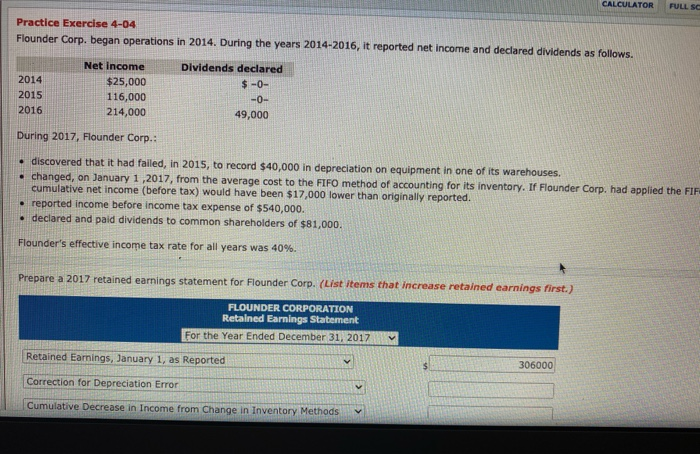

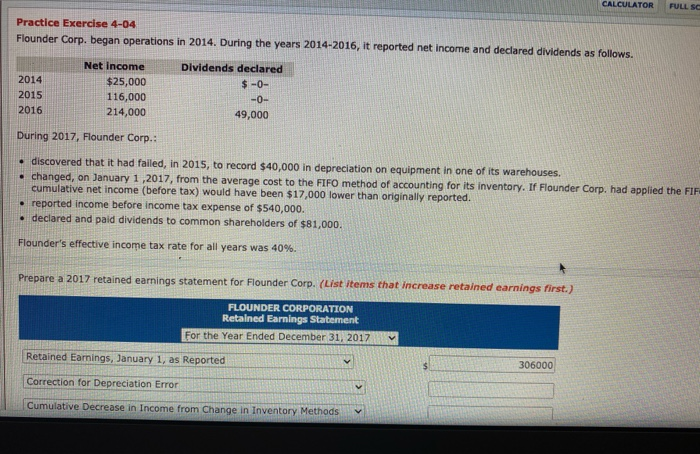

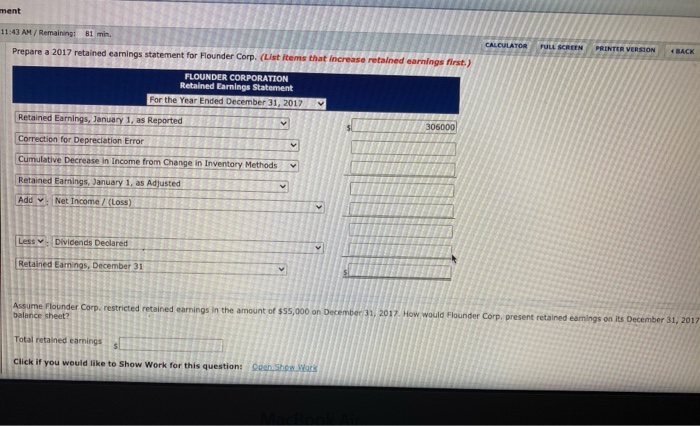

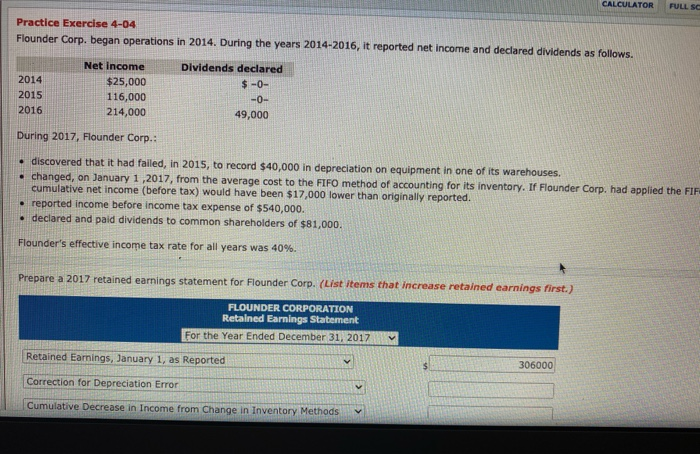

Flounder Corp. began operations in 2014. During the years 2014-2016, it reported net income and declared dividends as follows.

Net income

Dividends declared

2014$25,000$ 0

2015116,0000

2016214,00049,000

During 2017, Flounder Corp.:

discovered that it had failed, in 2015, to record $40,000 in depreciation on equipment in one of its warehouses.

changed, on January 1 ,2017, from the average cost to the FIFO method of accounting for its inventory. If Flounder Corp. had applied the FIFO method to it inventory in prior years, cumulative net income (before tax) would have been $17,000 lower than originally reported.

reported income before income tax expense of $540,000.

declared and paid dividends to common shareholders of $81,000.

Flounders effective income tax rate for all years was 40%.

Prepare a 2017 retained earnings statement for Flounder Corp.

CALCULATOR FULL SC Practice Exercise 4-04 Flounder Corp. began operations in 2014. During the years 2014-2016, it reported net income and declared dividends as follows. 2014 2015 2016 Net Income $25,000 116,000 214,000 Dividends declared $-0- -0- 49,000 During 2017, Flounder Corp.: discovered that it had failed, in 2015, to record $40,000 in depreciation on equipment in one of its warehouses. changed, on January 1, 2017, from the average cost to the FIFO method of accounting for its inventory. If Flounder Corp. had applied the FIF cumulative net income (before tax) would have been $17,000 lower than originally reported. reported income before income tax expense of $540,000. declared and paid dividends to common shareholders of $81,000. Flounder's effective income tax rate for all years was 40%. Prepare a 2017 retained earnings statement for Flounder Corp. (List items that increase retained earnings first.) FLOUNDER CORPORATION Retained Earnings Statement For the Year Ended December 31, 2017 Retained Earnings, January 1, as Reported 306000 Correction for Depreciation Error Cumulative Decrease in Income from Change in Inventory Methods CALCULATOR FULL SC Practice Exercise 4-04 Flounder Corp. began operations in 2014. During the years 2014-2016, it reported net income and declared dividends as follows. 2014 2015 2016 Net Income $25,000 116,000 214,000 Dividends declared $-0- -0- 49,000 During 2017, Flounder Corp.: discovered that it had failed, in 2015, to record $40,000 in depreciation on equipment in one of its warehouses. changed, on January 1, 2017, from the average cost to the FIFO method of accounting for its inventory. If Flounder Corp. had applied the FIF cumulative net income (before tax) would have been $17,000 lower than originally reported. reported income before income tax expense of $540,000. declared and paid dividends to common shareholders of $81,000. Flounder's effective income tax rate for all years was 40%. Prepare a 2017 retained earnings statement for Flounder Corp. (List items that increase retained earnings first.) FLOUNDER CORPORATION Retained Earnings Statement For the Year Ended December 31, 2017 Retained Earnings, January 1, as Reported 306000 Correction for Depreciation Error Cumulative Decrease in Income from Change in Inventory Methods ment 11:43 AM / Remaining: 81 min. Prepare a 2017 retained earnings statement for Flounder Corp. (List items that increase retained earnings first.) CALCULATOR FULL SCREEN PRINTER VERSION 4 BACK FLOUNDER CORPORATION Retained Earnings Statement For the Year Ended December 31, 2017 v Retained Earnings, January 1, as Reported 306000 Correction for Depreciation Error Cumulative Decrease in Income from Change in Inventory Methods Retained Earnings, January 1, as Adjusted v Add Net Income /(Loss) Less Dividends Declared Retained Earnings, December 31 Assume Flounder Corp. restricted retained earnings in the amount of $55,000 on December 31, 2017 How would Flounder Corp. present retained earnings on its December 31, 2017 balance sheet? Total retained earnings Click if you would like to Show Work for this question: Doen Show Wor