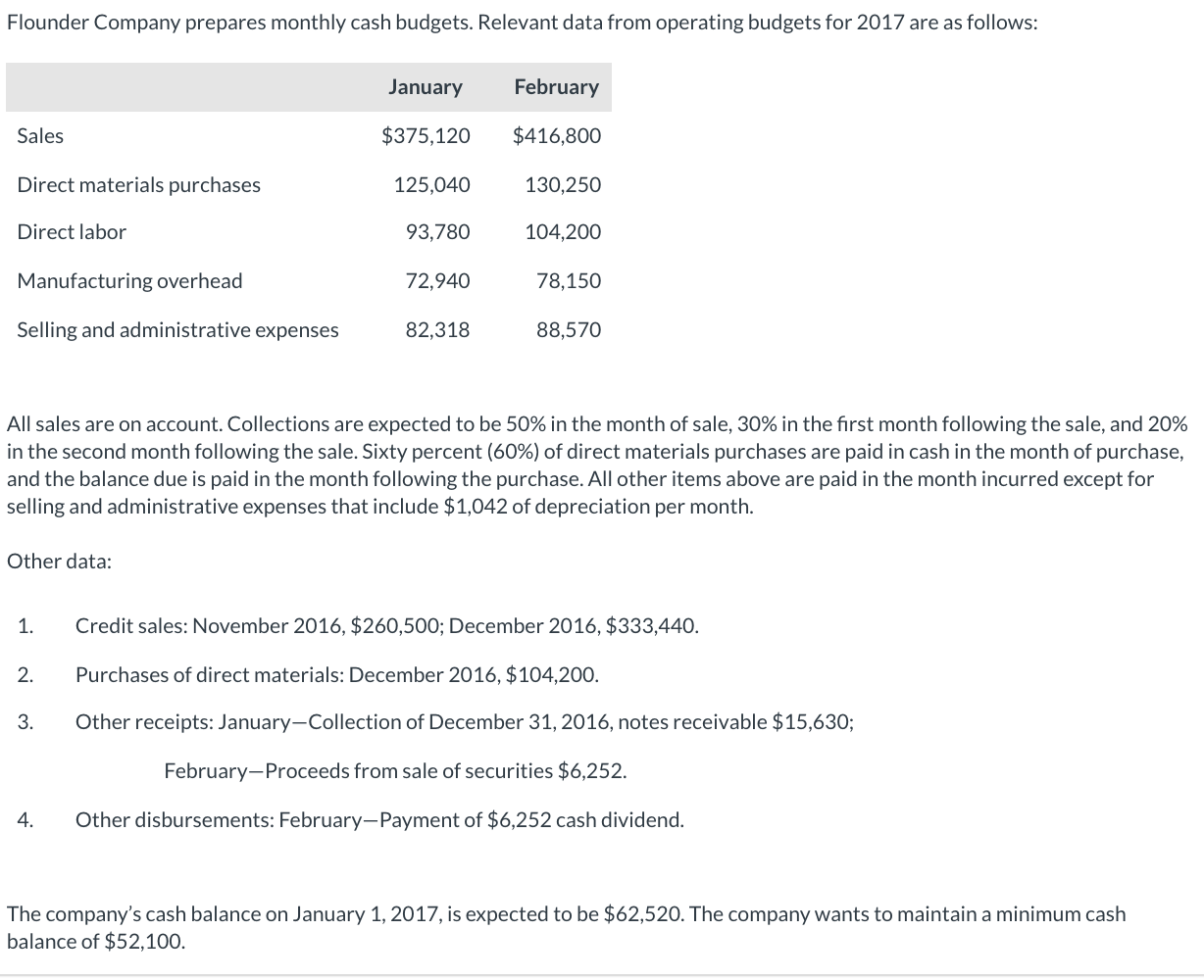

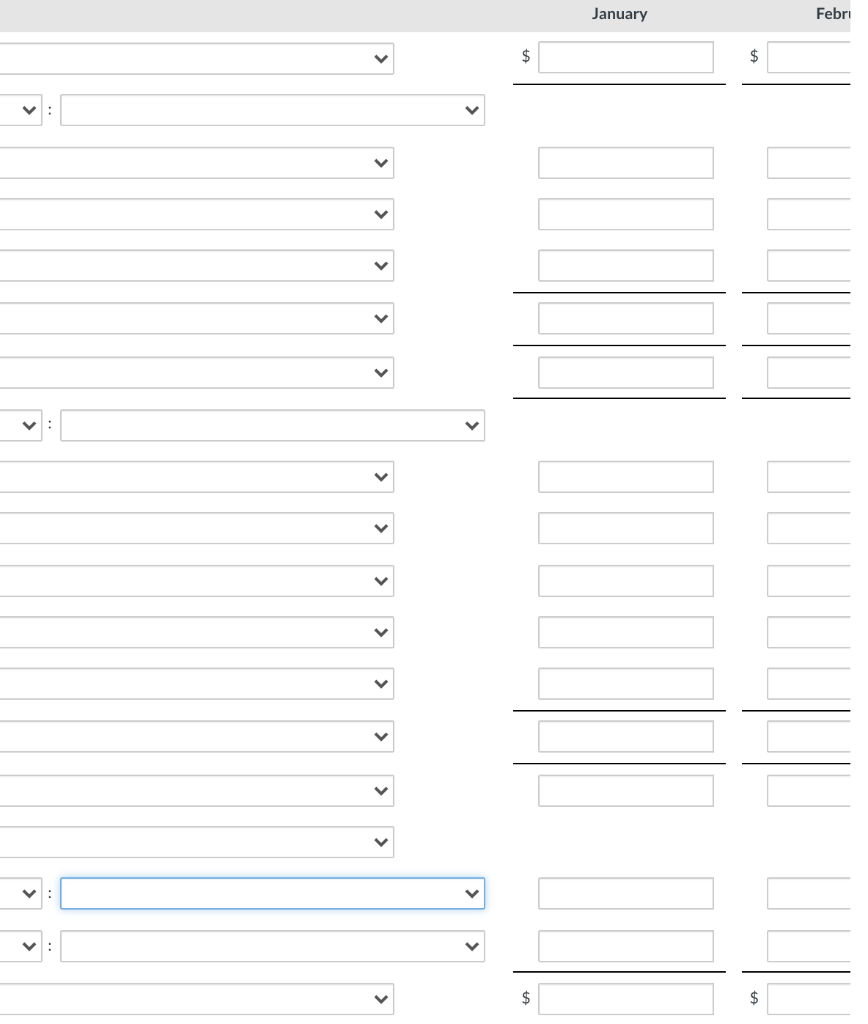

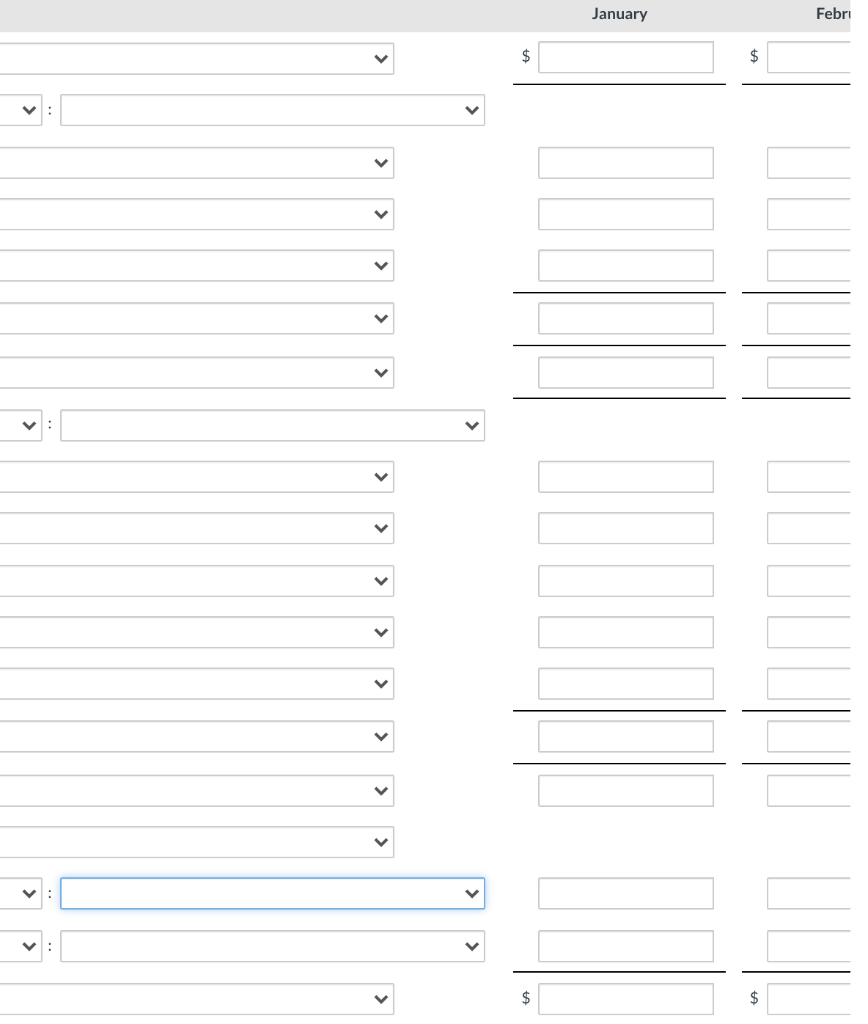

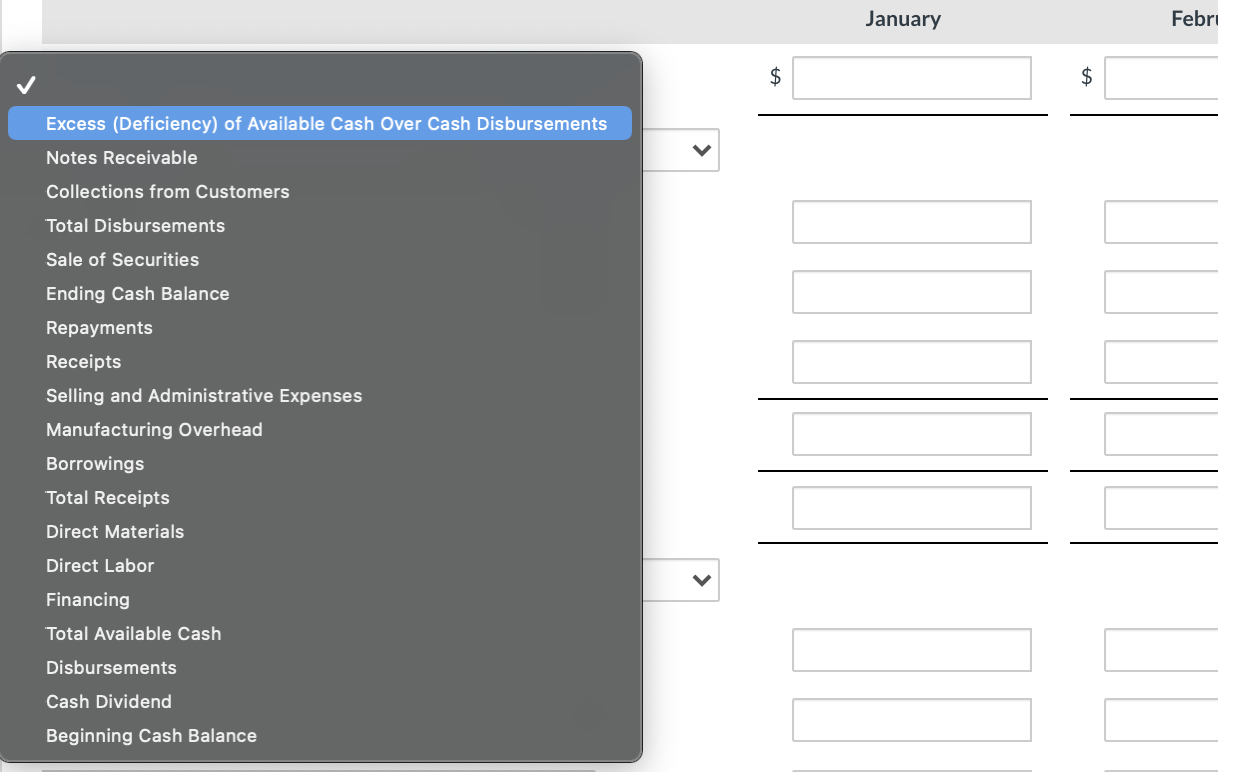

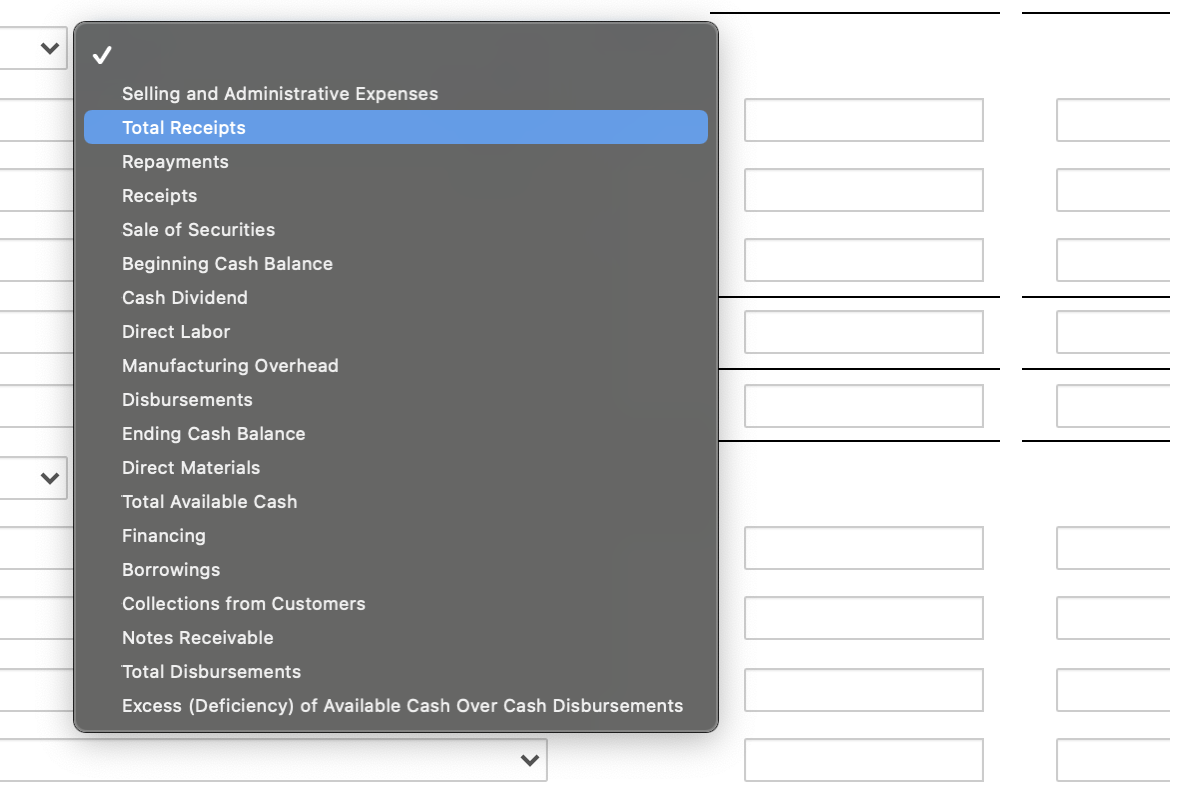

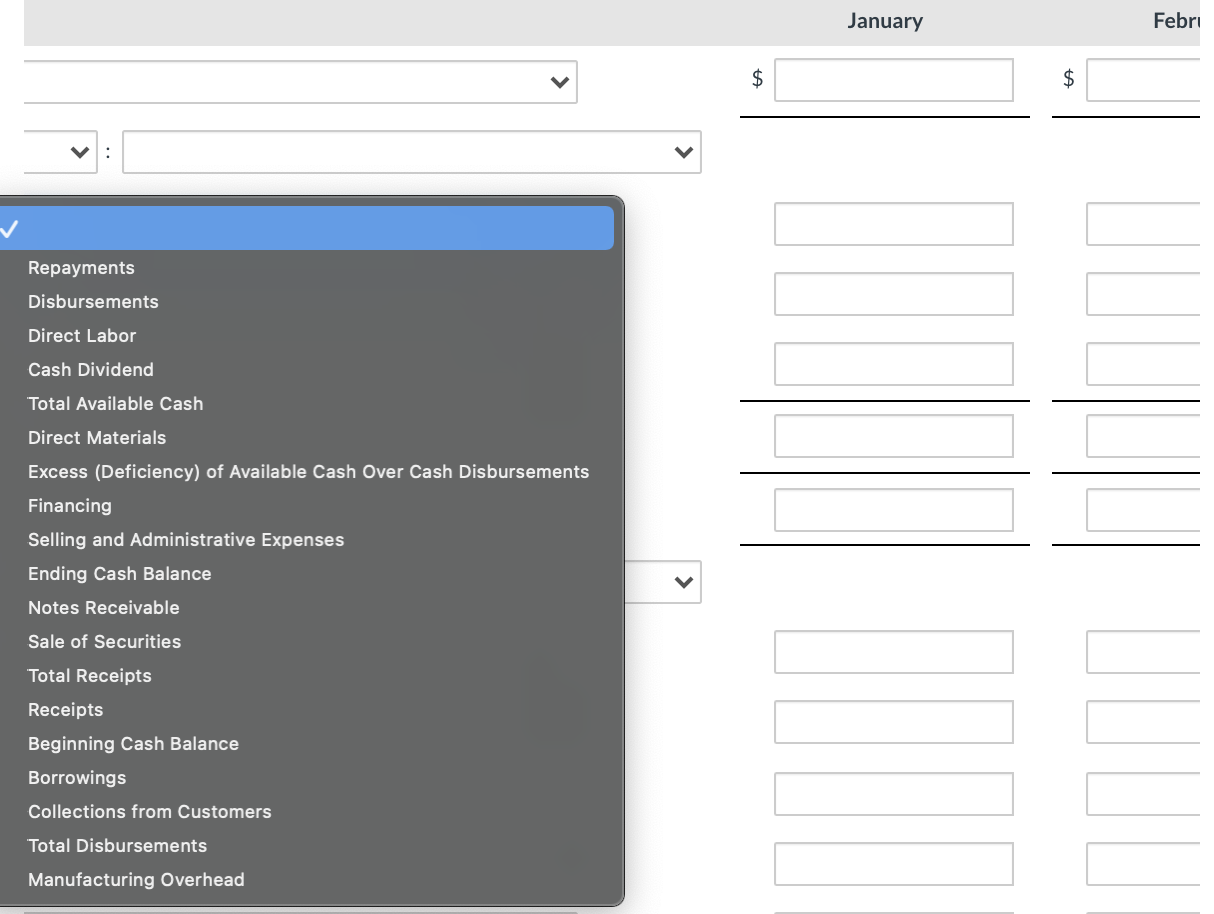

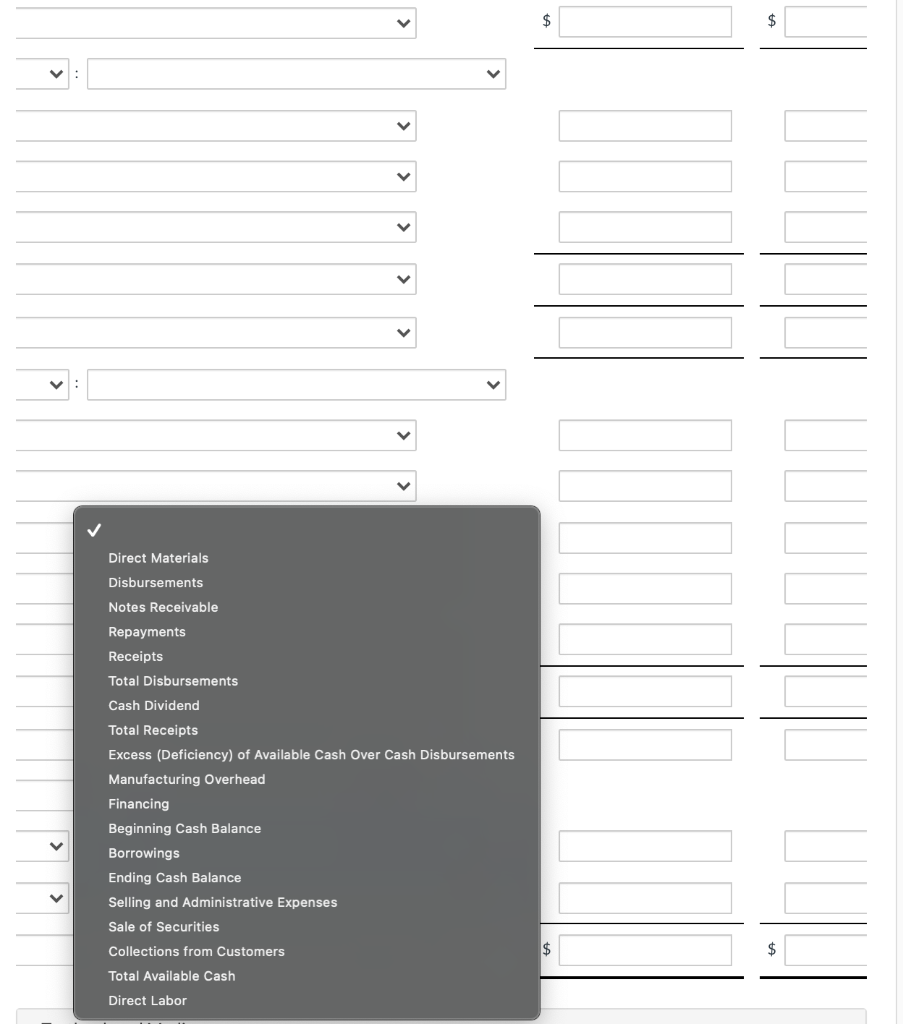

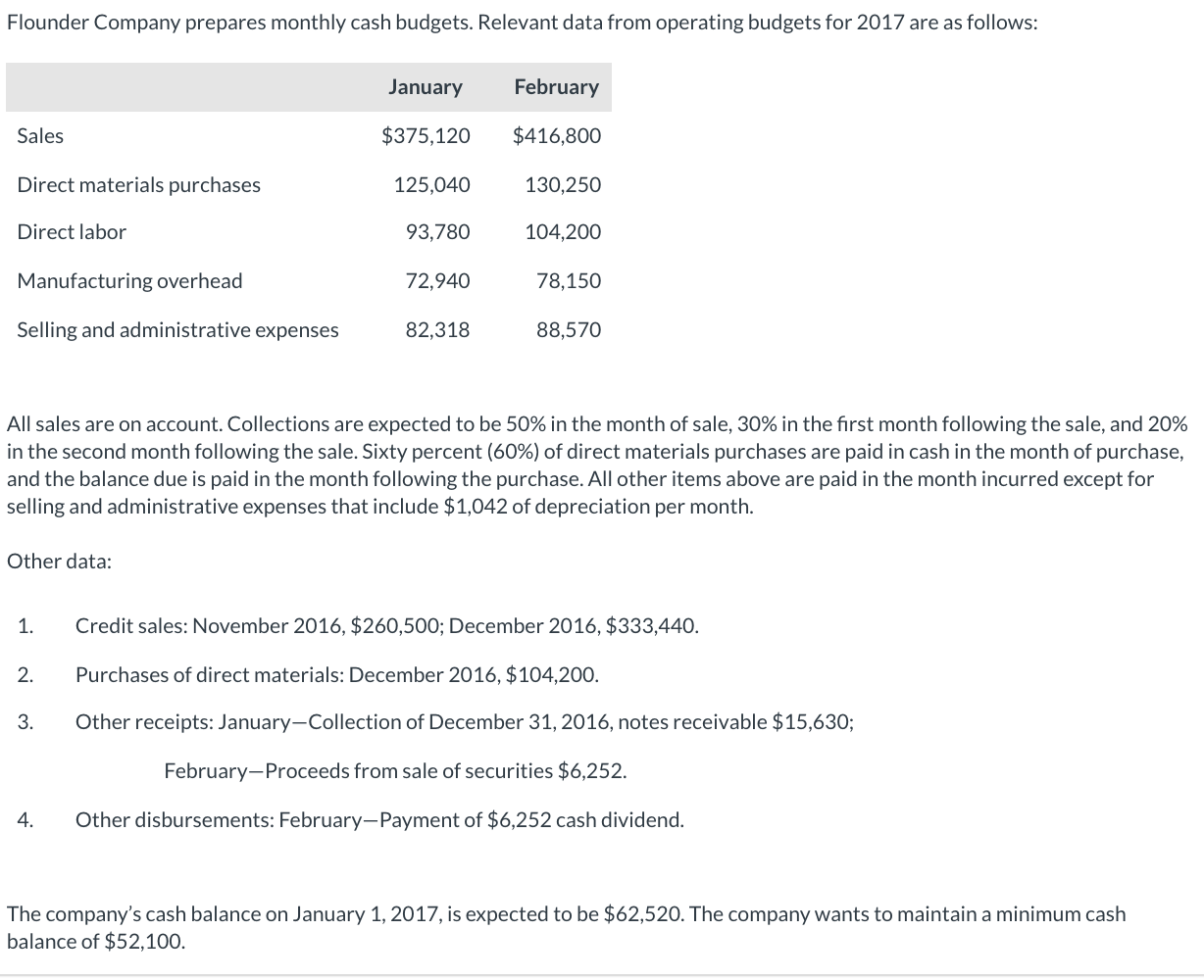

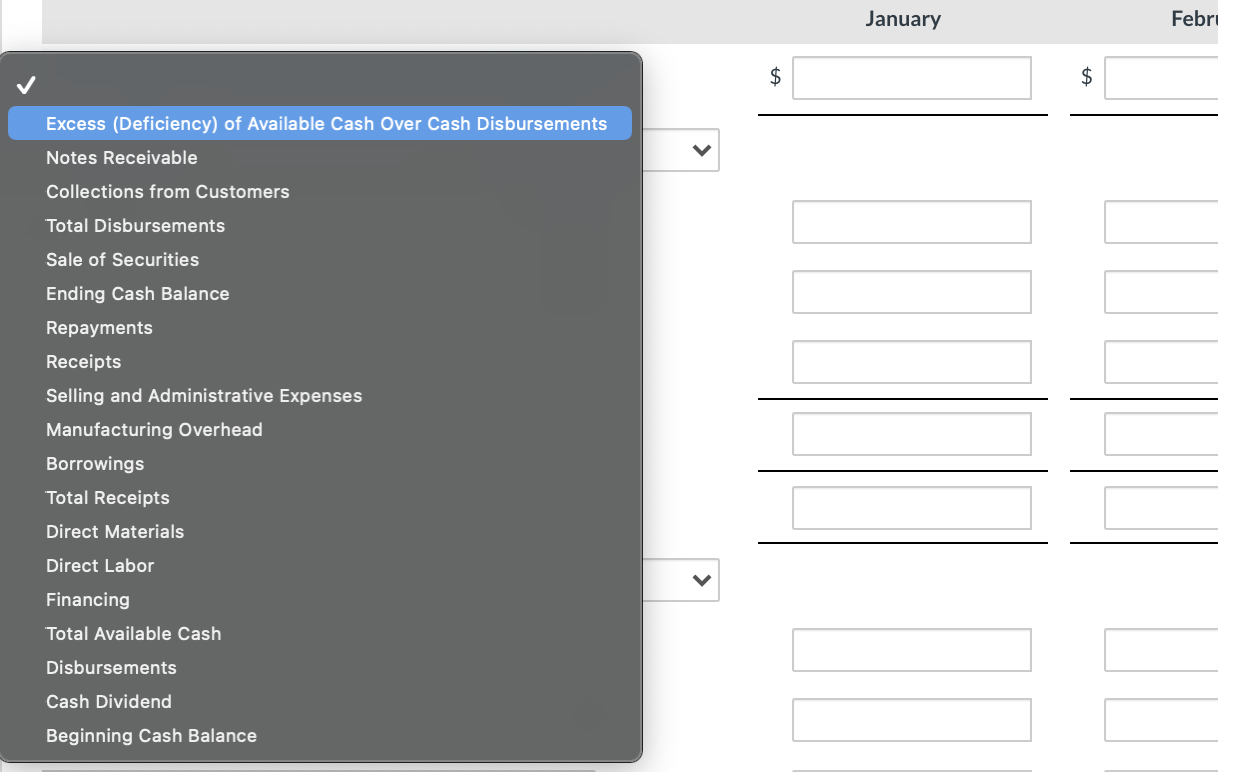

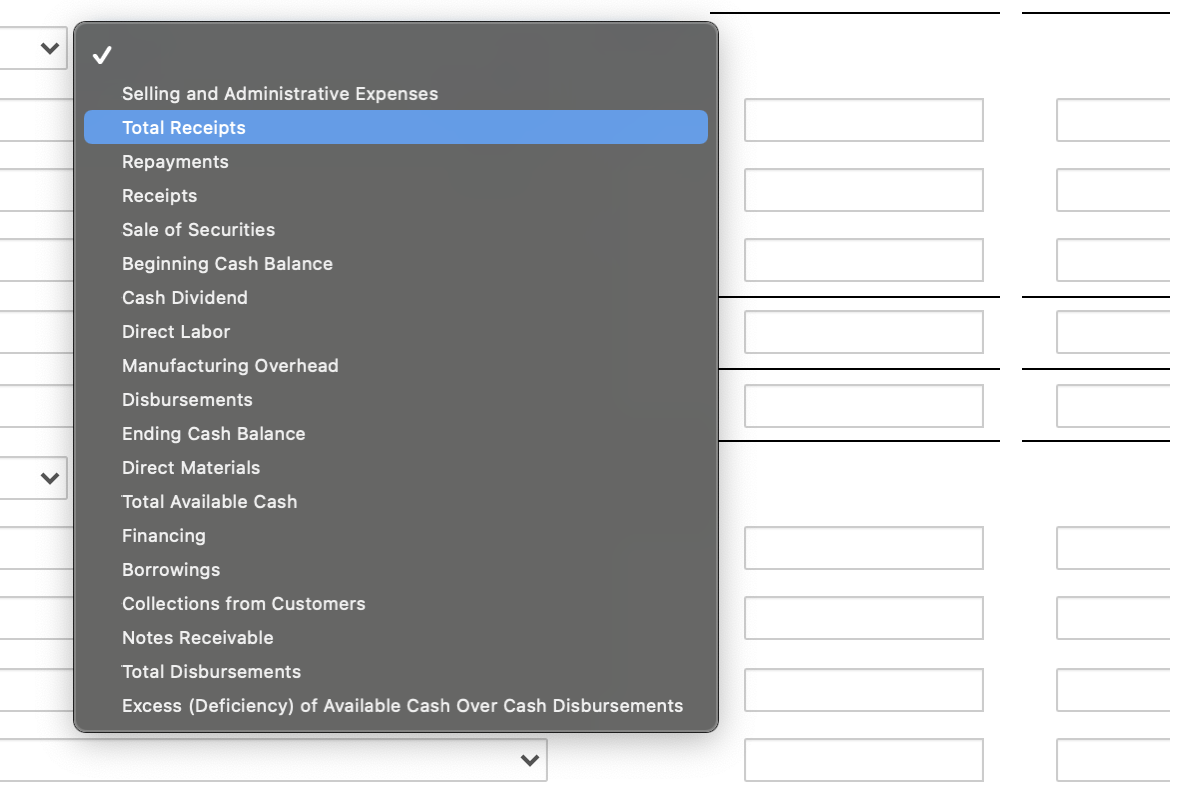

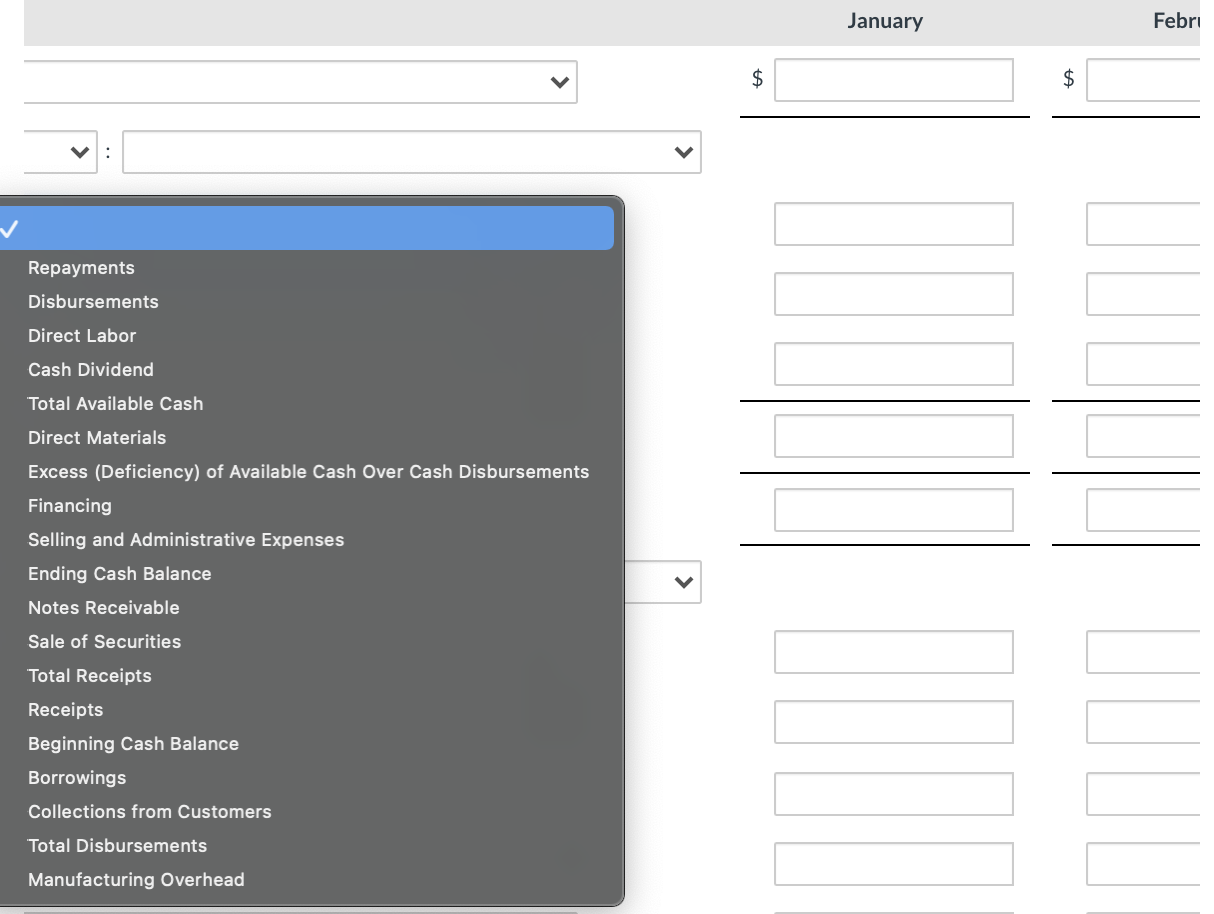

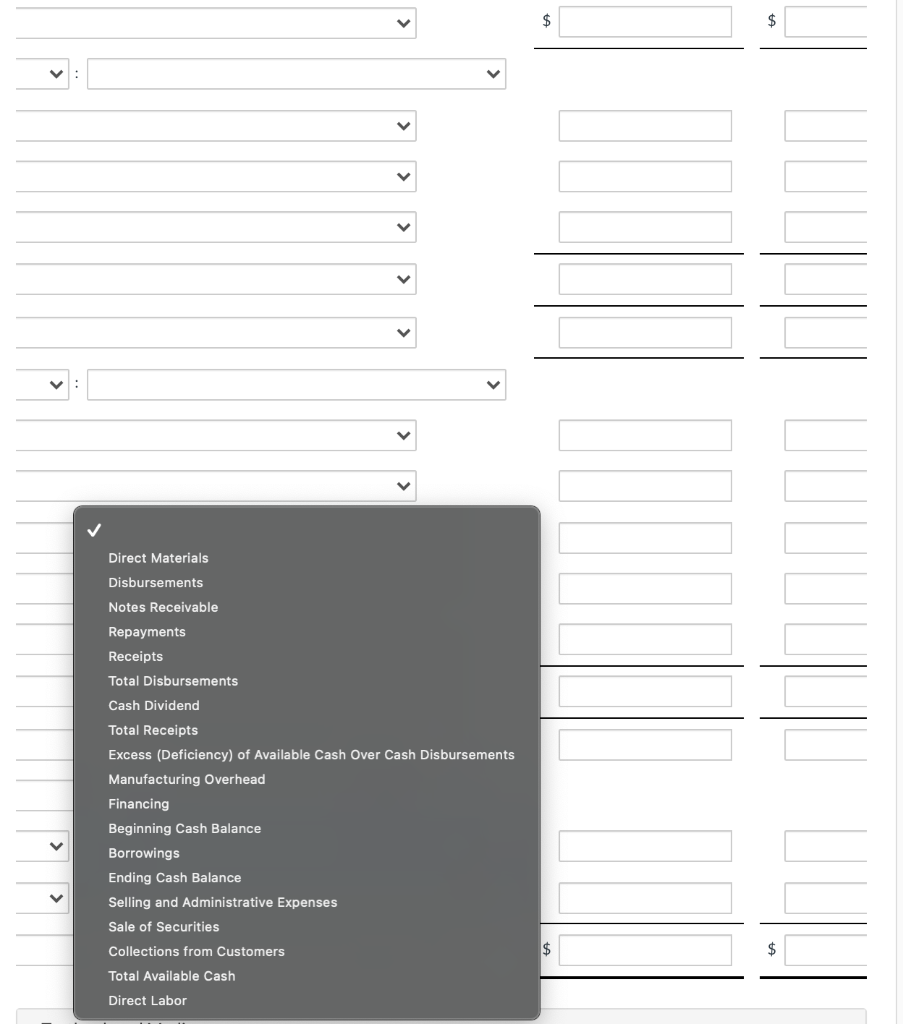

Flounder Company prepares monthly cash budgets. Relevant data from operating budgets for 2017 are as follows: January February Sales $375,120 $416,800 Direct materials purchases 125,040 130,250 Direct labor 93,780 104,200 Manufacturing overhead 72,940 78,150 Selling and administrative expenses 82,318 88,570 All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1,042 of depreciation per month. Other data: 1. Credit sales: November 2016, $260,500; December 2016, $333,440. 2. Purchases of direct materials: December 2016, $104,200. 3. Other receipts: January-Collection of December 31, 2016, notes receivable $15,630; February-Proceeds from sale of securities $6,252. 4. Other disbursements: February-Payment of $6,252 cash dividend. The company's cash balance on January 1, 2017, is expected to be $62,520. The company wants to maintain a minimum cash balance of $52,100. January Febri $ > $ $ January Febri $ > $ $ January Febri $ $ Excess (Deficiency) of Available Cash Over Cash Disbursements Notes Receivable Collections from Customers Total Disbursements Sale of Securities Ending Cash Balance Repayments Receipts Selling and Administrative Expenses Manufacturing Overhead Borrowings Total Receipts Direct Materials Direct Labor Financing Total Available Cash Disbursements Cash Dividend Beginning Cash Balance Selling and Administrative Expenses Total Receipts Repayments Receipts Sale of Securities Beginning Cash Balance Cash Dividend Direct Labor Manufacturing Overhead Disbursements Ending Cash Balance Direct Materials Total Available Cash Financing Borrowings Collections from Customers Notes Receivable Total Disbursements Excess (Deficiency) of Available Cash Over Cash Disbursements January Febri $ $ Repayments Disbursements Direct Labor Cash Dividend Total Available Cash Direct Materials Excess (Deficiency) of Available Cash Over Cash Disbursements Financing Selling and Administrative Expenses Ending Cash Balance Notes Receivable Sale of Securities Total Receipts Receipts Beginning Cash Balance Borrowings Collections from Customers Total Disbursements Manufacturing Overhead > $ $ > Direct Materials Disbursements Notes Receivable Repayments Receipts Total Disbursements Cash Dividend Total Receipts Excess (Deficiency) of Available Cash Over Cash Disbursements Manufacturing Overhead Financing Beginning Cash Balance Borrowings Ending Cash Balance Selling and Administrative Expenses Sale of Securities Collections from Customers $ $ Total Available Cash Direct Labor